The debt problems afflicting China’s real estate market deepened this week after another property developer defaulted on its bonds and the world’s most heavily indebted property group Evergrande extended a suspension of its shares into a second day without explanation. Fantasia Holdings, a mid-sized developer, that just weeks ago assured investors it had “no liquidity issue”, said in a stock exchange filing that it “did not make the payment” on Monday of a $206m bond maturing that day, triggering a formal default. The default adds to fears that a crisis at Evergrande will spread to include more of China’s property developers, which account for a large portion of the Asian high-yield bond market.

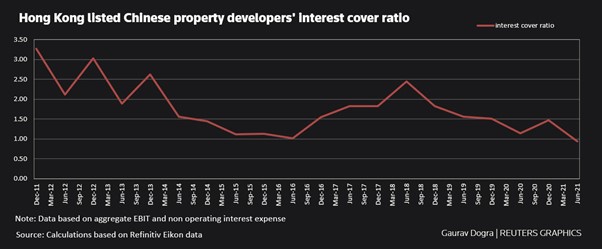

Evergrande missed an interest payment on an offshore bond on September 23, triggering a 30-day grace period before a formal default, and has yet to provide any announcement on the matter. But even before China Evergrande Group’s debt crisis sent the country’s property sector into a tailspin, Chinese property firms were struggling to earn enough to make interest payments on their debt. At the end of June, the aggregate interest coverage ratio of 21 big Hong Kong-listed Chinese real estate developers fell to 0.94, the worst in at least a decade, according to Reuters calculations based on Refinitiv data.

Hong Kong listed Chinese property developers’ interest cover ratio

In other words, China’s private property sector are now composed of ‘zombie’ companies just like 15-20% of companies in the major capitalist economies. The question now is whether the Chinese authorities are going to allow these firms to go bust. Shares in Huarong, China’s biggest bad debt manager, were suspended for months earlier this year after the company delayed its financial reports before finally unveiling a record loss in August. The delays sparked a debate over the extent to which Beijing will step in to help distressed companies.

The real estate sector faces pressure from Beijing to reduce leverage after decades of debt-driven expansion that helped fuel the country’s rapid economic growth. The government’s financial authorities have set three ‘red lines’ that financial and property companies cannot cross. Back in 2020, the People’s Bank of China and the Ministry of Housing announced that they’d drafted new financing rules for real estate companies. Developers wanting to refinance are being assessed against three thresholds: 1. a 70% ceiling on liabilities to assets, excluding advance proceeds from projects sold on contract; 2. a 100% cap on net debt to equity; 3. a cash to short-term borrowing ratio of at least one. Developers will be categorized based on how many limits they breach and their debt growth will be capped accordingly. There are now several large property companies in that situation.

The government is faced with a dilemma. If it allows Evergrande and other property companies to go bust, then millions of homes for people may not be built and the losses incurred by lenders to, and investors in, these companies could have a cascading effect across the economy. On the other hand, if the authorities bail out the companies, then the speculation could continue as the real estate sector could assume that they had government backing for all their speculative projects and they were ‘too big to fail’ – that’s so-called ‘moral hazard’; the same dilemma that faced the US authorities in 2008 when the property markets went belly up and the mortgage lenders and banks hit the dirt.

Most likely, the government will do something in between. It will ensure that the homes promised by the likes of Evergrande to 1.8m Chinese will be built by taking over the projects; already local authorities have moved in to take over local projects from Evergrande. At the same time, central government and the PBoC will allow Evergrande to default on investors and bond holders (to a degree). If those losses spill over into the financial sector, the Chinese government has plenty of financial slack to absorb the hit, as it has done in the past. For example, Evergrande’s debt of $300bn should be compared to total credit outstanding in China of $50trn, ie not very large. Moreover, if the final bill falls on the state and the state banks, reserves there can easily digest the losses.

The real problem is that in the last ten years (and even before) the Chinese leaders have allowed a massive expansion of unproductive and speculative investment by the capitalist sector of the economy. In the drive to build enough houses and infrastructure for the sharply rising urban population, the central and local governments left the job to private developers. Instead of building houses for rent, they opted for the ‘free market’ solution of private developers building for sale. Evergrande-like development in China wasn’t just capitalism doing its thing. It was capitalism facilitated by government officials for their own purposes. Beijing wanted houses and local officials wanted revenue. The housing projects helped deliver both. The result was a huge rise in house prices in the major cities and a massive expansion of debt. Indeed, the real estate sector has now reached over 20% of China’s GDP.

This growth in real estate and other unproductive activities in finance and consumer media has been driving China’s official annual growth rate. As the productive sector of industry, manufacturing, hi-tech communications, etc grew more slowly, the authorities fooled themselves into claiming that real GDP growth targets of 6-8% a year were being met but this was increasingly because of the real estate market. Of course, homes need to be built, but as President Xi put it belatedly, “homes are for living in, not for speculation.”

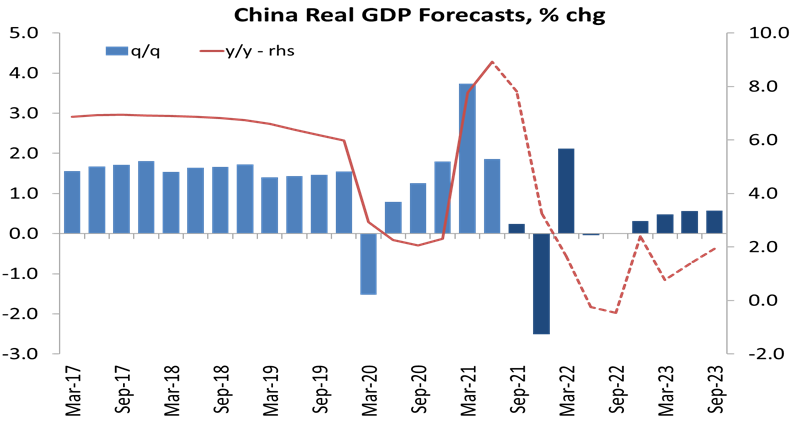

There is no getting away from the fact that there will be an immediate hit to growth from Evergrande and the associated spill-overs. China’s recovery from the pandemic slump had already been faltering, partly because of new COVID variant eruptions that caused mini lockdowns, but mainly because investment and trade growth is being limited by the patchy recovery in the major capitalist economies. So China will be lucky to hit a 2% rate for the remainder of this year.

