It has been the historic mission of the capitalist mode of production to develop the “productive forces” (namely the technology and labour necessary to increase the output of things and services that human society needs or wants). Indeed, it is the main claim of supporters of capitalism that it is the best (even only) system of social organisation able to develop scientific knowledge, technology and human ‘capital’, all through ‘the market’.

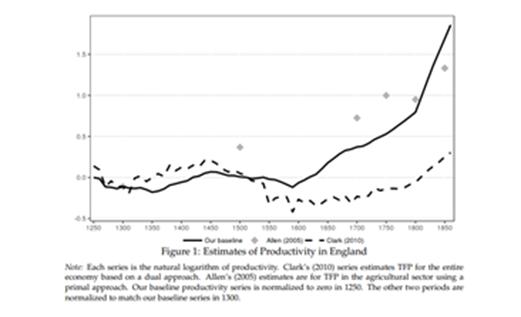

The development of the productive forces in human history is best measured by the level and pace of change in the productivity of labour. And there is no doubt, as Marx and Engels first argued in the Communist Manifesto, that capitalism has been the most successful system so far in raising the productivity of labour to produce more goods and services for humanity (indeed, see my recent post). In the graph below, we can see the accelerated rise in the productivity of labour from the 1800s onwards.

But Marx also argued that the underlying contradiction of the capitalist mode of production is between profit and productivity. Rising productivity of labour should lead to improved living standards for humanity including reducing the hours, weeks and years of toil in producing goods and services for all. But under capitalism, even with rising labour productivity, global poverty remains, inequalities of income and wealth are rising and the bulk of humanity has not been freed from daily toil.

Back in 1930, John Maynard Keynes was an esteemed proponent of the benefits of capitalism. He argued that if the capitalist economy was ‘managed’ well (by the likes of wise men like himself), then capitalism could eventually deliver, through science and technology, a world of leisure for the majority and the end of toil. This is what he told an audience of his Cambridge University students in a lecture during the depth of the Great Depression of the 1930s. He said: yes, things look bad for capitalism now in this depression, but don’t be seduced into opting for socialism or communism (as many students were thinking then), because by the time of your grandchildren, thanks to technology and the consequent rise in the productivity of labour, everybody will be working a 15-hour week and the economic problem will not be one of toil but leisure. (Economic Possibilities for Our Grandchildren, in his Essays in Persuasion)

Keynes concluded: “I draw the conclusion that, assuming no important wars and no important increase in population, the ‘economic problem’ may be solved, or be at least within sight of solution, within a hundred years. This means that the economic problem is not – if we look into the future – the permanent problem of the human race.” From this quote alone, we can see the failure of Keynes prognosis: no wars? (speaking just ten years before a second world war). And he never refers to the colonial world in his forecast, just the advanced capitalist economies; and he never refers to the inequalities of income and wealth that have risen sharply since the 1930s. And as we approach the 100 years set by Keynes, there is little sign that the ‘economic problem’ has been solved.

Keynes continued: “for the first time since his creation man will be faced with his real, his permanent problem – how to use his freedom from pressing economic cares, how to occupy the leisure, which science and compound interest (!MR) will have won for him, to live wisely and agreeably and well.” Keynes predicted superabundance and a three-hour day – the socialist dream, but under capitalism. Well, the average working week in the US in 1930 – if you had a job – was about 50 hours. It is still above 40 hours (including overtime) now for full-time permanent employment. Indeed, in 1980, the average hours worked in a year was about 1800 in the advanced economies. Currently, it is still about 1800 hours – so again, no change there.

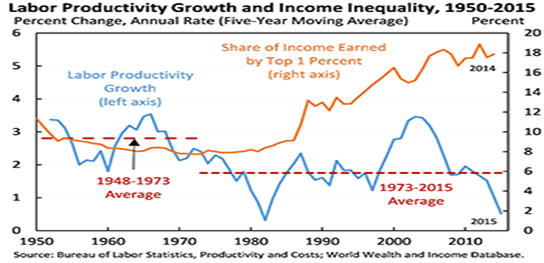

But even more disastrous for the capitalist mission and Keynes’ forecasts is that in the last 50 years from about the 1970s to now, growth in the productivity of labour has been slowing in all the major capitalist economies. Capitalism is not fulfilling its only claim to fame – expanding the productive forces. Instead it is showing serious signs of exhaustion. Indeed, as inequality rises, productivity growth falls.

