The latest data on economic recovery in China and the US suggest that both economies should be back to or above the pre-pandemic levels of national output by the end of this year (in the case of China probably some 10% above). This has renewed optimism that the pandemic slump may quickly be reversed.

Keynesians like Larry Summers and Paul Krugman have previously argued that the US economy would bounce back quickly because the COVID slump was more like closing down tourist sites in holiday resorts over the winter. Once the summer comes, service businesses re-open and economies leap forward again as the flowers come into bloom.

As one mainstream economics think-tank put it: “Together these improvements in the outlook have led the fund to predict that, as a whole, advanced economies are on course to lose less than 1 per cent of output by 2024 compared with its pre-pandemic forecasts — an outcome that seemed barely plausible last October. The US is top of the pack and now has forecasts showing it on a stronger path than before the pandemic, but other advanced economies are not far behind in the medium term.”

Of course, all this assumes that the COVID plague will be over by year end as vaccinations rise and infections fall, as populations reach ‘herd immunity’. That is optimistic, to say the least, given the plethora of COVID variants of various degrees of infection still spreading. Also, I have argued in many previous posts that this scenario flies in the face of what has happened to the major economies; namely the scarring of employment, investment and the growing number of bankrupt or ‘zombie-like’ businesses in the major capitalist economies.

But let us consider the longer term. Assume that the COVID pandemic subsides or is brought under control sufficiently by year end to allow all the major economies to return, more or less, to full activity, at least as much as they were in 2019. Does this set the scene for a decade of fast growth in output and incomes for all?

There is much talk in optimistic circles that after COVID, just as after the Spanish flu epidemic of 1918-19 and the end of the First World War, that it’s going to be another Roaring Twenties. The main arguments for this forecast are based on the history of the Roaring Twenties in the last century.

Like COVID, the so-called “Spanish flu” was a virulent contagion which not only killed hundreds of thousands of Americans from the fall of 1918 to the spring of 1919, but also shuttered businesses from coast to coast. Just like COVID now, this calamity plus the end of WW1 laid the basis for a severe recession in the US and other major economies in Europe during 1920-21. This recession was a “brutally hard, but very efficient depression” (said one historian). The stock market lost nearly half its value, unemployment reached 19 percent, and countless businesses went bankrupt.

The 1920-21 slump was hard but it was efficient in creating the conditions for a new period of fast growth – the deadwood was burnt and cleared and new shoots emerged. After 1921, the US not only recovered but entered into a decade of growth and prosperity. The so-called Roaring Twenties was on. From 1921 to 1929, real GDP rose 42%. Real GNP per capita grew 2.7 percent per year between 1920 and 1929. By both 19th and 20th century standards this was a relatively rapid rate of growth – and certainly rapid by 21st century standards.

New construction almost doubled from $6.7 billion to $10.1 billion and unemployment rates fell below 4% for the whole period.

There was a wave of technological advances — widespread electrification of homes and factories, the introduction of household appliances like refrigerators and washing machines, rapid adoption of the automobile, the growth of commercial radio stations and cinemas. All these technologies had been on the horizon during WW1 and now they took off in commercial application. The 1920s was also the decade when the US was fully transformed from farming economy into an industrial one. Farming declined from 18% to 12.4% of the economy, while farm income fell 21%.

Labour productivity grew more rapidly during the 1920s than in the previous or following decade. Similarly, ‘capital productivity’ (ie output per unit of investment in means of productin) had declined in the decade previous to the 1920s. But it increased sharply during the 1920s as, particularly, developments in energy and transportation accelerated. Labour productivity growth averaged over 5% a year and capital productivity rose over 4% a year.

In my view, the 1920s investment and productivity boom was the result of some key factors. First, there was a significant rise in the profitability of capital after the slump of 1920-21, incentivising capitalist firms to introduce the new technologies and to expand commercial production of new use-values (consumer products). It is difficult to get a reliable measure of the movement in the profitability of capital in the 1920s for the US, let alone other economies. Here we must rely on the work of Esteban Maito for estimates of the profitability of capital in Sweden, Netherlands, the UK and the US. The US estimates are actually based on the work of Dumenil and Levy from their historic work on profitability in the US since the American Civil War (see Maito, Chapter 4 in World in Crisis).

