The recent massive demonstrations against the Macron administration in France forcing through so-called pension reforms reveals the determined attempts of pro-capitalist governments in all the major economies to cut real wages when we are old and can no longer work.

The Macron government has forced by decree a ‘reform’ that raises the pension age to 64 years from 62 years. In Spain, where the retirement age has been fixed at 65 years for decades, the government is opting for an alternative solution to the so-called pensions problem. It is going to increase contributions from the incomes of younger higher earners to pay for older retirees.

Pensions are really deferred wages, deductions from income from work to pay for a decent income when people retire. After decades of work (and exploitation), workers, male and female, should be entitled to stop and enjoy the last decade or so of life without toil without being poverty. Literally, they will have earned it. But capitalism in the 21st century cannot ‘afford’ to pay decent living incomes as state pensions when workers retire. Why? Well, the mainstream arguments are several-fold.

First, the demographic trends, particularly in the advanced capitalist economies, mean more people are reaching retirement age and fewer people are at working age. So the argument goes, higher ‘age dependency rates’ mean that those at work have to pay more in taxes for those who are not working. For example, in Spain there are three people of working age for every single pensioner; by 2050 that dependency ratio will be just 1.7 to one.

The second argument is that life expectancy has risen so much and people are much healthier, that the ‘gap years’ between stopping work and dying have risen far too much. For example, Spain’s life expectancy is 83 — one of the world’s highest. So people should work longer to reduce that gap to where it was before.

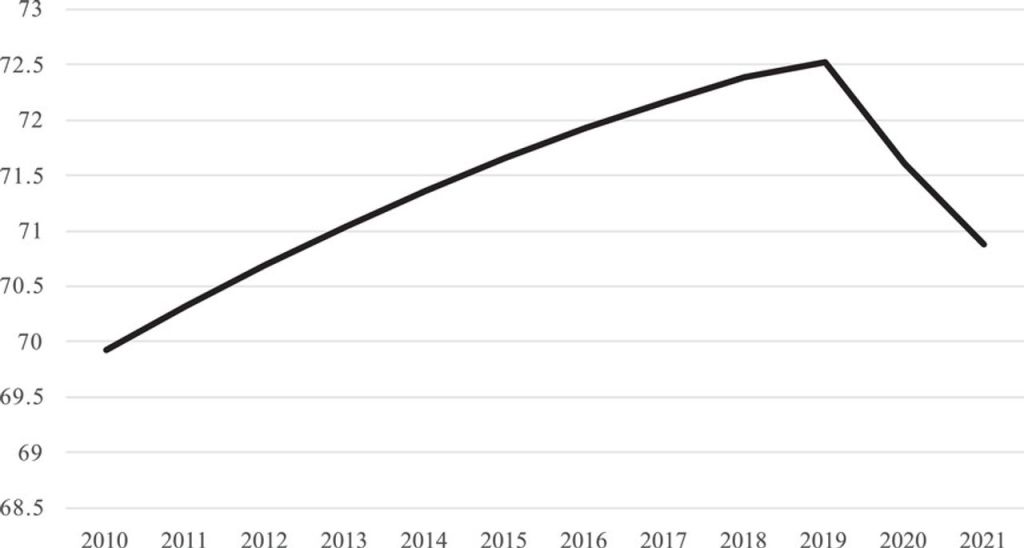

The cruel irony is that the pensions cuts that the French and Spanish governments seek to impose for reasons of demography are taking place when life expectancy in the major economies has started to fall. In the first decade of this century, life expectancy increased by nearly three years every decade. But now life expectancy at retirement is two years less than previously expected.