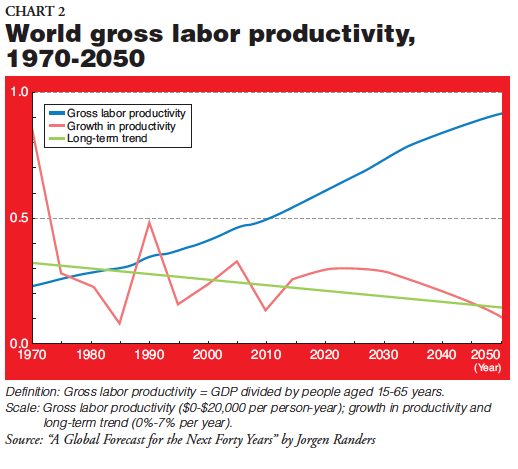

Economic growth depends on two factors: 1) the size of employed workforce and 2) the productivity of that workforce. On the first factor, the advanced capitalist economies are running out of more human labour power. But let’s concentrate on the second factor in this post: the productivity of labour. Labour productivity growth globally has been slowing for 50 years and looks like continuing to do so.

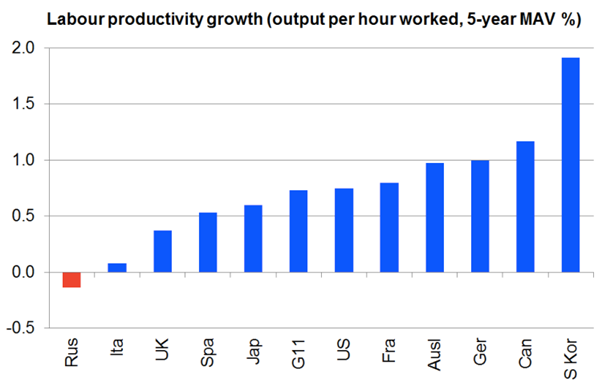

For the top eleven economies (this excludes China), productivity growth has dropped to a trend rate of just 0.7% p.a.

Why is productivity growth in the major economies falling? The ‘productivity puzzle’ (as the mainstream economists like to call it) has been debated about for some time now. The ‘demand pull’ Keynesian explanation is that capitalism is in secular stagnation due to a lack of effective demand needed to encourage capitalists to invest in productivity-enhancing technology. Then there is the supply-side argument from others that there are not enough effective productivity-enhancing technologies to invest in anyway – the day of the computer, the internet etc, is nearly over and there is nothing new that will have the same impact.

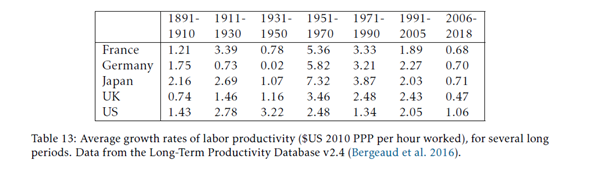

Look at the average growth rates of labour productivity in the most important capitalist economies since the 1890s. Note in every case, the rate of growth between 1890-1910 was higher than 2006-18. Broadly speaking, labour productivity growth peaked in the 1950s and fell back in succeeding decades to reach the lows we see in the last 20 years. The so-called Golden Age of 1950-60s marked the peak of the development of the ‘productive forces’ under global capital. Since then, it has been downhill at an accelerating pace. Annual average productivity growth in France is down 87% since the 1960s; Germany the same; in Japan it is down 90%; the UK down 80% and only the US is a little better, down only 60%.

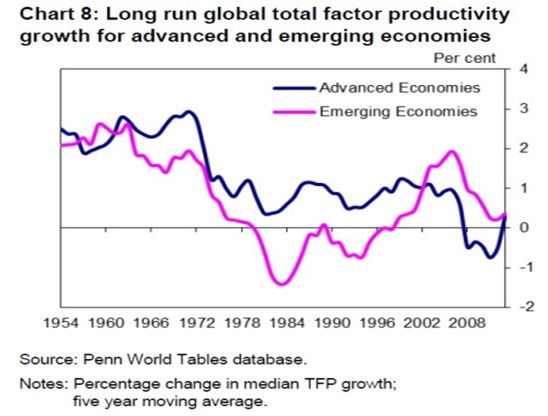

There are three factors behind productivity growth: the amount of labour employed; the amount invested in machinery and technology; and the X-factor of the quality and innovatory skill of the workforce. Mainstream growth accounting calls this last factor, total factor productivity (TFP), measured as the ‘unaccounted for’ contribution to productivity growth after capital invested and labour employed. This last factor is in secular decline.

