Steve Keen has a new book out. It’s called: Can We Avoid Another Financial Crisis? Steve Keen is professor of economics at Kingston University in the UK. His earlier book (Debunking economics) is a brilliant expose of the fallacious assumptions and conclusions of mainstream economics, i.e. ‘perfect competition; general equilibrium and ‘rational expectations’ of economic ‘agents’.

The failure of mainstream economics to see the coming of the global financial crash and the ensuing Great Recession is now well documented – see my own coverage here. This failure has led several mainstream economists to disavow its usefulness. One such recently was Paul Romer, a former New York university professor and now the chief economist of the World Bank. Last fall, before taking up his appointment at the World Bank, Romer wrote a paper accusing his fellow macroeconomists of forming a monolithic intellectual community, which deferred to authority, disregarded the opinions of those outside of their group and ignored unwelcome facts. They behaved more like cult members than genuine scientists. Romer compared modern macroeconomics to string theory, famously described as “not even wrong.”

This did not go down well. And now there has been a rebellion among his 600 economists (yes, 600!) at the World Bank. They have insisted that he no longer be in charge of managing them, after he demanded that they drop their long-winded economic jargon and adopted a simpler style of prose. Romer responded ironically to this demotion of his power at the World Bank, “Apparently the word is out that when I asked people to write more clearly, I wasn’t nice. And that I slaughter kittens in my office.”

But I digress. The point of this Romer story is to show that those who dispute the assumptions and conclusions of mainstream economic apologia are not likely to get much of a hearing. As I said in my post on Romer’s critique, that he won’t succeed in getting “mainstream economics yanked back into reality”. And so it has proved.

Steve Keen, however, continues his attempt to provide an alternative closer to economic reality. And his new book also makes a prediction: that another crash is coming and even picks out some likely candidates where it is likely to kick off. Now readers of this blog know that I think it is the job of economics, if it really sees itself as a science, to not only present theories and test them empirically, but also to make predictions. That is part of the scientific method. So Keen’s approach sounds promising.

But all depends, of course, on whether your theory is right. Keen reiterates his main thesis from his previous work: that, in a modern capitalist economy credit is necessary to ensure investment and growth. But once credit is in the economic process, there is nothing to stop it mismatching demand and supply. Crises of excessive credit will appear and we can predict when by adding the level of credit to national income. In the major capitalist economies leading up to the crisis of 2007, private sector credit reached record levels, over 300% of GDP in the US. That credit bubble was bound to burst and thus caused the Great Recession. And this will happen again. “A capitalist economy can no better avoid another financial crisis than a dog can avoid picking up fleas – it’s only a matter of time.”

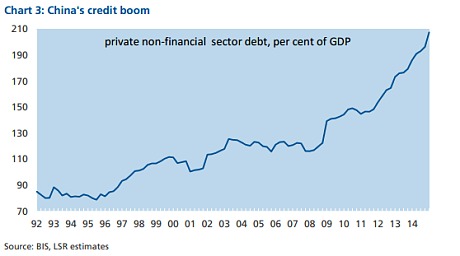

So what of the next crisis? With his eye on credit growth, Keen sees China as a terminal case. China has expanded credit at an annualized rate of around 25 per cent for years on end. Private-sector debt there exceeds 200% of GDP, making China resemble the over-indebted economies of Ireland and Spain prior to 2008, but obviously far more significant to the global economy. “This bubble has to burst,” writes Keen.

Nor does he have much hope for his native Australia, whose credit and housing bubbles failed to burst in 2008, thanks in part to government measures to support the housing market, lower interest rates and massive mining investment to meet China’s insatiable demand for raw materials. Last year, Australian private-sector credit also nudged above 200% of GDP, up more than 20 percentage points since the global financial crisis. Australia shows, says Keen, that “you can avoid a debt crisis today only by putting it off till later.”

This idea that it is the level of credit and the pace of its rise that is the main criterion for gauging the likelihood of a slump in capitalist production also lies behind the view of another heterodox economist, Michael Hudson in his book Killing the Host: How Financial Parasites and Debt Bondage Destroy the Global Economy. Hudson’s main contention that the FIRE economy – finance, insurance, and real estate – cripples the “real” economy and is slowly reducing most of us to debt bondage.