World average life expectancy (years at birth)

https://onlinelibrary.wiley.com/doi/10.1111/padr.12477

And what is ignored is the huge disparity in life expectancy between lower income people retiring and very dependent on state pensions and better-off people with additional company pensions. For example, almost eight years separates the life expectancy of retirees living in exclusive parts of London like Kensington and Chelsea to those living in Glasgow. A 60-year old man in the Scottish city might live a further 19 years. For his London contemporary that rises to 27 years. In both places women live almost three years longer than men. Indeed, the fall in life expectancy in the UK has forced the government to delay until 2026 raising the retirement age (already at 67 years) to 68 years.

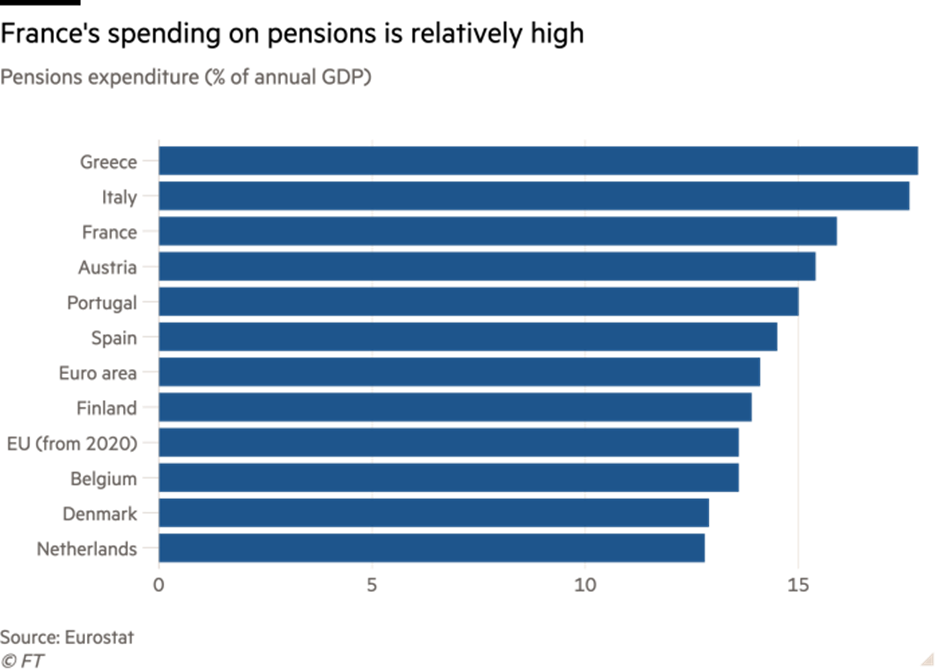

And the third argument is the cost to the public purse. The argument is that too much public money goes to pensioners, thus reducing available funds for other important public services and benefits. Governments are forced into running budget deficits that increase public debt and so raise interest costs that eat into public spending. It’s true that pensions in France are higher than most other EU countries. And Spain’s net pre-retirement income average at 80% is actually ahead of France’s 74 per cent and an average of 62 per cent in the OECD.

But does that mean the aim should be to ‘level down’ pensions to those of the UK, for example, which has one of the lowest state pensions relative to average earnings in the OECD? Surely, the aim should be to ‘level up’ to the best?

And the pensions deficit in France is tiny compared with the cost of measures introduced in response to the pandemic (€165bn) and the energy shock (around €100bn), as well as President Macron’s commitments to invest more in nuclear power (€50bn) and defence (€100bn by 2030).

Nevertheless, mainstream economists continue to see the ‘problem of pensions’ as causing excessive government spending and deficits. Here is what one such analysis put it in vigorously supporting Macrons’ attack on French state pensions. “France’s pension reform, centred on prolonging the age of retirement to 64 from 62, should ensure the progressive rebalancing of the pension system by 2030, given unfavourable demographic trends and a widening deficit. The reform sends a strong signal to European partners and international institutions of France’s intent to preserve medium-term fiscal sustainability and introduce supply-side reforms.” So it’s to encourage the others to level down.

