There is one outstanding statistical feature of 21st century capitalism. Capitalism is increasingly failing to develop what Marx called the “productive forces” (namely the technology and labour necessary to expand the output of things and services that human society needs or wants). As measured by gross national product in all the economies of the world (or per person), world capitalism is finding it more and more difficult to expand.

When Marx and Engels wrote the Communist Manifesto 170 years ago, they proclaimed the productive power unleashed by the capitalist exploitation of labour power, based on using more and more means of production (machines, technology etc) to replace human labour, while extending its tentacles to all parts of the globe. Indeed, the rapacious drive for profit has led to an uncontrolled destruction of nature and of the earth’s resources that has polluted the planet. And now, fossil fuel production has caused an increasingly irreversible global warming that is changing the earth’s climate, bringing with it extreme weather and disasters.

Last year global GDP among the world’s 195 nations hit a record $85trn. Remarkably, three-quarters of this was accounted for by just 14 economies – the lucky few with an individual GDP in excess of $1trn.

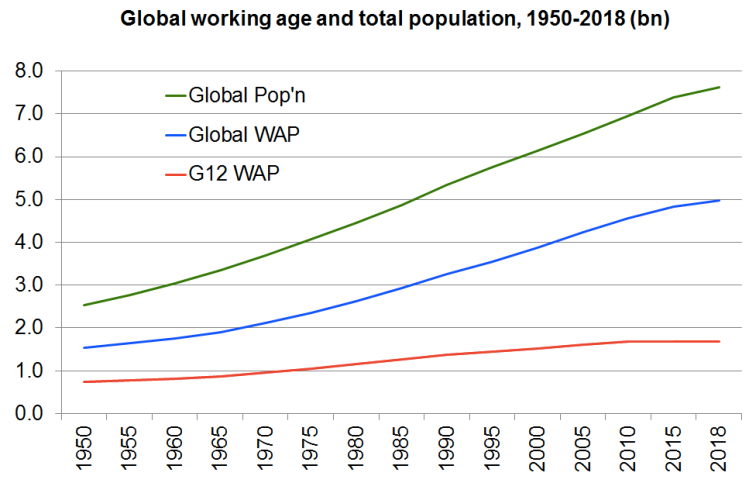

The global population also hit a record last year of 7.6bn. That’s a doubling in less than half a century. The working age population (WAP) has reached 5bn, but this is mainly outside the top 12 economies (ie G14 minus India and Brazil).

In the major capitalist economies, output is now expanding much more slowly than ever before. As Alan Freeman has shown in a recent paper, “economic growth of the industrialised North has fallen continuously, with only brief and limited interruptions, since at least the early 1960s. The trend is extremely strong and includes all major Northern economies without exception.” The_sixty-year_downward_trend_of_economi (1)

As Freeman concludes, “we face, not merely a decline in the GDP growth rate of one country (for example, the United States, whose decline has been studied more exhaustively) but of an entire group – the advanced or industrialised countries – whose growth rates follow the same trend and indeed, have converged. The trend observed is thus highly likely to be systemic – accounted for by the structure of the world economy as a whole – than being a result of the problems or vagaries of one particular country.”

Capitalism is not fulfilling its only claim to fame –expanding the productive forces. It is exhausted. Alongside that, inequality of wealth and income in the major economies is widening, poverty levels and the gap between rich and poor countries and people is widening. And nature and the climate are severely damaged.

Economic growth depends on two factors: 1) the size of employed workforce and 2) the productivity of that workforce. On the first factor, there is a demographic demise. The advanced capitalist economies are running out of more human labour power. As for the second factor, the productivity growth of the employed workforce is slowing.

For the first time since the emergence of capitalism as the dominant mode of production globally, the largest economies – the G12 — saw their collective working age populations (WAP) decline. And this decline will accelerate, according UN Population Division forecasts.

