Financial markets responded to the news of US economic growth jumping to a 4% annual rate in Q2 2014 by selling off. The reason was that faster growth in the economy would imply an earlier move by the Federal Reserve to raise interest rates and ‘normalise’ monetary policy. The Fed’s monetary policy committee said it was sticking to its existing ‘easy money’ policy, although it was tapering its rate of credit injection and stopping altogether in October. However, one Fed board member dissented and wanted a rate rise now. This spooked markets into reckoning that the era of cheap money since the Great Recession might soon be over.

The whole situation reminds me of the move to tighten monetary policy in 1937 during the Great Depression. Then it appeared to the US authorities that the slump was over and it was time to ‘normalise’ interest rates. On doing so, the economy promptly dropped back into a new recession that was only overcome when the US entered the world war in 1941. The reality was that the profitability of capital and investment had not really recovered and raising the cost of borrowing tipped the economy back (see my post,

https://thenextrecession.wordpress.com/2012/08/06/the-great-depression-and-the-war/).

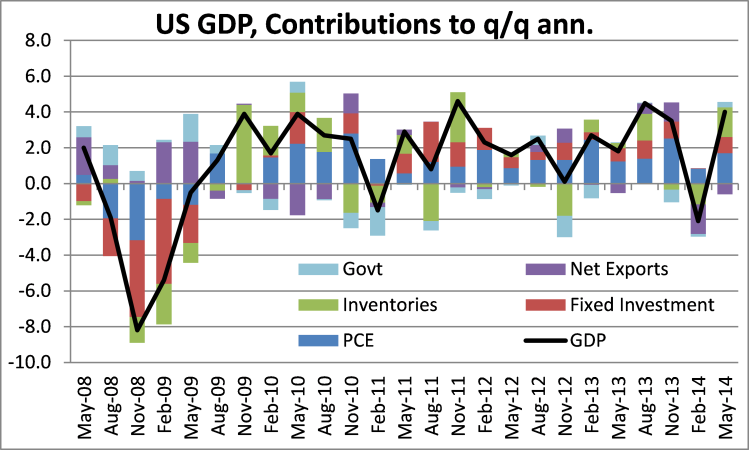

That is the danger this time also. The headline growth figure for Q2’14 was a 4% annual rate and the first quarter disaster was revised up to a contraction of -2.1%. But this jump mostly reflected a sharp rise in inventories, namely stocks of goods that companies are piling up and have not been sold. This contributed 1.7% points of the 4% uptick. This suggests that US companies may have produced more but cannot yet sell it all. We’ll see in the next quarter.

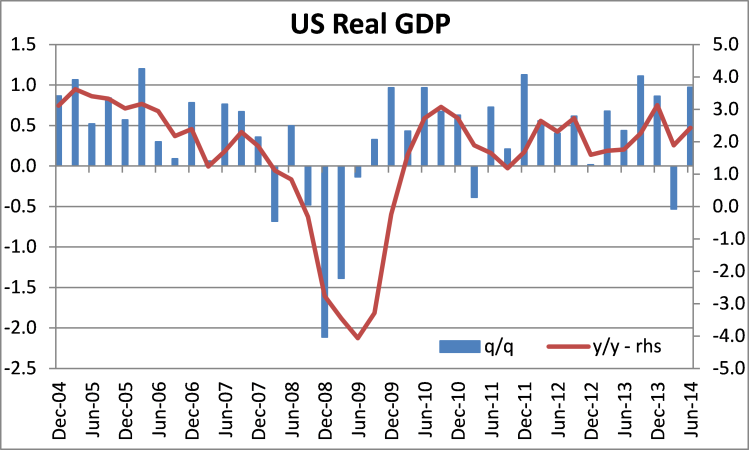

Moreover, if we look at the level of US gross product compared to this time last year, the growth rate in Q2 was only 2.4%, a much better gauge of the level of expansion that the annualised figure. So even if growth accelerates in the second half of this year, the IMF forecast for the whole year of 1.7% that I mentioned in a recent post is likely to be confirmed. If you look at the graph below, you can see that the red line of year-on-year growth is pretty static at about 2% a year.

