| The world’s stock markets continue to hit the roof, particularly the US markets which have reached all-time highs. ‘The Donald’ may dominate the headlines with his presidential decrees and tweets, but on the whole, financial investors remain optimistic. As I showed in a previous post, there is a growing consensus among economists and investors that things are looking up and the world economy is set for a sustained recovery.

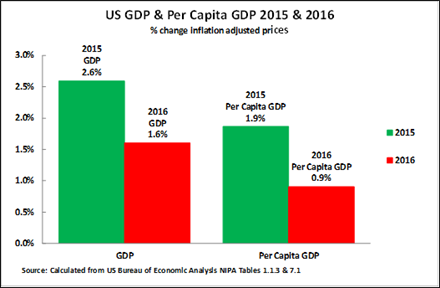

Take the latest forecasts from Gavyn Davies, former chief economist at Goldman Sachs and now running his own financial agency, Fulcrum. He comments “One of the most important questions for 2017 is whether this bout of reflation will continue. My answer, based partly on the latest results from the Fulcrum nowcast and inflation models, is that it will continue, at least compared to the sluggish rates of increase in nominal GDP since the Great Financial Crash.” Moreover “The nowcasts continue to report strong growth across the board, with world activity now expanding at a 4.2 per cent annualised rate Strong growth is especially apparent in the advanced economies, where the growth rate is now 3.0 per cent, a figure that is well above the long term trend of 1.8 per cent. Furthermore, activity growth is estimated to be above trend in all of the major advanced economies simultaneously: US (3.6 per cent), Eurozone (2.5 per cent), Japan (1.8 per cent) and the UK (2.5 per cent).” So it is looking good. However, as I did in my previous post, I must throw some cold water on this forecast for higher and sustained economic growth. Sustained trend growth does not depend on consumption; it does not depend on more spending by households on goods and services financed by more borrowing or induced by higher share prices. It depends on increased investment in production capacity leading to higher productivity growth. And that, in turn depends on better profits for the key corporate sector of an economy. And as yet, there is little sign of that. For example, in the data for the last quarter of 2016 for the US economy, any pickup in business investment was minimal. US real GDP figures show an annualised rise of 1.9%. So real growth in 2016 was just 1.6% compared to 2.6% in 2015 – the slowest rate since the end of the Great Recession. There was a bit more business investment after three quarters of decline. But business investment was still up only 0.3% yoy. The key sector of equipment investment was still falling by 3.6% yoy. As a result, productivity growth (that’s the increase in output per worker), is stagnant, especially in the key productive sectors like manufacturing. These are similar points to those made by John Ross in his latest post on the US economy, namely the myth of a strong economic recovery. Well, it could be argued: that’s the past. As Gavyn Davies and others argue, things will be different this year. Even ‘post-Brexit’ Britain is likely to record reasonable growth of 2% this year, say the Bank of England and other agencies, contrary to their doomladen forecasts after the referendum last summer. But I say again, the key indicators are an increase in business investment and behind that, the driver of, an increase in corporate profits. The figures we have for the third quarter of 2016 (general the latest) suggest a mild recovery in global profits from the slowdown experienced since 2014. But it is not much to go on. The overall trend in US corporate profits has been down for over two years. The graph below shows what has happened to earnings per share (EPS) for the top 500 companies in America. And behind this decline lies a fall in the record highs achieved in corporate profit margins (i.e. the share of profits in total output) from as early as 2011 – in other words, corporate profits rose but even more slowly than corporate sales or total output. Some mainstream economists argue that this is good news because tighter margins will increase competition and reduce inequality. But this is nonsense, as I argued in Jacobin last year. I argued in that Jacobin piece, falling profits and profit margins herald a slump in investment and then a slump in production and employment. JP Morgan and other investment bank economists have made the same point. Corporate profit margins are still well above their historic average. In order for them to revert to their mean, they would have to fall to 9%, according to Casey Research. The last time profit margins sunk that low, the US economy entered the Great Recession of 2008-9.

|

As I showed in a recent post, profitability across the spectrum of the corporate sector in the major advanced capitalist economies remains weak and there is a sizeable section of that sector that are ‘zombie’ firms, unable to make any more profit than necessary to cover the servicing of their debts, let along invest in new productive technology to raise productivity and expand.