More worryingly, even if a more disorderly spiral across the property market can be averted, the end of the credit-fuelled real estate model (or even a tempering of it) will mean lower growth. That’s the issue. The ‘Western China experts’ are convinced, either that China is finally going to have a financial implosion (something forecast nearly every year for the last 20 years); or that the economy will fall into a low growth path of 2-3% a year, hardly higher than the ‘mature’ capitalist economies.

One reason presented is that the working population is declining (indeed, it is reported that China’s fertility rate is now below that of Japan) to the point where the population could be halved by the end of the century. Another reason popular with the experts is that China’s investment-driven, export-led model for growth is over. Instead of investment, China should now rely on boosting consumption for the masses, as in the US and most of the G7 – and that means reducing the size of the state through privatisations and opening up the economy to even more ‘consumer markets’. Moreover, exports may no longer make much of a contribution to China’s growth rate because of the trade and technology barriers being erected by the US and its allies to isolate and curb China’s progress. The Chinese government is aware of this. That is why the Xi leadership talks of a ‘dual circulation’ development model, where trade and investment abroad is combined with production for the huge domestic market.

As I argued in a previous post: “Gross investment has averaged over 47% of GDP since 2009. But real GDP growth has been slowing. So China’s productivity return on new investment (or the productivity of capital input) is declining. Back in 2006, before the global crisis, it took 2.9 units of investment to increase real GDP by 1 unit. In 2014, it now takes 6.6 units. China needs to return to its long-term average TFP [total factor productivity] rate of over 2.5% a year to sustain 7% real GDP growth.” In previous posts, I have attacked the arguments of the Western experts that China is about to have a financial crash like the 2008 one in the major capitalist economies; or that its growth rate will shrink to near nothing because of the failings of its state-led economic model.

Growth in real GDP depends on two factors: growth in the size of the workforce; and growth in the productivity of existing workforce. If the former slows or even falls, then a fast enough growth in productivity can compensate or even overcome the former. Productivity growth depends primarily on more capital investment in technology; better technology that saves labour time and a better trained workforce that can deliver more in less time. The problem for China from hereon is that its capitalist sector has been allowed to expand (in a “disorderly” fashion, says Xi) to the point where the contradictions of capitalist production are beginning to damage China’s formerly spectacular rise.

Indeed Xi’s call for ‘common prosperity’ is a recognition that the capitalist sector so fostered by the Chinese leaders (and from which they obtain much personal gain) has got so out of hand that it threatens the stability of Communist Party control. Take billionaire Jack Ma’s comment before he was ‘re-educated’ by the authorities: “‘Chinese consumption is not driven by the government but by entrepreneurship, and the market,’… In the past 20 years, the government was so strong. Now, they are getting weak. It’s our opportunity; it’s our show time, to see how the market economy, entrepreneurship, can develop real consumption.’”

—The Guardian, 25 July 2019

The profitability of the capitalist sector has been falling for some time, just as it has the major capitalist economies. So Chinese capitalists have looked for higher profits in unproductive sectors like real estate, consumer finance and media – that’s where the billionaires are found. These sectors are now blowing up in the faces of the Chinese leaders.

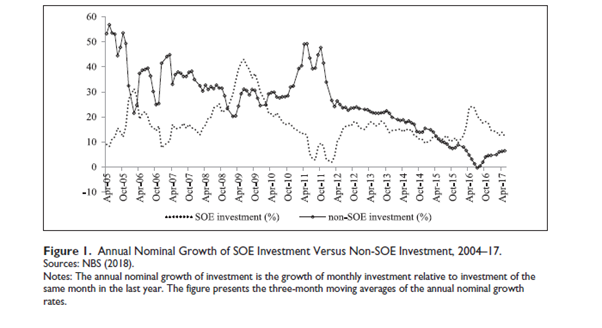

State sector investment has always been more stable than private investment in China. China survived, even thrived, during the Great Recession, not because of a Keynesian-style government spending boost to the private sector as some economists, both in the West and in China argued, but because of direct state investment. This played a crucial role in maintaining aggregate demand, preventing recessions, and reducing uncertainty for all investors. When investment in the capitalist sector slows down as it does as profit growth slows or falls, in China the state sector steps in. SOE investment grew particularly fast over 2008–09 and 2015–16 when the growth of non-SOE investment slowed down. As David Kotz showed in a recent paper: “Most of the current studies ignore the role of SOEs in stabilizing economic growth and promoting technical progress. We argue that SOEs are playing a pro-growth role in several ways. SOEs stabilize growth in economic downturns by carrying out massive investments. SOEs promote major technical innovations by investing in riskier areas of technical progress. Also, SOEs adopt a high-road approach to treating workers, which will be favorable to the transition toward a more sustainable economic model. Our empirical analysis indicates that SOEs in China have promoted long-run growth and offset the adverse effect of economic downturns.”