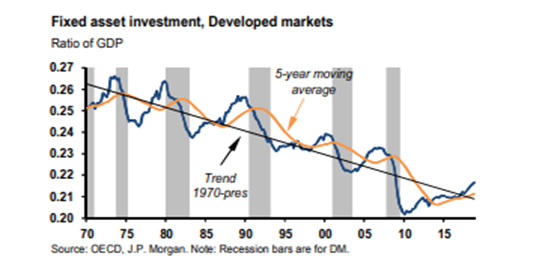

Corresponding to this slowing of labour productivity is the secular fall in the fixed asset investment to GDP in the advanced economies in the last 50 years ie starting from the 1970s.

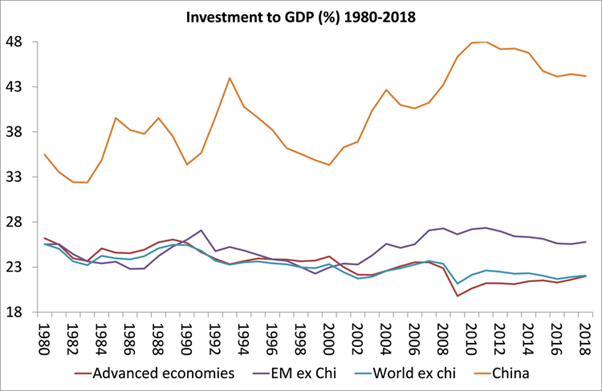

Investment to GDP has declined in all the major economies since 2007 (with the exception of China). In 1980, both advanced capitalist economies and ‘emerging’ capitalist ones (ex-China) had investment rates around 25% of GDP. Now the rate averages around 22%, a more than 10% decline. The rate fell below 20% for advanced economies during the Great Recession.

The slowdown in both investment and productivity growth began in the 1970s. And this is no accident. The secular slowing of productivity growth is clearly linked to the secular slowing of more investment in productive value-creating assets. There is new evidence to show this. In a comprehensive study, four mainstream economists have decomposed the causal components of the fall in productivity growth.

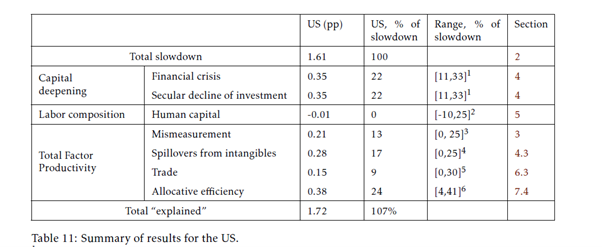

For the US, they find that, of a total slowdown of 1.6%pts in average annual productivity growth since the 1970s, 70bp or about 45% was due to slowing investment, either caused by recurring crises or by structural factors. Another 20bp or 13% was due to ‘mismeasurement’ (this is a recent argument trying to claim that there has been no fall in productivity growth). Another 17% was due to the rise of ‘intangibles’ (investment in ‘goodwill’) that does not show an increase in fixed assets (this begs the question of whether ‘intangibles’ like ”goodwill’’ are really value-creating). About 9% is due to the decline in global trade growth since the early 2000s; and finally near 25% is due to investment by capitalists into unproductive sectors like property and finance. The four economists sum up their conclusions: “Comparing the post-2005 period with the preceding decade for 5 advanced economies, we seek to explain a slowdown of 0.8 to 1.8pp. We trace most of this to lower contributions of TFP and capital deepening, with manufacturing accounting for the biggest sectoral share of the slowdown.”

In other words, if we exclude ‘intangibles’, mismeasurement and unproductive investment, the cause of lower productivity growth is lower investment growth in productive assets. The paper also notes that there has been no reduction in scientific research and development, on the contrary. It is just that new technical advances are not being applied by capitalists into investment. Now maybe, the rise of robots and AI is going to give a productivity boost in the major economies in the post-COVID world. But don’t count on it. As the great productivity theorist of the 1980s, Robert Solow, put it in a famous quip ‘you can see the computer age everywhere but in the productivity statistics’ (Solow 1987).

