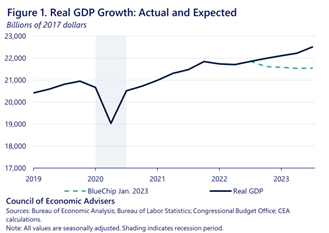

I have been considering why in 2023 the US economy grew by 2.5% in gross domestic product (GDP) in real terms (ie after the official inflation rate is deducted). This growth rate was not forecast by the consensus at the beginning of 2023 – indeed the majority forecast that a slump i.e. a contraction in national output, was more likely – including me.

First, let’s remind ourselves that real GDP may have risen by 2.5%, but real domestic income (GDI) rose only 1.5%. GDP has been growing faster than GDI because there is more consumer borrowing (and running down of savings) and because there is more production without sales. So the GDI measure may well be more accurate about what is happening to the US economy than GDP. But we don’t have the final figure for GDI in 2023 yet, so let’s accept the GDP figure for now.

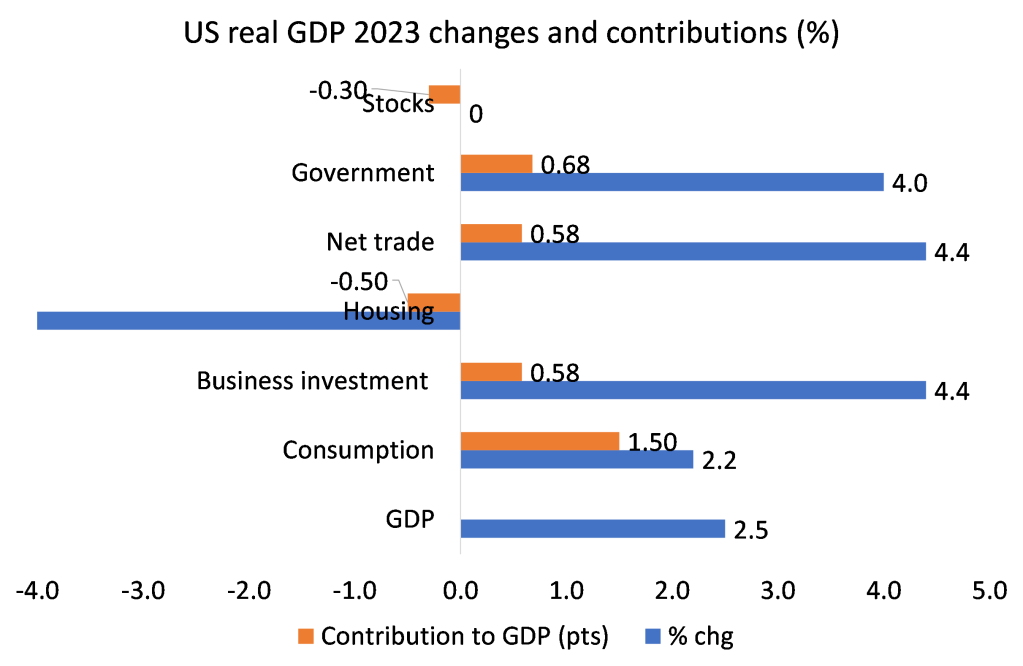

What happened to deliver this significant, if modest rise in real GDP? The mainstream economists and media go on about how consumption remained strong i.e. American households continued to spend more and it was this that delivered the faster growth than expected. But there are two things wrong with this explanation. First, in 2023 consumption growth was actually slower than in 2022, slowing from a 2.5% rise in 2022 to a 2.2% rise in 2023. Yet real GDP growth accelerated from 1.9% in 2022 to 2.5% in 2023. So this cannot be the main reason for the rise last year.

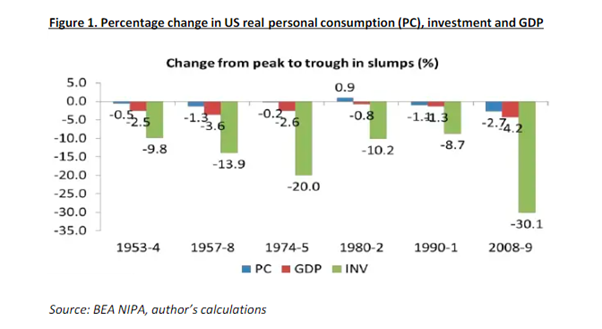

Second, theoretically, consumption is never the swing factor in economic growth, contrary to the views of ‘simplistic’ Keynesians. In all US economic recessions since 1945, it has been a contraction in investment that has led to a slump and vice versa. Investment leads consumption and is the swing factor.

Yes, consumption growth contributed 60% of the 2.5% real GDP rise in 2023, but that contribution was down from over 90% in 2022 and 2021. Also, the increase in household consumption was mainly confined to spending on healthcare and on leisure services. Most Americans were forced to increase spending on private health insurance and utilities. But spending on other basic items was up only a little. Indeed, inventories i.e. stocks of goods that could not be sold, did not fall in 2023, after a large rise in 2022. So companies still had a hangover of stock in 2023 from 2022.

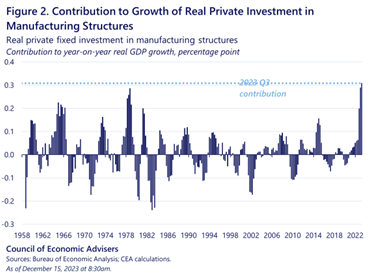

It was business investment that saw the biggest swing to boost real GDP growth. The housing market continued to fall as mortgage rates rose, but investment in new structures and transport (factories, offices, roads etc) rose nearly 13% in 2023, having fallen in 2022. This contributed 0.5% pts (or 20%) of the 2.5% growth. It was in structures that increased business investment concentrated, because investment in equipment (computers,etc) did not rise at all.

What was going on here? Government spending on consumption and investment rose considerably. Under GDP definitions, such spending is regarded as an addition to national output. Having declined 0.9% in 2022, spending rose 4% in in 2023 or a 4.9% pt swing from 2022. Spending both on defence and civil projects rose significantly.

It was the huge tax incentives and subsidies offered by the Federal government and distributed through the states to companies willing to build new plant and factories, particularly in strategic sectors like tech and semiconductors as part of the US administration’s ‘chip war’ against China. It also seems that the biggest spending boost came from the state governments, using unused COVID funds and unexpectedly higher tax revenues. This extra money went mostly on employing government staff in education.

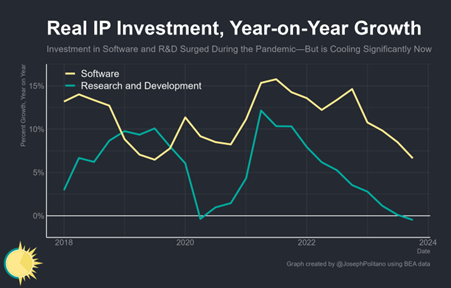

But there were no new tax incentives etc for business investment in equipment etc, so growth in that sector was stagnant. There was a substantial deceleration in the pace of real investments in ‘intellectual property’ as the tech industry slowed down and higher interest rates weighed on research and development decisions. Over the last year, software investments have grown at the slowest pace since late 2015, while real R&D output outside the software sector has shrunk for the first time since the early pandemic.