What the figures show is that, during the deep recession of 1920-21, the profitability of capital fell 44% in the UK, 38% in Sweden and just 9% in the US. In the Roaring Twenties, profitability rose 14% in the US, 75% in the UK, 8% in the Netherlands and 31% in Sweden. Indeed, in my own work on the UK rate of profit, I find a rise of nearly 30% for UK profitability from 1921-29. (See chapter 6 in World in Crisis).

Source: Maito, my calculations

Rising profitability for capital may have boosted investment and new technologies boosted the productivity of labour, but surprise, surprise, this did not translate into a ‘Roaring Twenties’ for labour. Indeed, this was the second factor that drove up profitability: increased exploitation at the expense of real wages. While labour productivity grew over 5% a year, average real wages for skilled and unskilled workers rose just 3% a year from 1921 to 1929, and if you include the recession years 1920-21, then real wages rose only 1% a year during the 1920s.

During the 1920s too, union membership plummeted, leaving workers exposed directly to ‘free market’ forces in the labour market.

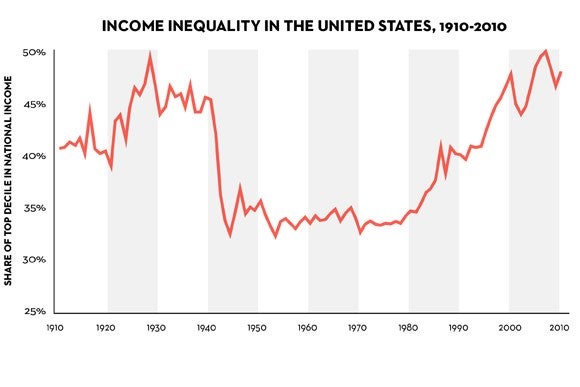

Indeed, inequality of income and wealth rose sharply. Per-capita GDP rose from $6,460 to $8,016 per person, but this prosperity was not distributed evenly. In 1922, the top 1% of the population received 13.4% of total income. By 1929, it earned 14.5%. The work of Thomas Piketty et al provides all the data on rising inequality of incomes in the 1920s.

Then there is the third factor peculiar to the US. The US was by far the strongest capitalist economy after WW1. The war years were boom years for the US as the federal government poured money into the wartime economy, while the country avoided devastation, unlike Europe. Previously a debtor nation, the US emerged from the war as a chief lender and arguably the strongest and most vibrant economy in the world. As a result, during the 1920s, the US produced almost half the world’s output because World War I had destroyed most of Europe.

Per capita income ($)

But the Roaring Twenties came to an end – there was no permanent expansion. As Marxist economic theory argues, capitalist production does not proceed in a harmonious way and with sustained expansion, but instead is subject to regular and recurring crises because of the contradictions in capitalist accumulation expressed in the profitability of capital. The Roaring Twenties gave way to the Great Depression of the 1930s.

And indeed, we can see why. In the US, the profitability of capital peaked in 1924, thereafter falling by over 13% up to 1929 (according to the D-L data – see chart above and see The Long Depression, p53). As a result, capitalist investment switched from productive capital into ‘fictitious capital’. Just as in the credit boom leading up to the global financial crash of 2008-9, much of the skyrocketing wealth of the 1920s was increasingly built on a shaky foundation of easy credit and stock market speculation. This fictitious capital crashed in 1929 and a major slump ensued with many banks going under.

So can the Roaring Twenties of the last century after the Spanish flu epidemic be repeated in this century after COVID? Will there be a new lease of life for the major capitalist economies that ends the ‘secular stagnation’ (Keynesian) or the Long Depression (Marxist) of the last decade since 2010?