Indeed, the US official statistics were revised in this latest report. In the three-year period 2011-13, the real GDP growth rate averaged exactly 2% a year, revised down from 2.2%. So the ‘recovery’ since the end of the Great Recession in mid-2009 remains the weakest since the Great Depression. And the gap between where the trend growth rate would have taken the US economy without the Great Recession happening and the reality remains unbridged, with some $1.5trn of output lost forever, or about 10% of GDP.

The majority of the Federal Reserve board remains reluctant to move on tightening monetary policy as the dissenters want. They stick to the view that there is still a sizeable gap between potential output and effective demand in the economy. This is the Keynesian view, as propounded by the likes of Paul Krugman and Larry Summers, who fear that that the US is in ‘secular stagnation’ that requires keeping interest rates near zero and more printing of money

(https://thenextrecession.wordpress.com/2013/11/30/secular-stagnation-or-permanent-bubbles/)

The dissenters are growing in strength though. Recently the Bank of International Settlements (the central banks association body) published its annual report and raised fears that unending printing of money and credit injections was creating financial and property asset ‘bubbles’ that would eventually burst and renew the financial crash of 2008 (http://www.bis.org/publ/arpdf/ar2014e.htm). This was not a new debate kicked off by the BIS. The BIS pushed the same story last summer (see my post,

https://thenextrecession.wordpress.com/2013/06/26/the-failure-of-qe-2/).

Jaime Caruana, head of the BIS, said the international system “is in many ways more fragile than it was in the build-up to the Lehman crisis”. Debt ratios in the developed economies have risen by 20 percentage points to 275pc of GDP since then. Credit spreads have fallen to to wafer-thin levels. Companies are borrowing heavily to buy back their own shares. Caruana correctly pointed out how stock and bond markets were racing up to new highs but the ‘real economy’ of output and investment was stuck in very low rates. This suggests a dangerous bubble as higher risk corporate leverage (debt) has risen to new highs.

And the Fed dissenter, Robert Fisher put it: “the money we have printed has not been as properly circulated as we had hoped. Too much of it has gone toward corrupting or, more appropriately stated, corrosive speculation.” And Fisher quoted Neil Irwin of the NYT who pointed out that “Around the world, nearly every asset class is expensive by historical standards. Stocks and bonds; emerging markets and advanced economies; urban office towers and Iowa farmland; you name it, and it is trading at prices that are high by historical standards relative to fundamentals.” (http://www.dallasfed.org/news/speeches/fisher/2014/fs140716.cfm).

A good measure of how far financial markets are out of line with reality is Tobin’s Q, a measure of the market value of stocks against the actual value of the stock of fixed assets owned by companies. This measure was invented by James Tobin, a leftist economist back in the 1980s.

The great collapse in equity prices in 2000, which led to the secular ‘bear market’ in stocks since then (see my posts,

https://thenextrecession.wordpress.com/2013/03/30/its-still-a-bear-market/ and

https://thenextrecession.wordpress.com/2014/02/07/waste-bear-markets-and-fictitious-capital/),

was clearly suggested by Tobin’s Q peaking at an astronomical high then. The Great Recession saw the ratio drop below the historic average. But since then it has risen back to the highs of the 1990s. So are we due for another fall?

The BIS critique is really based on the ideas of the so-called Austrian school of economics. This school reckons that there are financial crises under capitalism but that they are caused, not by faults in the banking system or by flaws in the capitalist mode of production. On the contrary, the market economy is a wonderful piece of social engineering and the ‘invisible hand’ of market forces is the only viable way for economies to operate efficiently. The problem is that governments (departments of finance and central banks) interfere with the smooth operation of financial and product markets and try to fix interest rates or the quantity of money. This just leads to ‘malinvestment’ and credit bubbles. Then these bubbles will need to be burst like a blister to get rid of the poison of speculation, even if it leads to a slump in production.

Actually, the BIS does not adopt Austrian economics outright. It follows the work of Kurt Wicksell, a Swedish economist, and now backed up by the work of BIS economist Claudio Borio. They reckoned that modern capitalist economies with a large financial sector are subject to endogenous cycles of credit booms and busts spread over 15-20 years (Borio says 16 years – see my post,

https://thenextrecession.wordpress.com/2013/02/10/why-is-there-a-long-depression/). The BIS reckons that if no preemptive action is taken, then the major economies, particularly the US and the UK, are heading for another credit bust.