Another surprise booster to US economic growth was net trade. Net exports were up 4.4% in 2023 after contracting in the four previous years. Exports were boosted by sales of liquid natural gas and oil to Europe given the loss of Russian energy imports there and by financial services exports, but the main cause of the jump in net trade was a decline in imports as import prices in energy and food fell sharply after two years of sharp rises.

To sum up, the US economy grew modestly instead of going into recession in 2023 because of: stronger business investment funded by government spending; a positive trade balance as energy imports fell; and because of the continuance of a sizeable stock of unsold goods. If all these (mainly one-off) contributions to growth had not happened in 2023, US economic growth (in GDP) would have been just 1.5%, not 2.5%. i.e. lower growth than in 2022.

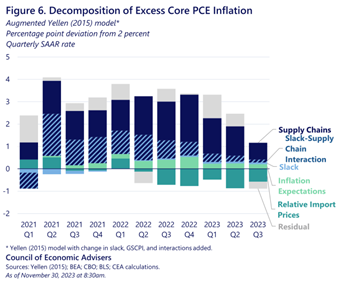

Also, average real incomes rose in 2023 as wage growth outstripped price inflation for the first time since the end of the pandemic. As has been argued in many previous posts, the acceleration in inflation was mainly due to ‘supply-side’ factors: supply chain blockages and stagnant manufacturing output and trade. It’s not been due to ‘excessive demand’ and so the interest rate hikes by the Fed have played little role in halving the inflation rate in 2023. It was the improvement in supply chains that did it.

But the Fed’s rate hikes did not induce a slump in 2023, so does that mean a ‘soft landing’ for the US economy after the ‘sugar rush’ recovery in 2021 has been achieved, or even better, no landing at all but just a strong economic boom ahead?

There are many things to suggest that the factors that delivered faster growth in 2023 will not be around this year. First, investment in manufacturing structures will cool significantly. And the sharply increased spending by state governments is probably a one-off. Also, the decline in software and R&D investment in 2023 is not a good sign for 2024.

Second, net trade is unlikely to contribute to growth in 2024 as import costs will rise again, given a weaker dollar in foreign exchange markets and hits to the global supply chain from disruptions in the Middle East.

Third, the cost of government spending is reaching record levels in debt servicing. Federal government interest payments on bonds have surpassed $1trn and are still rising. Unless the Fed gets interest rates down fast, that is going to eat into the funding of government services (outside defence, of course) as the Biden government aims to reduce spending from hereon.

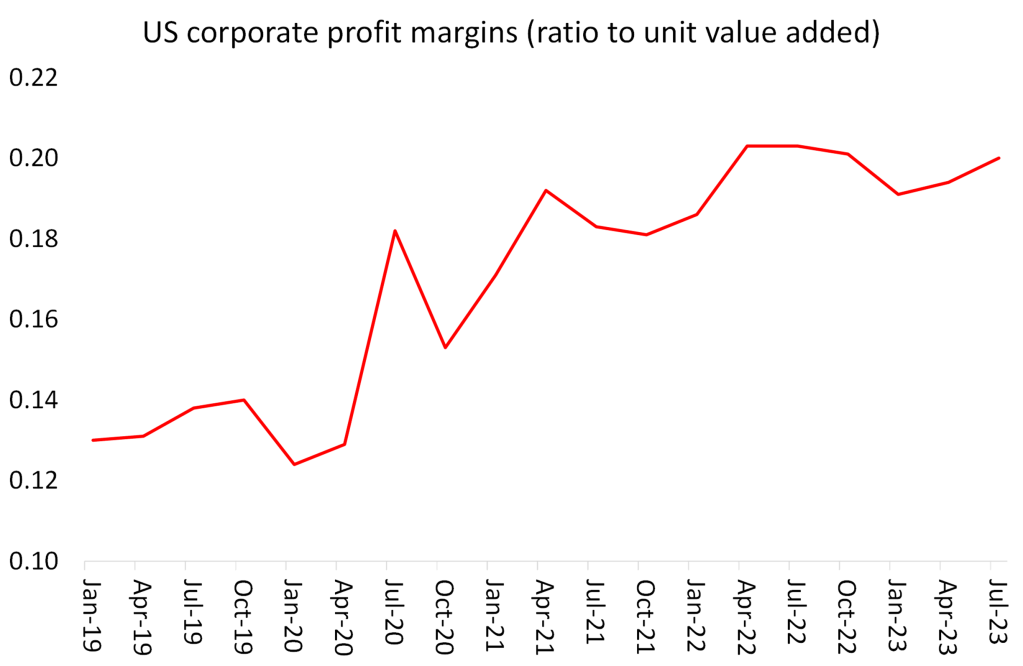

In 2024, much will depend on whether inflation continues to fall and whether the existing high level of nominal interest rates does not turn into a sharp rise in the real rate of interest (that’s after taking inflation into account). If it does, then corporate profits will begin to fall. Corporate profit margins (profit per unit of value added) have flattened out since 2022 and even fell a little in 2023. But they are still very high (if mainly due to high margins for tech and energy companies).

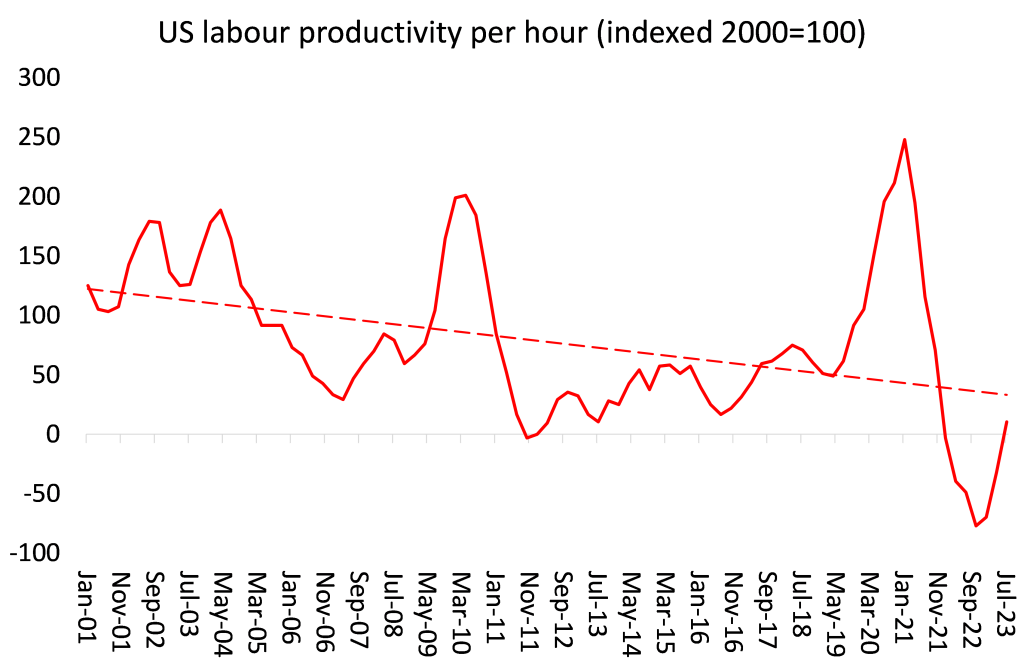

But wage rises are not being compensated for by increased productivity of labour (thus raising the rate of exploitation) and so margins will fall this year.