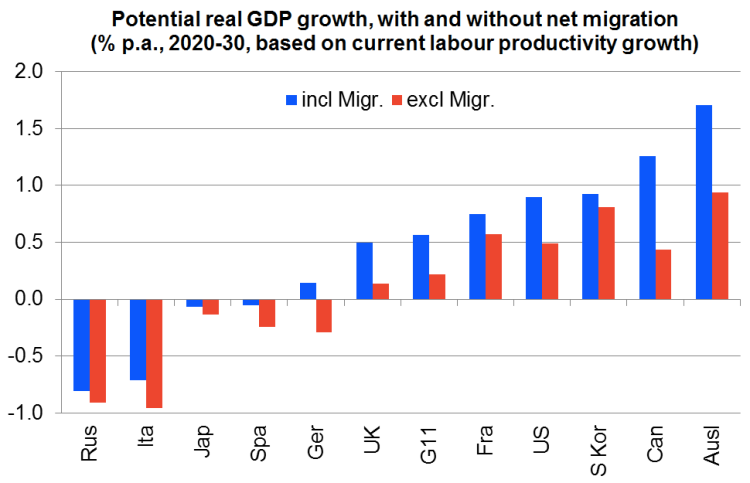

Of the 14 economies with $1trn or more GDP, there are only two – India and Brazil – where the working age population will grow over the next generation. The other 12 will experience a decline in their workforce. It’s possible that increased immigration from more populous regions could enable the US, the UK, Canada and Australia to expand their workforce for a while – although the governments in all these countries want to cut back immigration. In Japan, Germany and Italy even immigration will not stop the fall. In South Korea, Germany and Italy, excluding immigration, the workforce will fall by 1% a year over the next ten years. So, other things being equal, that is 1% a year of potential GDP growth.

As a result, these leading capitalist economies will have ageing workforces and an increasingly dependent non-working population. Currently, among the biggest economies, people of working age (15-64 year olds) typically account for 65% of the total population.

Japan’s rapidly ageing population, however, shows the way forward. By 2030, the ratio of WAP/total population will decline everywhere. For those countries unable to “import” skilled working-age people, it will decline precipitously.

Then there is the productivity of that declining workforce. If productivity growth could be accelerated, then this could compensate for the contraction in the workforce and so sustain real GDP growth. But global productivity growth is slowing.

Over the last 40 years and especially in the last 15, there’s been a broad-based slowdown in output per hour worked across the major economies. For the G11 (excludes China), it’s currently running at a trend rate of just 0.7% p.a.

Russia’s productivity level is falling, while that of Italy and the UK is hardly moving.

If we add together the potential growth in the workforce and the growth in productivity of that workforce, we can get a forecast of potential real GDP growth over the next ten years. And remember, this assumes no new slumps in investment, employment and production from a crisis in capitalist production.

Without net immigration, real GDP across the G11 bloc will expand by less than 1% a year, with Australia doing best at 0.9% a year, while Russia and Italy could suffer an annual shrinkage of a similar proportion. With immigration, Australia’s potential annual growth could reach the heady heights of 1.7% a year, but everybody else would have a sub-1% growth rate. Even allowing for some skilled immigration from outside, it’s unlikely that real GDP growth for the G11 bloc as a whole would exceed 0.5% p.a!

But why is productivity growth in the major economies falling? The productivity puzzle has been debated by mainstream economists for some time now. The ‘demand pull’ Keynesian explanation that capitalism is in secular stagnation due to a lack of effective demand to encourage capitalists to invest in productivity enhancing technology. Then there is the supply-side argument from others that there are not enough effective productivity-enhancing technologies to invest in – the day of the computer, the internet etc, is over and there is nothing new that will have the same impact.

But there is also another very simple explanation. Evidence shows that productivity growth is mainly driven by capital investment, which replaces labour with machines – the machines boost the output of each worker using the technology and also reduce the number of workers needed. There are three factors behind productivity growth, the amount of labour employed, the amount invested in machinery and technology and the X-factor of the quality and innovatory skill of the workforce. Mainstream growth accounting calls this last factor, total factor productivity (TFP), measured as the unaccounted for contribution to productivity growth after capital invested and labour employed.

In the case of the US, all three factors were at their strongest in the ‘hi-tech’ decade of the 1990s, but in the 2000s, the contribution of capital investment and labour employed dropped and since the Great Recession and in the subsequent Long Depression, all three factors have declined.

Part of the decline in US capital and labour investment can be laid at the door of increased globalisation as American companies went overseas for their factories and activities. But investment to GDP has declined in all the major economies and since 2007 (with the exception of China).