What is needed is not a further expansion of consumer sectors by opening them up to ‘free markets’, but instead state-led investment into technology to boost productivity growth. And that state sector investment can be directed towards environmental goals and away from uncontrolled expansion in carbon-emitting fossil fuel industries. As Richard Smith has put it: “The Chinese don’t need a higher standard of living based on endless consumerism. They need a better mode of life: clean unpolluted air, water and soil, safe and nutritious food, comprehensive public health care, safe, quality housing, a public transportation system centred on urban bicycles and public transit instead of cars and ring roads.”Rising personal consumption and wage growth will follow such investment, as it always does.

But that means it is time for the Chinese government to make a turn back towards state investment and planning of housing, technology and public services and involve China’s highly educated industrial and urbanised workers in that planning. Unfortunately, China’s leaders do not want any shift towards the latter, so the danger of long-term economic slowdown will remain.

A copy-paste of FT articles, with a Marxist twist. The Chinese model made a blog. Ironic.

It is a contradiction and simply not in accord with the reality to speak of “the capitalist sector so fostered by the Chinese leaders (and from which they obtain much personal gain) has got so out of hand that it threatens the stability of Communist Party control.” The entire economy is capitalist. The SOEs are empires for various cliques of officials. SOEs issue shares; only a small part of the total equity, but investors expect gains from buying the shares.

“SOEs adopt a high-road approach to treating workers.” (Kotz) The whole thing got started when SOEs tossed out millions of workers in the 1990s and tore up their social safety net! SOEs today employ a small portion of the workforce.

The interconnections between Party officials and capitalists are pervasive and tight. Read Red Roulette for example after example. Xi Jinping’s family has hundreds of millions of dollars in corporate wealth in China and real estate wealth in Hong Kong. This is typical. The notion that these officials are tough communists just waiting to turn a capitalist society on a dime to socialism has no basis in fact. It is a dangerous illusion. China is a monopoly capitalist power.

“SOEs issue shares; only a small part of the total equity, but investors expect gains from buying the shares.”

Liberals think that state owning big share in a private company makes it a state-owned enterprise. Thinking that state property becomes private property if the same happens to them – them issuing shares to private investors – is liberalism. Truth of the matter, however, is that in China SOEs follow the Plan as a law, and only then they think about whatever obligations they have to shareholders.

“The SOEs are empires for various cliques of officials.”

Typical slander by the neoliberals, who have to claim that state is less efficient (through cliques and corruption and such) than private enterprise for ideological reasons.

“The whole thing got started when SOEs tossed out millions of workers in the 1990s and tore up their social safety net! SOEs today employ a small portion of the workforce.”

And yet SOEs amount to a staggering amount of total goods produced. Why should SOEs focus on employment, if they are state property, meaning everyone’s property and are supposed to benefit the whole of society? The state efficiently producing basic goods for the economy, and people getting different jobs in light industries using those cheap affordable basic goods. So, SOEs achieve a domination of the economy using less people, with those people instead choosing to work in the light industries – how’s that a bad thing?

“Read Red Roulette for example after example.”

It’s all slander and lies. Not the first time western propaganda tried to portray communist bureaucracy as the real oppressors.

“The notion that these officials are tough communists just waiting to turn a capitalist society on a dime to socialism has no basis in fact.”

China has no capitalist society, and had none since Mao, because having capitalists doesn’t mean that you have capitalism, just like having workers under capitalism doesn’t mean you are a socialist country. Read articles tagged with China in this blog, it’s all explained really well.

Nopenope says, “SOEs amount to a staggering amount of total goods produced.” Nope. A study by Chunlin Zhang at the World Bank finds that SOEs account for 23 to 28 percent of GDP. The World Bank needs to know the facts before it can fashion its policy line. See https://openknowledge.worldbank.org/handle/10986/32306

Nopenope says, “in China SOEs follow the Plan as a law.” You will look in vain to find an overall planned allocation of investment, let alone an institutition that enforces the overall allocation of investment.

Charles,

Thanks for mentioning “Red Roulette”.

Makes clearer what is meant by “socialism with Chinese characteristics”.

“But that means it is time for the Chinese government to make a turn back towards state investment and planning of housing, technology and public services and involve China’s highly educated industrial and urbanised workers in that planning. Unfortunately, China’s leaders do not want any shift towards the latter, so the danger of long-term economic slowdown will remain.”

This is a puzzling conclusion to your post on China’s Turning Point.

Isn’t re-engaging the state with the private sector what Xi is doing by issuing all the new regulations? The real estate bubble in China is not a mortgage crisis; it is a “completion” crisis to meet existing demand for housing. The state can, and probably will, use SOE construction firms to complete most of the projects. The main losers are likely to be investors, especially foreign ones. That should warm the hearts of Marxists everywhere….

As for “involving” the educated masses in planning: The CCP is, or claims to be, a dictatorship of the people through the agency of the state. This generation is led by, and recruits among, the educated and urbanized classes. But it is unapologetically authoritarian. I/you/we don’t like its repression of civil liberties, suppression of minorities, and rampant nationalism (and not just against Western “imperialism”). But authoritarianism does enable a degree of economic decisiveness that the rest of the world can only envy. When led by a romantic peasant revolutionary who learned his Marxism at the feet of Lenin and Stalin, that decisiveness leads to a Great Leap Forward and disaster. When led by technocrats like Xi (however single-minded or ruthless), broadly recruited, who appear to learn from other system’s mistakes (Soviet-style command-all economies; Western-style trickle-down free-market economies, now apparently unable to confront BigTech) China seems to clearly define its economic problems and to act directly to solve them rather than worrying about theory, or deficits and the bond market, or the falling rate of profit.

Deng Xiao Ping proclaimed that China first had to engage with the world economy as it existed and to allow some people to benefit disproportionately. Now that China is a major part of the global economy, Xi is rooting out the corruption of the system, re-affirming egalitarian Socialist goals, and attempting to safeguard the CCP-led state from the competition of BigTech. His goals are more similar to Deng’s than they are to Mao’s Peasant Communism with Soviet Characteristics because both Chinese and global economies have evolved.