These ideas are, of course, anathema to the Keynesians, who reckon the Great Recession was the product of a huge drop in ‘effective demand’ and the capitalist economy must be given huge dollops of ‘free money’ to boost demand before it can be allowed to stand on its own two feet. They reckon that, as demand has not fully recovered (unemployment may be falling, but wage income is stagnant and business investment is pitiful), the Fed’s printing presses must continue to pump out dollars and at the very least, the cost of borrowing should not rise.

However, stock market investors have become worried that the gravy train they have been on for the last few years as the Fed pumped in ‘free money’ to borrow in order to speculate in stock and property markets might be coming to an end soon. The strong headline US GDP figure and the split in the Fed’s board between the BIS and Keynesian wings was the trigger for a sell-off.

I think the stock markets are right to be worried, but not just for the reason of ‘uncontrollable credit’ that the BIS cites. There is also the productive sector of the economy. There is a huge gap between the value of financial assets and property prices and the productive growth in the major economies. And now there is a significant turn in profitability appearing.

Profits are the key to investment and the correlation between the movement in the mass of profits and business investment is well documented (at least for the US) – see my post,

https://thenextrecession.wordpress.com/2012/06/26/profits-call-the-tune

and my joint paper with G Carchedi, The long roots of the present crisis.

And US corporate profits have stopped rising. In the first quarter of this year, they fell absolutely for the first time since the end of 2006. When they fell in 2006, investment slumped about one year later and the Great Recession began. If corporate profits continue to fall, it will be a clear indicator of new recession in the offing just a year or so away, perhaps exactly when the Federal Reserve starts to raise interest rates.

It could be 1937 all over again.

The implication here is that central bank planners can control the cost of capital, which is quite contrary to what Marx says! The rate of interest, according to Marx is the market price for capital sold as a commodity, i.e. it is the market price for the use value of money-capital. Central banks in buying particular financial instruments, such as government bonds, may be able to influence the market price of those particular instruments, but only at the cost of distorting in the opposite direction the market price of other financial instruments.

Interest rates have not been low because of central banks ability to dictate market prices – if they could do that, then why can’t they dictate all market prices, and thereby banish crises forever? – but for the reason Marx sets out in Capital. That is the supply of potential money-capital has exceeded the demand for money-capital, and the reason it has done so, is because the mass and rate of profit has risen so much in the last 30 years. That again is what Marx describes in Capital as always happening in this phase of the cycle.

There is no evidence that low interest rates, or the policy of the Federal Reserve in providing excessive liquidity has benefited the real economy. On the contrary, the purpose of the excess liquidity has been to prevent the necessary destruction of the massive amounts of fictitious capital that has been built up, and thereby to prevent the exposure of the global banking system as insolvent, and founded on huge quantities of worthless or massively inflated assets.

In so doing, it has created incentives for capital to flow towards speculation for rapid and excessive capital gains, for company executives to use resources to boost share prices, and stock options, buy using company funds to buy back shares, rather than investment in productive capital etc. It has priced large numbers of people out of the property market, which also means that potential property construction is undermined, as builders have to pay inflated prices for land, and cannot build houses at prices that people could afford; it has made workers pensions unaffordable, because high stock and bond prices mean that the more or less fixed level of monthly contributions has bought fewer and fewer bonds and shares to be accumulated in those funds, and the yield on the shares and bonds has simultaneously fallen.

The consequence of both of the latter is to raise the value of labour-power, and thereby squeeze profits, as well as to reduce potential output.

The 1937 downturn happened towards the end of, but still during a period of long wave downturn. In fact, where Europe entered that downturn between 1914-20, the US did not enter it until 1929. Today, the world is mid way through a global long wave boom. A rise in interest rates will happen with or without the Federal Reserve changing policy. It will cause that fictitious capital to be destroyed.

But, for the reasons Marx sets out, such events are generally good for the capitalist system. As he says the build up of these bubbles add not one cent to real value or wealth, and their destruction likewise takes nothing away from it. It is a transfer of fictitious wealth from one set of hands to another, usually more secure set of hands.

As Marx and Engels described in relation to the financial crises of 1847 and 1857, when similar bubbles burst, provided sufficient liquidity is provided to enable commodities to continue to circulate, there is no reason why such financial crashes should have any lasting effect on the real economy.

First, I wouldn’t advise anyone to draw any conclusions about the direction of the economy based on one day in the stock market, or even an entire trend in the stock market.