In 1980, both advanced capitalist economies and ‘emerging’capitalist ones (ex-China) had investment rates around 25% of GDP. Now the rate averages around 22%, or a more than 10% decline. The rate fell below 20% for advanced economies during the Great Recession.

Indeed, productivity growth is also slowing in the so-called emerging economies like China, Brazil and India.

Why is investment in new technology so sluggish and thus failing to restore productivity growth? The main reason for low investment in capitalist economies is that capitalists do not think it is profitable to invest in new technology to replace labour. Indeed, in the post Great Recession period, in many major economies like the US, the UK, Japan and in Europe, companies have preferred to keep their labour force and employ new workers on more ‘precarious’ contracts with fewer non-wage benefits and part-term or temporary contracts. That is revealed in very low official unemployment rates alongside low investment rates. Thus productivity growth is poor and overall real GDP growth is below-par.

The way to restore productivity growth and so get economies growing at a rate that can meet the demands of people for decent homes, education, health, and renewable energy is boost investment in new technology and the labour skills to go with it and distribute the gains to all. But here lies the contradiction in capitalist production. Production for profit not need. And increased investment in technology that replaces value-creating labour leads to a tendency for profitability to fall. So the need to expand and develop the productive forces comes into conflict capitalist accumulation. And resolving that contradiction through slumps that raise profitability or by increased exploitation of the global workforce is getting much more difficult.

world rate of profit – average of 14 major economies (profits as % of fixed assets)

The global workforce available to exploit is not growing so fast and while there are still reserves of labour in Africa (eg Nigeria etc) and Asia, in the developed capitalist economies, the workforces are set to shrink; while productivity growth through more investment in technology cannot compensate if profitability continues to press downwards over time.

The last highly interesting graphic shows a condensed view of 150 years of capitalist development. Unfortunately, all explanatory information is missing for this graph: What exactly does the graph depict? Which countries went into the bill? How was the data calculated?

scratchinghead

Yes sorry wal

It’s a measure of the world rate of profit that I have used so often that I forgot to include the title or explanation! It is measured as the average of the profitability on fixed assets in 14 countries as compiled by Esteban maito and modified by me with the captions added by me

First of all, I would like to point out that a rate of profit based on 14 mature capitalist countries is, in my view, not a “world rate of profit” but the rate of profit of the capitalist core zone. It can be surmised that peripheral profit rates are higher and a combined rate of profit for companies operating both in the core zone and in the periphery is also higher.

In addition, the graph ends at 15% and not at zero percent, as is scientifically common.

There is still room before hitting rock bottom. Many large companies in Germany survive with a rate of 5 percent.

The 14 countries were not all mature. They include China India Argentina and Brazil. And you are right the rates of profit are higher in those countries than in the core. And yes we are not at rock bottom. See Esteban maito chapter in world in crisis book

What does the chart at the end measure? It doesn’t have a caption or title.

Yes sorry left out title. It’s a measure of the world rate of profit on capital (fixed assets) ie an average of about 14 major economies

Once again, two developments are muddled together. The falling rate of profit explains slowdown and bust, destruction of capital value, and thus cycles. The stagnation and decay since the 1960s that Freeman documents is something else again. (After all, the profit cycle operated from the early 1800s against a background of vigorous industrial growth, too.) Capitalism has run up against its historical barrier, which has its own explanation.

And, this time, waging a world war will be more difficult, because now we have nukes.

Sorry. This is off topic but i do not know of anyother way to communicate with Mr. Roberts. Mr. Roberts, you gave a talk at a British Communist society meeting which i watched on Vimeo. It was about your recent book, “Marx 200”. In it you mentioned a book you are working on about the evidence for Marx “law” of the falling rate of profit. Is this book still a work in progress and when do you expect to publish?

Hi mark. Yes that book called world in crisis was published in November available at haymarket press or the usual amazon etc

Thanks for the comprehensive data and astute analysis. Let me suggest, however, one caveat about measuring growth. Growth can be measured in absolute values (dollars or other units) or by percent. I agree that the decline in the percent growth reflects (in part) capital’s choice not to invest in technology and education/training of labor. However, a decline in % growth also reflects a larger base of production. As that base gets larger, even the same absolute growth will appear as lower percent growth. From the point of view of living standards, perhaps the best measure would be change in absolute value of production per capita. On the other hand, given the enormous and growing inequality, even that is flawed since averaging production per capita will hide rather than reveal the change in material conditions for the poorest sectors.