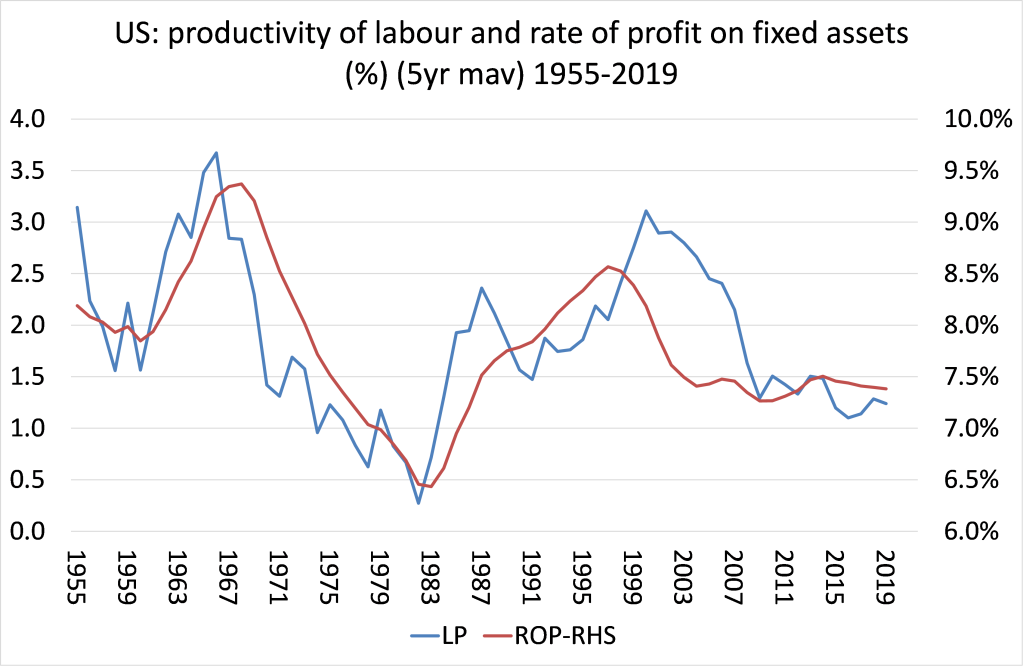

If investment is key to productivity growth, the next question follows: why did investment begin to drop off from the 1970s? Is it really a ‘lack of effective demand’ or a lack of productivity-generating technologies as the mainstream has argued? More likely it is the Marxist explanation. Since the 1960s businesses in the major economies have experienced a secular fall in the profitability of capital and so find it increasingly unprofitable to invest in heaps of new technology to replace labour.

And when you compare the changes in the productivity of labour and the profitability of capital in the US, you find a close correlation.

Source: Penn World Tables 10.0 (IRR series), TED Conference Board output per employee series

I also find a positive correlation of 0.74 between changes in investment and labour productivity in the US from 1968 to 2014 (based on Extended Penn World Tables). And the correlation between changes in the rate of profit and investment is also strongly positive at 0.47, while the correlation between changes in profitability and labour productivity is even higher at 0.67.

And as the new mainstream study also concludes, there is another key factor that has led to a decline in investment in productive labour: the switch by capitalists to speculating in ‘fictitious capital’ in the expectation that gains from buying and selling shares and bonds will deliver better returns than investment in technology to make things or deliver services. As profitability in productive investment fell, investment in financial assets became increasingly attractive and so there was a fall in what the new study calls “allocative efficiency” in investment. This has accelerated during the COVID slump.

There is a basic contradiction in capitalist production. Production is for profit, not social need. And increased investment in technology that replaces value-creating labour leads to a tendency for profitability to fall. And the falling profitability of capital accumulation eventually comes into conflict with developing the productive forces. The long-term decline in the profitability of capital globally has lowered growth in productive investment and thus labour productivity growth. Capitalism is finding it ever more difficult to expand the ‘productive forces’. It is failing in its ‘historic mission’ that Keynes was so confident of 90 years ago.

I don’t think that labour productivity can be used for interpreting/predicting crises as many economists say, since it is actually affected by them, rather than casing them. Falling profitability and bubble- bursting cause the crises.

How is any productivity measured? Isn’t it value added or profits to capital or wages? But this value added can theoretically fall to zero if the capitalist can’t sell any products (in a crisis) no matter how productive the worker or the capital are in real terms (in terms of use values produced). Also, it is the falling of investment as noted that affects productivity pre-crisis, but that is a side-effect of falling profits.

The aforementioned economists tend to accuse the lazy workers or even the lack of innovation and inspiration of the capitalists for the falling productivity “therefore” for the crises, which is not the actual case.