Secondly, it’s very likely that the market did not sell-off based on the “good news” about the economy. I mean this is such an empty argument, nothing but the reflected image of the argument that says, “the stock market achieved new highs based on the expected (or previous) “good news” about the US economy.

Third– it’s much more likely that the cause of the sell-off was the default of Argentina; the accelerating conflict in the Ukraine, which is the conflict of the US and Western European capitalism with Russian capitalists; the actions of the Israelis in Gaza.

And then I’d caution about making comparisons to 1937, because– well because it reminds of the saying about army generals–“always ready to fight the last war.”

I would be remiss if I shirked my obligation to refute Boffy’s new nonsense, namely his explanation of low interest rates:

“That is the supply of potential money-capital has exceeded the demand for money-capital, and the reason it has done so, is because the mass and rate of profit has risen so much in the last 30 years. That again is what Marx describes in Capital as always happening in this phase of the cycle.”

This simply flies in the face of facts: Interest rates have been reduced since 2008 because of the decline in profitability, not an increase.

Rates of profit in the US have not exceeded the previous peak of 1969-1970.

And here’s the best part: If rates of profit have risen so much in the last 30 years, meaning 1984-2014, how can that be reconciled with Boffy’s own assertion that the period 1984-1999 is part of the “great stagnation” (his term) of 1974-1999?

I believe at another point he refers to the 80s and 90s as a “depression.”

It’s kind of like Edgar’s pointing out that at one and the same time Boffy claims strikes don’t represent class consciousness while he tries to bolster a case for increased class consciousness by pointing to strike activity.

By different ways, we arrive at the same conclusions. Read my article

http://elfindelasmultinacio.wix.com/f-d-m#!la-encrucijada-del-capitalismo-en-2014/c21ok

Is in Spanish, you can use a translator and consult what you see confusing. I would be grateful to read my book and we can exchange ideas on the crisis of capitalism

Solidarity

Daniel Campos

Daniel

I’ll read it and get back to you

Boffy subscribes to the permanent boom theory of capitalism ie one which states that an endless amount of debt can generate permanent capitalist growth even when this growth has no actual public sector growth. Its a variation of Osborneomics which continues the previous disastrous policy of building flats in perpetuity importing tens of thousands of labourers and adding half the flats once built onto the housing benefit/tax benefit subsidy racket.

In the meantime he only sees growth as GDP figures are fake as QE bumps em up…

I see your penchant for making incorrect, extravagant and unsubstantiated claims is undiminished. I’m only surprised that you haven’t added in your usual anti-US conspiracy theory, and accused me of being a CIA agent, as well as a supporter of George Osborne.

“Boffy subscribes to the permanent boom theory of capitalism ie one which states that an endless amount of debt can generate permanent capitalist growth even when this growth has no actual public sector growth.”

Very odd given that I have written so much about Long Wave theory, which posits equal periods during which the global economy experiences downturns, as well as booms. Odd that I have described, and written about the effect of debt in creating fictitious capital, and speculative bubbles that inevitably burst and create financial crises, and so on.

But, then facts and the truth are both strangers to you. As is seen by your website that pretends to be of the Left, and yet distorts the writings of Marx, Lenin and others to support your reactionary nationalistic politics, and support for Immigration Controls etc.

Boffy,

I agree with your response to VN Gelis, in that you have explained very clearly your long wave views.

But can you please clarify your ‘end game’ position when it comes to capitalism? Because I can’t quite see it.

You seem to believe that capitalism will expand and contract indefinitely. If I cut to the chase, isn’t this just another way of saying permanent boom, albeit one punctuated by periods of crisis?

Surely it would be a strange kind of “Permanent” boom that was punctuated at regular intervals by crises of overproduction, and contained equal periods of stagnation! That’s a bit like saying people enjoy continuous good-health except when they are ill.

I don’t believe that Capitalism can simply go on forever, expanding via the continual positing and resolution of crises. At some point, Capitalism would become incapable of developing further, just as happened with the slave societies of Greece and Rome.

However, that historical analogy should be enough to warn against waiting for Capitalism to reach that stage, rather than seeking to create its replacement here and now. The “end game” should be that we develop socialistic property as the historically superior form here and now, so as to increasingly replace capitalist property, and build the economic and social power of the workers, just as the bourgeoisie did from the 15th century on in replacing feudal property, and building their economic, social and political power.