I agree with this last point regarding the treatment of “growth” as an assumed goal for countries. It resembles the assumptions made in the post-WWII period that national economies had to expand at all costs: production should go up, up, up in order to ensure prosperity for all, was the thinking. More is better; quantity, not quality; production despite pollution. These were the mantras of capitalism because they justified the expansion into ‘foreign’ markets and the concomitant imperialist trade policies.

I would be interested, in subsequent discussions of “growth”, in a fuller discussion of what ‘growth’ means: why is growth important for the planet? Why should we want to have growth rates that exceed the increased population size in countries? Should we not instead prefer a low growth rate (or none at all) that improves the health and well-being of the populations through re-distribution of the world’s wealth? Perhaps a more basic explanation from a Marxist view of what economic growth entails, and why it is a valuable measure to consider (if indeed it is), would be helpful in future discussions.

I agree but in analysing the effectiveness of capitalism in its own terms then growth of production and profitability are important categories

Yes, that’s the principle of the “tendency of the profit rate to fall”: the larger the organic composition of capital (what you call “larger base of production”), the more resources you need to keep it.

Profit rate is what matters to the survival of capitalism, and not absolute profit, because profit is a social relation by definition. There’s no “substance” of profit. The capitalist “perceives” profit in the real world when he “sees” he extracted more value in money form than what he initially invested (in a given point of time in the past). Profit is only profit when accumulated, concentrated in one “place” (person).

That’s the contradiction of capital Roberts highlights in this post: capitalism produces a lot of things, but at the cost of an ever growing misery for the vast majority of humanity. Think about the Dragon in Beowulf: he hoards wealth, but doesn’t know what to do with it (besides wishing to accumulate even more).

I am not reading your post that way. The thrust of the critique seems to me to be based on growth rates not being sufficiently robust. The clearest statement is in the paragraph that starts, “Capitalism is not fulfilling its only claim to fame…” and then you outline very clearly how it is not doing so, rather than stating what is wrong with considering growth as a legitimate parameter for understanding economic well-being. I would like to see a post on growth and growth rates focusing on the latter. Perhaps in the future?

Sean – yes, that’s right. For capitalism, profits, investment and and ‘growth’ are the claims to fame/aim. For socialism, it’s a different story.

I followed your links to older blog posts where you are discussing Robert J Gordon. If I understood you right, you seem to argue that if Gordon is wrong, there could be another round of profitable investment to come, if he is right then stagnation will continue. This sounds like your are saying: if there are productive technologies out there, then there are also profits.

But shouldn’t a Marxist say that productivity and profit diverge under capitalism? Gordon is wrong in his pessimistic assessment of future productivity through technological innovation, but we nevertheless won’t get there if it’s not profitable for capitalists to do them!

Investments aren’t done because profits are too low or too risky or profits can’t be captured, privatized (lots of positive externalities in research and education), the same goes for public infrastructure. Even worse is the housing problem, which is pure artificial scarcity, pure rentseeking (there is enough land for everybody).

I think I was saying capitalism can find ways to restore profitability through crises and expansion into new areas of exploitation of labour globally but it is becoming more difficult. So yes, I agree with your difference with Gordon’s one sided analysis

Once again, two developments are muddled together. The falling rate of profit explains slowdown and bust, destruction of capital value, and thus cycles. The stagnation and decay since the 1960s that Freeman documents is something else again. (After all, the profit cycle operated from the early 1800s against a background of vigorous industrial growth, too.) Capitalism has run up against its historical barrier, which has its own explanation.

In my book The Long Depression, I combine the secular and the cyclical aspects of Marx’s law.

Yes, Michael, roughly summarized in your remark: “We are now in the winter phase within the downward section of the fourth Kondratiev cycle. … capitalism will eventually enter a new spring with a recovery in profitability and new growth based on new technologies already ‘discovered’ and just waiting for development.” So, it is The Hollow Colossus or The Long Depression.

