At the beginning of each year, I make an attempt to forecast what will happen in the world economy for the year ahead. The point of making any forecast at all is often ridiculed. After all, surely there are just too many factors to feed into any economic forecast to get even close to what eventually happens. Moreover, mainstream economic forecasts have been notable in their failure. In particular, they never forecast a slump in production and investment even a year ahead. In my view, that shows an ideological commitment to the promotion of the capitalist mode of production. Although, it is a confirmed feature of capitalism that there are regular and recurring slumps in production, investment and employment, these slumps are never forecast by the mainstream or official agencies until they have happened.

That does not mean making a forecast is a waste of time, in my view. In scientific analysis, theory must have predictive power and that applies as well to economics if it is to be considered a science and not just an apology for capitalism. So if Marx’s theory of crises is to be validated, it must have some predictive power – namely that slumps in capitalist production will happen at regular recurring intervals, primarily due to changes in the rate of profit on capital and resulting movements in the mass of profits in a capitalist economy.

But as I have argued in previous posts, predictions and forecasts are different. From their models, climate scientists predict a dangerous rise in global temperatures; and virologists have also been predicting an increase in deadly pathogens reaching humans in a series of pandemics. But forecasting when exactly these predictions become reality is much more difficult. On the other hand, climatologists are not yet able to forecast well what the weather in a country is likely to be over a whole year, but their models are now pretty accurate for the weather over the next three days. So forecasts for output, investment, prices and employment one year ahead are not so impossible.

Anyway, let’s bite the bullet and make some forecasts for 2022. Last year’s forecast was relatively easy. It was clear that all the major economies were going to make a recovery from the slump of 2020. I wrote: “Real GDPs will grow, unemployment rates will start to decline and consumer spending will pick up.” With the rollout of vaccines, the “G7 economies should be recovering significantly by mid-year”. But I added that “this will be no V-shaped recovery, which means a return to previous levels of national output, employment and investment. By the end of 2021, most major economies (China excepted) will still have levels of output etc below that at the beginning of 2020.” These forecasts have been borne out.

There were two main reasons why I expected the economic recovery would not restore global output to 2019 levels by the end of 2021. First, there had been a significant ‘scarring’ of the major economies from the COVID pandemic in jobs, investment and productivity of labour that can never be recovered. This was exhibited in a huge rise in debt, both public sector and private, that weighs down on the major economies like the permanent damage of ‘long COVID’ on millions of people.

This ‘scarring’ was also exhibited in a fall in average profitability of capital in the major economies in 2020 to a new low, the revival of which in 2021 was not sufficient to restore profitability even to the level of 2019.

Nevertheless, as expected, global real GDP growth in 2021 was probably around 5%, after falling an unprecedented 3.5% in the 2020 slump. According to the IMF, in the advanced capitalist economies, real GDP per person fell 4.9% in 2020 but rose 5.0% in 2021. That meant real GDP per person in these economies was still slightly below the level reached at end-2019. So two years of scarring.

Most forecasts for this year, 2022, are more (or less) of the same as in 2021. The world economy is expected to grow around 3.5-4.0% in real terms – a significant slowing compared to 2021 (down 25% on the rate). Moreover, the advanced capitalist economies (ACE below) are forecast to grow at less than 4% in 2022 and at less than 2.5% in 2023.

Forecast for real GDP growth (%) by the Conference Board.

| 2020 | 2021 | 2022 | 2023 | |

| US | -3.4 | 5.7 | 3.8 | 3.0 |

| Europe | -6.6 | 5.0 | 4.1 | 1.7 |

| Japan | -4.7 | 2.5 | 3.3 | 1.4 |

| ACE | -4.6 | 5.1 | 3.9 | 2.3 |

| China | 2.2 | 5.0 | 3.3 | 3.2 |

| India | -7.1 | 7.5 | 8.5 | 4.3 |

| LA | -7.5 | 6.4 | 2.2 | 1.7 |

| EME | -2.1 | 5.2 | 4.0 | 3.2 |

| World | -3.3 | 5.1 | 3.9 | 2.8 |

It’s a similar story for the so-called emerging economies (EME) of the ‘Global South’, including China and India. China was the only major economy that avoided a slump in the year of COVID, 2020. But growth of China’s output in 2021 was much weaker than after the end of the Great Recession in 2009. The Conference Board seriously underestimates China’s growth rates, but even so, in 2022 China’s real GDP is unlikely to rise much above 5%.

What these forecasts suggest is that the ‘sugar-rush’ of pent-up consumer spending engendered by COVID cash subsidies from fiscal spending by governments and huge injections of credit money by central banks are waning and will do so further this year. Indeed, as we know, central banks are now planning to ‘taper off’ their credit creation and even raise policy interest rates on borrowing. The Bank of England has already started to hike its policy rate and the US Fed plans three hikes in the latter part of 2022.

And all the forecasts for this year rely on the view that the new Omicron variant of COVID will prove to be short-lived and only mildly damaging to human health, thanks to vaccinations and new medical treatments. That may be optimistic and even if Omicron turns out not to disrupt economies this year, there is no certainty that another, more devastating variant may not emerge.