We do that in the context of a real “class” struggle, i.e. a struggle to replace capitalist property with our property, bourgeois democracy with workers democracy, the capitalist state with a workers state, on the basis that at each stage the resistance of the bourgeoisie to the further development of our property, and social relations built upon it will require a response from us that is fought out at the industrial, ideological and political level.

To do otherwise is to invite disaster. The idea that its possible to wait for some re-run of 1917, possibly encouraged by some economic disaster, and that in the meantime all that can be done is to “build the party” bit by bit by relating to strikes, or parachuting in to whatever is the latest big campaign is a non-starter. But the idea that Socialism can be built on the back of a collapse of Capitalism goes against everything that Marx and Engels, and their heirs have said. The example of the collapse of slave society is that at that stage, it leads to the destruction of the contending classes, and a collapse into reaction.

But, to come back to your original question about permanent boom, although I do not believe that Capitalism could simply go on forever, the question for a Marxist has to be dealt with concretely. That is do we see any sign that we are actually at that stage? The answer is no. Quite the opposite.

To quote Trotsky.

“It is already possible to postulate a priori that epochs of energetic capitalist development must possess features – in politics, in law, in philosophy, in poetry – sharply different from those in the epochs of stagnation or economic decline. Still more, a transition from one epoch of this kind to a different one must naturally produce the greatest convulsions in the relationships between classes and between states. At the Third World Congress of the Comintern we had to stress this point – in the struggle against the purely mechanistic conception of capitalist disintegration now in progress. If periodic replacements of “normal” booms by “normal” crises find their reflection in all spheres of social life, then a transition from an entire boom epoch to one of decline, or vice versa, engenders the greatest historical disturbances; and it is not hard to show that in many cases revolutions and wars straddle the borderline between two different epochs of economic development, i.e., the junction of two different segments of the capitalist curve. To analyze all of modern history from this standpoint is truly one of the most gratifying tasks of dialectical materialism.”

The Curve Of Capitalist Development

“The movement of economic development is characterized by two curves of a different order. The first and basic curve denotes the general growth of the productive forces, circulation of commodities, foreign trade, banking operations, and so on. On the whole, this curve moves upward through the entire development of capitalism. It expresses the fact that society’s productive forces and mankind’s wealth have grown under capitalism. This basic curve, however, rises upward unevenly. There are decades when it rises only by a hair-breadth, then follow other decades when it swings steeply upward, only in order later, during a new epoch, to remain for a long time on one and the same level. In other words, history knows of epochs of swift as well as more gradual growth of the productive forces under capitalism. Thus, by taking the graph of English foreign trade, we can establish without difficulty that it shows only a very slow rise from the end of the Eighteenth Century up to the middle of the Nineteenth Century. Then in a space of twenty-odd years (1851 to 1873) it climbs very swiftly. In the ensuing epoch (1873 to 1894) it remains virtually unchanged, and then resumes the swift upward climb until the war.

If we draw this graph, its uneven upward curvature will give us a schematic picture of the course of capitalist development as a whole, or in one of its aspects.

But we know that capitalist development occurs through the so-called industrial cycles, which comprise a set of consecutive phases of the economic conjuncture: boom, lag, crisis, cessation of crisis, improvement, boom, lag, and so on. Historical survey shows that these cycles follow one another every eight to ten years. If they were placed on the graph, we would get, superimposed on the basic curve which characterizes the general direction of capitalist development, a set of periodic waves moving up and down. Cyclical fluctuations of the conjuncture are inherent in capitalist economy, just as heart beats are inherent in a living organism.

Boom follows crisis, crisis follows boom, but on the whole the curve of capitalism has climbed upward in the course of centuries. Clearly the sum total of booms must have been greater than the sum total of crises.”

Trotsky – Flood Tide

By the way, V. N. Gelis has been identified by many on the Left over the internet, both in this country and in the US, as purveying some very reactionary views. Some of the letters to the Weekly Worker from US socialists provide the details.

Boffy,

Appreciate the clarification. Not much I can disagree with. Though I have no interest in getting into character assassination.

“Surely it would be a strange kind of “Permanent” boom that was punctuated at regular intervals by crises of overproduction, and contained equal periods of stagnation!”

I was thinking of the underlying curve of development here, as your Trotsky quote provided.

Though if you look at the wage share that is showing a secular decline!