Well, let us consider a Marxist model for creating a longish boom in capitalist production. A long boom will only be possible, according to Marx, if there has been a significant destruction of capital values, either physically or through devaluation, or both. Joseph Schumpeter, the Austrian economist of the 1920s, taking Marx’s cue, called this ‘creative destruction’. By cleansing the accumulation process of obsolete technology and failing and unprofitable capital, innovation from new firms could prosper. Schumpeter saw this process as breaking up stagnating monopolies and replacing them with smaller innovating firms. In contrast, Marx saw creative destruction as creating a higher rate of profitability after the small and weak were eaten up by the large and strong.

For Marx, there were two parts to ‘creative destruction’. There was the destruction of real capital “in so far as the process of reproductuon is arrested, the labour process is limited or even entirely arrested and real capital is destroyed” because the “existing conditions of production.. are not put into action”, ie firms close down plant and equipment, lay off workers and/or go bust. So the value of capital is ‘written off’, because the physical use value of labour and equipment etc is no longer used.

In the second case, it is fictitious capital that is destroyed. In this case “no use value is destroyed. … Instead:”a great part of the nominal capital of society ie of exchange value of the existing capital, is completely destroyed.” There is a fall in the value of state bonds and other forms of fictitious capital. But this leads only to a “simple transfer of wealth from one hand to another” (those who gain from falling bond and stock prices from those who lose). But it can also lead to the destruction of real capital, when it leads “to the bankruptcy of the state and of joint stock companies.” Marx 1861-63 Writings, cited by Giacce, https://www.jstor.org/stable/23104259?seq=1

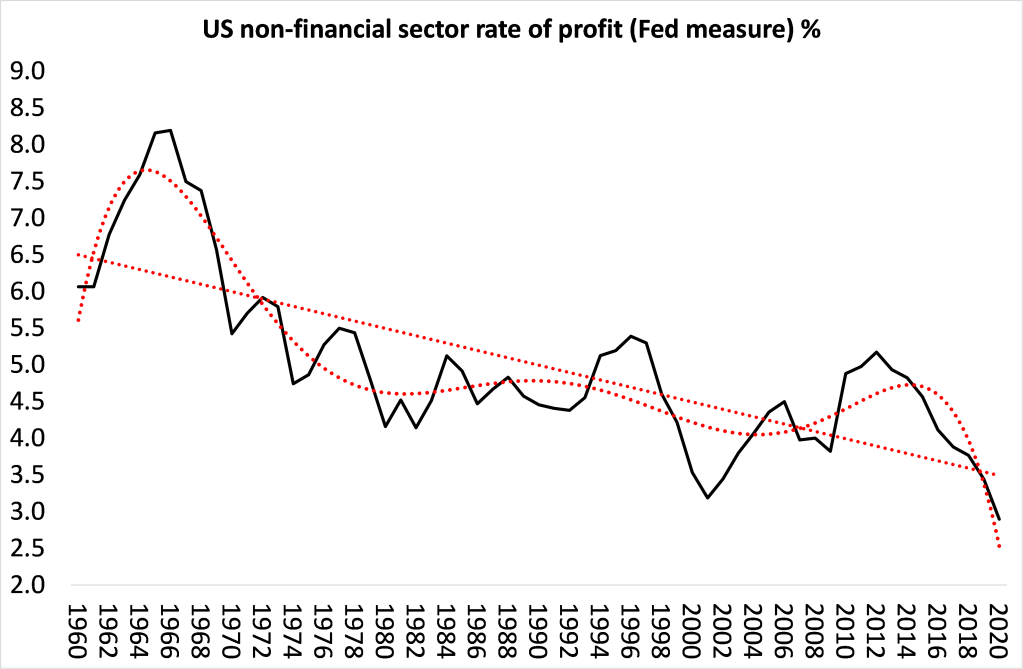

Let us take the first of these cases of creative destruction. Can we say that in 2021, the COVID slump has sharply increased the profitability of capital in the major economies, or that it will do so? Before the pandemic slump, profitability in the major capitalist economies was near all-time lows, one of the key indicators and explanations of the Long Depression of the last decade or so.