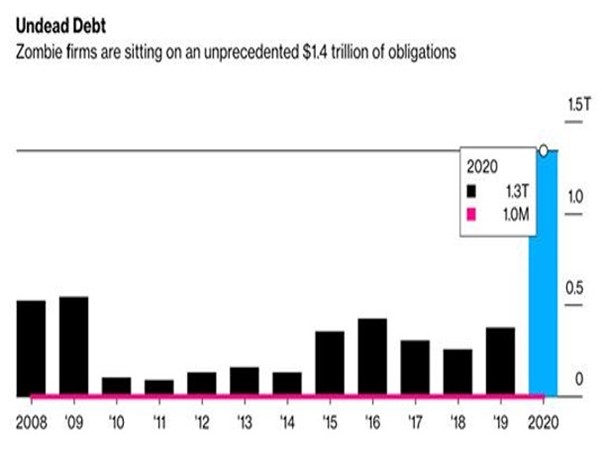

Then, in my view, there is a third leg in the aftermath of COVID slump to come, probably in 2022. In my 2021 forecast, I raised the possibility that such was the size of corporate debt and the large number of so-called ‘zombie companies’ that were not even making enough profit to cover the servicing of their debts (despite very low interest rates), that a financial crash could ensue.

And that is just the risk in the advanced capitalist economies. The so-called emerging economies are already in a dire state. According to the IMF, about half of Low Income Economies (LIEs) are now in danger of debt default. ‘Emerging market’ debt to GDP has increased from 40% to 60% in this crisis. And there is little room to boost government spending to alleviate the hit.

The ‘developing’ countries are in a much weaker position compared with the global financial crisis of 2008-09. In 2007, 40 emerging market and middle-income countries had a combined central government fiscal surplus equal to 0.3 per cent of gross domestic product, according to the IMF. Last year, they posted a fiscal deficit of 4.9 per cent of GDP. The government deficit of ‘EMs’ in Asia went from 0.7 per cent of GDP in 2007 to 5.8 per cent in 2019; in Latin America, it rose from 1.2 per cent of GDP to 4.9 per cent; and European EMs went from a surplus of 1.9 per cent of GDP to a deficit of 1 per cent. The Conference Board is forecasting a fall in the real GDP growth rate for Latin America of two-thirds from 6.4% to 2.2% and then even lower in 2023. That’s a recipe for a serious debt and currency crisis in these countries in 2022 – already Argentina is heading for another default on its debt.

Emerging economy governments are thus faced with either applying severe fiscal austerity that would prolong their stagnation; or devaluing their currencies to try and boost export growth. The Turkish government of Erdogan has opted for the policy of cutting not raising interest rates – in the policy style of Modern Monetary Theory. This has led to an outflow of capital and a 40% depreciation of the Turkish lira against major currencies. Inflation has rocketed. In 2022, the Turkish economy will dive and ‘stagflation’ will ensue.

A financial and debt crisis did not happen in 2021. On the contrary, global stock and bond markets never had it so good. Central bank-financed credit flooded into financial assets like there was no tomorrow. The result has been a staggering rise in financial asset prices (stocks and bonds) and in real estate. Central banks have injected $32 trillion into financial markets since the start of the COVID-19 pandemic, lifting global stock market capitalisation by $60 trillion. And companies worldwide raised $12.1 trillion by selling stock and taking out loans as a result. The US stock market index rose 17% in 2021, repeating a similar rise in 2020. The S&P 500 index reached a record high. The Nikkei 225 Index delivered its highest annual gains since 1989.

But as we go into 2022, the days of ‘easy money’ and cheap loans are coming to an end. The huge stock market boom of the last two years looks likely to peter out. Indeed, since April 2021, just five high-tech stocks—Apple, Microsoft, Nvidia, Tesla and the Google parent Alphabet—have accounted for more than half of the rise in US S&P index, while 210 stocks are 10% below their 52-week highs. And one-third of ‘leveraged loans’, a popular form of debt creation, in the US have a debt to earnings ratio exceeding six, a level regarded as dangerous to financial stability.

So this year could be the one for a financial crash or at least a severe correction in stock market and bond prices, as interest rates rise, eventually driving a layer of zombie corporations into bankruptcy. This is what central banks fear. That is why most are being very cautious about ending the era of easy money. And yet they are being driven to do so because of the sharp rise in the inflation rates of prices of goods and services in many major economies.

US consumer goods and services annual inflation rate (%)

This inflation spike is mainly due to pent-up consumer demand as people run down savings built up during lockdowns coming up against supply ‘bottlenecks’. These bottlenecks are the result of the restrictions on the international transport of goods and components and continued restrictions on raw materials and components for production – it is part of the aftermath of the COVID slump of 2020 and because much of the world is still suffering from the pandemic.

Mainstream economics is divided over whether this spike in inflation is ‘transitory’ and inflation rate will return to ‘normal’ levels or not. In my view, the current high inflation rates are likely to be ‘transitory’ because during 2022 growth in output, investment and productivity will probably start to drop back to ‘long depression’ rates. That will mean that inflation will also subside, although still be higher than pre-pandemic.

There is a view that 2022 will actually be the start of new levels of GDP and productivity growth as experienced by the US in the ‘roaring twenties’ of the last century after the end of the Spanish flu epidemic. During the so-called roaring twenties, US real GDP rose 42% and by 2.7% a year per capita. But there seems to be no evidence to justify the claim by some mainstream optimists that the advanced capitalist world is about to experience a roaring 2020s. The big difference between the 1920s and the 2020s is that the 1920-21 slump in the US and Europe cleared out the ‘deadwood’ of inefficient and unprofitable companies so that the strong survivors could benefit from more market share. Profitability of capital rose sharply in most economies. Nothing like that is being forecast for 2022 or beyond, as the Conference Board forecasts (above) show, or for that matter, those of the IMF (below).

Optimists for a new long boom in the 2020s to replace the long depression of the 2010s, like the Conference Board, base their argument on a revival of total factor productivity (TFP). This measure supposedly captures the role of efficiency and innovation in output growth. The CB reckons global TFP will rise by 0.4% on average annually this decade compared to zero over the past 20 years. That’s not much of an improvement when compared with the forecast slowing or even falling working-age employment and weak capital investment growth globally. Indeed, in Q3 2021, US productivity growth slumped on the quarter by the most in 60 years, while the year-on-year rate dropped 0.6%, the largest decline since 1993, as employment rose faster than output.