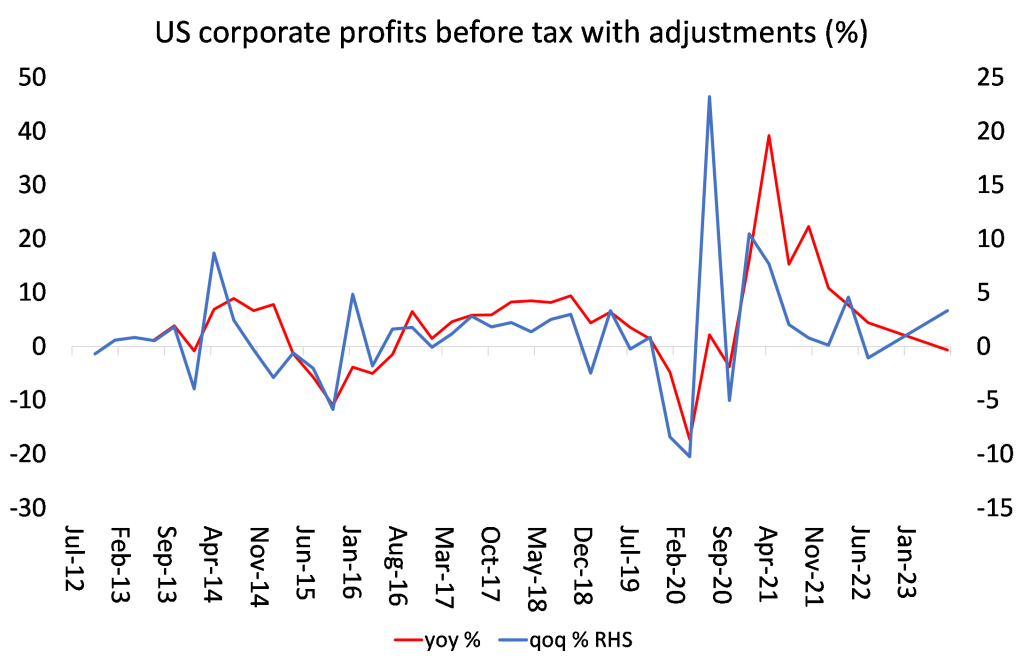

Corporate profits (that’s margins multiplied by sales) are already slipping towards negative territory.

And it is profits that lead investment that then leads to employment, incomes and consumption – not the other way round, as the Keynesians argue. So slowing or falling profits will reduce the incentive to invest more.

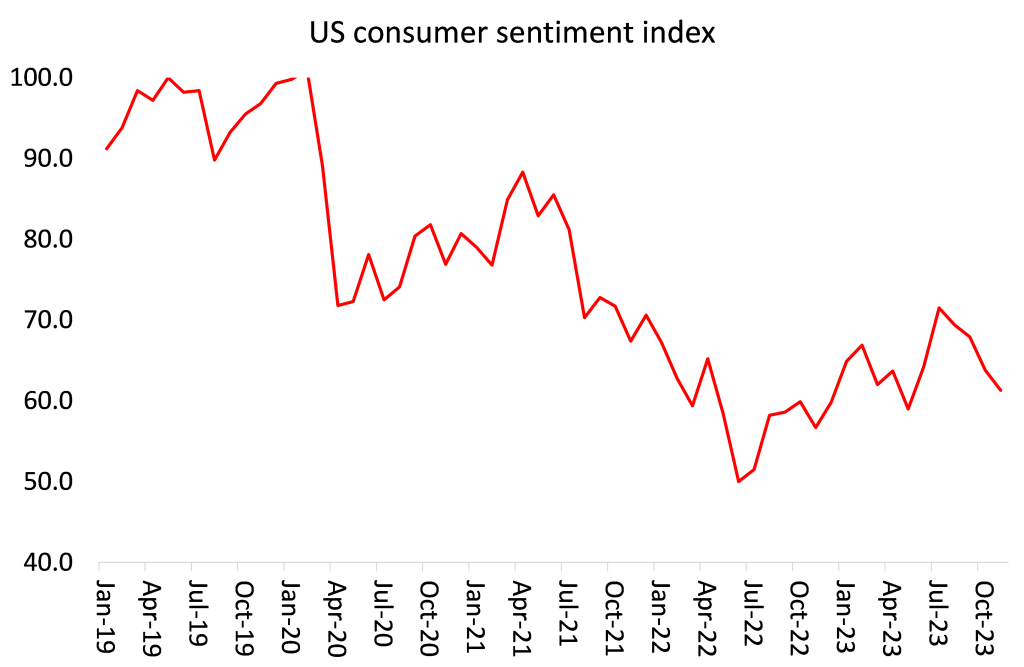

At the same time, the labour market is ‘cooling’. Unemployment is creeping up and the jobs available are mainly low-paid, part-time or temporary. American households are spending more by reducing savings and/or borrowing more (at very high interest rates). No wonder the average American consumer thinks the economy is in a recession, not in a boom. Consumer sentiment improved in 2023, but it’s still way below pre-pandemic levels.

If interest rates stay high and the Fed appears to have no intention of starting to cut rates before the summer, the impact will feed through this year into more corporate bankruptcies (already rising) and perhaps another banking crisis like last March.

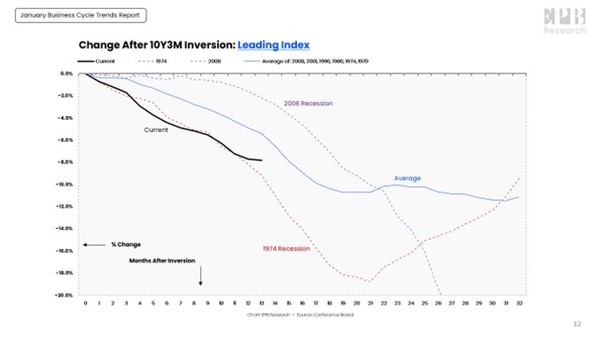

And let’s remind ourselves of what was considered to be a very reliable indicator of a recession: the inverted bond yield curve i.e. where short-term interest rates are higher than long-term bond yields. The inversion supposedly shows that investors want to hold ‘safe’ government bonds more than cash or investments, suggesting that they fear a slump ahead. History shows that if the curve remains inverted for long enough, then a recession arrives. The average length of inversion before a recession comes is about 18 months (as with the 1974 and 2008 slumps). The current inversion is about 13 months old.

