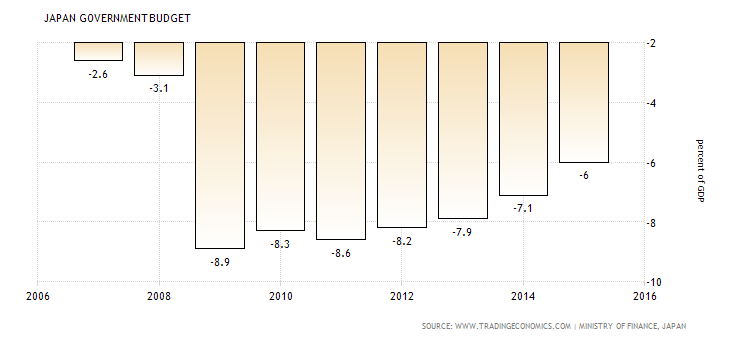

Back in 2012 when Japanese PM Abe came to power, he launched a new economic policy that was supposed to get Japan out of its seemingly permanent deflationary stagnation. The ‘three arrows’ of this policy were 1) to print money and take interest rates down to zero and beyond to stimulate consumer spending – so-called ‘unconventional monetary policy’; 2) to increase government spending and run sizeable budget deficits to ‘pump-prime’ the economy in traditional Keynesian-style; and 3) to introduce ‘structural reforms’ i.e. labour and market deregulation in the neo-liberal approach. Warning – graph alert!

Former Fed chair Ben Bernanke, the architect of unconventional monetary policy, was flown to Abe’s Cabinet meetings to advise on the first arrow.

Paul Krugman, the great guru of Keynesian stimulus policies, was also flown in to advise on the second arrow; while Abe himself tried to implement the third arrow with sharp cuts in corporate taxes and weakening of labour laws.

In previous posts, I pointed out that Abenomics was really the ultimate policy of mainstream economics in all its wings that would supposedly end Japan’s depression – but it would not work unless profitability of capital was revived and business investment took off.

One of the key targets of Abenomics was to get inflation of prices in the shops rising at 2% a year. This supposedly would force Japanese citizens to spend more and stop saving too much, which had been the result of the deflation of previous years. The combined policies of monetarism and Keynesianism would do the trick.

Well, the latest data from Japan show the miserable failure of these policies. Annual consumer prices are now falling not rising. Core consumer prices, which include oil products but exclude volatile fresh food, fell 0.3% in 2016 from a year earlier, a 10th straight monthly decline.

And as for economic growth, Abenomics has failed spectacularly. Real GDP growth is struggling to reach 1% this year, way below levels achieved when Abe came into office at the time of ‘recovery’ from the Great Recession.

It is just as well that Japan’s ageing population continues to shrink because that has meant that GDP per person has risen more.

But even this meagre rise in GDP hides the deeper failure of Keynesian style policies. Fiscal stimulus and monetary easing has not led to increased household spending. On the contrary, Japanese households are consistently spending less.

Why is that? Well, the answer lies in the partial success of the third arrow – the real drive of Abenomics – namely trying to raise the profitability of capital and the productivity of labour to get Japanese capitalism going. Under Abenomics, profitability has been turned around. Japanese profitability was in long-term decline during the 1990s and that was only reversed by the previous neo-liberal policies of PM Koizumi and the global credit boom of the 2000s. But the Great Recession saw a 25% collapse in profitability. Abenomics set out to restore profitability of capital.

And Abe did it in two ways. The first was a sharp cut in corporate taxes.

And while corporate profits taxes were reduced, a special sales tax was imposed on the Japanese public and social security contributions were hiked.

The outcome was a big shift in the share of labour in national income towards profit share. Real wages per employee fell and with it, household spending.

However, it seems that Japanese corporations, despite improved profitability, are still not prepared to step up business investment by any decisive amount. That’s because the actual generation of profitable investment is still weak and cuts in corporate taxes are not enough to counteract that. Capital formation remains nearly 20% below where it was in the late 1990s and still below the peak of 2007.

As a result, Japan’s productivity per worker has not increased at all under Abenomics.

So, after four years of Abenomics, employing all the weapons of mainstream economics, and paying their leading advisers to help, Japanese capitalism remains stagnant and worker’s real incomes are falling.

Thank you Michael. I have faithfully read your blog for several years now. Politically and parlamentarily active within the Swedish left party where I find myself on the left of the party. I argue that reformism no longer cuts the grade as there is no money to implement reforms. Austerity is the reality today. Your down to earth writing and analysis has been of great help in improving my critical thinking, reading and study.

I would love to here your thoughts about the AMECO meassure (net return on capital)!

Axel, The AMECO measure of net return on the stock of fixed capital is a reasonable proxy for a measurement of the rate of profit in an economy. It is not as good as using national data and identifying Marxist categories direct, especially as it is indexed. However, I have found that national stats do usually show a similar trend to the AMECO measure. So AMECO gets some backing from any national measures to increase confidence in it. Also I use other measures like PENN and Extended PENN to compare in case AMECO looks like an outlier – which it does sometimes.

For more on this, see my paper Revisiting a world rate of profit https://thenextrecession.files.wordpress.com/2015/12/revisiting-a-world-rate-of-profit-june-2015.pdf

For the definition of the AMECO measure, see http://ec.europa.eu/economy_finance/ameco/HelpHtml/apndk.html

So, Michael, if globalisation and Abenomics have failed to get capitalism out of our misery, will Trumponomics save American workers?

see my post, https://thenextrecession.wordpress.com/2016/11/18/testing-trumponomics/

Hi Michael

I am also a fan but extremely challenged in terms of economic theory. Could it not be argued that a central problem with Abenomics is its eclecticism? As you pointed out it has three wings. But has the failure not shown that you cannot combine neoliberalism and Keynesianism?

Gary

Well I suppose the key policy from capital’s point of view is the last arrow of ‘structural reform’, but even that has not worked yet. Combining Keynesian policies with it is designed to make the impact of neoliberal policies less harsh and avoid political reaction.

Reblogged this on 21st Century Theater.

Thanks, Roberts, for all your posts. In India right now we experience all the “three arrows” shot together. Demonetisation (refuelling the banks by calling back the cash) is a risky lethal weapon that seeks to combine the power of all these arrows. What do you think about Modinomics at this juncture? Does this article published in a group active in Delhi make any sense to you?

https://radicalnotes.com/2016/12/27/demonetisation-maturing-capitalism/