This was particularly the case for US capital. Recently, fellow Marxist economist, Chris Dillow, who writes for Investors Chronicle, reiterated the arguments and data that I have been making about US profitability. He commented: “They show that the pre-tax profits of non-financial companies last year were just 7.4 per cent of non-financial assets (measured at historic cost). This was only half the rate that firms enjoyed in the mid-1950s. And even before the pandemic, the profit rate had been trending down for decades: it was lower in 2019 than it was in the 1970s, for example.” Here is my chart, measured slightly differently, but making the same point.

Globally, too corporate profits (the mass, not profitability) growth had virtually ground to a halt before the COVID pandemic.

This was not the situation in 1919, at least in the US.

Second, far from the pandemic slump clearing away fictitious capital so that new capital could sprout, there has been an unprecedented expansion of cheap credit money to support businesses, large and small. The Long Depression was one where although productive capital grew slowly, fictitious capital rocketed. And so it has been during the pandemic slump. There has been no collapse in stock and bond prices (so far).

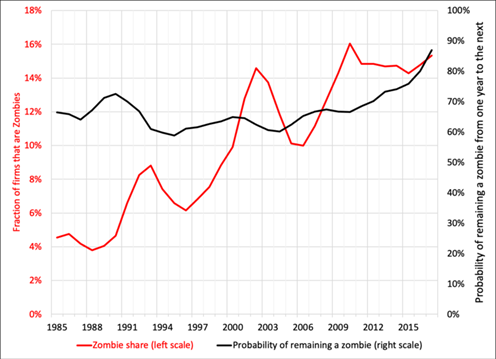

So the pandemic slump has not led to the destruction of weak and unprofitable ‘joint stock companies’ but to the opposite. There are yet more unprofitable, mainly small, businesses, staggering on and kept afloat by a wave of zero interest cheap money pumped in by central banks. It’s not ‘creative destruction’ but the rise of the ‘zombies’.

The latest data show that in the US nearly 20% of all firms are in the ‘zombie’ category, while in Europe it is as high as 40%. While these firms remain, they keep average profitability low, labour productivity growth weak and unemployment down. That is not the capitalist recipe to start a long boom.

By the way, currently there is an argument that these zombie companies are not really zombies at all. Companies that appear to be running at a loss (with negative net income) are not. Instead, they have been investing in ‘intangibles’ (software, R&D and media that are being deducted from income. If added back to income, then many zombies are doing well. However, if this were the case, where are the results in productivity growth? But that’s another post.

Perhaps the Biden fiscal stimulus and infrastructure programs that constitute a seemingly huge injection of government spending (16% of US GDP) will ‘prime the pump’ of an investment explosion that will deliver a roaring twenties. That is certainly the hope or expectation of many Keynesian economists. But Biden measures (even if fully implemented) do not compare in magnitude to the post-WWII reconstruction boom in Europe. The major economies are not in such a post-war situation.

Remember, even before the virus hit the global economy, many capitalist economies were slowing fast or already in outright recession. In the US, one of the better performing economies, real GDP growth in Q4 2019 had fallen to under 2% a year with forecasts of further slowdown this year. Business investment was stagnating and non-financial corporate profits had been on downward trend for five years. The capitalist sector was and is in no shape to lead an economic recovery that can lead back to higher growth, productive investment and rising real incomes.

The point is that, once the current pandemic lockdowns end, what is needed to revive output, investment and employment is something like a war economy; not bailing out big business with grants and loans so that they can return to ‘business as usual’. This slump can only be reversed with war time-like measures, namely massive government investment, public ownership of strategic sectors and state direction of the productive sectors of the economy.

But isn’t that what the Biden programmes aim to do and Roosevelt dd with the New Deal in the 1930s? Well, the historical evidence is that the New Deal did not restore a long boom for US capitalism. It took WW2 to do that. Keynes himself said that the war economy demonstrated that “It is, it seems, politically impossible for a capitalistic democracy to organize expenditure on the scale necessary to make the grand experiments which would prove my case — except in war conditions.” In a post of mine back in 2012 I showed that: “in 1940, private sector investment was still below the level of 1929 and actually fell further during the war. So the state sector took over nearly all investment, as resources (value) were diverted to the production of arms and other security measures in a war economy.”