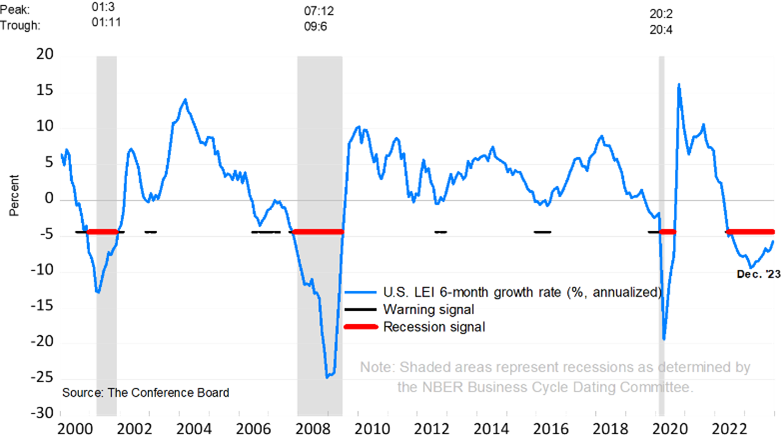

And looking ahead, the US Conference Board has a leading economic index (LEI) made up of components in the US economy to measure future expansion or recession. This LEI continues to signal recession.

So far, these indicators have not proved right, but we shall see in 2024.

Hi Michael, An editorial question … what does this sentence mean:

It was in structures that increased business investment concentrated, because investment in equipment (computers etc) did not rise at all.

Thanks, Dave

I will write this as follows in our LH copy …

It was in manufacturing structures that increased business investment was concentrated …

On Tue, 30 Jan 2024, 11:03 am David Cartwright, < david.w.cartwright@gmail.com> wrote:

Yes

Two main factors or hypotheses:

Make no mistake: this system worked very well for the USA and thus capitalism during the 1990s until the crisis of 2008. The nations were compliant, and adjusted to it until they couldn’t. What we’re witnessing right now is the collapse of a global architecture that was very successful for 17-22 years, depending on where you put the beginning of the neoliberal hegemony (i.e. if you retcon Mexico 1986 as the fiat lux moment of neoliberal domination; but one could also put the fall of the Berlin Wall in 1989; or, ultimately, the fall of the USSR proper in 1991).

Michael Roberts is quite wrong in his estimation of the drivers of the economy during 2023 in the USA when GDP increased 2.5%. Personal consumption contributed 2.2%, private fixed investment was down 1.2%, foreign trade did no contribute anything at all, but government spending contributed 4.0%. This data can be obtained from NIPA Table 1.1.1 when it is modified to provide annual rather than quarterly data.

In other words the biggest driver has been the fiscal deficit, where the government spends more than it taxes. Why is this stimulatory? When the government borrows to cover its spending, it mops up idle hoards and converts them into actual spending by paying pensions and benefits, paying for health care, investing and so on (excluding interest payments most of which goes back into hoards). The current Federal spending of around $550 billion is up $150 billion per month compared to 2019. Four years ago, this was equal to 22.3% of nominal GDP in 2019 ($21.521 trillion) rising to 24.1% of nominal GDP in 2023 ($27.356 trillion). Over the four years this contributed 5.6% in real terms to GDP compared to the 10.8% growth rate for the entire economy, or over 50% of the growth rate. Without it, annual growth would have averaged just 1.3%. Even real growth in 2023 of 2.5% would have reduced to 0.7% as confirmed by Table 1.1.1. However such a growth stimulus is unsustainable in the longer term as it cumulatively builds up debt.

This extract was taken from my recent post comparing the Chinese and US economies: http://theplanningmotive.com/2024/01/30/a-preliminary-enquiry-into-the-relative-performances-of-the-us-and-chinese-economies-during-2023/

US deficit does not “mops up idle hoards and converts”. Because of the Dollar Standard, it simply sucks up capital from the rest of the world.

That’s why the rest of the world is in recession while the US continues to grow. In this sense, I find it very difficult to think those countries think this capital drained by the American money printing machine is “idle hoard”.

Quantitative Easing built up debt. I’ve lost track of why you dismiss that debt as an issue. Similarly although I know why I don’t think there is a normal to return to, where increased revenues from a growing economy will ease the state’s debt problem (the same as Michael Roberts’, I think,) I’ve forgotten why you don’t. It seems like fiscal debt crisis mongering is the next Big Thing among key leaders. Jamie Dimon’s recent remarks seem to me very much a policy proposal for governments everywhere.

Yes, it is written in the USA’s book as debt. The difference is, contrary to the other nation-States, the USA doesn’t have to, ultimately, pay it back; or, alternatively, it can pay it all back with printed money, because said debt is in USD. The USA can do that all the while it is doing what it needs to do to make its economy more productive (and use the capital it brought with printed money to do so).

Given that much of the US economy is fictitious capital (if I understand correctly,) could capital inflow into the US financial system play a role in staving off collapse? I gather that enough new infusion of money capital to keep up appearances than keep a fundamentally decrepit system going longer than it should, and it wouldn’t necessarily take huge amounts? In bad economic times (the world economy) the rich (in this question, the US) can buy up those more desperate or capture the business of those going broke (bourgeois in other countries and currencies, in this question) and prosper, relatively and temporarily? Generally, that the world economy is in fact slumping and the US is just the part least affected right now? Things being evenly distributed is not the norm, after all, and that includes slump?

“Given that much of the US economy is fictitious capital (if I understand correctly,) could capital inflow into the US financial system play a role in staving off collapse?”

The answer is: yes. Capitalism has a feature which is every nation-state has two main accounts/balances: trade and capital. You can have the most extraordinary trade surplus in history, but if your balance of capital is awful, you just lost what you won with years of hard work in the “real economy”.

The selective ignorance of the balance of capital is the reason why we should make a mockery of those who think capitalism is merely “the market”, as if it is just the Roman-Carthaginian economy with better technology. Capitalism is completely different from merchantilism.

Can anybody put some specifics and numbers to “fictitious capital” as a portion of the US economy? What sectors are “fictitious” and what proportion of the economy do they amount to?

Bernie Madoff as fictitious capital I understand, but I don’t think even synthetic debt instruments, like asset backed securities amount to fictitious capital since 1) there are real asset values being represented 2) many of these instruments do not act like capital at all, for example credit default swaps 3) the financial platforms function, at least partly, to transfer values from enterprises with less than average OCC and greater than average socially necessary labor time for production to enterprises with a greater than average OCC and less than average SNLT.

Real estate? Does the selling of residential or commercial structures amount to “fictitious capital”? Or is it platform for realizing already produced value?

Insurance? does the pooling of money for investment in bond and equity instruments, tapping revenues from multiple smaller capitals and savings, automatically translate to fictitious capital.

Hedge funds, those notorious asset strippers? Even they claim their profit from the liquidation of real values, and function as a vector for capital’s self-devaluation as a response to overproduction and over accumulation.

So exactly what, and how much in aggregate, makes up fictitious capital.

@ Anti-Capital

I recommend reading Tony Norfield for the sizes and weights of the ficititious capitals of the different nation-States of the present.

All I can forward here is that the USA’s financial sector (fictitious) is immense and by far the biggest in the world, and that the Dollar Standard is one of its main features (and that it is declining: the USD remains the dominant means of exchange among nation-States, but its role as reserve of value is declining pretty fast, albeit not collapsing).