Hudson goes further. For him, the old system of industrial capitalism – hiring labor, investing in plants and equipment and creating real wealth backed by tangible goods and services – has been eclipsed by the re-emerging dominance of a parasitic neo-feudal class. It is this elite, not industrial capitalists, who are the foundation of most of our economic woes. The 2008 crisis was not a typical boom and bust housing crash of capitalism but the logical conclusion of financial parasites slowly bleeding most of us dry. “Today’s neoliberalism turns the [free market’s] original meaning on its head. Neoliberals have redefined ‘free markets’ to mean an economy free for rent-seekers, that is, ‘free’ of government regulation or taxation of unearned rentier income (rents and financial returns).”

I read this to mean that it is not capitalism of the past, competition and the accumulation of capital for investment, that is the problem and cause of crises, but the ‘neoliberal’ world of ‘rentier’ capital, ‘feudal’ parasites and ‘financialisation’. This would suggest that crises could be solved if capitalism returned to its previous role, as Adam Smith envisaged it, as expanding production through division of labour and competition.

Also, for Hudson, the problem of capitalism is not one of profitability and the striving to extract surplus-value out of the productive labour force but one the extraction of ‘rents’ out of industry by landowners and financiers. “Labor (‘consumers’) and industry are obliged to pay a rising proportion of their income in the form of rent and interest to the Financial and Property sector for access to property rights, savings and credit. This leaves insufficient wages and profits to sustain market demand for consumer goods and investment in the new means of production (capital goods). The main causes of economic austerity and polarization are rent deflation (payments to landlords and monopolists) and debt deflation (payments to banks, bondholders and other creditors).” (Hudson)

Thus we have a model of capitalism where crises result from ‘imperfections’ in the capitalist model, either due to a lack of competition and the growth of financial rentiers (Hudson) or due to excessive credit (Keen). Moreover, crises are the result of a chronic lack of demand caused by squeezing down wages and raising the level of debt for households. The latter thesis is not new – as many mainstream economists have argued similarly and it dominates as the cause of crises on the left. As Mian and Sufi put it, “Recessions are not inevitable – they are not mysterious acts of nature that we must accept. Instead recessions are a product of a financial system that fosters too much household debt”.

The key omission in this view of crises is any role for profit and profitability – which is after all the core of Marx’s analysis of capitalism – a mode of production for profit not need. Profit is missing from Keen’s analysis. Indeed, Keen considers Marx’s theory of value to be wrong or illogical, accepting the standard neo-Ricardian interpretation and Marx’s law of the tendency of the rate of profit to fall as being irrelevant to a theory of crises. Hudson has nothing to say about Marx’s key insights.

The post-Keynesians rely on the Keynes-Kalecki equation, namely that profits = investment, but it is investment that drives or creates profits, not vice versa, as Marx would have it. This view recently reached its extreme in another relatively new book, Capitalism as Oligarchy, by Jim O’Reilly, where, similar to the view of leading post-Keynesian, Engelbert Stockhammer, that is rising inequality that is decisive to crises rather than profitability of capital, O’Reilly argues that “inequality isn’t a side-effect of something we happen to call ‘capitalism’ but is rather the core of what the system is”.

According to O’Reilly, profits does not come from the unpaid labour of the working class but are ‘created’ for capitalists by the sale of goods and services to the consumer. Profits come from exploiting the consumer, not the worker. “where does profit come from? It can’t be from workers since they can spend no more than the wage received (!! – MR). Wages are a source of revenue through sales, but they’re also a cost. For the system as a whole, they must net to zero—workers are simply not profitable.” Only capitalists have more income than they spend, so they create their own profits (hmm… MR).

Apparently, Rosa Luxemburg was on the case… “Her insight that profit had to come from a source beyond the worker was correct but she erred in accepting the conventional monetary wisdom that capitalism’s “aim and goal in life is profit in the form of money and accumulation of capital.” In this theory, profits are not the driver of capitalism but the result of investment and consumption.