Whether we like it or not, and whatever the fate of Xi’s authoritarian regulatory reforms, I suspect that when the economic history of this era is written, Western Classical economics and Marxism alike will be footnotes and precursors to the incredibly rapid and more pragmatically led transformation of the living standards of China’s billions of people, one unprecedented in global history. Whatever one thinks of that form of government, it unquestionably led that transformation.

Excellent comment from Jobernard, who now only needs to include the role of ‘money printing’. in a successful sustainable development of the Chinese economy. Especially if the AGW “climate change emergency” is real,

to bypass market economics.

Well, thanks for the kudos.

As sympathetic as I am to the goals of MMT, if one accepts that MMT only serves the needs of a few resource- and monetarily-favored countries, then the question of whether it perpetuates international resource inequities still remains. I mean, this is a dilemma of inequality that no economic system solves. If Bill Mitchell proposes some kind of international economic body to deal with global inequality, that’s kind of wishing a (highly improbable to realize) solution to the entire problem, like “Let’s just seize the means of production!”

Jobernard,

Your easy sweeping aside of the patent swingeing supression and oppression by and the corruption of the Chinese fascist regime is breathtaking.

The living standards of a huge swathe of humanity may have been raised rapidly but it has nothing to do with socialism or communism.

Xi’s assault on the capitalist sector has nothing to do with egalitarian values.

It is a pure power play designed to ensure the economic and political hegemony of the Party and the preservation of its privilege.

“It is a pure power play designed to ensure the economic and political hegemony of the Party and the preservation of its privilege.”

It is better that the party have political and economic hegemony in China than the capitalist class. That the CPC represents the interests of the Chinese proletariat is proven by the vast improvements in living standards that have been accomplished under their hegemony. That there is a powerful bureaucratic and bourgeois element within the Party is not a negation of that fact nor does it render the “regime” fascist (authoritarianism is not synonymous with fascism.)

Harpo,

I would say totalitarianism plus oligopoly capitalism is fascism.

Where is the “socialism” (forget communism)? Its a farce.

The high leaders of the Party have enriched themselves and will protect and preserve their privilege at all costs.

Long live the glorious revolution!

Marx said it would happen, not that it would be pretty.

There’s a reason the CPC calls their system “Market Socialism with Chinese Characteristics”. It is not the definitive form of socialism, not even an international form of socialism. It is meant to be transitory.

We could also invert the question: the failure of Western Marxism to do the communist revolutions in its countries isolated China, which is having to develop the productive forces on its own because it cannot have help from the developed places.

There’s no doubt socialism is only viable on an international scale. If China keeps being isolated, it will eventually suffocate and die, as did the USSR. All the CPC is doing is to buy time for the rest of the world to also implement socialism. If the rest of the world doesn’t come to the rescue, socialist China will eventually fail, and the proletariat will have to start all over again.

That explains the friendly relations with Pinochet, the adoration of Milton Friedman, the displacement of thousands by real estate “developers,” and of course the extension of mining projects against the interests of the indigenous people in Ecuador, not to mention suppression of miners in Zambia– just buying time for the rest of the world to also implement socialism.

Your comment is mean-spirited and pointless, except as your particular “pure” socialist declaration of war on China. VK’s is more to the point: a critique of such “marxist” views of China (and the ex-Soviet Union).

This comment deserves a considered response because it makes some points about Chinese policy that are unarguable from the perspective of My/Your/His beliefs about individual human rights and socialist internationalism. So let me try to explain why I think CCP-led China undertakes these policies without trying to justify the policies involved.

Lacking any tradition of individual rights or “civil” liberties, China’s oldest tradition might be termed “Confucian authoritarianism”: obey the head of the family/state who had (almost by definition) the sanction of god/ancestors/nature and (again by definition) the duty to do what is best for the nation. Along with that, came a belief that China (Zhongguo: Middle Kingdom, as in “center of the world”) was/is the civilized center of the globe. That is a high national valuation! And China probably does have the longest continuously documented culture in history.

Present-day Chinese communism, despite its original iconoclasm, builds upon both of these. Despite a hundred years of national shame under Western imperialism, what is emerging is a form of aggrieved “National” (not International) Socialism. Xi has definitely tapped into this and, often dangerously, recently roused nationalism to fever pitch. There may be nothing more dangerous to peace than a once-proud civilization, recently trampled upon, rediscovering a sense of its own power and pride in its own traditions.

The CCP doesn’t care about the world’s oppressed masses: they care about the safety and well-being of their country and their own people. Xi is forcefully reminding them of that, but especially the latter. Therefore, the Chinese practice realpolitik with a vengeance. “We deal with your government in our own national interest. We don’t criticize you. Don’t criticize us. This is especially true if we need your resources. This is true if our mining companies need your workers.” (This latter has also been true of Chinese workers recently under Chinese capitalism. They are often exploited by corrupt local fiat.)

Xi says he wants to change the exploitation of the Chinese people, but don’t expect him to change foreign policy to suit international working-class solidarity any time soon. Not in this polarized international environment. So Pinochet, Africa, the rest follow this pattern. What Chinese companies–SOEs or private–do overseas isn’t China’s problem if there is national benefit. And there is a defensiveness against foreign criticism that does militate against recognizing any inconsistency. (“What about….”)

That said, I am not aware of any Chinese adoration of Milton Friedman. Like all countries, they utilize monetary policies, but state ownership and fiscal policies are way, way different. And the economic results speak for themselves.

You phrase it as if it was the fault of China that Pinochet existed, when, in fact, the fault lied with Allende’s utopian social-democracy. Had Allende done what needed to be done, there would be no Pinochet.