These financial securities differ from ordinary money in that they are supposed to pay dividends or interest. But they are usually convertible almost instantly into money and vice versa. In this sense, money or securities are monetary signs, i.e. a claim on a share of social wealth. Together, they are what economists call “liquid assets”, unlike capital that exists in the solid, fixed form of the means of production.

http://www.demystification.fr/blog/credit-capital-financier-et-crise/

Dear Professor Michael Roberts, perhaps this is not the right place or the right post to ask you the following question:

The “lifeblood” of capitalism is the production of value. Many Marxist authors consider that the production of value is DECREASING, given the increasing substitution of labour, labour power (source of value) by technology, machines, robots, etc, and that what is being produced is a gigantic simulation of it, by the massive use of indebtedness, something that will eventually explode and destroy the capitalist mode of production; while others consider that it is not decreasing, but INCREASING, bringing for this the fact of the incorporation of more and more workers (the source of value) into the circuits of wage labour (China, India, Eastern Europe and the former USSR).

The health of capitalism as a system depends on the health of the production of value, hence the importance of this question.

Could you give us your opinion on this, which group do you agree with, or do you have a particular explanation on this question?

Thank you and best regards from Spain.

“The “lifeblood” of capitalism is …” -> The “lifeblood” of the INDUSTRIAL SOCIETY, no matter if capitalist, socialist, anarchist, etc. is DIESEL FUEL. We have traveled so long and so far because of the INTERNAL COMBUSTION ENGINE (ICE) and it runs on DIESEL FUEL (gasoline being reserved for recreational purpose vehicles). And what is going on with DIESEL FUEL production? https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjiPb8n6i__B9BEaJHTpvEfDQOBfOzdzFhHEGUYZsIVavxJrGG11W1Tk73ypp-hcp-NWqZKuTL8vYrPWd5FOwSusfhzpGD4jc4gbrWthpZh-vX1YlYvOXdEWJ3nP12BH3YhUIYsixJEfw9AcaQfAacF93_ph_bt6vVVMVTRE_mnYvlrPHiSDIWYke1XY8w/s860/IMG6.%20Di%C3%A9sel.png And with oil? “Global conventional crude oil production peaked in 2008 at 69.5 mb/d and has since fallen by around 2.5 mb/d.” (Page 45 of the World Energy Outlook 2018 by the International Energy Agency). So yes, the INDUSTRIAL SOCIETY IS SHRINKING MERCILESSLY and with it the value it produces. The first cabal is right: NOT because the stock of machines is GROWING (for God’s sake, the MORE machines the LESS value? Seriously?) but exactly the opposite. Steve Keen verbatim: “ENERGY is the source of value, without it labour is a corpse and capital is a sculpture” (Very unpleasant to read, huh?). More about determination of physics on the economy in Tim Morgan’s blog https://surplusenergyeconomics.wordpress.com/

The production of value is always increasing in capitalism as a whole (it may be falling in some nation-states, but they are just a tiny piece of capitalism), but the rate of profit is falling.

Michael Robert’s argument is that, in a given individual nation-State, when the mass of profits falls alongside the rate of profit, a crisis will ensue.

But Marx had already noted that one of the most notable features of the movement of the TPRF is the rise of the rate of surplus value — which is self-evident because the TPRF is movement of the rise of OCC.

The capitalist mode of production is a mode of production for profit

There is no reduction in value (use value/exchange value).

There is an increase in material wealth.

With the increase in productivity, it is the overall rate of return that tends to fall and it is because of this trend that productivity increases.

Debt is C/C (constant capital), living labour C/V variable capital, called variable capital because it produces more than it costs.

Technology speeds up productivity, but reduces the value of each unit produced, otherwise what is the point of technology in production?

Capitalism sees living labour as the only source of measurement and wealth.

José Mercado

We have just learned that the capitalist mode of production plunders resources profitably.

All the more reason to switch to socialism.

The energy that lies beneath our feet is worthless unless labour is involved first.

D’où parlons nous ? Si l’argent n’est pas de l’argent( qui ne contient pas de travail accumulé), mais un jeton comptable fiat inconvertible. Cela équivaut à augmenter des unités de compte sur des unités de compte et ne plus avoir de mesure fiable entre valeur d’échange et prix?

I think you have not understood what I have put forward: according to Marx VALUE is the materialisation of abstract social labour in commodities, value comes from and its source is living human labour, when muscles and nerves are put into action to create a commodity.

Mr. José Mercado says “the MORE machines, the LESS value? Really?), but exactly the opposite”. According to Marx, machines do not create value, they help to create it, but they do NOT create it. Another thing Mr. Mercado is to consider, and I completely agree with you, that capitalism would possibly not exist if it had not crossed the road with oil: since there is no energy pattern outside of fossil hydrocarbons that allows it to function as it has been doing under Anglo-Saxon domination for about 150 years.

Technological progress, and above all the application of microelectronics to production, has steadily reduced the role of living labour. Some individual enterprises can still make large profits, but the whole system begins to lose its “substance” (the Substance of capital is labour). Capitalism therefore saws off the branch on which it sits: THE VALORISATION OF VALUE THROUGH THE USE OF LIVING LABOUR. It has run this risk since the Industrial Revolution and the insertion of machinery into production. For a long time, the diminution of value, and of the portion of surplus value contained in each particular commodity, has been compensated (or overcompensated) by the absolute extension of production, filling the world with commodities, with all the consequences that this implied; that is why capitalism, if it does not grow, perishes. With the end of the Fordist phase, the last model of accumulation based on the massive use of living labour was exhausted. Since then, TECHNOLOGIES, WHICH DO NOT CREATE VALUE, guarantee the essentials of production in almost all fields. The absolute mass of value, and of surplus value, plummets. This puts the whole value-based society, but also the workers themselves, in a critical situation. Hence the main problem created by capitalism is no longer exploitation, but the growing masses of “superfluous” human beings, unnecessary for production and therefore incapable of consumption.

Why has the capitalist system not collapsed completely? Mainly because of “financialisation”, i.e. the flight of “fictitious capital” (Marx). Once real accumulation had almost stopped, the abandonment of the convertibility of the dollar into gold in 1971 being a symbolic date, the even more massive recourse to “credit” made it possible to “simulate” the pursuit of accumulation. (This atmosphere of simulation, we can say of virtualisation, spread throughout society and explains the long diffusion of so-called “post-modern” approaches in all fields during the years 1980-1990). In credits, future profits are expected, which will never come and which are consumed and keep the economy alive. As we know, credits and other forms of fictitious money (stock market values, real estate prices) have reached astronomical dimensions and feed a gigantic speculation unleashing terrible repercussions on the “real” economy, as it happened in 2008. Speculation, far from being the “cause” of the crises of capitalism and growing poverty, has for decades helped to “delay” the great crisis.

The cause lies in the fact that all additional goods and services represent, despite their increasing quantity, an ever decreasing amount of value. This also implies that a large part of the money circulating in the world is “fictitious” because it does not truly represent “productively” employed labour. There will be no return to capitalist prosperity because the technologies that replaced labour cannot be eliminated from capitalist production.