Edgar,

Not a matter of character assassination. Others have documented his reactionary ideas, and those he’s associated with. I pointed it out because people have a right to know, so they can check it out themselves.

A Marxist would not be surprised to see the wage share declining. If you looked at the whole of human history you would see the “wage” share declining, i.e. the proportion of total output that goes to creating the consumption fund.

It is, in fact, a measure of development, because it means rising productivity is occurring. Consider Robinson Crusoe. He starts off on his island, and has to spend all of his available labour-time collecting food, to survive, to produce some kind of rudimentary shelter etc. With whatever small amounts of surplus labour time he might have, he collects surplus product, to be able to later spend some of his time, producing other things like animal traps, or fishing rods that will help him produce his consumption requirements more easily, i.e. he devotes some of his time not to his wages, but to producing surplus value to invest in means of production.

The more these means of production help him to produce his wage goods, the less proportion of the day he needs to devote to that function, which means he then spends an increasing part of the day producing other means of production to raise his productivity further, and to maintain the means of production he has already created.

So, as his productivity rises, so the proportion of his total output that goes to his wage share will fall, and the proportion going to producing and maintain means of production, and of surplus labour-time so that he can produce even more effective and complex means of production will rise. Yet, at the same time the actual quantity of wage goods he consumes, his standard of living rises, because of that very process which increases his productivity.

That will be the case under Socialism too, except that we will make conscious decisions at any particular time about how much of total output at any time we need to devote to the consumption fund, the production fund, and the social surplus.

I take your point Boffy, I really do but we don’t have a Robinson Crusoe economy, we have capital exploiting Labour. I think linking a reducing wage share to a measure of development is dangerous in a class based economy. Unless you want to be an apologist for exploitation!

Though it was my fault that I brought it up in the first place!

Edgar,

The point was to indicate that the economy is comprised of these three funds – production fund, consumption fund, and surplus. In all societies, be it Robinson Crusoe, primitive Communism, Feudalism, Capitalism or Communism, development sees, the size of each fund grow, but necessarily sees the consumption fund fall relative to the other two. That is a necessary consequence of rising productivity.

The other consequence is a growing mass and range of use values produced, as social wealth increases. This is the process Marx discusses in the Grundrisse, of the Civilising Mission of Capital, and I don’t think he could be described as in any way an apologist for exploitation.

“On the other side, the production of relative surplus value, i.e. production of surplus value based on the increase and development of the productive forces, requires the production of new consumption; requires that the consuming circle within circulation expands as did the productive circle previously. Firstly quantitative expansion of existing consumption; secondly: creation of new needs by propagating existing ones in a wide circle; thirdly: production of new needs and discovery and creation of new use values. In other words, so that the surplus labour gained does not remain a merely quantitative surplus, but rather constantly increases the circle of qualitative differences within labour (hence of surplus labour), makes it more diverse, more internally differentiated. For example, if, through a doubling of productive force, a capital of 50 can now do what a capital of 100 did before, so that a capital of 50 and the necessary labour corresponding to it become free, then, for the capital and labour which have been set free, a new, qualitatively different branch of production must be created, which satisfies and brings forth a new need. The value of the old industry is preserved by the creation of the fund for a new one in which the relation of capital and labour posits itself in a new form. Hence exploration of all of nature in order to discover new, useful qualities in things; universal exchange of the products of all alien climates and lands; new (artificial) preparation of natural objects, by which they are given new use values. The exploration of the earth in all directions, to discover new things of use as well as new useful qualities of the old; such as new qualities of them as raw materials etc.; the development, hence, of the natural sciences to their highest point; likewise the discovery, creation and satisfaction of new needs arising from society itself; the cultivation of all the qualities of the social human being, production of the same in a form as rich as possible in needs, because rich in qualities and relations — production of this being as the most total and universal possible social product, for, in order to take gratification in a many-sided way, he must be capable of many pleasures [genussfähig], hence cultured to a high degree — is likewise a condition of production founded on capital. This creation of new branches of production, i.e. of qualitatively new surplus time, is not merely the division of labour, but is rather the creation, separate from a given production, of labour with a new use value; the development of a constantly expanding and more comprehensive system of different kinds of labour, different kinds of production, to which a constantly expanding and constantly enriched system of needs corresponds.”