Milton Friedman only rose to influence in the USA because the center-left that dominated public opinion during the Keynesian era collapsed after they wholly supported the Vietnam War. He was only able to fill the vacuum because the so-called center-left (which included both Western Marxists and Non-Communist Leftists) did not have the strength to contain the neoconservatives, who won the ideological war. Again, China had nothing to do with the rise of Milton Friedman.

Besides, there’s a huge difference between having to deal with and propping up a regime. China has to deal with the capitalist world. The USA props up those regimes.

Western Marxism should stop blaming the others and start questioning why they’ve been failing since the 1900s (or, for that matter, since Marx’s death). It was Russia and China (and then Vietnam) who did victorious proletarian revolutions, not the glamorous Western Europe or the USA. The only successful proletarian revolution in the West so far is Cuba (which many Western Marxists have already given up and taken it as lost).

If the Western Marxists continue with their defeatist and fatalist positions, it won’t take too long until they lose the little credibility they have left, and be treated, for all intents and purposes, as accomplices of capitalism.

I think Jobernard correctly assesses the imperative behind China’s actions, guardians of the reputation of the CPC to the contrary not withstanding: the CPC acts on the basis of its perceived interest. Now you can justify it as national interest, but you shouldn’t confuse it with proletarian internationalism, waiting for socialism, or anything other than what it is, however mean-spirited acknowledging reality may appear to some. And that’s the point.

As for this: “Milton Friedman only rose to influence in the USA because the center-left that dominated public opinion during the Keynesian era collapsed after they wholly supported the Vietnam War. He was only able to fill the vacuum because the so-called center-left (which included both Western Marxists and Non-Communist Leftists) did not have the strength to contain the neoconservatives, who won the ideological war.”… talk about missing the point and by a mile.

VK would have us believe that class interest has nothing to do with what political economic ideology ascends to the level of religious truth in the bourgeois order. Friedman’s “popularity” was based on the decline in profitability in the US, and the need for capitalism to attack the protections labor had won during the post WW2 era. The ideology of the free market is just that– an attack on living standards, on any “restraint” of avarice, and the imperative of capital to breakdown the protections and measures of equality already in existence, in order transfer wealth up the social ladder– which is exactly what happened with Reagan and Volcker (and Thatcher).

Oh… as for a “declaration of war on China,” I understand the need of some to maintain the canon of the church, but that’s not Marx’s method– which was something like “merciless criticism of everything in existence.”

To the extent that the facts are right, and I’ll take his word for it, I agree with Anti-capital on this point.

I think the proof of the pudding is in the eating: if some third world country getting the short end of the stick from some exploitative agreement with China decides enough is enough and to kick the Chinese investors out, I hope those who support China’s domestic policy will also respect other countries acting in their best interests.

And I’ll cross my fingers that true to its non-interventionist history, China won’t retaliate by regime change or economic sabotage. I understand if they choose not to do business with said country, it’s their right, but I hope they won’t resort to any of the underhanded tactics the US engages in to keep smaller countries down and out.

That will be the litmus test of whether China is imperialist or not. Until it happens, I wish China’s government and people success. But I reserve judgement on its economic model. The argument that an intelligentsia/bourgeois class threatens any transitional polity that hasn’t reached a full-fledged planned economy yet is cogent, grounded in precedent, and should serve as a cautionary tale for China. I hope they learn from it. Xi Jinping talks a good talk, I hope he walks a good walk.

Reply to “jobernard” (October 6, 2021 at 7:19 pm)

The form and shape the CPC and the PRC have taken to the present day have nothing to do with some kind of “Confucianism”, but with the old debate that happened during the 1920s and thereafter about the role of the Bourgeois-Democratic revolution as a theoretical intermediary phase between the periphery of the capitalist world and the Proletarian-Socialist revolution.

In Western Europe, evidently, there was no talk about any bourgeois-democratic revolution – Marxists spoke of a straightforward transition to socialism. In the underdeveloped periphery, however, it was a different story. This aspect is essential, because it helps us to understand why Eastern Marxism (and here I’m also talking about the Communist Party of Vietnam, not just the CPC) puts so much emphasis on the need of developing the productive forces first, before endeavoring in any kind of more radical socialist reforms (i.e. to complete the tasks the peripheral bourgeoisie didn’t want to do), and why Western Marxism became so messianic after WWII (during the “golden age of capitalism”/”Keynesian Consensus”).

The “Confucianism”/”Feudal heritage” thesis doesn’t hold ground mainly for three reasons which can be empirically attested:

1) The Chinese gave up their “feudal” culture in the 1911 Revolution. Mao’s Cultural Revolution was just a continuation and the pinnacle of that process, i.e. the process where the Chinese people, conquered and humiliated by the Europeans, realized their culture was inferior to the Western one, therefore they needed to modernize not only technologically, but also culturally;

2) China not only is not the only “Confucian” nation in East Asia, it is not even the most “Confucian. That prize goes to South Korea – which is turbo-capitalist, a dog-eat-dog world (which the South Koreans themselves call “Hell”). Japan is also much more “Confucian” than China, with its extreme respect to hierarchy and gerontocracy (see the accident in Fukushima, which reflected the problems of this system of blind faith on hierarchy). In fact, China is probably the least “Confucian” of the “Confucian” nations – and, if it is, it is because it is a Marxist nation; more importantly, it is patent that whatever we call “Confucianism”, it is clearly more compatible with capitalism than with socialism;

3) the CPC openly and frequently declares itself as not only Marxist, but Marxist-Leninist. There is no documental evidence that gives any indication it follows some version or some variation of Confucius; there are no mentions of the name of Confucius in the CPC’s official resolutions, except, maybe, as obiter dicta.