Forgive me for making this long exposition. That is why I would like to know what comrade Professor Roberts’ opinion is.

Thank you and best regards from Spain.

Contemporary capitalism in two phases: the formal crisis of capitalism, a vulnerable system of speculative bubbles bursting one after the other, various crises in real estate, banking and technology. The real crisis, the collapse of the world’s reserve currency. As far as productive work is concerned, the question is not definitively settled. If we start from the principle that productive work is work that produces ….. surplus value, from the moment that surplus value is extracted, value is produced.But where the contradiction lies in service jobs is that they are both C/C & C/V. The result is that employability is often below subsistence level.

VK good point. At $7.6 trillion, foreigners own nearly 30% of outstanding US public debt. However, it does not change the point, if it is the case that the rise in state debt is primarily financed by idle hoards in the hands of rentiers, or even pension and insurance funds, that money is converted into spending. If part of it comes from abroad it just means it is less inflationary because it strengthens the dollar and pays for more imports. That is the general case. As an aside, a rise in deficit spending works against monetary authorities, aka the FED, forcing it to raise interest rates higher than would be the case were the deficits to fall. The funny thing is that for decades a convention has arising whereby the FED is not allowed to comment publicly on the fiscal stance of the White House or Congress. Steven, I do not think the build up of debt is a good thing or sustainable. If you read my articles you will see this build up of debt is merely kicking the can down the road.

But Michael is right to ask the question why the economy shrugged off higher interest rates. It was primarily due as I said to Covid funds in the first instance and the latterly to a budget deficit running at between 6 and 7% currently. For more evidence of this take a look at this graph prepared by the FED covering M1 (currency, cheque accounts etc.) It is awesome. https://fred.stlouisfed.org/series/M1SL

“As an aside, a rise in deficit spending works against monetary authorities, aka the FED, forcing it to raise interest rates higher than would be the case were the deficits to fall.”

Didn’t happen like that in the past: Fed Funds rate declined as deficits expanded 1981-1992; turned up as deficits declined under Clinton; and of course were held near zero during the deep deficit years after 2009.

Depends on what you are intending to demonstrate.

At a philosophical level, the concept of “idle hoard” doesn’t affect Marx’s theory: the working class must always reproduce itself through simple reproduction (C – M – C), while the banking/financial/ficitious “sector” (capital) will always serve as the de facto headquarters of the capitalist class (therefore, determines what is and what is not “idle”).

But, at a strictly conjunctural, political science or geopolitical level: you could argue that the USA, as the really existing financial superpower of today, “sees” wealth denominated in USDs in other countries and “sees” this wealth as “idle” for the simple fact it is not at the service of American national interests. Either way, this is just a moral judgement: what really matters is the concrete, material things the USA can and does with the Dollar Standard, not how it calls it.

Of course that this conjunctural situation didn’t spam out from nothing. It had a historical, concrete origin: in 1946, the USA was both the industrial and financial superpowers. The rest of the (capitalist) world not only had to accept USDs in order to buy basically anything, but they wanted USDs to do so — because the USA had the real economy to back it all up. Yes, a country of, say, Western (capitalist) Europe had to use USDs to buy a machine — but that machine was produced by the USA, so the “equation was always correct”. The problem arose when the USA lost its status as the industrial superpower but managed to retain its status as the financial superpower through ossification of the system (1971-present). For many decades, the Dollar Standard was still acceptable because, albeit not THE industrial superpower anymore, the USA was still the most industrialized nation-State, and capitalism had to keep itself united to fight against the Soviet Union anyway (the external factor against capitalism).

That situation finally changed with the rise of China, which, at the same time, became the industrial superpower and remained socialist while managing to integrate with the capitalist world (relation of dependency). Now, the Dollar Standard is completely anachronistic; there are no objective reasons to keep it alive.

“… if it is the case that the rise in state debt is primarily financed by idle hoards in the hands of rentiers, or even pension and insurance funds, that money is converted into spending.” Isn’t that a big if, so big as to call the usefulness of the notion into question? A substantial portion of state debt is t-bills held by Social Security. Does FICA really produce idle hoards?

There is no money in circulation (commodity money), there is an unconvertible fiduciary money, an accounting token which does not exactly represent abstract labour, the value of working time is expressed not only by muscles but also by neurons – knowledge -. According to the theory, only living labour produces surplus value, so, thanks to productivity, there will be superfluous working time, but never complete exclusion from C/V. Technology consumes and wears out, so working time cannot be considered wasted time. Technology consumes and wears out, and returns in value only what it costs. If capitalism resorts to the anticipation of surplus value in credit to the future, it is because the value is not sufficient: a growing mass of capital cannot find a sufficiently profitable sector of production. So it speculates on air, water, forests and so on.

Capital has to grow; if it doesn’t, it’s dead capital.

Gracias

Enviado desde Yahoo Mail para Android

In una società post-capitalista, il lavoro non sarebbe più la misura della ricchezza sociale e quindi non strutturerebbe più le relazioni sociali. Una simile rivoluzione è resa possibile oggi, secondo Postone, dalla sostituzione del lavoro umano con le macchine, il che significa che solo una piccola parte della ricchezza materiale è oggi prodotta attraverso il tempo di lavoro diretto.

Questo divario sempre più ampio tra la produzione di ricchezza materiale e la produzione di valore è la causa principale della crisi del capitalismo. Il capitalismo diventa semplicemente anacronistico quando la sua base, il lavoro che crea valore, perde la sua importanza. In altre parole, la sostituzione del lavoro concreto svolto dal proletariato” in modo che “il plusprodotto non sia più creato principalmente dal lavoro umano immediato”.

In a post-capitalist society, work would no longer be the measure of social wealth and therefore would no longer structure social relations. Such a revolution is made possible today, according to Postone, by the replacement of human labor with machines, which means that only a small part of material wealth is today produced through direct labor time.

This increasingly wide gap between the production of material wealth and the production of value is the main cause of the crisis of capitalism. Capitalism simply becomes anachronistic when its basis, value-creating labor, loses its importance. In other words, the replacement of the concrete labor performed by the proletariat” so that “the surplus product is no longer created primarily by immediate human labor.”

👏👏👏👏👏

Another rule of thumb indicating GDP is inflated is productivity data, especially in the USA. Whenever productivity jumps above trend, as it did in Q3 and Q4 (released today) this not real but due to GVA on which GDP is based, being intoxicated. Whoever said on this site that Chinese data was inexact remember the saying: don’t throw statistics in glasshouses.

Not quite a gilded lily: https://www.bls.gov/news.release/prod2.nr0.htm

Manufacturing sector labor productivity increased 2.3 percent in the fourth quarter of 2023, as output decreased 2.4 percent and hours worked decreased 4.6 percent. The 4.6-percent decrease in hours worked is the largest decline since the historic decline in the second quarter of 2020.