It is uncanny but typical of the educated bourgeoisie of England, that Keynes, at the center of a better than 300 year old empire, was as indifferent to its existence (and contibuitions to his comforts) as gentlemen at his club would be to the servant serving their Indial tea. England expropriated more wealth from india (to say nothing of the other exploited colonies) from 1700 to his 1930’s lectures than it was able to create in the first 100 years of its industrial revolution.

Hasn’t the fall in labor productivity at the imperial centers been somewhat balanced by the unpaid rise in the productivity of labor in the former colonies? If so, then why, but for the golden years of military Keynesian capitalism, has the neoliberal program of off-shoring productivity failed to maintain the aristocrisy of (white) US and European labor, but in fact has presided over its immiseration?

No. After produced, value is already created.

If the capitalist cannot sell his commodity-capital, then value is destroyed (literally: the commodities are destroyed, donated or rot in a warehouse) and profit is not realized.

Profit is literally value, from another point of view/social relation.

I didn’t get to whom you respond. But its not realized yet. So its pretty much the same as not created from thew capitalist point of view.

also, on which capital is this productivity measured? Total or non-financial?

Super interesting

One of your best researched articles with well chosen sources.

You point to a rise in inequality and falling productivity but fail to make a direct connection. The rise in inequality is associated with the rise in the consumption of luxury goods many of which are bespoke, that is to say they are often hand-made and resistant to automation because of the impact on the reputation of the product. Take the watch industry. In 2018, Switzerland produced only 13.8 million wrist watches out of a global total of 1,200 million or just over 1%. Yet their sales value was $21.6 billion or nearly 50% of the global total. The typical export price of a Swiss watch was $859 (not its retail price which would be at least double) compared to $3 for a Chinese watch. http://www.fhs.swiss/file/59/Watchmaking_2018.pdf

You refer to the 13% lost due to mismeasurement. There is an element of truth in this. In the internet age there has been a surge in corporations built around free click to view and communicate. Tik Tok, Alphabet and Facebook being prime examples. These corporations do not sell the labour of their workers thus converting this labour into additional value but rely on transferred value in the form of advertising revenue generated by workers elsewhere. (In other words these analysists are looking in the wrong direction.) This loss of value will have a depressive effect on productivity as value added forms one side of the productivity equation.

In addition when measuring productivity we should follow Marx’s advice that only over the course of the whole industrial cycle do matters become clear. You must have noticed the spike in productivity at the onset of the upside of the cycle when turnovers start accelerating, only to be met years later by a collapse at the end of the cycle, when turnovers decelerate. These variations do not speak to technical changes in production as much as they do to changes in market conditions . Thus we should be looking at and comparing the averages between 1983 and 1989, 1992 and 2000, 2002 and 2008 and 2009+. Could you do the honors as you have access to more data basis than I do? (This has a bearing on Vasilis first comment.)

Finally, because I want to keep this comment to a minimum there is an inherent tendency towards a fall in productivity in developed capitalist economies. As goods pour out of a more productive industry, both durable and non-durable, the investment in the consumptive circulation of these goods must increase. So alongside the production of expresso machines we have the mushrooming of coffee shops and chains such as Starbucks. The production of expresso machines lends itself to productivity increases, the serving of coffee does not, and yet the share of investment going into coffee shops and chains eclipses that of the companies producing expresso machines. Incidentally the rise in inequality raises the costs off circulation, because dammit, the rich like to be pampered.

In conclusion, I do agree with you that the single biggest influence on productivity must be the investment in labour saving techniques of production and that depends on profitability.

Hello. Question. The reason profitability declines is because markets become saturated and prices fall, right? tr

“Investment to GDP has declined in all the major economies since 2007 (with the exception of China).” Technically true of China, except that, according to the public data, Chinese i/GDP peaked in 2010 or 2011 and has been on a declining trend since then. *** In general, the falling rate of profit has been in force for 200 years. Something else is needed to explain the basic turn of productivity and progress downward since 1973. That is the year that the real median earnings of U.S. workers peaked. They have declined or stagnated ever since. Welcome to The Hollow Colossus.

Another problem of the Keynesian theory and its variants is that the concept of aggregate demand cannot explain technological innovation at all. They simply assume the individual entrepreneur will use his absolute freedom and “animal spirits” to cough up the next revolutionary technology sometime, somewhere.

Technological innovation, therefore, is another of those “external shocks” of the system in equilibrium – only in this case a “good” one, one that must happen and is welcomed. But that’s a necessity in a “theory” (again, I don’t consider Keynesianism a theory, but ok) that doesn’t work with the category of profit.