Yes, the Chinese soft power insertion in the Western university world happens through an institute called “Confucius Institute”. But the explanation for that is extremely simple and self-evident: the West is capitalist, not socialist; it would be extremely difficult – if not outright impossible – for China to do such enterprise with an institute called “Marx-Lenin Institute”. Instead, they picked up their most famous philosopher, from a long-distant past, in order to give a tone of neutrality to it. It would be akin to the West penetrating China’s universities with a “Plato Institute”, or “Socrates Institute”, “Aristotle Institute” or maybe even a “Kant Institute” (if you’re more of a Cold Warrior type of propaganda).

I in no way hold China “responsible” for the overthrow of Allende. I do think a “socialist” state, or a revolutionary government led by a communist does NOT have the same latitude for actions available to bourgeois states vs other bourgeois states. In particular, the so-called socialist state cannot extend loans to a bourgeois state, cannot take advantage of the destruction of labor protections to secure minerals, like copper, through favorable relations with CODELCO, which by law had to provide a portion of its revenues for the purchase of weapons for the Chilean military (and yes, for those who remember their history, I think the Bolsheviks violated their obligation to workers’ revolution with the treaty facilitating the German capitalists’ production of weapons within the boundaries of the Russian Revolution–, weapons which inevitably found use against the workers uprisings in Germany).

China’s involvement in Africa in the 1970s and 1980s, driven by its determination that “Soviet social imperialism” was its main global threat, is a record of manipulations, accommodations to the US, support for those in Angola,( UNITA, for one) that called on the assistance of apartheid South Africa, etc. with China backing any number of leaderless and riderless horses in a race going nowhere.

I actually don’t consider China to be “imperialist,” but that’s probably because the “definitions” of imperialism are so flabby as to be useless. But I don’t consider China to be completely capitalist yet– a bourgeoisie is in formation, relations of commodity exchange are expanding, but the bourgeoisie have not yet succeeded in converting the mode of production into one where all the means of production are exchange values, commodities.

Supporting the CPC, any faction of the CPC is one way to ensure that conversion reaches completion. If that amounts to a declaration of war, on my part, “against China,” I’ll simply point out how little firepower I’m bringing to bear on “socialism with Chinese characteristics” compared to the firepower unleashed by the CPC through its domestic and international policies.

‘’ Accomplices of capitalism. ’’

This definition, in addition to that of ‘’ defeatists ’’, referring to Western Marxists about their position on the Chinese Communist Party, could not be more disinterested (away from the real world) and lack of knowledge, a lack of research would rightly say Unbcanpolitical. Who is more complicit with capitalism, a Marxist who criticizes Chinese support for decades of neo-liberal governments around the world, or is Ji Xinping and his family with multimillion-dollar wealth in state-owned companies and real estate investments in Hong Kong ?. Multimillion-dollar wealth that also has, according to well-documented reports and already commented on this page, the leadership of the Communist Party and, probably, a good part of the 95 million civil servants. What kind of socialism do the CCP’s defenders aspire to? To a feudal socialism?

On the other hand, speaking of the failure of Western Marxists (Europe, United States) to not carry out a socialist revolution is another sign of serious ignorance. It is not knowing where and why revolutions originate. One hint: it is not in the most prosperous nations or in countries in times of economic growth that revolutions historically originate. A little study of the cycles of class struggles would not be anything more. Hint: study the Kondratiev cycles thoroughly.

Summary: There are no good and bad Marxists. There are only those with more or less knowledge. More advanced or more backward. The same thing happens to the rest of the people.

@ Anti-Capital – October 7, 2021 at 9:06 pm

I generally agree with the interpretation that CPC is doing successfully what Gorbachev tried to do. Both countries went through their 1989 moments. The Soviet/Russian one failed and market reforms were brutal. In China, the CPC managed to stay in power and tame the social forces that the opening up unleashed and is achieving a controlled transition to capitalist relations. This is still on going of course. I think VK and other people who believe China is still “communist” or whatever are engaging in wishful thinking. Xi praising socialism (with chinese characteristics) isn’t a proof of china’s socialist path any more than Biden or any other POTUS praising the democratic system of the West is proof for the western system. They use different ideological covers but the underlying productive relations are the same.

That being said, China and the imperialist world and NOT the same and, honestly, I do cut some slack in favor of China. So what if it is capitalist? It is still encircled by Anglo navies, it is still over-reliant on US-guarded trade routes and as far as the cases of “exploitative” relations with other nations in africa, I beg your pardon, but China is simply acting within the imperialist framework put in place by G7. Africa in particular is still a neo-colony of europe in the same fashion latin america is for the US. You look at dubious economic “metric” to establish if china is imperialist or not but you forget the number one, hard, metric: the presence of military of foreign power. France still controls some 1/3 of the whole continent of africa *militarily* and has engaged in some 70 leader assassinations the last 70 years or something. Remember what happened to Gaddafi? That was Frances initiative. When China wanted to establish a supply chain in Guinea and “extract” its good quality iron ore, France (and the US) made sure this wouldnt come to pass. And sure enough, a coup occurred with their backing.

All the talk about “authoritarianism” is just pure ideology. Anyone who takes political economy seriously shouldn’t fall in the “values” trap.

RE: VK et al.

So-called “Western Marxists” are a pathetic joke in general. They are delusional as they are arrogant. Indeed, they share these character traits in common with their own ruling classes, whom they claim to oppose.

In particular, Western Marxists delude themselves that, as citizens of the world’s leading capitalist-imperialist nations like America, Canada, Britain, or other Western war criminal states, they are going to somehow contribute to or even lead their glorious Socialist Revolution worldwide.

In reality, this creature called the “Western Marxist” represents an extremely fringe section of the imperial academic caste or middle-class intelligentsia in the American Empire and its allied crime partners in the Anglosphere or Europe.