A long boom would only be possible, according to Marx, if there is a significant destruction of capital values in a major slump. By cleansing the accumulation process of obsolete technology and failing and unprofitable capital, innovation from new firms could then prosper. That’s because such ‘creative destruction’ would deliver a higher rate of profitability. But there is no sign yet of any sharp recovery in the average profitability of capital. Probably there needs to be a sustained rise of about 30% in profitability to deliver a new long boom like the ‘roaring twenties’ or the post-war ‘golden age’ or even that modestly achieved in the neo-liberal period of the late 20th century.

And don’t expect any further fiscal and monetary help from governments. Given the high level of public sector debt, pro-business governments everywhere are looking to reduce fiscal spending and budget deficits. Indeed, taxes are set to rise and government spending to be curtailed. According to the IMF, general government spending in 2022 will fall 8% as a share of GDP this year over last year. This fall is partly due to less spending on COVID support and a rise in GDP.

But if we look at the US government spending and revenue projections, according to the Congressional Budget Office, federal government spending is set to decline by 7% on average up to 2026 compared with 2021 levels while tax revenues are expected to rise by 25%. The US federal budget deficit will be halved in 2022 and kept down for the following years. So no Keynesian-style fiscal stimulus is planned – on the contrary.

US president Biden’s plans to expand fiscal spending have been stymied by Congress and anyway would have had only a small impact on economic activity. The EU’s recovery fund for the weaker Eurozone economies has not yet even started and again will be insufficient to sustain faster economic growth.

In conclusion, assuming no new disasters from the continuing COVID pandemic, the world economy will grow in 2022, but nowhere near as fast as in the ‘sugar-rush’ year of 2021. And by the end of this year, most major economies will have started to slip back towards the low growth, poor productivity trends of the Long Depression of 2010s, with prospects of even slower growth over the rest of the decade.

… And a Happy New Year to you, too, Dr Roberts.

Thinking of creative destruction: suppose the central bank authorities decide that restoring profitability is needed to save capitalism from this quagmire, and a wave of creative destruction ensues where zombie companies go bankrupt after a hike in interest rates (engineered to achieve that) makes them unable to service their corporate debt.

Historically, would that resemble the 20s or the 30s?

Also, what the TRPF curve often shown in this blog conveys to me is that every recovery restores profitability only partially, never to the level of the previous expansion period. And there’s another factor: creative destruction, if I understand it right, leads to mass lay-offs and a period of unemployment before the employees of bankrupt companies are reabsorbed by the reorganised corporate scene. I’m interested in this reabsorption: in these times of erosion of labour rights, contract workers and the gig economy, do you think a wave of creative destruction would swell the ranks of the so-called precariat?

I’m thinking that the winners of the corporate jungle, the ones who would reap the benefits of creative destruction, have no reason offer good terms of employment to the laid-off workers. It stands to reason that periods of elimination of non-performing companies offer the chance of rising profitability not just by increasing productivity, but also by intensifying exploitation and extracting more surplus value from workers.

But if that process takes place in an environment of near-intolerable work conditions (for example, the horror stories of Amazon wage slaves that made the news last year), wouldn’t creative destruction be a very risky move in terms of finally prodding workers to radicalise?

Not that I think it’s gonna happen. I agree with you that economic policy has been hijacked by the moneyed classes, and as such the way ahead will be to prop up the zombies and try to make ends meet without causing too many ripples in the economy. The quagmire as the new normal. But I wonder whether there’s some awareness among the policymakers that restoring profitability by shoving the bitter pill of creative destruction down the throats of the productive sector entails significant political risks.

Dear DGE You are right about the curve of profitability – there is a long term downward tendency as Marx expected. Each time it is more difficult to restore the previous level of profitability. That shows the transient nature of the capitalist mode of production. And you are right that laying off and re-employing them later with worse wages and conditions is another way to raise profitability. This was dome systematically in the neo-liberal period. And I agree, for the moment the economic strategists of capital do not want to go down the road of the liquidation of capital as they opted for in the 1930s. As you say that has political risks for them apart from threatening the banks and weaker capitalists. But eventually it will have to happen, I think.

Now this is another point I’m curious about: why do you think it will have to happen?

Is there a reason why this current quagmire can’t go on indefinitely, a terminal stage for capitalism that we just have to manage properly, another version of the end of history? If capital liquidation to restore profitability is too risky, both politically and to the financial sector, what’s the source of instability that makes the status quo unsustainable?

I can think of one thing: the public sector debt. From what I understand, the state is propping up the zombies and the private sector more broadly by absorbing its debt through QE, instead of changing the interest rate. So I imagine that doing this indefinitely would begin to impair the ability of the state to run the public sector, or there would be inflationary pressures from keeping the economy artificially heated by essentially printing money.

There’s one aspect of MMT I don’t think you’ve dealt with, or at least I don’t remember that you did: the debt jubilee proposed by Michael Hudson and others. What would happen in your opinion if the state rebalanced its books by simply erasing the debt and creating a clean slate? Would that counteract the destabilising effects of QE in the public sector, give relief to the non-performing segments of the private sector and preserve the financial sector?

(Looking at it that way, it occurs to me that this aspect of MMT would be in fact a way to save capitalism in the same way ICUs can “save” a patient by extending its terminal state indefinitely. Hardly a life worth living, though. And MMT would thus help preserving the financial sector, too, hardly a progressive outcome.)