Another chimera of Keynesianism derived from the fact that they don’t have any concept of profit (value) is the anomalous concept of “skill gap”, i.e. that inequality in capitalism is solely derived from certain working skills getting outdated by new technology (technological innovation), which results in workers getting laid off, while workers with the new skill will get employed with better salaries. That’s why many Keynesians still insist on democratization of education (specially college education) and the creation of retraining education as the Deus ex Machina against both inequality and unemployment.

But we have, as a result, a very bizarre picture: a good shock from the outside (technological innovation) generates a bad shock from the outside (unemployment and inequality). The first should always happen, but the second should never happen, according to Keynesianism – but they do happen. Hence the panacea of “Education”.

I’m curious to know what Keynesians think about Japan nowadays: high education (almost universal), low population, high technological development, but declining wages and now rising unemployment.

Profit is meaningless unless it flows increasingly and constantly to labor/society which in turn supports demand which drives innovation/production generating profit.

With less and less profit flowing to labor and therefor society in general, demand declines which reduces innovation/production especially for quality goods, (not luxury goods).

The last 50 years and especially the last 25 years have been all about how to reduce the cost of labor or doing away with it entirely. This is insanity. The results are obvious.

I really like this kind of data, makes us (re)think productivity as it can be applied in so many fields than we need to step back sometimes to have the big picture.

Thanks for sharing.

As for this topic, our team wrote about and hope you’ll find it useful: https://zenkit.com/en/blog/focus-the-key-to-unlocking-your-productivity/

Hi Michael, the first graph in the picture titled “Estimates of productivity in England” is impossible to read in detail(a very unpleasant experience) because of the extremely low resolution, it would be nice if you could reupload a higher resolution version.

the best version is in the original source: https://eml.berkeley.edu/~jsteinsson/papers/malthus.pdf

If capitalism is such a failed system of economic relations why is it that every socialist state that arose in the twentieth century adopted so-called capitalist reforms.

Investment has declined progressively post war in the West because the West directed it’s investible surpluses first to Japan and Korea, then South East Asia and more lately to China.

This globalization of production has caused profit centres to move Eastward and has brought competition to Western labour from Asian labour.

There has been a massive shift of income to Eastern labour from Western labour but Western capital has continued to profit and increase its share.

The money elites have disproportionally enriched themselves leaving themselves with wealth beyond belief. They have essentially nothing better to do than play games in financial markets.

“If capitalism is such a failed system of economic relations why is it that every socialist state that arose in the twentieth century adopted so-called capitalist reforms.”

Nobody said that capitalism is a “failed” system in a historical sense: the Marxist position is that it will inevitably fail due to its contradictions but only after fulfilling its historical role.

“The money elites have disproportionally enriched themselves leaving themselves with wealth beyond belief.

Their wealth is held predominately in fictitious capital and denominated in worthless fiat money and facilitated by reckless banking policy that will inevitably result in massive inflation.

“Investment has declined progressively post war in the West because the West directed it’s investible surpluses first to Japan and Korea, then South East Asia and more lately to China.

This globalization of production has caused profit centres to move Eastward and has brought competition to Western labour from Asian labour.

There has been a massive shift of income to Eastern labour from Western labour but Western capital has continued to profit and increase its share.”

These figures take into account investments western capitalists make in foreign markets, so I don’t see your point here. The data also shows relative decline in productivity world-wide, not just in the west. The boom in the stock market is not due to increased profits but due to speculation facilitated by banking policy.

” They have essentially nothing better to do than play games in financial markets.”

Yes, because their is little incentive to invest in productive capital, hence the problem.

“the Marxist position is that it will inevitably fail due to its contradictions but only after fulfilling its historical role.”

No, that is rather vague. Let alone the fact that capitalism “fails” during every crisis, but is still standing. The Marxist position is that capitalism is no longer helping humanity and that it must be overthrown, but this is not “doomed” to happen as it is a matter of favorable objective conditions and political struggle. Socialism or barbarism.

Capital is not synonymous with capitalism. The existence of capital doesn’t determine the existence of capitalism.

Capitalism is the system where capital is the dominant form of social reproduction.

Capital is the process where value self-valorizes.

–//–

From a historical standpoint, capitalism survived the waves of communist revolution around the world during the 20th Century.

But it happened at great cost, probably irreversibly: it had to syncretize with socialism and permanently adopt many of its “minimum program” policies: universal suffrage, free elections, welfare of the common citizen as an end that justifies itself, the concept of the universal human being (i.e. all humans are equally human), and countless other moral-philosophic values that are taken for granted today even in the First World countries (which are not liberal values; they were appropriated by the liberals from the socialists-communists over time).