In the durable manufacturing sector, productivity increased 1.4 percent, reflecting a 4.4-percent decrease in output and a 5.7-percent decrease in hours worked. Nondurable manufacturing sector productivity increased 2.5 percent, as output decreased 0.3 percent and hours worked decreased 2.7 percent.

Total manufacturing sector productivity increased 0.7 percent from the same quarter a year ago. (See tables A1, 3, 4, and 5.)

Unit labor costs in the total manufacturing sector increased 4.2 percent in the fourth quarter of 2023, reflecting a 6.6-percent increase in hourly compensation and a 2.3-percent increase in productivity.

Manufacturing unit labor costs increased 5.4 percent from the same quarter a year ago. (See tables A1 and 3.)

Manufacturing sector labor productivity has increased at an annual rate of 0.2 percent during the current business cycle, which began in the fourth quarter of 2019. This rate reflects a 0.1-percent growth rate for output and a 0.2-percent rate of decline for hours worked. This slow productivity growth rate follows the 0.0-percent annual rate of growth during the last business cycle that spanned the fourth quarter of 2007 through fourth-quarter 2019, and is below the long-term rate since the first quarter of 1987 of 2.1 percent.

I refer to non-farm productivity which is a better measure of inflated GDP which went up 4.8% and 3.3% q over q. Manufacturing is not.

Anti-Capital instructs us that there is very little fictitious capital, a point making any further comments by me irrelevant.

But there is this comment on the US economy via Adam Tooze’s Top Links of today,

The Great Revealing: Taking Competition in America and Europe Seriously | ITIF

Figure 2, which is what Prof. Tooze included, seems to me relevant to the issue of US economic performance vis-a-vis the rest of the world.

“Anti-Capital instructs us that there is very little fictitious capital, a point making any further comments by me irrelevant.”

If only….

But all seriousness aside, I said nothing of the sort. I have no idea how large or not it is, but if you can’t qualify and quantify it, and obviously you can’t, how can you make any assertions about its influence and size relative to the economy?

That’s the question. No inference needed. Anybody can answer.

But if it can’t be described (“can’t qualify it”) and you can’t measure it (“can’t…quantify it…) the implication is that it is a fiction, a metaphysical conceit and not a real thing. The possibility you think fictitious capital can be a real causal phenomenon with real effects and you are really asking about it strikes me as the only unwarranted inference. Thus, the irrelevance of my previous comments are confirmed, as is the uninterestingness of Fig. 2 in the link (again, found in Tooze’s Top Links for today.)

One thing I want you, Marxists, to ask. Why more labour productivity ends in fall of the rate of profit? More productivity means more products on the market and if demand is sufficient, the rate of profit (profit/capital invested) would go up. This is because of more and more additional profit from commerce. The decline of workers’ labour input because of technological improvement shouldn’t be a reason of rate of profit to fall as more and more commodities could be sold and the capitalist will get additional income.

Less “labour value” is not a problem. The source of profit is not a “social workers’ labour,” but the commercial success. The Marx’s theory is here against the real life capitalism. Even some Marxists undertood this, like Monthly Review school, where the demand problems are crucial for the capitalism’s well-being, not the labour input decline, while the “economic surplus”, that is mass of profit, is rising. The idea that the labour power is the only source of profit doesn’t have any empirical credibility. The rate of profit declines if the sales are falling. You can use some labour in the production proces, but the profit will come only if products are sold. This is why the ads are so widespread in the “monopoly capitalism”: trade matters most!

Only in one situation the rate of profit could fall because of OCC to rise against labour input: if this OCC is economically inefficient and the labour productivity is declining or even wasted. But this means falling sales!

“One thing I want you, Marxists, to ask. Why more labour productivity ends in fall of the rate of profit? (…)”

Philosophically speaking: because, ultimately, human beings don’t have superpowers and are not special in the greater scheme of things. As such, humans are very limited beings, just a biological species like any other.

So, let’s take the above axiom and apply it to economics: you could breed humans so that they can be more productive in capitalist terms — the same way we breed horses, cows, pigs, chicken etc. etc. for a certain goal (trivia: Charles Darwin was pro-eugenics because of that). But even in this impossible scenario (if humans bred humans to reach human goals, it would defeat the purpose of having human goals to begin with; also, artificial selection on such scale would rise OCC), there would be a biological limit to human strength, stamina, durability etc. etc. Besides, there is the simple fact Marx himself noticed in book I of time itself: there are only 24 hours in a day, if you’re going the route of absolute exploitation, there is a hard cap on the time you can do that (think of that as a salary cap in the NFL, but absolute, natural instead).

So, in practice, if a human wants to rise its own productivity while staying human, it will have to build machines, which are not living things, let alone humans. They are tools used by (very limited, very weak) humans so they can catapult their own productivity. But machines do not fall from the sky: they have to be built by other humans, which means labor time. Once built, a machine can only go as far as the specific purpose it was built to: you cannot, e.g. order a printer to print 5,000 sheets of paper with an ink cartridge that only has enough ink to print 2,500. In other words, you cannot EXPLOIT a machine — you can only exploit the human who presses the buttons that activate the machine for a given human purpose. As you can see, the machine is human labor, but human labor crystalized: once it is built, it is built — it cannot go beyond what it already has.

But, if you want to produce more things, you have to have more machines in labor time terms, because the human is the same — the same weak, limited living being it always was. Only the machine can get better, not the human. But you can only exploit humans, not machines, in a mode of production that depends on infinite growth (profit rate) to exist. Living humans must work not only to produce value for themselves and their capitalists, but also to replenish the crystalized value in the machines they use: it is a triple replacement over the shoulders of one single part (the worker). [animals like horses, oxen, dogs etc. are the same thing: they are only machines made of flesh]

Commerce does not produce wealth. It is literally the transference of one commodity from one hand to the other hand. It just circulates, not produces, value. If commerce generated value, then capitalism could rise its profit by simply creating an ever greater, more multi-layered network of middlemen (e.g. a network of insurers in the American healthcare system); it would be the same as stating bureaucracy creates wealth.

This is the very simplified, very incomplete, philosophical explanation of why the profit rate must fall as labor productivity grows. I hope it sufficed. I you are not willing to read even this very shortened version, I will resume it in one phrase: profit rate falls as labor productivity grows because, at the end of the day, humans are very limited beings — they don’t and can’t do miracles.

Vk, Your explication of why commerce doesn’t produce value is clear as a bell.

But your seemingly purely objective analysis of the limits of human animal’s production and reproduction is contradicted by the alientated (within the capitalist mode of production) subjectivity of the animal observed … So it is, indeed, very incomplete.

Arnoldo

Less “labor value” is not a problem. The source of profit is not “social workers’ labor,” but commercial success. Marx’s theory is here at odds with real-life capitalism.”

With the pardon and respect you deserve: this is barbaric, you with know neither Marxism nor Marx. You can have your criteria, but with those opinions you are not and will never be a Marxist, and in this blog I don’t know what you are going to learn about it.

That’s not what the statistics say, the rate of profit in the 1850s +/- = 45%.direct labour was massively involved.2023 around 6% without counting credit expectations.The counterpart of your post, if capital actually increases it decreases in profit, hence overaccumulation.