Doc Roberts,

Recently I was watching some excerpts from your talk at WAPE about the Financialization Hypothesis. After reading the figure of 32 trillion being interjected into the financial market and this resulting in a 60 trillion dollar capitalization, I wonder if FH has some new merit here- perhaps not a in a long term sense but during specifically the time of the pandemic. Aren’t profits simply being printed at this point? If a considerable amount of that infusion of cash went into so called “zombie companies”, who in turn burn through it to weather the storm, aren’t we several degrees removed from productive labor in any real sense? At least for the duration of the pandemic?

Have economists in general ever been able to create a statistic comparing the amount of QE relative to profit (either the rate of profit or total profit) to better understand their relationship? In general, how do you view the relationship between QE and profit?

“During the so-called roaring twenties, US real GDP rose 42% and by 2.7% a year per capita. … The big difference between the 1920s and the 2020s is that the 1920-21 slump in the US and Europe cleared out the ‘deadwood’ of inefficient and unprofitable companies so that the strong survivors could benefit from more market share. Profitability of capital rose sharply in most economies. ” -> In 2020, the United States consumed approximately 20.54 million barrels of oil per day. A rise of 42% would imply 8.6 million MORE barrels (and that assuming a 1 to 1 relationship between economic production and oil consumption, an idealistic hypothesis). Almost a new Saudi Arabia ONLY for the US. Where is it going to come from?

“But there seems to be no evidence to justify the claim by some mainstream optimists that the advanced capitalist world is about to experience a roaring 2020s.”

“And by the end of this year, most major economies will have started to slip back towards the low growth, poor productivity trends of the Long Depression of 2010s, with prospects of even slower growth over the rest of the decade.”

The 1920s was the result of a technology boom.

The great cycles in economic activity are driven by technology booms where previously discovered new technologies are implemented and commercialized. Key new technologies are discovered which spawn development of derivative products (e.g. vacuum tube -> radio, hifi audio, film).

In the 1920s it was the vacuum tube, internal combustion engine and flight.

In the 1940s and 1950s, it was the transistor and jet engine.

In the 1980s and 1990s it was personal computing and mobile communications.

In the 2020s it will be photovoltaics, energy storage and nanotechnology.

Capitalism repeatedly pulls rabbits out of hats.

All of those technologies you listed were hugely influenced by public spending, specifically on research institutions. They were open ended investments that sprung out of first the New Deal and then the space race. Just look into the history of the transistor.

Where is the comparable spending on such research in the Neoliberal (last 40 year) age? It has been gutted through austerity, we now leave such development to billionaires motivated primarily (theoretically) by profit? When has a profit motive been the primarily cause (or even loosely correlated with) technological development?

Seems like you are crafting an ahistorical concept onto history, then claiming we should extrapolate this largely unsuccessful strategy of the last 40 years as a basis for the future?

This leads to a deeper conversation about the dead-end and stagnation of current theoretical physics, and it’s failure to produce the scientific and technological progress it promised for so many decades. Engineers and scientists in Quantum Computing are literally flying blind, without a theory to proceed their technological development.

Meanwhile we cope by pretending the latest Iphone is the cat’s meow, while in reality it looks like a rotary phone compared to Huawei’s product.

Chris,

Your sometimes very poor attempts to discredit capitalism at every turn border on silliness.

I have no idea whether government funding was involved in the construction of the first transistor at Bell Labs in the late 1940s. As far as I know, Bells Labs was a private organization, but perhaps it had some government funding?

Even if it did have, it was private enterprise that motivated the commercialization of these technologies.

The Audion (three electrode amplifying vacuum tube) was invented by de Forest, a solo effort as far as I understand.

The plain fact is that the two seminal technologies that underwrote the majority of new technologically advanced products in the 20th century, the vacuum tube and the transistor, were developed in the West. Their commercialization proceeded in the West.

Socialist economies, as far as I can see can lay little claim to such fundamental technological developments – but I’m sure you are going to show that they did.

“Seems like you are crafting an ahistorical concept onto history, then claiming we should extrapolate this largely unsuccessful strategy of the last 40 years as a basis for the future?”

This statement is full of nonsense. What I have described is historical fact. And you slide into your argument the prominence of neoliberalism of the last 40 years. The fact is that computing and mobile communications revolutionized the way we live and do business, not only in the West.

The future may or may not be driven by neoliberalism, but it is always driven by technological change, and this technological change is evident now.

“This leads to a deeper conversation about the dead-end and stagnation of current theoretical physics, and it’s failure to produce the scientific and technological progress it promised for so many decades. Engineers and scientists in Quantum Computing are literally flying blind, without a theory to proceed their technological development. ”

So what? What is the relevance of this to the argument? Commercialization of technology has always proceeded without complete understanding of the underlying science. That’s what engineers are for. Engineers get on with it while scientists scratch their heads.

Are you saying we are seeing the end of science? So what if science has reached a cul de sac? Not the first time.

Newtonian physics was developed almost 300 hundreds years ago, Despite the understanding of the more accurate Theory of General Relativity, Newtonian physics is good enough for interplanetary travel.

“Your sometimes very poor attempts to discredit capitalism at every turn border on silliness.”

No one has discredited capitalism’s achievements, what has happened is you have discredited socialism’s achievements in a completely ignorant manner.

“I have no idea whether government funding was involved in the construction of the first transistor at Bell Labs in the late 1940s. As far as I know, Bells Labs was a private organization, but perhaps it had some government funding?”

Could I get you to read for 2 minutes on how the entire microchip industry, as well as the initial production and development of the transistor was almost completely funded by government money? Like the entire 1950’s and 60’s history of the technology?

“Even if it did have, it was private enterprise that motivated the commercialization of these technologies.”

Governments funded the research and development and practical application of these technologies in order to advance their military capabilities and their edge in the space race. You can claim a profit motive was behind this push, but then you would have to explain how open ended funding was given to these projects for decades without any thought of “profit” beyond the social end of defense and space exploration. The long way to a profit, for sure.