Nowadays, even the most rabid neocon doesn’t even come close to the classical liberals (from Locke to David Ricardo), which are believed to be the ideologues of the purest form of capitalism.

‘’ From a historical standpoint, capitalism survived the waves of communist revolution around the world during the 20th Century. ’’

Capitalism has not survived these communist waves. In fact, it has been reduced in size and is in its final phase of liquidation. If Capitalism existed in the 19th century with private companies producing 90-95% of world GDP, but today (and also in the 2nd half of the 20th century) capitalist companies produce only 50/60% of total production in the West (China aside), although this participation is increasing. We are not today, said in intellectual economic rigor, in any Capitalism but we are in a model of Mixed Economies (State-private companies), as all the academic and mainstream macroeconomics manuals recognize and accept. On the other hand, and as a prediction, the socialist revolutionary waves of the 21st century are missing. Which will be the last and decisive. It will be in a single main wave and its replicas around the year 2,050. 2,050 is the year with a Profit Rate equal to 0 in the G7 countries and is the year of the end of the Kondratieff, Profit, Juggler and Kuznets cycles. A wave is a synonym for cycle. Of a cycle of class struggle. Does it surprise you? It should not surprise you, the cycles are shocking but they are only so because they are unknown to most. But they contain enough academic science for validation.

It seems to me that Keynes has it right but his timing is out.

Technology will radically shift economic relations in the future.

AI and robotics will dominate production, displacing great swathes of labour from employment.

Production and productivity will rise enormously but this is unsustainable as there will be hardly anyone with the income to purchase output.

Output will have to be distributed in some way. Capitalists will be allowed to make a return otherwise there will no incentive to maintain production.

It could be said this would be a form of communistic economic relations (i.e. a distribution system according to one’s needs) but with property possibly remaining in private hands.

There will be no socialist form of intermediating/intervening/bridging economic relations. Socialism will have no future just as it failed its future in the twentieth century.

More likely, resource depletion and ecological disasters will intervene before such a techno-utopian future can arise.

Social ownership and democratic control of wealth produced for use and distributed on the basis of need has yet to make an appearance on the stage of world history because it is an emancipatory project initiated by the immense majority of the working class who recognise the need for it to be established. Perhaps they will as the climate collapses. Then again, it may already be too late.

It doesn’t have to involve social ownership although it might.

And the development of economic relations as I have suggested isn’t a function of some law of history – looking through Marxist eyes blinds you to the plain reality of the situation.

Technology will force some form of radical re-oganization of economic relations.

“And the development of economic relations as I have suggested isn’t a function of some law of history – looking through Marxist eyes blinds you to the plain reality of the situation.

Technology will force some form of radical re-oganization of economic relations.”

Marx didn’t believe in historical laws, he believed that history is driven by the material conditions of production which in turn lead to social transformations. That technology will lead to economic re-organization is exactly what Marx predicted: the capitalist mode of production necessitates a continuous increase in the composition of capital which creates a tendency to reduce the rate of profit. The evidence seems to be in Marx’s favor with regard to the rate of profit.

Wayne,

“Marx didn’t believe in historical laws, he believed that history is driven by the material conditions of production which in turn lead to social transformations.”

That sound like a law of history to me.

“The evidence seems to be in Marx’s favor with regard to the rate of profit.”

Which will, it seems, be offset by the law of accumulation, allowing the capitalist to continue prosper or is my surmise not valid?

That’s not what Keynes defended. Not at all.

Keynes stated extreme automation of production would create a surplus that would be freely distributed to all human beings within the capitalist system, therefore people wouldn’t need to work at all to live in wealth (leisure) or very little.

What you describe is the more realistic version of capitalism: extreme production of wealth with extreme generation of misery.

Your hope that “this wealth will have to be distributed in some way” is a dangerous trap. First, because it is not necessarily true (wealth can simply be destroyed, as is the case of expired food in supermarkets, which are forbidden to be donated and/or given to its employees). Second, because there’s no deadline for it (when will we have to wait for it to happen?). Thirdly, because there’s no limits for it (the capitalists could just give the bare minimum for survival to the masses and state that’s all – there is no accountability).

vk,

Why does there have to be extreme misery?

The capitalists get a return so they engage in production – there is ample output to be distributed and it will be distributed.

The fact is, you don’t want it to work. 🙂

Henry

“That sound like a law of history to me.”