As usual, this is a thoughtful contribution from Michael Roberts. I would like to draw attention to my latest book “Anti-Imperialism in the Age of Great Power Rivalry” which includes a chapter in which I deal critically with Michael Roberts’ arguments on population growth, migration, labor force and the future of capitalism (Chapter III and XII). The book can be read online or downloaded as a pdf for free here: https://www.thecommunists.net/theory/anti-imperialism-in-the-age-of-great-power-rivalry/

Thanks Michael P. I had a quick look at the section criticising my arguments. No time to respond in detail. But obviously I dont agree with your critique of my view on long waves or that I have an element of Kautskyism in my arguments. But I’ll leave it all to another time.

I have some modest disagreements with the thesis as presented. These might be issues of nuance more than substance, but the devil’s in the details.

For one thing to claim that capitalism can longer expand the forces of production and then cite GDP data particularly rate of expansion of GDP as evidence of that inability is confusing. GDP is a measure, accurate or not, of wealth production, not expansion of the means of production.

It is central to Marx’s critique of capital that, cyclically and structurally, the more the means of production accumulate as capital, the more that accumulation undermines the production and reproduction of wealth as capital.

The convergence of moment and trend marks the linking of Marx’s notions of the immanent limitations to the accumulation of capital: 1. the conflict between the forces of production and the relations of production (property) 2. the overproduction of capital 3. the law of the tendency of the rate of profit to decline– which Marx calls “the most important law” and which he explicitly regards as representing the limits to capital’s ability to produce wealth.

It is the very expansion of the forces of production– 1948-1970 1976-1979, 1993-2000, 2005-2008– as capital that threatens the reproduction of capital as wealth.

Certainly this “blows back” on capital investment and inhibits further expansion, but the origin is in the ability for expansion and the threat that presents to property relations, to capital’s expression as and of wealth.

In the ” less developed” areas, this conflict between forces and property gives us uneven and combined development where capital embeds itself and leans on pre-existing property forms and modes of accumulation and remains unable to transform the “whole” mode in its own image.. This is a result of accumulated forces of production that have, and have the ability, to overwhelm, outpace markets; where commodities find limited prospects for exchange internationally where the “advanced” capitalist countries dominate, and find even more limited prospects for exchange domestically, where the population remains trapped in primitive relations of land and landed labor.

You write: “In 1980, both advanced capitalist economies and ‘emerging’capitalist ones (ex-China) had investment rates around 25% of GDP. ” Yes, and what was the result of that? Reagan, Thatcher, the lost decade in Latin America, asset-stripping, maquiladoras, attacks on the working class in advanced and developing sectors, dispossession and migration of rural populations in the Philippines, Thailand.

Capital exists in a condition where the expansion of the forces of production triggers a “countervailing” reaction. It is not the case that capital is “exhausted,” cannot “expand the forces of production”– after all wasn’t that claimed in the 1930s, 1940s, 1970s, 1980s, 1990s, 2000s?– but that such expansion requires, before and after, greater destruction.

“For one thing to claim that capitalism can longer expand the forces of production and then cite GDP data particularly rate of expansion of GDP as evidence of that inability is confusing. GDP is a measure, accurate or not, of wealth production, not expansion of the means of production.”

Wealth production is a conditio sine qua non for both simple and amplified reproductions. For capitalism to expand, it needs first to reproduce what it already has/spent. Simple reproduction is the base for amplified reproduction, the second being the first beyond a certain point (the point being itself).

So, GDP is a good indicator when things can’t reproduce (expand). It may be a bad indicator when things can reproduce (since a lot of this expansion can be in the capital accounts, i.e. financialization). If GDP is negative, stagnant or not high enough, it is guaranteed that the means of production are not expanding; but the opposite is not true (i.e. even a high GDP growth is not a guarantee the means of production are expanding).

Think you’re missing the point, which is that when GDP does contract, go stagnant etc., it is precisely because the forcse of production have expanded, not that the capitalism “can no longer expand the forces of production” or “improve the productivity of labor.”

All through the post 2009 period, with GDP growth rates slowed in advanced countries, and reduced on a global basis, and with trade growth rates only at half their previous levels, the expansion of the forces of production and circulation has continued.

Good data, clea rly shown, essentially agrees with my own analyses.