“The plain fact is that the two seminal technologies that underwrote the majority of new technologically advanced products in the 20th century, the vacuum tube and the transistor, were developed in the West. Their commercialization proceeded in the West.

Socialist economies, as far as I can see can lay little claim to such fundamental technological developments – but I’m sure you are going to show that they did.”

Says nothing about the material conditions in which the “West” found itself in though, comparatively. Also speaks nothing about the fact that the Soviets first developed both the Hydrogen bomb and where the first in space. This when Russia had only a few decades earlier been a Feudal society with mass death starvation from famine every 10 years going back to the middle ages.

Look into all the technology present in the “Iphone”:

Are you seeing a trend in the programs directly linked to the technologies development yet?

“So what? What is the relevance of this to the argument? Commercialization of technology has always proceeded without complete understanding of the underlying science. That’s what engineers are for. Engineers get on with it while scientists scratch their heads.”

I don’t think you understand technological development at all or the physics that precedes it. Absolutely no technological development in human history worth speaking of has preceded the a physical theory. Did people develop nuclear energy before mass-energy equivalence (E=Mc2) was known? Could engineers calculate trajectories of rockets before differential and integral calculus? Could Edison invent a light bulb before Maxwell field theory was established?

I’m an engineer, so please spare me the nonsense about the order of how we work.

The fact is the current trend in technology lacks any basis in theory, because guess what- there is no fundamental theory of Quantum Mechanics or QFT to explain how entanglement works- or how to encode information in a superposition. There are theories, but they do not explain probability and they certainly do not explain inference interactions. There is also no real concept of how human consciousness works, so there is no theory of Artificial Intelligence beyond brute force computation. Companies may portray this to be the case in order to sell stock, but we are flying blind for the first time in human history when we posit that technology can develop without a theory to predicate it.

This also coincides with the complete privatization of tech development and the utter lack of public funding…………

Chris,

“Absolutely no technological development in human history worth speaking of has preceded the a physical theory.”

Are you saying that primative man understood the laws of friction and angular momentum before he fashioned the first wheel?

And I suppose the local caveman’s collective supplied him with the stone and his food while he chipped away?

Chris,

“Could Edison invent a light bulb before Maxwell field theory was established? ”

I’m sorry. I have to pick you up on this one.

Too funny for words.

Edison burnt hundreds?/thousands? of filaments until he found the one that had some longevity.

(And I guess he could have used the negative solutions to Maxwell’s field equations to demonstrate that there is also a flow of energy backwards in time and saved himself burning hundreds of dud filaments.)

“Meanwhile we cope by pretending the latest Iphone is the cat’s meow, while in reality it looks like a rotary phone compared to Huawei’s product.”

China was a third world basket case until it introduced capitalist reforms and opened itself up to western investment, western technology, western education and western markets.

That is simply not true. Compare China to India in 1960, or 1980, in terms of literacy, maternal mortality, infant mortality and it’s clear that China was not a “basket case.”

A-C

Why not compare China to Swahililand – the comparison would be even starker.

A-C

It was an economic basket case.

UN estimates of 1970 GDP per capita in current US$:

US $5136, Hong Kong $963, Papua New Guinea $448, DR Congo $238, China $111.

(It’s probably all CIA propaganda anyway.)

https://en.wikipedia.org/wiki/List_of_countries_by_past_and_projected_GDP_(nominal)_per_capita

1970s. Real gdp per capita rise China 245%. India 198%. Both started on virtually the same gdp per cap in 1970

Michael,

You can dress it up any way you like.

The fact is that China was an economic basket case before the introduction of capitalist reforms.

That’s why capitalist reforms were introduced.

Well yes I’ll dress it up with the facts. China and India are the best comparisons . Two huge countries with low levels on income in 1970. By the end of the 1970s China had grown 50% faster than India even before market reforms under Deng. The annual growth rate of gdp was 6.7% from the early 1950s to 1979. The growth rate after 1978 was about 8.5%; better than before 1978 but with over 6% plus rate before 1978, China was hardly a “basket case”. That is how I dress it up. Meanwhile India remained relatively a “basket case”.

Michael,

Numbers from Macrotrends, GDP per capita current US$, 1970, 1980, 1980/1970:

Hong Kong 960, 5700, 5.94

PNG 232, 713, 3.07

India 112, 267, 2,38

China 113, 195, 1.73.

Check your figures. On these figures China under performed India.

I have. Your figures are from the world bank and mine from the un. The difference could be due to the world bank reducing annual growth rates in dollars for China. Many official agencies do this. And it’s strange because the world bank shows china’s growth in real gdp per cap for that decade to exceed indias comfortably but there we are stats never lie! If I have time I shall do a proper series comparison.

Michael,

Looked for other figures.

Countryeconomy.com has China as $112, $307 and India as $112, $271.

So table reversed on these figures.

I guess we could go on.

The fact still remains that there were many third world countries with per capita incomes in the 1960s, 1970s which were considerably higher than China’s

It was an economic basket case.

Of course there were many global south countries with much higher income per capita in 1950 than China immediately after the 1949 revolution. On that basis China was a basket case but by 1980 China had closed the gap on many of these even before the Deng reforms. In that sense it was no “basket case” or more accurately no failure But you have your definition of basket case and I have mine

Checked Countryeconomy China data again.

1979 went from $183 to $307 in 1980.

Their numbers have to be in error or there was a change in basis.

Michael,

” In that sense it was no “basket case” or more accurately no failure..”

If things were going along so swimmingly, why did they flick the switch to capitalism?

That’s a good question. I have written on this in detail on this blog and in papers. I cannot answer this question in a comment. Suffice it to say I don’t agree that a switch was flicked to capitalism. China is not dominated by its capitalist sector. Actually that sector is now holding back further development, not helping it anymore as after 1980. But more tonight Henry as it is late in the uk.