Andrew Bossie and J.W. Mason published a perceptive paper on the experience of that public sector role in the war-time US economy. They show that all sorts of loan guarantees, tax incentives etc were offered by the Roosevelt administration to the capitalist sector to begin with. But it soon became clear that the capitalist sector could not do the job of delivering on the war effort as they would not invest or boost capacity without profit guarantees. Direct public investment took over and government-ordered direction was imposed.

The war economy did not ‘stimulate’ the private sector, it replaced the ‘free market’ and capitalist investment for profit. To organize the war economy and to ensure that it produced the goods needed for war, the Roosevelt government spawned an array of mobilization agencies which not only often purchased goods but closely directed those goods’ manufacture and heavily influenced the operation of private companies and whole industries.

Bossie and Mason found that from 8 to 10 percent of GDP during the 1930s, federal spending rose to an average of around 40 percent of GDP from 1942 to 1945. And most significant, contract spending on goods and services accounted for 23 percent on average during the war. Currently in most capitalist economies public sector investment is about 3% of GDP, while capitalist sector investment is 15%-plus. In the war that ratio was reversed. The Biden plans would just raise the government investment ratio (over ten years) to about 4% of GDP, if fully implemented.

Bossie and Mason conclude that: “the more—and faster—the economy needs to change, the more planning it needs. More than at any other period in US history, the wartime economy was a planned economy. The massive, rapid shift from civilian to military production required far more conscious direction than the normal process of economic growth. “

What the story of the Great Depression and the war showed was that, once capitalism is in the depth of a long depression, there must be deep destruction of all that capitalism had accumulated in previous decades before a new era of expansion becomes possible. There is no policy that can avoid that and preserve the capitalist sector. If that does not happen this time, then the Long Depression that the world capitalist economy has suffered since the Great Recession could enter another decade.

“The Roaring Twenties” was the glided cover of a decrepit and corrupt economy. Yeah, there must be a destruction before there is room to reset the accumulation process; but the destruction alone will not guarantee that will happen.

Well researched, valuable and quotable piece. The only thing roaring about the 2020s is global warming. This period is unique and has no parallel. Your graph on Global Corporate profits needs qualifying. The reason profits rose last year was purely due to subsidies from Relief Bills. Strip them out and this is the rate of profit from 2013 to 2020 in the USA. 6.59%, 6.55%, 5.96%, 5.63%, 5.50%, 4.77%, 4.41% and 2.95% (based on pre-tax non-financial corporate profits over fixed and circulating capital). So an unbroken fall every year for 7 years, the length of the average business cycle, unprecedented. It is likely that the rate of profit stripped of subsidies will also fall this year making 8 years of falls. The GDP growth figures also need qualifying. The corporate sector alone received subsidies equivalent to 3.5% of GDP. Without these subsidies GDP would have fallen 7% last year not 3.5%. And this is not counting the subsidies that went to non-corporate business, the non-profit sector, the household sector and sections of government such as Medicare and Medicaid. So the boost to GDP, even without more robust consumer spending, was very significant.

All in all the figures are totally distorted currently and we should not draw too many conclusions. You are right to be ambivalent about the virus. Where one does not have to be ambivalent about is the perspective there will not be another relief package, the fourth. The Chair of the FED has said as much when he stated last week that govt debt was of a size where it was barely manageable. And as you have pointed out repeatedly, the Infrastructure Spend is likely to amount to at most $250 billion which is neither here nor there when taking into account the offsets.

I do not support the argument that the Zombie corporations are not Zombies because of their investment in intangibles. This is a sleight of hand created by the 2012 revisions to the SNA which converted costs such as R&D into capital by means of an imputed (fictional sale). They are still costs despite having been moved from the profit and loss account to the balance sheet.