Similarly, that paper for capitalist strategy, the UK’s Financial Times, called Macron’s move ‘indispensable’. “Plugging a hole in the pension system is a gauge of credibility for Brussels and for financial markets which are again penalising ill discipline.” The FT went on: “If unchanged, the (French) pension system will run annual deficits of between 0.4 per cent and 0.8 per cent of gross domestic product over the next quarter-century; (there are more benign scenarios of break-even, but these suppose a productivity miracle). It is not a catastrophic hole: the minimum contribution for a full pension is already quite exacting at 41.5 years — and it is climbing to 43 — even if a pension age of 62 looks generous. Yet it is a hole that needs to be filled.”

Two things here. So this (not so large) deficit hole has to be filled? Even if we accept that it does, why does it have to be filled by forcing people to work longer or make higher contributions from their wages now to pay for pensions later? And also, note that “there are more benign scenarios, but they suppose a productivity miracle’. And this is the crux of the ‘pensions problem’. Without recognizing it, the FT exposes the mainstream arguments as bogus.

Ten years ago, I called the ‘pensions crisis’ (yes, it was doing the rounds then) a myth. Then I put it this way: “There are enough resources if they are properly organised and fully used. It’s both a political choice and question of economic organisation. Does a country want to use its resources so that people can stop work at the age of 60 or 65 and have enough income to live on in reasonable comfort, or not? It can be done.”

It depends on two things: first, that an economy creates enough resources and expands sufficiently to cater for its elderly population that may also be getting larger as a share of the population. And second, given finite resources, decent pensions can be provided by cutting out other calls on government revenues i.e. such as bailing out the banks; increased arms spending; more subsidies for private corporations to invest in fossil fuels; and lower taxes for top earners and corporations etc.

It is not a choice between good pensions or a good health service or education system. Ten years ago, I showed that just a 1% pt sustained rise in average real GDP per capita in the major economies could deliver enough extra revenue to governments to easily maintain current pension levels and terms with something to spare. And that would be without changing the allocation of public money to defence (now set to increase in all EU economies to at least 2% of GDP each year) or chasing down the tax havens and avoidance schemes by which companies and rich individuals lose revenues for governments by up to 10% a year.

And I emphasise the word a ‘sustained’ increase in real GDP growth. Every 8-10 years, capitalist economies have slumps in output and investment which significantly hit government revenues and often lead to substantial bailouts of banks and multi-nationals, further reducing revenues to pay for public services and pensions. A planned economy, where production is not based on profitability and not subject to regular and recurring crises, could soon ‘afford’ decent pensions.

Instead, in the 21st century, capitalist economies are experiencing slowing economic growth and already three slumps, with the prospect of another right now. The World Bank has just published a truly shocking report on the prospects for the world economy for the rest of this decade. The Bank reckons that the world’s maximum long-term growth rate is set to slump to a three-decade low by 2030. Between 2022 and 2030 average global potential GDP growth is expected to decline by roughly a third from the rate that prevailed in the first decade of this century—to 2.2% a year. For countries like France, the growth rate will be well below 2% – indeed just 1.2% a year.

Given that the working age population in France, like many other advanced economies in the Global North, is set to fall further in the rest of this decade, growth depends higher productivity from a shrinking labour force (unless governments force people to stay in work longer or work longer hours). But productivity growth is slowing to almost a trickle as investment in value-creating sectors of economies stagnates. So increased productivity is unlikely to compensate for a declining labour force.

And there is no answer to be found in privatising pensions. Already, corporate pension schemes are failing to meet workers needs. First, private pension managers take a sizeable cut in fees for managing pension funds.

Second, these investment managers cannot deliver sufficient returns on investing in stocks and bonds, so that private pension funds often go into deficit. And pension fund managers resort to risky investments to try and boost returns. That can lead to crises and losses – for example, the meltdown in UK pension funds in so-called “liability driven investment” schemes (LDI) last year when bond yields rocketed, forcing the Bank of England to provide emergency credit of £65bn.