The argument that credit plays a key role in capitalism; and ‘excessive credit’ does so in crises was first explained by Marx. As Marx wrote in Volume 3 of Capital, “in a system of production where the entire interconnection of reproduction process rests on credit, a crisis must inevitably break out if credit is suddenly withdrawn and only cash payment is accepted…at first glance, therefore the entire crisis presents itself as simply a credit and monetary crisis”. (p621) But that’s at “first glance”. Behind the financial crisis lies the law of profitability: “the real crisis can only be deduced from the real movement of capitalist production” (TSV2, p512).

Looking for a cause is scientific. But dialectically there can be causes at different levels, the ultimate (essence) and the proximate (appearance). The ultimate is found from the real events and then provides an explanation for the proximate. The crisis of 2008-9, like other crises, had an underlying cause based on the contradictions between accumulation of capital and the tendency of the rate of profit to fall under capitalism. That contradiction arose because the capitalist mode of production is production for value not for use. Profit is the aim, not production or consumption. Value is created only by the exertion of labour (by brain and brawn). Profit comes from the unpaid value created by labour and appropriated by private owners of the means of production.

The underlying contradiction between the accumulation of capital and falling rate of profit (and then a falling mass of profit) is resolved by crisis, which takes the form of collapse in value, both real value and fictitious. Indeed, wherever the fictitious expansion of capital has developed most is where the crisis begins e.g. tulips, stock markets, housing debt, corporate debt, banking debt, public debt etc. The financial sector is often where the crisis starts; but a problem in the production sector is the cause.

Undoubtedly the rise of excessive credit in the major capitalist economies was a feature of the period before the crisis. And its very size meant that the crunch would be correspondingly more severe as capitalist sector saw the value of this fictitious capital destroyed.

But is it really right to say that excessive credit is the cause of capitalist crises? Marx argued that credit gets out of hand because capitalists find that profitability is falling and they look to boost the mass of profits by extending credit.

It is a delusion or a fetish to look at credit as the main or only cause of crisis. In a capitalist economy, profit rules. If you deny that, you are denying that capitalism is the right term to describe the modern economy. Maybe it would be better to talk about a credit economy, and credit providers or creators and not capitalists. Thinking of credit only, as Keen does, leads him to conclude that China is the most likely trigger of the next global crisis. But that has already been refuted by the experience of the last year.

We must start with profit, which leads to money, investment and capital accumulation and then to employment and incomes. And there is a mass of empirical evidence that profitability and profits lead investment, not vice versa.

Moreover, why did debt and financial rents become ‘excessive’ in the so-called neoliberal period? The Marxist explanation is that the profitability of productive capital declined in most modern economies between the mid-1960s and the early 1980s, and so there was a rise of investment in finance, property and insurance (FIRE), along with other neo-liberal counter measures like anti-trade union legislation, labour laws, privatisation and globalisation. The aim was to raise profitability of capital, which succeeded to a limited extent up to late 1990s.

But as profitability began to fall back, the credit boom was accelerated in the early 2000s, leading eventually to the global financial crash, credit crunch and the Great Recession. As profitability in most top capitalist economies has not returned to the levels of the early 2000s, investment in productive sectors and productivity growth remains depressed. The boom in credit and stock markets has returned instead. Fictitious capital has expanded again – as Keen shows. And rentier capital dominates – as Hudson shows.

If excessive credit alone is to blame for capitalist crises and not any flaws in the profit mode of production, then the answer is the control of credit. If rentier capital is to blame for the poverty of labour and crises, then the answer is to control finance. Indeed, Keen argues that the best policy prescription is to keep private sector credit at about 50% of GDP in capitalist economies. Then financial crises could be avoided. Hudson recommends annulling unpayable debts of households. And Hudson recommends a nationalized banking system that provides basic credit.

These are undoubtedly important reforms that a pro-labour government or administration should implement if it had such power to do so. But that alone would not stop crises under capitalism, if the majority of the productive sectors remained privately owned and investing only for profit not need. As Hudson says himself: “Just to be clear, ridding ourselves of financial and rentier parasites will not usher in an economic utopia. Even under a purely industrial system, economic problems will abound. Giants such as Apple will continue to offshore profits, companies like Chipotle will keep stealing their workers’ wages, and other big businesses will still gobble up subsidies while fulminating against any kind of government regulation. Class divisions will remain a serious issue.”