(Grundrisse, Chapter 8)

Boffy quotes Trotsky from…….1921… From the First 5 years of the Communist International, which of course is the first 5 years when the Communist International was pretty much getting everything wrong in its analyses of conditions of the actual class struggle going on; when murdering morons like Bela Kun were allowed to act as emissaries of the International, fomenting, not solely to be sure, the March Action, which Lenin and Trotsky supposedly denounced in private, but in public… they expelled Paul Levi who had opposed the action before it took place, and had the good sense to criticize it in public in front of the working class when it did take place.

Yep, that sure is an authority I want to quote on the oscillations of capitalist development and class struggle.

I suppose I should be grateful that Boffy is actually quoting somebody not from the 19th century, but I’m the ungrateful type.

Of course 12 or 15 years later, Trotsky seems to put all these curves behind himself and has switched his analysis to that of the era of permanent imperialist decay, “death agony” of capitalism and all that jazz, where capitalism is incapable of advancing the development of the productive forces, that is to say, enhancing the productivity of social labor. Wrong there, too, but “less” wrong. After all, it only took the immolation of what 50 million? 100 million? to restore a profitable balance between the living and the dead components of capital….but hey, who’s counting?

Boffy says: ‘The “end game” should be that we develop socialistic property as the historically superior form here and now, so as to increasingly replace capitalist property…’

Well here’s a question: how does this differ from the old new left “liberated territories” theorizing; or the autonomist stuff; or the Zapatista “model”?

Or more bluntly: what is this nonsense about building a ‘historically superior form of property’ when in fact property is the expropriation, or the alienation (in the commercial sense of the word) of labor power; when the task is the historically superior organization of social labor, a superior condition of labor where the products of labor do NOT in fact appear as property at all, as a power over human beings.

That might sound a bit obtuse, and I know I haven’t added hundred year old quotes from the first 5 years of the Communist International, or 150 year old quotes from Marx, but I think anyone who carefully reads the Grundrisse, or the other manuscripts that make up the Economic Manuscripts 1857-1864 will recognize that in this subtle distinction resides the real, and revolutionary, basis for Marx’s critique of capital.

Just sayin’……… I mean maybe I’m wrong, but then again, maybe not.

A very profound question!

How would you describe a producer coop? Wouldn’t they essentially be exploiting themselves, albeit within a capitalist system of exploitation? Didn’t Marx go into this self exploitation in some detail. I.e. The labourer as capitalist becomes the negation of the capitalist…

I would describe worker coops essentially, as marginal phenomena; not very important when the struggle is classwide action designed and avowedly to overthrow the bourgeoisie. I don’t the issue can be posed as workers exploiting themselves in a coop, no more than an individual capitalist is only exploiting the workers he/she employs in the pursuit of accumulation. We know the capitalist lays claim to a part of the total social surplus value. So too will and does a workers coop.

Edgar,

The role of Co-ops for Marx and Engels is clear. In Capital III, Marx describes both co-ops and joint stock companies as forms of socialised capital, as the transitional form between capitalism and socialism. He argues that the means of extending co-ops across the economy on a national scale, is the use of credit. He describes joint stock companies as the dissolution of capital within capitalism itself.

In his Inaugural Address to the First International he says the development of co-operatives was the most important development of the economy of the workers as an alternative to the economy of capital there had been. It would need to be developed nationally by a class struggle, which would require a political struggle via the establishment of a Workers party, and struggle against the attempts of capital in parliament to frustrate it.

A look at the correspondence of Marx and Engels from the FI, shows them continually asking their comrades across Europe, what progress was being made in establishing Co-ops. Engels argued that the most advanced workers in Germany were demanding the disbanding of state property and its transfer directly into the hand of workers.

Engels states in a letter to Bebel, that both he and Marx saw co-operatives playing a central role for a prolonged period in the transition to Socialism. The class struggle, is a struggle for the domination of one form of property over the other, it is not a struggle for simply less harsh conditions of exploitation for workers under capitalism.

Not putting too fine a point on it, Marx, after saying all those things about joint stock companies some are fond of quoting, concludes with this:

“There is antagonism against the old form in the stock companies, in which social means of production appear as

private property; but the conversion to the form of stock still remains ensnared in the trammels of capitalism; hence, instead of overcoming the antithesis between the character of wealth as social and as private wealth, the stock companies merely develop it in a new form.”