In summation, the first half of the year will still be the twilight zone where subsidies massage the data. In the second half of the year, when the tide of subsidies has passed, only then will we see what is lying on the sea bed, and it is likely to be scoring rather than roaring (scarring does not rhyme sorry ).

please add, $250 billion per annum (regarding infrastructure spending)

In contrast to the meager Biden agenda, Bernie Sanders wanted to “Directly invest an historic $16.3 trillion public investment toward these efforts, in line with the mobilization of resources made during the New Deal and WWII” under his Green New Deal plan. Michael, would you consider such a plan sufficient or would it still be too small?

Sorry to reply so late. Missed your question. As far as I remember, Sanders plan was over 15 years, thus spending perhaps $1-2trn a year, maybe more up front. So it would have been a bit larger than Biden’s approx $1trn a year on climate and infrastructure but not much more.

“The latest data show that in the US nearly 20% of all firms are in the ‘zombie’ category, while in Europe it is as high as 40%. While these firms remain, they keep average profitability low, labour productivity growth weak and unemployment down. That is not the capitalist recipe to start a long boom.”

Why is that? One factor only, in my opinion: China.

It would be very easy for capitalism to initiate creative destruction – they did so constantly during Adam Smith and David Ricardo’s time (the “classical liberalism era”). They could do so because, sure, there was no democracy (universal suffrage), but, most importantly, the working classes were completely defenseless.

It was the rise of socialism in the mid 19th Century that put a stop to that process. This process culminated with the opus of Karl Marx and the triumphs of the social-democratic parties in the main Western European nations (of which the Germany SPD was the most successful). Liberalism was not the only ideological game in town; if you were a liberal economist, you would have to tone down your beliefs from now on.

Things got even worse for liberalism when it self-destructed in WWI (1914-1918), in a process in which the first successful proletarian revolution happened (October, 1917). The first ever proletarian State spread the virus of anti-colonialism to the world and put even more pressure on the liberal (capitalist) powers, which now had to start to give up even their colonies.

After the WWII (the war waged to destroy socialism once and for all), the USSR not only survived, but it survived stronger than ever and with an insurmountable prestige. The capitalist would have to give high life standards to their working classes – at least in the geostrategic ones (Western Europe, Japan, South Korea) – if it wanted to win what was now an political-ideological war (Cold War). If it wasn’t for the immense pressure the USSR exerted over Western Europe and Japan, for sure the vaunted Welfare State wouldn’t exist. It was the existence of socialism in the real world (not just in theory) that inserted this anomalous element – a good standard of life and the right to vote to the workers – in capitalism. The middle class was born.

It is necessary to highlight that the formation of the “aristocracy of the working class” was the main stumbling block for the Bolsheviks to spread their revolution in the aftermath of October 1917. The Social-Democratic parties of Western Europe complained to the Bolsheviks that their base didn’t want to go through the destruction and privations of the Russian Revolution. They wanted a safe and tranquil passage to a communist revolution, without having to give up what they’ve already conquered (“minimum program”).

The aristocracy of the workers were the wall with which capitalism blocked the Communist Revolution in 1917, and it was the battering ram with which it destroyed the USSR: Gorbachev was clear when he stated that the Soviet people wanted what the peoples of Western Europe enjoyed, and that’s why he destroyed the system which, by all economic metrics, was very far from collapsing (the CIA was extremely surprised by the quick fall of the USSR).

Irony of ironies, it is the aristocracy of the workers who’s now the main stumbling block for capitalism. Capitalism knows it must destroy its middle class to initiate its process of rebuilding, but it can’t. And it can’t because there’s a new USSR in town: the Popular Republic of China.

I think the First World countries are afraid of initiating their creative destruction now because China would come out on top. Socialism would gain the upper hand in this Second Cold War. That’s why they’re keeping their zombies, and why they’re printing money like there was no tomorrow.

And this guides us to another problem: there are no technologies on par with electricity in the 1920s-1940s. Of the seven technologies which the capitalists claim will start a new industrial revolution, only one – quantum computing – is near mass application (and it’s still on the trial stage!). All the rest they claim will come out any moment now is pure fluff: even what they claim to be “AI” that’s already out is not genuine AI, but simply more complex algorithms with more powerful computers.