I think that Steve Keen do contemplate the rate of profit in their differential equations model (Goodwin) KM indicates credit itself is a source of instability in Capital Vol III.

Credit helps to mobilise existing resources; without it, the activity would fall. Public investment does not directly require profit be produced and helps to increase profits in private sector.

Interesting. On the face of it, Marx’s concept of “fictitious capital” seems to dovetail nicely with the Keen/Minsky analysis of credit and debt.

The scientific term for credit is that it acts as a catalyst. Credit accelerates accumulation and its withdrawal decelerates it. Like all good catalysts, credit does not take part in the social reaction that produces profit itself. Nor does it have an existence independent of the chemical reaction itself. That social reaction takes place solely in production where surplus value is produced, By reducing the barriers presented by money or its absence, credit finances accelerated production. In the late stage of the profit cycle, it can enable production to expand beyond it profitable limits, but always at the cost of a deeper crises. Michael is quite right to remind us of the inner connections between profit and credit, and to prevent us being dazzled by the reflected superficial. In the case of 2008 the matter is more complex than described above as it was also the result of the prior seismic shift in the relationship between the banking sector and the multi-nationals as I have written elsewhere.

Isn’t this the same-old same-old bifurcation of capital into “good” or “productive” industrial capital and “bad” “parasitic” financial capital?

Reads that way to me.

Credit functions to “bridge” the gaps, the differences, in the different turnover times of the various capitals. As such, it then also functions to distribute profits and realize a general or average rate of profit.

It is indispensable to capitalist production.

“Marx argued that credit gets out of hand because capitalists find that profitability is falling and they look to boost the mass of profits by extending credit.”

Comrade, could you please provide a source? Also, would a big finance regulation not depress capitalism or give way to crises earlier?

Even if Marx did say that it’s not relevant to Keen’s argument.

Keen produces data that shows unsecured credit to buy goods remains broadly in line with historical trends – this is in my opinion what Marx is implicitly referring to.

The problem is specifically with the housing market, as credit demand causes the asset price to increase which in turn increases credit demand.

As the rate of profit per sold commodity produced by the industrial working class declines, the credit bubble in real estate, insurance and banking rises. As Dickens had Mr. Micawber say, “”Annual income twenty pounds, annual expenditure nineteen [pounds] nineteen [shillings] and six [pence], result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery.”

Thanks for having a look at Michael Hudson’s book. Your analysis points in the same direction I would take. If the big problem was simply an out-of-control new rentier class of bankers exploiting industrial capitalists and thus dragging down the ecomomy then those capitalists would urgently call for the state to correct this problem – which they obviously don’t. And the state would act quickly and decisively like it has done during the neoliberal “revolution” when profit rates were restored by effectively crushing trade unions and labour rights.

You misstate my argument on the nature of profit in my book Capitalism as Oligarchy. I argue that the system is today, as it has been for thousands of years, one of oligarchy – i.e. concentrated minority power. Thinking in terms of ‘capitalism’ only confuses the issue.

The oligarchic class uses its power to costlessly divert the labor of society to achieve its key motives of luxury consumption and wealth defense / maximization. In our monetary socioeconomy, profit (as a general simplification) is the return flow of what the class spends on these goals. I most definitely don’t see profit as “‘created’ for capitalists by the sale of goods and services to the consumer”. I see it instead as the structurally guaranteed return of what the oligarchic class spends for itself, rendering it costless. The population in and of itself can never be ‘profitable’ over any extended period – the idea actually doesn’t make sense on the macro scale. Systemic inequality – oligarchy – demands only that they be perpetually costless to the class sitting at the top of the structure.

Hi Jim, so your view is that profits are the result of oligarchic consumption not the exploitation of labour, as Marx has it. Right?

Any contribution that emphasises the oligarchic nature of all previous and current class societies is certainly to be welcomed. That some Marxists still insist on describing the U.S. and other imperialist powers as ‘bourgeois democracies’ rather oligarchic despotisms is further to reinforce the hegemony of bourgeois ideology.