Apparently, some aren’t quite so fond of quoting this conclusion– that the joint stock companies do NOT in fact represent the self-abolition of capital, however much some might wish that, but merely express the antagonism inherent, immanent, to capital in a more developed, a more “perfect” form.

As for cooperatives, Marx says this, the first sentence in the paragraph:

“The co-operative factories of the labourers themselves represent within the old form the first sprouts of the new, although they naturally reproduce, and must reproduce, everywhere in their actual organisation all the shortcomings of the prevailing system.”

So Marx concludes regarding joint stock companies with the analysis that the contradictions are not resolved, and cannot be resolved in this form. The point being that the development of capital is necessary for the development of its expropriation; for social revolution.

And Marx begins his comments on cooperatives with the recognition that the cooperatives are both product and reproducer of the “shortcomings”– conflicts in the old system.

Marx continues:

“But the antithesis between capital and labour is overcome within them, if at first only by way of making the associated

labourers into their own capitalist, i.e., by enabling them to use the means of production for the employment of their own labour. They show how a new mode of production naturally grows out of an old one, when the development of the material forces of production and of the corresponding forms of social production have reached a particular stage. Without the factory system arising out of the capitalist mode of production there could have been no co-operative

factories.”

Ummh…….no not really, because the conflict is not simply or simply ever or simply confined to the conflict between any individual capitalist and any particular group of workers, but is a conflict based upon the condition of labor that dominates all of society, that determines the class organization. So coops might show as was shown in the LIP strike, or in Argentina how workers might run a factory with internal democracy etc. etc.,and do it “efficiently,” and even expand sales, but that in no way addresses the social conditions where labor power is expressed as value production through the medium of wage labor.

In addition, as Marx explicates in volume 3, the individual capitalist does not obtain the surplus value extracted from his/her particular group of wage laborers, but claim a portion of the total social surplus value in proportion to the size of his/her capital and its relative efficiency. The workers coop likewise obtains a portion of the total social surplus and while one can claim, the coop workers are not exploiting each other, the viability of such a coop depends upon the system of exploitation, and as such, is not viable as the basis for a revolutionary organization; as a class wide vehicle for the expropriation of capital.

We may “like” such cooperatives; we may applaud the democracy; we may feel better about BUYING products from such cooperatives, but such cooperatives do not provide a base, a platform, for the expropriation of capital.

The joint stock companies and cooperatives that Marx labels as transitional forms are transitional in the manner that capitalism is transitional to socialism– that is to say requiring expropriation on the same scale that it exists.

Boffy as always uses long quotes to obfuscate. Long wave theory is about economic decline or ascent? Are we in the middle of a new American century or coming to the end of one? He has consistently argued that profit rates have not declined even when tonnes of manufacturing has gone East, he argues consistently that we have global growth based on made up figures both in the USA and China.

In fact with most of his analysis one would see massive growth everywhere apart from real growth in actual living standards

Permanent boom supporters of capitalism support capital in all its flaws for they see positive in the negative and they turn the negative into …growth. One could actually argue they are economic reactionaries who justify the large transnational corporations that rule the earth as some for of global ‘socialism’ as they bring barbarism ever closer like eg fracking in the UK or wars over energy like Iraq and Ukraine which are allegedly part of the global …GDP growth…

Capitalist meltdown separated from global empires and alleging one sidedly that Trotsky only predicted permanent capitalist decay aint true. He argued that capitalism could restabilize post war under certain conditions. It did.

The question is why hasn’t there been inter-imperialist war for 7 odd decades when between 1914 and 1939 there were two which increased the death rate exponentially arriving at a mechanised form of extermination: gas chambers and atom bombs.

Global imperialism became united under the USA and with the USA it will fall, not separately but together as they are one giant interdependent part. The proponents of the permanent boom theory of capitalism and there are many indeed they have been around since the 60’s (Mandel comes to mind among many) believe wholeheartedly that an unlimited amount of debt, and unlimited amount of mass migration and an unlimited amount of house building have ended boom and bust forever. In that sense they resemble the class that rules. Its just Business as Usual.

Its difficult to argue sometime with economists that originate from countries where the printing presses rely on a reserve role of a currency or sub-reserve role…

Reblogged this on Don Sutherland's Blog and commented:

This blog regularly talks about profits, and seeks to explain why understanding profits is so important to truly understand what is happening in economies, both national and global.