Even if those new technologies do come out, they won’t come out exclusively in the USA: China is already there, if not one step ahead, in quantum computing, and is on equal stand on the rest. Nuclear fusion (ITER) is a joint project between the main countries, so whatever is discovered there will automatically go to both the USA and China. China is already ahead in 5G, 6G etc. etc., and, in the military area, Russia, like a phoenix, has already surpassed the USA in key areas (hypersonic weapons, which render the American naval power almost useless), not counting the areas it was already ahead (because the USSR was ahead), like submarines, tanks, electromagnetic warfare etc. etc.

Electricity was already ready to be used by the 1920s. All it needed was the literal destruction of the old infrastructure. That’s not the case with AI, quantum, nuclear fusion, nanotechnology, bioengineering etc. etc.

So much to take notes here. Very great perspective!

Another factor we should consider: how much will the new technologies rise the OCC?

More complex and sophisticated technologies bring a new problem: they require more sophisticated workers (at least at the labor aristocracy level). This was literally the biggest problem the USSR faced when it tried to transition from Fordism to Toyotism in the post-war period, as it was unable to reconfigure its entire planned economy towards a computerized, just-in-time planned economy. It would have to blow the entire thing up and rebuild again.

Capitalism may face an analogous problem: what if these new technologies, on the social level, are so complex and so resources intensive that creative destruction becomes not viable?

Of course, that’s not an Economic problem: capitalism went through an industrial revolution before, so there’s no reason not to think – economically – that it could do it again. But historically, this matters, as History is not a closed system.

Historically speaking, if these new technologies require an even more sophisticated middle class to operate it, while a creative destruction so devastating that it would be required to wipe it out, then capitalism may find itself in a dead end. It would then enter in a historical phase of shrinking and degeneration, where the capitalist elites would abandon any expectations of development of the productive forces and just try to survive as a social order. The Byzantine Empire maintained a non-hereditary system for its de facto nobility until the very end – even though, for more than three centuries – it was obvious that Manorialism (feudalism) was the superior system. Such a scenario wouldn’t even require a hypothetical socialist star affecting its gravitational field.

Cognitive Capitalism and rise of Artificial Intelligence is one of those developments that probably no one could have imagined, let alone predicted 150, 200 years ago. Other than in Science Fiction genre.

All major studies indicate to a drastic replacement of workers by various types of AI operated systems in the next 15 to 20 years; and these are not just entry level, minimal jobs, but also include some tasks within Investment Banks and other highly skilled jobs.

Creation and emergence of a “surplus population” will be only one after effects of such displacements.

Nick Dyer-Witheford: Cyber-Marx

https://www.historicalmaterialism.org/interviews/nick-dyer-witheford-cyber-marx

In the roaring 1920’s and in the glorious 1950’s the world was flooded with cheap oil. Today? https://www.nytimes.com/2021/02/11/business/shell-oil-production.html No oil, no recovery.

Dear Jose Mercado, I have a similar vision, I have written a paper about this. I would like to send you for your review.

So basically a war economy is the closest form capitalism can have to communism. And we do not look for war but war looks for us under such situation

Such a comparison depends on one’s definition of Communism; is the comparison to War Communism of early USSR? Or are we comparing to Council Communism?

Former does have some similarities.

Latter definitely not.

As long as Council Communism is mentioned, we would remiss not to also mention Paul Mattick and his incredibly perceptive (and still relevant) writings, covering almost half a century.

Paul Mattick

1904-1981

https://www.marxists.org/archive/mattick-paul/index.htm

Indeed

I do not think there is such a movement as council communism. The USSR had it’s councils and now PRC has it’s councils. It is just that peasants are dominant in these soviets today. Also War Communism is just a set of practices adopted by the Bolsheviks during the Russian Civil War for very immediate necessities of revolution. This is not what I meant. I said there is a similarity between capitalist war economy and communism because capitalist countries has to actively intervene in their economies for such militaristic transformation. Hence capitalism’s solution to crises is emulation of communism via creation of war like destructive situations. These does not only make state have more control on economy but also cause a devaluation of capital and labor power; Consequently procuring a higher rate of profit in country as cost of capital falls. Wages will fall if masses lost their jobs. Means of production will cheapen if there are lots of bankrupt firms who sell their industrial assets. All these will consequently give a rise to rate of profit.