Having said that, I must confess to finding Jim’s assertions decidedly vague. He asserts, ”The oligarchic class uses its power to costlessly divert the labor of society to achieve its key motives……oligarchy – demands only that they be perpetually costless to the class sitting at the top of the structure….. the minority is structurally empowered to costlessly force the population to serve its motives…… the essence of oligarchy as a system is that a small class is empowered to force labor to serve its needs without cost. It’s a simple matter of power.”

All this seems to me tautological. What Jim has to do ( and of course he may well have done so in his book) is to explicate the sources of an oligarchy’s power and how it sustains such. For Marx this is command over others’ labour, but how such command is exercised varies according to the mode of production and certainly involves a cost. This can be illustrated by an account I read recently by a traveller on the Mississippi in the 19th century. Observing a boat being laden with bales of cotton, he asked the captain,

“Why are the niggers on deck throwing the bales down to the paddies in the hold?”

“Because the paddies ain’t worth nuthin’. ” Far from confusing the issue Marx’s analysis of surplus labour explains the difference between a slave and a wage labourer. He points out that in the slave mode of production the slave is analogous to fixed capital in the capitalist mode.

I cannot for the world envisage how Jim could see even slaves as being ‘costless.’

In his life of Caesar, Plutarch estimated that on the basis of Caesar’s own figures he had sold 1million slaves. Sometimes these slaves revolted, most famously under Spartacus, whom it took several Roman armies finally to squash. No wonder that his successor Augustus introduced a series of military reforms that established a fully professional army with a pay system, a career structure and a retirement bonus. Costless? ”And Caesar Augustus declared that all the world should be taxed.” There was a poll tax, a tax on land, a tax on selling slaves, port duties and so on.So great was the drain on the Roman economy the emperor Vespasian even introduced a tax on urine!

Hi Michael,

I agree completely with the essence of Marx that exploitation is the foundation of profit. I think, though, that his conception of surplus value is unnecessarily complicated and misses the macro simplicity of how the minority is structurally empowered to costlessly force the population to serve its motives. (I reduce those motives to luxury consumption and aggressive wealth defense.)

The concept of costlessness is crucial, I believe, to understanding capitalism as oligarchy. ‘Cost’ has no real meaning within the power relationship between the 2 classes for there is none – the essence of oligarchy as a system is that a small class is empowered to force labor to serve its needs without cost. It’s a simple matter of power.

The existence of money, though, serves to disguise this simplicity. But if we recognize that money is just a token that must parallel and reflect the realities of the underlying power relationship, then we can see that the power of the oligarchic class to order production must be monetarily costless. And with a bit of help from Kalecki’s profit equation, interpreted in a somewhat unconventional way, we find this is true. Profit is the return flow of oligarchic diversion spending which renders it monetarily costless. (There are other elements of profit but it’s not relevant to get into them here.)

I discuss the arguments of my book at further length on my blog and a recent post https://commentsongpe.wordpress.com/2017/05/13/costless-diversion-in-modern-oligarchy/ is especially relevant to this specific topic.

Jim

“I agree completely with the essence of Marx that exploitation is the foundation of profit. I think, though, that his conception of surplus value is unnecessarily complicated and misses the macro simplicity of how the minority is structurally empowered to costlessly force the population to serve its motives. (I reduce those motives to luxury consumption and aggressive wealth defense.)”

Among many other problems, Jim’s formulation misses, ignores, and otherwise obscures what is unique to capitalism in the way it compels, and appropriates the labor and labor time of others. A minority compelling a majority to serve its purposes exists in any number of social organizations.

So what’s different about the capital relation? It must be in the specific expression, the mediation, or organization of that compelling force, which is the wage relation, which is the expropriation of unpaid labor time as value. Surplus value may be a “complicated” but it is necessarily complicated in that it is historically specific as a dominating relation of production under capitalism.

“The concept of costlessness is crucial, I believe, to understanding capitalism as oligarchy. ‘Cost’ has no real meaning within the power relationship between the 2 classes for there is none – the essence of oligarchy as a system is that a small class is empowered to force labor to serve its needs without cost. It’s a simple matter of power.”

This is an unnecessarily simplistic formulation that simply says that the basis of profit is the labor time the capitalists don’t pay for.

Jim’s argument sounds like it’s derived from Nitzan/Bichler “Capital as Power.”