They are a managerial class, or at best a Labor Aristocracy, whose relatively comfortable way of life is based upon maintaining not merely capitalism but especially American/Western world hegemony.

They do NOT represent the interests of the working class–and sure as hell not the working class of the Developing world, despite their pretensions to be crusaders for the international proletariat.

In short, Western Marxists are Ivory Tower Imperialists, Cruise Missile Leftists, and the Latte Left, who all are cult followers of a secular religion that they call “Marxism.”

What’s most comical about the Anglo American “Marxist” is this: the more that they utterly fail to create socialism in their own nations, the more aggressively they claim to be the moral judge and jury of True Marxism worldwide and pontificate about the “un-socialist failings” of nations like China.

The American Left in particular is so pathetic that it cannot even achieve a basic capitalist welfare state provision like Medicare For All in the middle of a pandemic that has unnecessarily killed hundreds of thousands of its own citizens—but these US Leftists sure can debate Marxist dogma with the best of them!

Worse still, the American Left functions as the “Left Wing” face of the American Empire. On matters of war, their primary function is to provide leftish rationalizations for America’s war of aggressions such as its humanitarian bombings of Serbia, Libya, or Syria—wars that many of these Cruise Missile Leftists promoted.

They are less than worthless.

Saigon

Thanks for the response, but I specifically stated I do not think China is imperialist. And….I said nothing about “authoritarianism.” Perhaps you meant your reply for someone else?

There is no Chinese wall, excuse the expression, between foreign policy and domestic policy. The Chinese cooperation in the endless siege of the people of northern Korea, like the invasion of Vietnam, express appetites of the Dengist faction at the top of the CPC. Nonetheless, the oft overlooked vital moral principle of expediency tells us that demanding revolutionary war now is not necessarily the left. Is it an accident Bukharin, the proponent of more war with Germany in 1918 turned out to be the biggest rightist of them all? Easy condemnations are useless, substitutes for real analysis, much less real action.

Yet…It is one thing to realize that would-be Communists in the “West” are up against the monster in its own den. In some ways, it is much easier to defy an opponent thousands of miles away. The richest countries are not the weakest link in the chain. Easy contempt for the workers of the US and Europe because they haven’t won is I suspect at heart contempt for losers/love for winners. This kind of dog-eat-dog values is more suitable I think for the petty bourgeois.

A note on Confucius Institutes, though. It is incorrect to assume that Confucius is just an ancient philosopher. Confucianism is not just a philosophy. It is not the Christian/Muslim version of a religion, but it is a religion. If a bourgeois country were to found Thomas Aquinas Institutes, the ideological thrust would be very clear.

For anyone interested in the origins of market reform in China, consider the influence of Hungarian Post-Soviet economist Janos Kornai, not Milton Friedman. He’s apparently no longer a fan of the Chinses economy he helped to create.

https://link.springer.com/article/10.1007/s11127-020-00835-0

Reblogged this on DAMIJAN blog and commented:

To dogajanje na Kitajskem močno spominja na Japonsko leta 1991. Dileme za vlado (bailout bankrotiranih podjetij ali stečaj) so enake. Japonska vlada je takrat čakala, predolgo, podjetja so se spremenila v zombie podjetja, banke v zombie banke in celotno gospodarstvo je šlo v hibernacijo. V dolgi spanec, kjer vztraja še danes. Že 30 let je zombificirano.

Bo Kitajska sledila japonski v hibernacijo ali pa vseeno uporabila vso municijo, ki jo ima na voljo? Do sedaj je kitajska vlada izjemno dobro menedžirala krize, boljše kot vse zahodne države skupaj, če je to kak pokazatelj za bodoče ravnanje…

“…not because of a Keynesian-style government spending boost to the private sector as some economists, both in the West and in China argued, but because of direct state investment. ”

What’s the difference?

“What is needed is not a further expansion of consumer sectors by opening them up to ‘free markets’, but instead state-led investment into technology to boost productivity growth. ”

What’s the point of developing more product unless the consumer sector is not commensurately developed? Export oriented production won’t happen if the West has any say in it, which of course it does.

“As Richard Smith has put it: “The Chinese don’t need a higher standard of living based on endless consumerism. They need a better mode of life: clean unpolluted air, water and soil, safe and nutritious food, comprehensive public health care, safe, quality housing, a public transportation system centred on urban bicycles and public transit instead of cars and ring roads.”Rising personal consumption and wage growth will follow such investment, as it always does. ”

This is riddled with contradiction.

” Unfortunately, China’s leaders do not want any shift towards the latter, so the danger of long-term economic slowdown will remain.”

This statement is replete with crazy logic.

To date, Chinese growth has been driven by export production and theft of technology from the West. The West has, for both economic and strategic reasons, decided this is to end. This leaves China with no other option than to develop its internal economy. It will still be the largest economy on the globe, it is just that it will have minimal impact on the global economy. And to the extent that China’s BRI expenditures are funded by its foreign exchange earnings, this programme will suffer.

On first comment:

The difference is between making money available to private firms and hoping they spend it in ways which helps the economy overall, or else just spending that money directly through government owned (or controlled) enterprises. As a government, you have more control in the latter case.

On second comment:

Your comment assumes that all production needs to have a private consumer to buy the goods. But this isn’t the case. If you invest as a government in infrastructure, research, public services such as education etc., you at least don’t need the consumers there till some time in the future when they reap the rewards of the investment. And that’s characterising them only as consumers – not all production needs to go via a monetary transaction, or is valuable because of it. Indeed, much of it already doesn’t – that’s a live topic of debate amongst people interested in measuring GDP (or developing some similar metric).

On final comment

This seems to assume that China’s foreign trade with the world can be restricted by West down to inconsequential levels. I don’t know whether the West has and will have that much power. But you might be right.