It’s not a law. Scientific laws are deterministic, historical materialism is tendential.

“Which will, it seems, be offset by the law of accumulation, allowing the capitalist to continue prosper or is my surmise not valid?

Accumulation of surplus value can only happen if the surplus value is capable of being realized. Yes increased constant capital generally implies an increased mass of surplus value in the form of commodity and productive capital but it doesn’t follow that the commodities can be sold or the means of production can profitably be put to use which is what occurs in the case of crises of overproduction. The lower the rate of profit and the higher the mass of surplus value, the more disastrous can the crises of overproduction be expected to be if that mass cannot be realized in the circulation process.

If it’s (the decline in overall productivity) is a trend, and has been going on for 50,60, or 70 years, it simply cannot be a “crisis,” no more than the decline in the rate of profit over 50 or 60 years can be categorized as a crisis. It has certain implications for capitalists, produces certain responses and changes, but it simply cannot be a crisis for accumulation.

The decline of the ROP is not itself a crisis but it generates increasingly destructive crises of overproduction that hasten the class contradictions that give rise to revolution.

It is very problematic to measure productivity in a capitalist economy. The very equation used to measure productivity speaks to this. The equation is value added divided by hours. So, on the one side we have a physical element and on the other an economic element. Worse the economic element of value added is itself based on the law of value which is an inexact and elastic measurement of actual costs of production and being elastic is the victim of fluctuations brought on by market conditions, primarily those influenced by the phasing of the industrial (business cycle) though not limited to it.

Thus the productivity equation does not compare the physical to the physical. Sure the statistical bureaus try to reduce the economic output to the volume of physical output by removing the effect of price rises. But even here their assumptions are wrong. Zeroing out price rises is a false assumption. Prices should be falling. Deflators need to be larger than merely reducing price rises to 0 to capture the essence of productivity. But if deflators are deflated (too low) then the volume of production will appear to be rising less fast. Productivity will appear to be less dynamic, and the irony is that the faster actual costs of production fall, the greater will be the propensity to underestimate productivity because of the problem with deflators designed to reduce price rises to 0. Generally the deflators are inaccurate. They do not and cannot capture exact price movements. And they are most vulnerable the faster actual costs of production, meaning that under this condition there is a greater propensity to underestimate productivity.

Actual productivity can only be measured accurately in a communist society where prices are directly connected to actual costs of production or what is the same thing weighted average labour times. In other words when we have bid goodbye to that crude and primitive measure, the law of value. Productivity will be expressed directly in falling general price levels, where price is merely the external appearance of costs of production in the sphere of consumption.

Old Leon Trotsky in the foundation program of IV International said: “The productive forces of humanity have ceased to grow. New inventions and new technical advances no longer lead to a growth in material wealth. Under conditions of the social crisis of the entire capitalist system, conjuncture crises overwhelm the masses with increasing deprivation and suffering.” Looks like he was right.

Great post, Michael! But I would like to add that TFP (total-factor productivity) is a poor indicator, which has been repeatedly proven.

Angelo Reati, 2001. Total factor productivity — a misleading concept (https://ojs.uniroma1.it/index.php/PSLQuarterlyReview/article/view/9935).

Paul Burkett, 2006. Total factor productivity: An ecological and economic critique (https://journals.sagepub.com/doi/abs/10.1177/1086026606288744).

Jesus Felipe and John McCombie, 2019. Illusions of calculating total-factor productivity and testing growth models. From Cobb-Douglas to Solow and Romer (https://www.adb.org/sites/default/files/publication/534761/ewp-596-tfp-testing-growth-models.pdf).

Rossitsa Rangelova, 2008. A Criticism of the Concept and Measure for Total Factor Productivity (https://ideas.repec.org/a/bas/econth/y2008i3p30-49.html).

It is worth remembering about the legendary critique of production functions from Anwar Shaikh (http://www.anwarshaikhecon.org/index.php/all-publications/aggregate-production-functions).

This article is probably the best contra argument to those business lobbies trying to convince us that working 5 days in the office gives us this extra boost of creativity and buzz and increases our productivity. Which productivity are they talking about?

Very interesting post, as always.

Just one question. Is it possible to say that the ‘profits’ made out of investments in the financial sector are just surplus value ‘taken’ from other sectors? I mean, from a Marxist point of view, the financial sector does not produce value.

I may be oversimplifying, but I don’t know.

Greetings from Argentina.

Yes, that is the Marxist view of productive and unproductive labour. Important in measuring the general rate of profit