Michael,

“Of course there were many global south countries with much higher income per capita in 1950 than China immediately after the 1949 revolution. On that basis China was a basket case but by 1980 China had closed the gap on many of these..”

It may have closed the gap, but China by 1980 still had significantly lower per capita GDP than many third world countries.

Michael,

Check this list, 1980 real per capita GDP in 1985 US$:

https://cepr.net/documents/publications/econ_growth_2005_11_27_table_1.htm

China well down on list. Many, many third world countries above it.

On these numbers, 1960 to 1980, China outperformed India.

Henry loves to use GDP and per capita economic data when he wants to claim a particular country as a basket case. We all know the limits of GDP and per capita income as measures of social welfare and robustness. He says China was a basket case before Deng’s reforms– by measure of longevity, infant mortality, literacy, female access to education, China was not a “basket case” but was in significantly better position than India, a country whose size, and history, makes it most comparable–independence at approximately the same time as China’s revolution, population size comparable.

What does not make sense is comparing China to Hong Kong– a protectorate of the British Empire, and not a “3rd world” country at all.

But Henry avails himself of Papua, New Guinea and DR Congo for comparison, so let’s use those two to compare relative welfare, using the two most commonly used indicators of social progress, life expectancy and infant mortality (per 1000 live births). So according to that venerable capitalist institution, the World Bank, here they are:

Life expectancy:

China 1970-59 years; 1980 66.8 years.

Papua New Guinea 1970 45.9 years; 1980 52.7 years

DR Congo 1970-43.9 years; 1980 46.09 years

Infant Mortality:

China 1970 79.5 1980 47.8 per 1000 live births

Papua 1970 98 1980 75.5

DR Congo 1970 148.8 1980 131.1

Actually the real basket case is Henry who has made a profession, practically, of disavowing reality.

Henry asks if things were going along so swimmingly in China, why did they take the policy decisions to invite FDI, allow market forces,etc.

That decision cannot be looked at in isolation from the general international situation. The CPC leadership believed the greatest threat to its rule would come from the former Soviet Union. “Soviet hegemonism” was a motivating fear in the CPC’s “turn to the west,” never more motivating than when the fSU intervened in Afghanistan. That was one of the compelling factors.

Deng thought that economic development of China was critical to opposing the fSU and for China to obtain its rightful status globally. The reforms were designed to quicken that development, and they have. Nobody denies that, not even those who inaccurately refer to China as a “basket case” before the reforms.

After the reforms were first initiated, the rise of Solidarnosc in Poland presented another nightmare to the CPC leadership and there was considerable conflict in the CPC between those who thought the best way to avoid generating a mass movement that would destroy all vestiges of the revolution was to advance the reforms and those who wanted to slow such reforms. Deng won.

Henry I concede you have a point here, but you go a little over the top. So, I must apologize for sharpening that “point” a bit in my reply. Here goes…

You might also point out that the roaring 20’s feasted on the destruction of property and a multitude of corpses resulting from capitalism’s first imperial world war, and, ditto the festivities of 40’s, 50’s, and 60’s, produced by capitalism’s second imperial world war. As for the 1980’s and 90’s, some credit for profitable gourmandizing should be given to neoliberalism’s desperately destructive endless wars on labor at the imperial centers while off shoring of its industrial infrastructure, and super-exploited labor in neo-colonized peripheries.

As for the 2020’s, capitalists can hope for profitable technological market solution feasts served up by their war on nature: energy storage and photovoltaic market solutions for global warming and boundless pollution might serve here, and, more recently, there has been a proven, super-profitable, patent medicine mandated solution for industrialized agriculture’s zoonotic pandemics! Market based agricultural solutions seem to guarantee and endless progeny of the liberal virus here.

But war has been since 1893 capitalism’s ultimate exogenic market solution to its insoluble contradictions.

The rabbits that capitalism repeatedly pulls out of its hat, therefore, come with a shovel, including a nuclear one, with which to bury itself, and hopefully (for those who would rather be dead than red) all mankind with it.

A-C,

I accept that there is more to assessing the development status of a country other than by purely economic criteria.

Thanks for your explanation for the adoption of the Deng reforms.

The point is though, the rate of Chinese development was not sufficient to satisfy the regime’s need to keep the Soviets at bay and that capitalist reforms were the best way to crank up China’s performance.

mandm,

“…but you go a little over the top…”

And you think I have gone over the top.

All the rotten things that happen on this planet cannot all be sheeted home to capitalism.

Sometimes it is just the sheer madness of despots (the complicity of the odd military industrialist does help).

Your comment is too hyperbolic to bother with as far as I can see.

I would say however, you might want to consider writing a treatise on political gastronomy.

Could I suggest you begin a Civet de Lapin.

I would be very happy to provide the hat to use as a stewing vessel.

“Edison burnt hundreds?/thousands? of filaments until he found the one that had some longevity.”

Sorry, I misspoke on Maxwell, it’s actually Faraday:

Faraday’s 1831 publication of his work on electromagnetic induction was the first in a series of papers eventually collected as Experimental Researches in Electricity (1844, 1847). This work became a standard reference on electricity for nineteenth-century scientists and is credited with inspiring and guiding inventors such as Thomas Edison (1847–1931), the American who invented the light bulb, motion picture, and phonograph record.

“Are you saying that primative man understood the laws of friction and angular momentum before he fashioned the first wheel?”

What we actually know about the “Simple Machines” in a European civilizational sense comes from Archimedes and he was definitely into theory, he was a physicist, astronomer, engineer, mathematician, etc.

As far as pre history, we just have a vague idea about the origin, so saying they had no theory is as silly as it gets.