Moreover, it is pointless to specify the counterpart: a debt that in 2021 amounted to $ 226 trillion, which means that for $ 1 growth $ 2.5 dollars of creation.

Just a few minor points that vulgar economics can’t resolve…

Dear Robert, thanks for this detailed presentation, in explaining why there was no recession, there is a mention of three causes; investment, net trade and “the continuance of a sizable stock of unsold goods.”

Could you elaborate a bit more on this one:

Why would accumulation of ‘unsold goods’ have such an effect?

Relieving Supply Chain issues?

What kinda of ‘goods’ are these?

Thanx

I have read all your answers, and thanks for them, but it seems to me that they are out of merit. Vk, you wrote interesting piece, but you did not explain why the rate of profit fall when labour productivity rises. You didn’t show why less nad less “labour-value” cristalised in a commodity ended in falling profits. Neither anyone else showed why “value” in the Marxist sence is crucial for profits. And, yes, trade and market are important for profits as profits come from the aggregate demand. “Labour-based value” is unimportant and wasted if the sales are not “realised” on the market.

All those Marxist theories seems to be metaphisical, not empirical.

I have to confess I throught that my simple question written from the standpoint of the mainstrean neo-classical economics will lead to interesting discussion. From my part, I know Marx and his “law”, and I find it as a relict of the pre-scientific classical economy without utility principle and based on metaphisics of labour. Now I see that even the hard core Marxists have troubles to explain their believes.

I thought profit, or surplus value only comes from the difference between what labourers gets paid for their work and the amount the product receives when sold and this explains why profit can only come from human labour as opposed to machines/robots. It also explains why the rate of profit falls as work is increasingly performed by machines. I mean this goes back over 200 years, to the first industrial revolution, living labour was ‘captured’ in machines, embedded if you will, in machines that emulated living labour. Moreover, the less it costs to produce commodities because adding machines to the production process, means that products get cheaper to produce (unless the price is increased beyond the means of a consumer to purchase it), means that eventually, no more products can be sold, unless, the capitalist produces ‘new’ products, in other words, capitalism is forced to continually revolutionise the production of commodities, or see its profits collapse. Isn’t this what’s meant by embedding more and more ‘value’ in commodities? Automobiles started out relatively simple but got more and more complex because it’s a method of embedding more value into the product, not because they got better.

A perfect example of this is the telephone network; once computers controlled the ‘production’ of telephone calls, the cost of making a call dropped to the point where it was impossible to extract surplus value from the act of making a call. Effectively, calls cost nothing to make. Adding the computer enabled the telephone company to make a profit from the content of communications as opposed to making a profit from the act of communication, so telephone companies purchased the content instead and made their profits from selling the content. Multiply this process to everything that gets produced and you see why, the rate of profit, over time, falls.

PS: The historic record of slump and recovery reveals that after every recovery, profits recover but always at a lower level than the previous recovery.

The rate falls because each unit produced falls.

Take 10 weavers, each producing 1 m at $10 per m per hour.

A clever weaver invents a machine that produces 10 metres per hour.

It produces 10 times more, but of course it will sell each 1 metre of fabric at a lower price – let’s say 1 dollar per 1 metre for the example.

The result is that the craftsmen go bankrupt, and the value of a metre of canvas has fallen. He has become more productive, but in terms of value he will have to sell 10 metres to achieve the same rate.

An extension of my previous comment.

The part of why profit rate is more important to the single capitalist is a long story and is already clearly put in book III; it would not fit in a comment of a blog, so you will have to read it yourself.

If humans really were special, spiritual, transcendental beings, then we would be able to, like God (or through God, if we go through Christian philosophy), be able to, somehow, create matter or, by negation, transcend matter (the afterlife, the soul, Hell and Heaven). If that really was the case, then the human species would be able to linearly march towards communism because the literal eradication of scarcity would only be a matter of time (humans would work abstractly until scarcity is overcome). There would be no need for History at all; it would only be a joke of bad taste Humanity has told to itself; a sadistic experiment it did to itself through its own Will.

This wrong assumption may be the reason why some early utopian socialists/communists and post-Hegelian idealists preached for a “return to the idyllic times”, i.e. the primitive times, instead of arguing for the development of the productive forces even further (of that of capitalism). The same wrong logic is used by the pro-capitalist ideologues, who argue the capitalist class literally creates things through the profit motive (Keynes’s example of the idealist “animal spirit of the capitalist” is an easy example of this, but all of vulgar economics suffers from this same idealist, secularized Christian, logical error).

FYI:

BEA Announcement: Updated Annual Industry Economic Account Statistics for 2017-2022 Now Available

Today the Bureau of Economic Analysis published the following annual Industry Economic Account statistics for 2017 through 2022, reflecting the 2023 comprehensive update of the National Economic Accounts:

Data prior to 2017 will be forthcoming.

Mr. Arnold you say, “The ‘labor-based value’ is unimportant and wasted if sales are not ‘realized’ in the marketplace.”

I answer your seemingly easy refutation of Marx’s labor-value theory.

Heat and surplus-value are already essential determinations of the commodity in terms of value objectivity even before its “realization” (sale) in the market. And the eventual absence of realization (which you see as a problem for endorsing Marx’s theory) does not change this: the value character of the commodity is then translated into the fact that it is absurdly thrown away instead of being consumed, which is only possible because its social essence consists “a priori” in the objectivity of value and not in the objectivity of necessity.

Sorry, as I use the translator I left out the word heat when I should have used the word value.

Man as a species is nature becoming conscious of itself, the particular species endowed with consciousness.

It is clear that if we understand nothing of the fall in the rate of profit of exploitation, we can perfectly well admit the unlimited accumulation of Capital, and we can also prove – in the autistic off-ground of the subjectivist elucubrations of perpetuated ideology – the mirage of its unlimited viability… If the capitalist mode of production were in a position to ensure the unlimited growth of the forces of production of the progress of capitalisation, then it would be invincible, except that it is not, and that it tells us so itself…

Global market saturation, the crisis of negative interest rates, the administrative fallow of international trade, the globalist deception of the health dictatorship of the state Coronavirus, climate-warming insanity, the US-Europe trade war… This is how the obsolescence of capitalisation both presents itself and hides itself, simultaneously organising the circulation of the great despairs of the hollow, tautological, slovenly, manic-depressive ego, which ends up getting lost in this uninterrupted wandering of eccentric anguish which, instead of thinking the history of real movement, sinks into the madness of a mechanical and automatic cycle of cold stupidity that it neurotically projects onto the world.

A few comparative remarks are in order: 6,000 years of exchange value versus 350,000 years of communities.

If we distinguish between communities and societies.

What is fundamental is that man organises himself almost simultaneously into a community and a culture,

But society, organised around the value of exchange, turns man into a singularity, a solipsistic individual, an “anguished cripple”.

This is the fundamental antithesis of community, that is, of anthropological naturalness, from which man leaves praxis and thinks subjectively.

In contemporary society, alienated man is fundamentally nothing other than his social practice,

To quote a well-known phrase: “Everything that has been experienced directly has been distanced in a representation”,