And behind that situation is the level of corporate debt, something ignored by the likes of Gavyn Davies. As Austrian economist, William White puts it in a damning piece, “the question that all market observers ultimately have to answer today is whether the epic accumulation of global debt is sustainable. If it is not, as I believe, the next question is how to identify the signs indicating that excesses are becoming unsustainable and leading to breakage.”

Michael Lewitt points out that stock markets “are chasing the highest valuations in history.” As the graph below shows, they still have some way to go to match the hi-tech bubble excess of 2000. But the US stock market is now at the same level of valuation as just before the 1929 crash.

And yet financial markets are not supported by strong corporate earnings and real GDP growth. According to Factset, estimated non- GAAP earnings growth for S&P companies in 2016 was a paltry +0.1% (and GAAP earnings growth was negative). Revenues were up roughly 2.0%. “Wall Street strategists trying to tempt investors into buying more stocks at these levels are playing with fire.” (Casey).

has anyone done a Shaikh-type comparison of _real_ stock prices to the US profit rate?

The .com crash could go so high, because it was not a real crisis by itself, but an extension of a global crisis that was delayed by the hoarding of money and credit that were happening already for few years. It didn’t cause any problems by itself, because the fixed assets were mostly virtual, it didn’t have any real value in marxist terms. The fall in corporate crisis happenned in 1997 with the Russian and Asian Tiger’s crisis. So, the valuation indicator is a failure in this case.

To see why it happens in this way, note that in the global corporate crisis, there is a depth in 199, with a recover which was reflects the hoarding of money and credit by US financial market, which likely helped to inflate the .dot com bubble. That it was really a hoarding, note that the margins of profit kept going lower and lower, since there was no actual value being created.

correction: “depth in 199” = “depth in 1997”

“As a result, productivity growth (that’s the increase in output per worker), is stagnant, especially in the key productive sectors like manufacturing.”

But, there has been a significant increase in the amount of labour employed over the last few years,a nd that increase is continuing above what is required to absorb the increase in workforce.

So, unless these millions of additional workers are processing thin air, and using no auxiliary materials, or using existing fixed capital, we have to assume that the increase in investment is manifest not in an increase in fixed capital, but in an increase in circulating constant capital and a more efficient use of existing fixed capital,which in itself represents a shift in the nature of value creation, which we might expect as a result of a shift from a manufacturing based economy, to a services based economy, especially a high value added services based economy.

Otherwise, in order to argue that their has been no capital accumulation, we would have to show not that productivity has been stagnant, but that there has been a huge drop in productivity, so that all of these millions of additional workers are actually processing less material etc.

If you only ever measure capital accumulation in terms of fixed capital accumulation, rather than all capital accumulation you will, of course, miss the expansion that is obviously taking place, and which will only be reflected in further large scale fixed capital investment when the rise in demand hits capacity constraints.

The problem with Boffy’s “suggestion” that we measure the accumulation of circulating capital in order to determine real capital accumulation– is that circulating capital does not accumulate. By definition, circulating capital is capital who gives up its entire value into product and whose value is consumed in the realization part of the capital’s rotations. What is accumulated in the movement of circulating capital is money, with the profit portion of money representing the surplus value. And this surplus value can only be capitalized by being “reabsorbed” or reinvested in the means of production– in the machinery of production that replaces living labor.

So yeah, just as Marx described the accumulation of fixed capital as the perfect form of capital, using fixed capital expansion as a proxy, marker, index to the robustness of capitalist reproduction is justified, important, and accurate.

“Quite right, as Marx says in Capital I, the accumulation of capital is the expansion of the workforce.”

No, not quite right, Non-supervisory production workers have not recovered to the level, not of 2007, which itself was already part of the steep reduction after 2001, but to the 2000 level, and more importantly, production worker hours have been declining for decades– part and parcel of a)the substitution of fixed capital, machinery for living labor and b)structural declines in the rate of profit converging with episodic overproduction.

“Marx says, the rise in the organic composition of capital which leads to the tendency for the rate of profit to fall is in the accumulation of this circulating capital, i.e. of all of the additional materials that are processed by labour as a result of the rise in productivity.”

Not even close to being right. Marx identifies the organic composition as expressing, as synthesizing, the “strict correlation” that exists between the technical composition of capital– i.e. the “weight” or mass, the physical dimensions of the machine portion in relation to the number of workers and worker hours required to animate that mass– and the value composition–i.e. the disproportionate value weighting of the the accumulated means of production, the constant capital which includes both the fixed and circulating components in relation to the value of the variable capital employed.