You’ve gone to very little effort to rebut any of the ideas I presented about modern technology after initially taking a stance that private industry made all of it, and that this was some kind of defense of a purely Capitalistic system.

Marx did not make some kind of hard break where capitalism became socialism, or that the two weren’t causally linked, or that it was anything but a process. If technology of the recent age was almost completely underwritten by social spending, then this is simply another proof that Marx’s theory was right. Capitalist production exists outside of the Capitalist Mode of Production, just as Socialist Production exists outside of the Socialist Mode of Production.

Technology in our contemporary framework all came from a Socialist Production.

Chris,

It seems to me you have grabbed anything you can to mount your very weak argument.

We are now in the realm of splitting hairs.

You now say it was Faraday’s theory of electromagnetic induction that inspired Edison’s development of the light bulb. Certainly Edison would have been aware of the various theories of electricity that had been formulated. But he did not need Faraday’s theory of electromagnetic induction to develop the light bulb. All he had to know was that a current passed through a conductor would cause it to heat and give off light if the current was high enough. His problem then was to find a filament that could sustain high current for long enough to produce light for an acceptable length of time before it self destructed. This did not require theories of electricity or electromagnetic induction. It required theories of materials science, a science then in its very early days. The way Edison settled on a filament was by incessant trial and error. No theory required. (The tungsten filament was developed years later by another inventor.)

“What we actually know about the “Simple Machines” in a European civilizational sense comes from Archimedes…”

So are you saying that primitive man had access to a time machine such that they could access Archimedes texts in which he explained his mechanics? This is getting stranger and stranger.

And are you saying that primitive man had theories of friction and angular momentum?

I could site other examples where the “inventor” more than likely had no theory to lean on.

Do you think that the people that developed copper metallurgy had theories of chemical valency and thermodynamics?

Do you think that the people that discovered the cat whisker detector had theories of quantum mechanics and understood conduction in semiconductors?

More often than not discovery precedes development of theory. There is a phenomenon called serendipity. There is also the old aphorism that says necessity is the mother of invention – no theory required.

“You’ve gone to very little effort to rebut any of the ideas I presented about modern technology after initially taking a stance that private industry made all of it”

That’s because I agree with the proposition that the development of modern technology has required the involvement of public funding.

“If technology of the recent age was almost completely underwritten by social spending, then this is simply another proof that Marx’s theory was right.”

That’s a big “if”. This I don’t agree with. Fundamental technological advancement is made by individuals. The state may be become involved at a later stage. Invention is the product of neurons not bureaucratic decree.

“Capitalist production exists outside of the Capitalist Mode of Production, just as Socialist Production exists outside of the Socialist Mode of Production.”

My understanding of Marxist principle is too weak to understand the distinction.

Please: what is acronym ACE in the table?

Yes sorry should have made that clear. ACE = advanced capitalist economies.

Thank’s. The Portuguese version is here: https://resistir.info/crise/previsoes_2022.html

Good Year for you, JF

MR,

I don’t understand the metrics that cause you to label the 1997-2020 a “long depression.” Compared to the depression of 1929-1939 using the numbers for fixed asset value, value of finished commodities, indices of manufacturing output, etc. the 1997-2020 period isn’t a depression at all.

Hi A-C. In my book I define depressions where the rate of real GDP, investment and productivity growth stays well below the previous average trend. These depressions are interspersed with several slumps that do not restore economies to previous rates of growth, This applies to the depression of 1873 to 1893 (7) and to the Great Depression of the 1930s as well as the period since the end of the Great Recession ie the 2010s. These depressions are kicked off by substantial changes in the profitability of capital beforehand. So the late 19th century depression started after a downward trend in profitability from the mid-1860s culminating in the slump of 1873. The Great Depression of the 1930s was preceded by a downturn in US profitability from 1926 culminating in the 1929 crash. The 21st century depression began in 2008 but was preceded by a long term decline in profitability from 1997 (and a short term drop from 2005). Changes in profitability trends are the driver here. So we had stock market crashes and slumps in 1974-5 and 1980-2 and 1991-2, but because the profitability of capital was still in an upward trend, these slumps were part of a classic capitalist boom and slump cycle and did not lead to a long depression. Anyway, I think that is how I see it in answer to your query.

Thank you

Nothing much to add. Just some factors I would like to emphasize.

The first one is the “zombification” of capitalism post-2008. From a historical point of view, it is a sight to behold that the middle class – an essential instrument for the triumph of capitalism over socialism during the Cold War (all evidence suggest Gorbachev took the Scandinavian model as the objective of his reforms) – became an obstacle, a drag to the capitalist system during the “End of History” era (1992-2008) and the “Late Stage Capitalism” era (2008-present), some kind of cancer that the capitalist class is trying to remove.

It will not be that easy, because socialism still exists at a menacing level (China), and, after Toyotism, the requirements for the specialization of the workforce imply a much higher floor for the welfare of the working class (at least for the ever shrinking remaining middle class). You cannot have engineers, propagandists and scientists – professions of finesse, which requires mental (here including social status, being treated as a superior citizen than the “rabble” of the rest) and physical comfort and welfare for the worker – at starvation wages and operating to the sound and touch of the whip.

Also, it is part of the social contract of the USA that it is a classless or middle class nation (the American Dream Doctrine). Indeed, that was the rationale during the “End of History” that, since History was over, so was the old Marxist division between Working and Capitalist classes, therefore the American people were all, at the same time, or could be, or was on the path of becoming, a nation where everybody was both a worker and a capitalist. The result of that was the legitimization of deindustrialization (Americans should only have “smart jobs”, i.e. white collar, middle class, college graduate jobs) and the so-called “financialization” (privatization of retirement funds, incentive for every American to invest their savings on stocks in Wall Street). To break this social contract is not going to be politically easy for anyone – we’re talking about a people that was educated their whole lives they would be working at a fancy office while illegal Latin American immigrants would be cleaning their suburban houses while Asians would be producing their stuff. That is, unless they go the route of Nazi-fascism and declare a (hot) war against China.