“To date, Chinese growth has been driven by export production and theft of technology from the West. The West has, for both economic and strategic reasons, decided this is to end.”

By so-called theft of technology you mean the alleged utilization of western “intellectual property”/patents without payment of monopoly rent to the holders of said patents. But if this “theft” has been ongoing despite being illegal how can “The West” unilaterally decide to stop this “theft.” It may be cracked down on but hardly stopped altogether. You also ignore the internal generation of technological innovations. Yes China is behind the west in that regard but that is a problem that the CPC is obviously aware of and attempting to rectify. And it should be mentioned that the IP theft narrative, often promoted by Sinophobes, is itself problematic (https://www.youtube.com/watch?v=n_klwY2RJDc&feature=emb_title).

“But that means it is time for the Chinese government to make a turn back towards state investment and planning”. But weren’t you arguing that China’s SOEs already are here? And that state investment is dominant?

Also, China is already dropping GDP growth rate-centered measurements for economic success – because it no longer coincides with the development of the economy. Let’s imagine a situation – a company instead of producing 1 unit for a price starts producing 2 units for half a previous price each. Will that increase GDP? Like in USSR right after NEP, China is at such a point in it’s development that measuring the economy in real units, in real production, becomes more useful than GDP growth rates because those GDP growth rates become plain misleading. Look at how many chips they are producing, how large and efficient their rail network is, how much cost they shaved off their ships, how much energy there’s generated total, and how much of it is not coal, how much steel is produced and how much of this number is recycled, how much industrial robots are there in the economy, look at their “dark factories” where there’s no light at all because it’s all automated, etc etc

It is important to focus on China. With an industrial economy three times bigger than the US, one which consumes half of global industrial inputs, and with a manufacturing base bigger than the base comprising the USA, Japan and Germany, what happens in China does not stay in China. Unfortunately there is a new driver which can replace real estate, one your article does not include, and that is arms production as China goes onto a war footing. The global political landscape is being sculpted by the economic rivalry between the USA & China.

The large increase in China’s arms production is miniscule compared to the United States/NATO’s and strictly defensive, surrounded as it has always been (but recently intensified and provocatively so) by the imperial powers. …I’m sorry, but have to say that our comment is alarmist and stangely , misleadingly, neoiiberal.

I guess I shouldn’t have to point our that “our” in the last sentence should be “your”…..such mistaken identity reflects the strange confused debate among “marxists” and “leftists’ within the core states of the imperial West, which is fortunately, itself’s worse enemy.

Less slogans more research needed. Half the tonnage of naval vessels being built currently is in China. The new Shanghai naval building can build the equivalent of the royal navy each year. etc etc

Interesting article on China in ‘Monthly Review.” https://monthlyreview.org/…/the-enigma-of-chinas-growth/

Michael,

I study your analyzes with joy and always with intellectual gain, but your assessment of China seems to me to be very optimistic – as if all options are still open with and through the CCP. That would mean that the CCP and the Chinese state represent (still) all classes of Chinese society.

I find it difficult to believe that a state can float “above the clouds” and above the classes for years and decades.

Wal Buchenberg, Hannover

https://marx-forum.de/Forum/

On Michael’s concluding paragraph, I think he is being far too pessimistic. China has repeatedly demonstrated its willingness to turn to public sector spending and other public sector solutions whenever the economy shows signs of slowing. And I have no doubt that it will do so now.

Moreover, I am sure that the CPC leadership will have learned some valuable lessons from the failures of its capitalist market sector. Certainly President Xi seems to be recognising the need to take steps to curb the excesses of the private sector and to rein in the power of the billionaires and the capitalist monopolies.

Equally important is to question Michael’s pessimism on the falling rate of return on investment in both the private and public sectors. For decades China naturally focused on catching up with the West in terms of technology and efficiency. This inevitably involved a lot of imitation and copying of technology.

However, around 2014 marked a turning point when it became clear that China had equalled the West in many technological sectors. And now needed to set its sights on taking the lead. Thus emerged in 2015 the ‘Made in China 2025’ programme which set the goal of China achieving prominence in the top ten emerging technologies. Not only did this shock the capitalist west but it was evidence of a new focus in Chinese planning which proceeded to expand government spending on R & D, and line up other policies on infrastructure, education and so on needed to achieve these goals.

New technologies have the potential to restore high rates of return in an economy. Not only in the new industries arising but in the application of new technologies in the old industries. Thus a switch to renewable energy can transform the traditional fossil fuel based sector. Or high speed trains can transform the old railway sector. Electric vehicles can transform the old auto sector. And so on.

The problem with capitalism and its private investment system is that it cannot make these transitions so that the majority of industries that are in their mature and declining life cycle stages lose their investment and increasingly weigh down the newly emergent sectors and bring down the capitalist economies as a whole.

China’s system is very different with finance in the government’s hands. With planning laying down the general direction of each sector and identifying where investment is needed and mobilising it to achieve the necessary outcomes.

Of course, the past expansion of a lightly controlled private sector has brought with it many contradictions. Not least the real estate sector with its wide scale speculation and corruption. We shall see how possible it is to successfully control the private sector in China. Also how far the state owned enterprises can go in delivering better performance and competing on the world market.

Here I agree with Michael Roberts in his suggestion of including the urban workers in future planning. Although this new 14th Five Year Plan introduced a novel feature in which the draft plan was discussed in meetings around China of specialist workers before it was finalised and brought forward to the leadership.

I would go further and suggest that we need to involve workers, customers and other affected groups as key partners in the governance of the SOEs, the public services and the state. This is the only way that I can see of moving on from the current top down bureaucratic model that dominates China. And offers a better alternative to the short-sighted, greed-driven private sector.