“The concept of costlessness is crucial, I believe, to understanding capitalism as oligarchy. ‘Cost’ has no real meaning within the power relationship between the 2 classes for there is none – the essence of oligarchy as a system is that a small class is empowered to force labor to serve its needs without cost. It’s a simple matter of power.”

This, btw, is hilarious, as anyone and everyone who has ever worked in a capitalist enterprise, like a factory, or a restaurant or a railroad, knows. Cost is and has real meaning. It has a real meaning in the production process, in the circulation process, in the reproduction process.

Arguing that “cost has no real meaning within the power relationship between the 2 classes” because in essence, the bourgeoisie don’t pay for surplus labor time, misses the fundamental point– that no individual capitalist is rewarded with the supposedly “individual” surplus value he or she throws into the market– but receives only a portion of the total surplus value so extracted, and that portion is awarded on the basis of size and efficiency of the various capitals– which is what cost, cost prices, prices of production are all about.

Jim says, ‘I agree completely with the essence of Marx that exploitation is the foundation of profit.” But Marx asserts, ”the commodity as the product of capital can be said to contain both paid and unpaid labour” ( Capital Vol.1 p954).

Speaking of the commodity and urine reminds me of Steve Keen’s supposed refutation of Marx. Keen claims that no matter how far back you go the means of production will always be found to take the form of a commodity. One might have thought that coming from ‘Down Under’ he might have done some on the spot research. As Sahlins ( ”Stone Age Economics” 1974 p xiv ) remarks, ”It is also conceivable that bourgeois economics is doomed, scheduled by history to share the fate of the society that nurtured it……….In the meantime, we cultivate our gardens, waiting to see if the gods will shower rain on us or, like those of certain New Giunea tribes, just urinate upon us.”

First impression: Jim’s exposition sounds like ahistorical claptrap to my mind.

But I guess I should investigate further before being so definitive!

“if we recognize that money is just a token that must parallel and reflect the realities of the underlying power relationship, then we can see that the power of the oligarchic class to order production must be monetarily costless.”

I do hope your book treats money more seriously than this!

Money expresses the limits of private property. Capitalist production is production for exchange. Therefore the labour of the individual only becomes part of the labour of society after it is exchanged that is sold for money. Credit seeks to overcome this contradiction or more precisely barrier. The seller of a commodity extends credit to the buyer allowing the use of the commodity to be transferred to the buyer prior to the buyer gaining ownership through repaying the resulting debt. In this way production becomes more seamless despite the presence of private property. The seller of commodities makes possible the transfer of the product without the means of money and thus the intervention of the moneyed capitalist and his demand for interest. However, because of the separation of use and ownership, the possibility always exists of a credit crisis, that is after the use of the commodity has been consumed, the exchange value cannot be paid due to the insolvency of the buyer. Far from being a token, money is an actual barrier fracturing the production and consumption process and it is eradicated only in a socialist society where the labour of the individual is now immediately and directly part of the labour of society.

Yes analysis of that like Jim’s is like someone saying after being bitten by a snake and some asks what snake it is ‘Who cares its a snake’

Questionable presupposition in a number of replies: “the 2008-2009 was the “longest” and/or “deepest” depression/recession since 1929″ (paraphrase). The baby boomers among us are vividly aware (thanks to oral history, i.e., what our parents tell us about what life was really like back then) that there is NO COMPARISON.

It depends how you define a crisis. while what your parents say life was like is valid it isn’t how economists measure these things.

Having said that my parents think the world has gone to hell in a handcart!

Michael, Why did US industrial productivity grow at rates of 5 percent a year between 1990 and 2007 and then fall to less than 1.5 percent a year from 2007?

Thanks

This comment addresses an important issue raised by the blog’s author in multiple posts that discuss Marxian vs Keynesian viewpoints at the causes of repeating crises of capitalist economies and practically feasible ways of their prevention and alleviation. Michael disagrees in principle, which he has demonstrated on multiple occasions, with the dominant Keynesian opinion that the root cause of crises is the “drop of demand problem” and argues that it’s rather the “drop of profit problem”. These arguments can be found in many Michael’s posts, e.g., https://thenextrecession.wordpress.com/2016/10/13/shaikh-at-greenwich/ or https://thenextrecession.wordpress.com/2016/05/02/explaining-the-last-ten-years-keynes-or-marx-who-is-right/.