Last but not least, there’s the generational factor. We’re still living in the age where the generation who fought in the Cold War (“Baby Boomers”, “Gen-X” and early “Millennials”) is dominant. If capitalism doesn’t recover in due time, the tendency is that, as those generations die, the later generations (late “Millennials”, “Gen-Y”, “Gen-Z”) will inherit the capitalist empire but will lose sight of the good times of the Post-War Miracle. Well, it is easy to explain to a 40-year+ person from a First World country why he or she should fight to the death for the capitalist system; but it may not be so easy for, e.g. a person from the “Gen-Z”. Long story short, the tendency is that the Post-War Miracle to be seen for what it really was: a historical anomaly.

The second one is: even if some miraculous technology comes up (equivalent to the transistor and electronic technology that was responsible for the Post-War Miracle), it is not guaranteed anymore that it will come up exclusively in the USA/Western Europe/Japan. China is not the Soviet Union: it is much more integrated to the global chains of production. The Chinese are still well behind the West technologically, but it already is ahead in some key technologies such as 5G (which will promote further automation of heavy industry and agriculture). Much of the Western industry is actually Chinese (something that wasn’t the case when the enemy was the USSR), so, even if it comes out from Western design, it will still be produced in a Chinese industry, at least in part. Falling profit rates will continue to force the West to outsource to China, even if the defense industry is spared for some time (and it is being spared at the cost of high budget deficits from the US Government).

China also has another advantage which the USSR couldn’t even dream of: even though its economic performance is not impressive by Soviet standards, the Chinese happened to grow at a time capitalism is in relative decline. That is, even though the USSR’s growth was more impressive than the Chinese one, it happened at a time capitalism was also at its apex, i.e. the roaring 20s and the Post-War Miracle. Yes, the Chinese growth is mediocre – but its happening at the right historical time (i.e. when the capitalist growth is pathetic). You know the old political science joke: you don’t have to be faster than the lion (you’re not and you’ll never be) – you just have to be faster than the person next to you. Politics is important for the survival of any economic system (that’s why the capitalist propagandists keep fighting, even after the series of humiliations since the 2008 meltdown).

I wish I could have seen your expression writing this article. I suppose the clue is in your throw away remark: “Anyway, let’s bite the bullet and make some forecasts for 2022.” I doubt we will have to wait for December 2022 to cut through the murk. I am of the opinion that January will set the tone for 2022 and it will be unwelcoming for both capitalist and investor. Recent data suggests economic activity in the USA peaked at the beginning of the final quarter of 2021 or October. (I was expecting a peak towards the end of the third quarter) and in China it has been ebbing throughout the second half as my next post will show. So use as little gas as you can and keep your eyes peeled.

As far as “creative Destruction” is concerned, another form of destruction (which has nothing to do with Polanyi’s concept) we’re increasingly witnessing theses past few years, are the destructions caused by extreme climate events. I haven’t looked up the numbers, but from what I recall hearing on the news, just in terms of insurance the increase has been in billions of dollars, one could imagine the expenditure and capital put into rebuilding some of these structures.

Is there any study which analysis the contradictory effects of climate change on process of accumulation; hindering accumulation by interrupting regular economic activities, and helping it by destruction and creating new opportunities and spaces for construction and creation of new systems and methods concerned with “resilience.” Almost every major city in the US now has a Resilience office.

Hi MichaelI wonder if I might ask what you think iof the ‘techno feudalism ” talk that’s been mooted in various quarters (Varoufakis, McKenzie Wark et al).It claims to map a post capitalism future – an unpleasant one.I haven’t come across much critical evaluation. YoursChris Horner Sent from Samsung Mobile on O2

Hi Well this argument springs from the post-Keynesian view that what is wrong with capitalism is monopoly and finance and not industrial productive capital, which is apparently fine. Now capitalism as marx anlalysed it has been replaced by rentier capital ie ethe extraction of ‘rents’ by tech monopolies. The question here is where to rents come from if not from the profits of exploitation of labour? The big exponent of this view is Michael Hudson who reckons productive capitalism has been replaced by feudal capitalism and that the latter is the enemy not the former. In my view, this is nonsense. See my comments on Hudson. https://thenextrecession.wordpress.com/2021/07/11/capitalism-has-the-leopard-changed-its-spots/

It is now confirmed with today’s data releases that the US economy peaked in October. So Michael bite the bullet, has the odds increased for a recession. Prompt, GDP Nowcast estimates Q4 growth has fallen from 6.8% to 5% its lowest reading to date. Does not bode well for Q1 2022. January 2022 did indeed turn out to be unwelcoming for speculators. I had to smile about Jamie Dimon doing the rounds Wednesday boasting about how grand economic conditions are. Following his banks profit release Friday the last timebi looked, JPM shares were down 5%. Shades of 2008.

Yesterday CEO, comrade executive officer Xi of China appealed to Western Central Banks to slow down monetary tightening lest they wreck China’s export markets. Instead they should do what they PCB is doing, making money cheaper there to re-ignite speculation. This selfless act by Xi brought tears to my eyes. Such an exemplary and inspirational act of international solidarity by this “communist”. Spivs and speculators of the world – unite.

Greetings Doctor

It has been almost a month since you wrote this blog. Do you think that the next recession could be closer to us than we think?

Simran not every stock market ‘correction’ means a recession but I’ll post something soon on whether the risk of a new recession is rising.

Thank you for the reply

I completely understand your point.

Looking forward to your post concerning the risk of a new recession.