In volume 3, Marx never identifies the tendency of the rate of profit to decline to the relation between circulating capital and variable capital. He always refers to constant capital in the chapters on the law, its consequences, and offsetting factors.

Re the fixed portion, Marx says this in the Grundrisse:

“We have seen that the magnitude of the capital already presupposed, presupposed to reproduction, is specifically expressed in the growth of fixed capital, as the produced productive force, objectified labour endowed with apparent life. The total value of the producing capital will express itself in each of its portions as a diminished proportion of the capital exchanged for living labour relative to the part of capital existing as constant value. Take e.g. manufacturing industry. In the same proportion as fixed capital grows here, machinery etc., the part of capital existing in raw materials must grow, while the part exchanged for living labour decreases. Hence, the rate of profit falls relative to the total value of the capital presupposed to production – and of the part of capital acting as capital in production. The wider the existence already achieved by capital, the narrower the relation of newly created value to presupposed value (reproduced value).”

And:

“Indeed, the capital can grow and the rate of profit can grow in the same relation if the relation of the part of capital presupposed as value and existing in the form of raw materials and fixed capital rises at an equal rate relative to the part of the capital exchanged for living labour. But this equality of rates presupposes growth of the capital without growth and development of the productive power of labour. One presupposition suspends the other. This contradicts the law of the development of capital, and especially of the development of fixed capital.”

And:

“(2) The second great law is that the rate of profit declines to the degree that capital has already appropriated living labour in the form of objectified labour, hence to the degree that labour is already capitalized and hence also acts increasingly in the form of fixed capital in the production process, or to the degree that the productive power of labour grows. The growth of the productive power of labour is identical in meaning with (a) the growth of relative surplus value or of the relative surplus labour time which the worker gives to capital; (b) the decline of the labour time necessary for the reproduction of labour capacity; (c) the decline of the part of capital which exchanges at all for living labour relative to the parts of it which participate in the production process as objectified labour and as presupposed value. The profit rate is therefore inversely related to the growth of relative surplus value or of relative surplus labour, to the development of the powers of production, and to the magnitude of the capital employed as [constant] capital within production. In other words, the second law is the tendency of the profit rate to decline with the development of capital, both of its productive power and of the extent in which it has already posited itself as objectified value; of the extent within which labour as well as productive power is capitalized”

And……and I could go on and on about the importance of fixed capital to the production process, the valorization process, the turnover of capital, and the tendency of the rate of profit to decline.

Amazing that some “experts” on Marx have missed all of this.

Yes, that’s exactly the case. To use an illustrative, recent example, we have the Super Bowl LI. It was heavily propagandized that Houston received a US$ 350 million boost to its economy because of the event.

But those US$ 350 million boost was mainly in services (circulation of already exisiting merchandise, made from already existing fixed capital), e.g. shops of souvenirs, bartending, fast food, production of events etc. It doesn’t even need to be a rise in efficiency in the use of already existing fixed capital, but just the dump of exceding industrial capacity.

The illusion of growth from “thin air” (in this case, a football game) lies in the fact that Houston will see a sudden growth in tax collection from VAT et al. – money enters the public coffers, there’s the illusion (appearance) of economic growth from the point of view of the city hall.

The problem with this kind of growth is that it easy comes, easy goes (in economics language, it’s not “sustainable”). Most jobs created are temporary and low paid, and the injection of funds to the city is a one-timer – it is not a revenue proper to the city hall.

Quite right, as Marx says in Capital I, the accumulation of capital is the expansion of the workforce. In fact, as Marx says, the rise in the organic composition of capital which leads to the tendency for the rate of profit to fall is in the accumulation of this circulating capital, i.e. of all of the additional materials that are processed by labour as a result of the rise in productivity.

What is different about modern production is precisely the extent to which it is dominated by services rather than manufacturing. Yet, even a worker in McDonalds has to have more burgers to serve to customers, the workers in a hotel have to have more alcohol to serve to residents and so on.

But, the addition of millions of additional workers in itself represents an accumulation of capital, i.e. of variable capital. The fixation with fixed capital as Marx details in Theories of Surplus Value, Part 2, was one of the things that prevented Ricardo from properly understanding prices of production, and the reason that prices diverge from values.