Since Council Communism has had numerous direct and indirect effects on various different movements, it might be a bit difficult as to fully and comprehensively asses and critically evaluate its influences.

For instance, Raoul Vaneigem in his “The Revolution of Everyday Life,” is said to be sympathetic to and influenced by Council Communist notions and ideas. Exactly how is “The Revolution of Everyday Life” Council Communistic?

Or closer to home many Occupy Wall St. activists and organizers were also very sympathetic to, and somewhat influenced by Council Communist principals (including but not limited to David Graber…)

Aside from these popular activist movements there is also the intellectual movements of this tradition and its transition into 21st century.

Witchcraft and magic among the Marxists

https://www.radicalphilosophy.com/reviews/individual-reviews/witchcraft-and-magic-among-the-marxists?highlight=Paul%20Mattick%20Jr

Perhaps there has always been a Council Communist movement, both in the activists’ movements and intellectual contributions.

“War Communism is just a set of practices adopted by the Bolsheviks during the Russian Civil War for very immediate necessities of revolution.”

Lenin adopted Taylorism as a form of labor management compatible for a workers’ state. They continued to be influenced by Taylorism long after Early 20’s. It must be exceedingly difficult to lead a workers revolution, with deadly illusions about methods of Capitalist labor management.

Issues of State Capitalism and its policies, its transition to 21 century, especially during and after Covid-19 crisis, and its trajectories remain crucial.

As long as Raoul Vaneigem has been mentioned here, it would be a real shame not to include

“The Revolution of Everyday Life”

The Everyday Eternity of Life

https://theanarchistlibrary.org/library/raoul-vaneigem-the-revolution-of-everyday-life#toc3

Vaneigem’s book is actually only one part of the compendium, and might be best to see with the movie below, and a reading of Debord’s contribution.

“La Dialectique Peut-Elle Casser Des Briques ?”

The Society of the Spectacle by Guy Debord (1973)

“Lenin adopted Taylorism as a form of labor management compatible for a workers’ state. They continued to be influenced by Taylorism long after Early 20’s. It must be exceedingly difficult to lead a workers revolution, with deadly illusions about methods of Capitalist labor management.”

Mr. Hoshang, this is not true at all. Taylorism and Fordism were rejected by Bolsheviks because they reduced the worker to a machine without free will. This happens at the First Conference on Scientific Organization of Labour:

https://en.wikipedia.org/wiki/First_Conference_on_Scientific_Organization_of_Labour

Towards the end of article it states:

“Currently in most capitalist economies public sector investment is about 3% of GDP, while capitalist sector investment is 15%-plus.”

What’s the story with the remaining 82%?

The breakdown is 65-70% personal or household consumption; 15-20% capitalist investment; 10-15% government consumption ie government employees and materials and 3% government investment (projects, infrastructure etc). Government taxes and welfare payments are ‘transfers’ and not included in the make-up of annual national expenditure.

One question intrigues me. Wars restore profitability because they induce a reconstruction of the Capitalist State, which is always more concentrated and oligopolized. Wouldn’t it be the oligopolization of companies that allows for an increase in the rate of profitability of capital? For if we skip the need for destruction and fall directly into the increase in market oligopolization, profitability rates would not be recomposed for some time.

In short, can the pandemic result in a small extension of capitalist society? Would the faster and stronger fall cycle resume afterwards?

Oligopolies can establish a higher rate of profit for a while in the markets they control, but that will be at the expense of the rate of profit of the smaller companies. Total profit cannot be increased by the price fixing of oligopolies but only by the exploitation of labour. If that is the case, oligopolies only redistribute the profits to their benefit – but only for a time because competitors will eventually appear. But as you say, crises actually increase the concentration and centralisation of capital in response.