And third, most private schemes are no longer ‘final salary’ ie pensions based on your wage when you retire, but on the amount of contributions you make from your wages as you go, and so relying on pension fund managers to invest wisely. Private pension schemes are a con – and anyway, most workers do not have one.

The French option for state pensions is to raise the retirement age so that people have to work longer. And that includes those who do tough, physically or mentally, stressful work that cannot be continued for more than a few decades, if that. Some might say that even 64 years is ok because in many countries the retirement age is way higher (at 67 years in the UK now). But the majority of French people do not agree. For them, the pension age was a hard fought right, along with better social services that people do not want to lose.

As one French sociologist put it: “For 40 years, successive governments have been asking the French people to accept ‘reforms’ reducing social rights. These have degraded public services in health, education, transport and so on, while eroding purchasing power and worsening working conditions … The French are fed up.”

Hi Michael Good to meet you the other day at Nick Roger’s webinar which I thought went well – everyone kept to short and informed contributions – not often you get that on the left! I am running this new website Talking About Socialism – . . . from a Marxist Point of View My self and Nick want to focus on Marxist analysis of contemporary issues. Would you be alright with us posting this article on it with due acknowledgement?

Comradely greetings Will

07968 950223

Not sure that is your email but sure go ahead.

It should be noted that most French don’t actually retire at 62. Since you also have to have worked for 42 years at that point.

You only get full pension after those 42 years, or after reaching 67 years of age.

Raising those numbers to 43 working years and minimum 64 years of age is a big middle finger to the working class French.

The retirement age not only does not have to increase but it could even decrease. If this does not happen it is because the governments do not want to touch specific interests — or, because they think that by touching those specific interests it will lead to other unintended negative consequences to the economy. In any case, in terms of resources it is not a necessity for retirement age to increase.

Michael gives some great analysis and evidence, but he seems to present a reformist solution where there is none. Revolution or ruin, socialism or barbarism.

As I mentioned in the former post, rising retirement age is all about rising the absolute extraction of surplus value, not necessarily the deficit or whatnot of the pension funds and systems.

In ideal capitalism, there would be no pension systems at all. Workers should stop working only after they absolutely could not continue, and then drop dead as soon as possible after that.

It is important to highlight that rising retirement age is a double whammy for the worker, because it not only rises the amount of time he or her has to work, but also lowers his or her total lifespan. The more one works, the less one lives, because the human body is a machine that worn down with use and intensity of use. That’s why it is the preferred method of reform by the capitalist class.

Also, in ideal capitalism, children must be put to work. We’re also starting to observe this in the USA, where many states are passing laws allowing people at 14 years old to work in almost all the relevant sectors of the economy. This also has the capitalistic benefit of lowering life expectancy.

For capitalism, the choice is clear: start a new Kondratiev Cycle, or else…

The case of France in particular is very straightforward. Of all the victorious big imperialist powers, France is the frailest and, as such, the one that most depends on its colonies to keep its First World status. As a recent article from The Global Times correctly stated:

“The current economic strength of France is based on the historical foundation of more than 500 years of Western colonial expansion, as well as the achievements of hardwork by one or two generations after the end of the WWII.

Today, France still controls the currency of 14 former West African colonies, with the franc being their legal currency, and these countries must deposit 50 percent of their foreign exchange reserves at the French Public Treasury. This is one of the reasons why the French still enjoy almost the most generous social welfare system in the world, including pensions.”

https://www.globaltimes.cn/page/202303/1287984.shtml

Few people are noticing that these reforms in France are accompanied or follow the disintegration of Françafrique: France is being slowly, but systematically and inexorably kicked out of its backyard. Without that fat African surplus constantly flowing the French Treasury, France will not be able to continue to sustain its welfare state.

The French case exposes, once more, the absolute limits of postwar social-democracy. The French working class will be defeated because its is incapable of seeing beyond “domesticated capitalism”, which means Macron has the advantage of escalation in this struggle. It will either fizzle out or degenerate into what the Soviets called “social-fascism”, i.e. a movement for the restoration of Françafrique.