“The problem with this kind of growth is that it easy comes, easy goes (in economics language, it’s not “sustainable”). Most jobs created are temporary and low paid, and the injection of funds to the city is a one-timer – it is not a revenue proper to the city hall.”

I disagree with this bit, however. There is nothing illusory or unsustainable in such service industry, provided as with any other industry what is provided is provided in the appropriate proportions.

As marx explains in Theories of Surplus Value Chapter 4, those involved in the provision of services, such as the example he gives of a prostitute, create value the same as any other labour, provided there is a buyer for the service. As marx points out, if the labour produced no value, no one would be prepared to exchange an equal amount of value for it.

And, as marx describes in Chapter 4, if the worker engaged in such work is employed by a capitalist, then the worker produces a surplus value, equal to the difference between the new value created by the worker, and the value of their labour-power.

That surplus value can then as Marx describes be accumulated as additional capital in the form of fixed capital such as additional buildings and machines, and circulating capital, in the form of additional raw and auxiliary materials, and as additional labour-power.

Here is Marx’s take on investment and capital accumulation.

We have to remember that, for Marx, capital is a social relation, between capital and wage labour.

In Capital I, Chapter 16, Marx makes this clear.

“Growth of capital involves growth of its variable constituent or of the part invested in labour power. A part of the surplus-value turned into additional capital must always be re-transformed into variable capital, or additional labour fund. If we suppose that, all other circumstances remaining the same, the composition of capital also remains constant (i.e., that a definite mass of means of production constantly needs the same mass of labour power to set it in motion), then the demand for labour and the subsistence-fund of the labourers clearly increase in the same proportion as the capital, and the more rapidly, the more rapidly the capital increases…

The more or less favourable circumstances in which the wage working class supports and multiplies itself, in no way alter the fundamental character of capitalist production. As simple reproduction constantly reproduces the capital relation itself, i.e., the relation of capitalists on the one hand, and wage workers on the other, so reproduction on a progressive scale, i.e., accumulation, reproduces the capital relation on a progressive scale, more capitalists or larger capitalists at this pole, more wage workers at that. The reproduction of a mass of labour power, which must incessantly re-incorporate itself with capital for that capital’s self-expansion; which cannot get free from capital, and whose enslavement to capital is only concealed by the variety of individual capitalists to whom it sells itself, this reproduction of labour power forms, in fact, an essential of the reproduction of capital itself. Accumulation of capital is, therefore, increase of the proletariat.”

The accumulation of capital is then, for Marx, an expansion of this relation, which means an expansion of the quantity of labour-power employed and exploited to produce surplus value. He writes,

“In short: in order to employ a greater quantity of labour, it is not enough either that a greater quantity of labour should be available, or that a greater quantity should be paid for, that is, more should be spent in wages; but the means of labour—raw material and fixed capital—must also be there in order to absorb a greater quantity of labour.” (Theories of Surplus Value, Chapter 4, p 254)

“Actual revenues, as reported under GAAP, over time, are obscured the best way possible, just as magicians obscure their sleight of hand by distracting their audience with some flashy moves,” Richter explains. “This relentless and eager focus on Wall Street hocus-pocus explains in part why the DJIA has soared 73% over the five years to 20,000 even as aggregate revenues, despite the delirious acquisition binge, have been mired down in a sea of stagnation.” This is a comment on the lack of revenue growth from Wolfstreet.com They present a number of graphs to show this stagnation over the last 5 years even when adjusted for oil prices and the replacement of AT&T by Apple. Everything is smoke and mirrors. If anything the US economy is now slowing down as shown by the recent Redbook, the Gallup good job index (compulsory reading) and other reports. Also we need to take into account that 2016 was a leap year so 1.6% real growth is really only 1.3% as the extra day is equal to 0.3%.

How can 1 day, which equals only 1/366 of a year be equal to 0.3% compared to the annual figure of 1.6%??? 1/365 of 1.6% is 0.0044%!

So if QE is subtracted from the figures what do we get more than $5trillion worth…since 2008

The Euro will implode this year by all accounts will not exist in its present form by 2018. The Americans will crash it. What effect will that all have on all the figures presented.

No one knows.

Reblogged this on 21st Century Theater.

Gran aporte.