Of course, every Marxist should agree that profit (or rather its reasonable expectation) is the driving force of capitalist economy, but profits don’t materialize from thin air; they are obtained, usually, in the course of market sale operations, which are impossible without appropriate demand. This looks so trivial that it’s not worth a serious discussion. Sometimes, it reminds the famous dilemma about chicken and egg, ‒ what came first. Capitalist production and realization is a single continuous process, which can only logically be separated in various elements for the sake of its analysis and comprehension, which was brilliantly done by Marx. On the other hand, it should be absolutely clear for any dialectic materialist that all the economic (and any other) concepts, such as capital, profit, value, demand, supply, money, etc. and their relationships are products of human intellect and exist only in human heads; they are mere abstractions or certain reflections of objective reality or matter.

Profit and demand can be considered mutually dependent dialectic opposites in the course of continuous capital reproduction. Without market demand potential profit produced by human labor cannot be realized or, in Marks’s own words, the labor cannot become social labor. And without profit demand cannot be satisfied. So, we see an obvious dialectic unity of these two concepts. In volume 1 of Capital, for the sake of analysis, Marx considered a situation of perfect demand when all products were consumed and profits were always realized, reinvested, etc. All Michael’s arguments related to this “profit vs demand” issue sound perfectly valid, but his main objective seems to prove Marx’s economic theory by making market forecasts (cycle durations, slumps, etc.) based on the use of Marxist methodology, which was definitely not the main objective of the original Marx’s analysis. Marx’s goal was to change the world, and not to just explain it, but this blog with its excellent analysis and broad and timely coverage of world events, besides its educational and informational value, has practical utility for investors, market analysts, and academics rather than working class and the left activists.

On the other hand, and this is the main point of these comments, if we analyze the role of demand in the course of the development and expansion of capitalism, it should become crystal clear that capitalism and any other form of social organization based on profit seeking, in principle, is unsustainable within a closed system, such as planet Earth, without periodic destruction of its material wealth and human population. And this destruction becomes increasingly severe and threatening the existence of the entire system as this social organization, such as capitalism, evolves. This conclusion, if sufficiently explained and emphasized, can become a key argument in the theoretical and practical struggle of Marxists and the left in general against existing social economic system.

Westerners have been whistling past the graveyard for over 20 years now. China cannot keep growing at this rate, their ghost cities will implode, their housing bubble, their silk road….etc., ad nauseum. How long before head is pulled out of rectum. 100 years?

China has four STATE BANKS. They create Yuans as loans, and then cancel the damn loans. This is effectively debt free money. The state banks channel this debt free into acquiring industry from U.S. and Europe. This is a very cheap way to climb up the technology learning curve. It is much harder and more expensive to invent, rather than buy. China buys.

So, China is playing their monetary game on another higher level, that leaves Western pundits stupified. (Yes, China also steals technology with cyber schemes, and does other negative games. But, the western world, if they weren’t complete dumb-asses, or also in on the take, would be able to counter China’s gambits.)

Stupified is the right word, because western neo-liberal economic banker hypnosis has put scales over people’s eyes. Chicago School Neo-Liberal economists are worse than useless, because they spread false ideas.

The one belt one road, will develop new areas of the world, and open up new mineral access. It will also create new markets for China. The U.S. grew by exploiting its natural wealth, then grew further by exploiting other areas of the world. Panama Canal anybody?

State banks since they hold the debt instruments can just cancel them in a jubilee. Or, state power can tax the money out of supply. The near future passing away of dollar system will actually make more demand for Yuans.

When you distill economy to its essence, all economy is conversion of the earth – into goods as prices.

Is there anything in the various comments above which refute the Marxist idea: that overproduction of capital itself and the poverty of the working class (consumers) is what cause crisis?

Also Nekto says: “This conclusion, if sufficiently explained and emphasized, can become a key argument in the theoretical and practical struggle of Marxists and the left in general against existing social economic system.”

We cloud aim to have these understandings as widespread as, for example, is discussion of the weather. After all it seems much less complicated.