As I have mentioned and defended here many times: social-democracy is not socialism. It is a proleviathanic ideology. In order for socialism to thrive, it must be antileviathanic, it must tend to the disappearance of the State, not of its strengthening (which is what the concept of welfare state literally is: the expansion of the State both in scope and power).

Thank you for stating what few know regarding France’s continued subjugation of its “former” colonies in Africa.

Also, the resource exploitation continues by the advanced capitalist economies in Africa, especially gold extraction in West Africa (Mail in particular).

I usually have no notes to add to your blog posts, but as a young spanish citizen I want to clarify that the retirement age in Spain is mixed. Under some circumstances (that is, if you have legally worked a minimum of years in your life), it is determined to be 65 as you mention, but there are some other circumstances (if you haven’t legally worked such minimum) that determine that the retirement age can be of up to 67 in 2027 (being 66 years and 4 months this year 2023). It was a bold move of the Popular Party (mid-right in the political compass, in short) in 2013, and it is expressed in a summary in this web page of the Social Security of the Government of Spain: https://www.seg-social.es/wps/portal/wss/internet/Trabajadores/PrestacionesPensionesTrabajadores/10963/28393/28396/28472.

Two things:

1)”Workers should stop working only after they absolutely could not continue, and then drop dead as soon as possible after that.”

–Absolutely, positively correct. During the so-called “transition” of the “Eastern bloc” countries, a salesman for a tobacco company actually made a pitch for one government’s to allow unrestricted imports based on how much money Marlboro’s were saving the government by shortening the lives of and payouts to pensioners.

2) “As I have mentioned and defended here many times: social-democracy is not socialism. It is a proleviathanic ideology. In order for socialism to thrive, it must be antileviathanic, it must tend to the disappearance of the State, not of its strengthening (which is what the concept of welfare state literally is: the expansion of the State both in scope and power)”

–Amazing, astounding- two observations in a single post by VK with which I am in agreement. BUT…if in order for socialism to thrive it must tend to the disappearance of the state… how then does VK come to the conclusion that the former USSR and the current China are examples of “really existing socialism”? Nothing about those social organizations was “antilevithanic.”

You answered the wrong guy, but whatever.

To complement #1: I have already said that before, but I think the ideal lifespan in today’s capitalism from the point of view of capital (personified by the capitalist class) is 65-67 years old — both to men and women. The ideal working age would be 14, but even earlier for some sectors, and later, for the select middle class (the “intellectual class“, using Hayek’s term). When the middle class returns to its normal self, which is what it as originally at end of the 19th Century, some positions may even have an ideal working age of 30 or so.

The original middle class were the direct managers of the colonial empires — which, contrary to today’s myth, also did include teachers and doctors (because they had to spread capitalist work discipline and sanitation, respectively), which were “aristocratic” (in the British sense of “posh”; elite) professions then. Indeed, in some parts of the Middle East and Northern Africa, China — and maybe even India and beyond — the first movements of liberal nationalism/independence came from teachers and (maybe) some doctors, who simply took the liberal ideology to its logical limit and turned it against their metropolitan bosses.

In Latin America, the process was different, because the liberal elites who engendered its independence came from fallen members of the Iberian nobility, not from the liberal professional class. They were generally fifth rate nobles who were sent a one way ticket to administer a portion of land in a far-away place (além-mar; ultramar).

But the essential difference between the original, colonial middle class and the modern, postwar middle class is its scope: the former was a very tiny minority of the empire’s population, even if you don’t count the colonized population. They were more akin to today’s executive class. Today’s middle class is a much larger percentage of the population, specially in the First World — to the point the USA can, to this day, sustain the illusion that its middle class is, by definition, the middle 40% of its population.

The expansion of the middle class in the postwar First World was a necessary concession the capitalist world had to make to its working classes in exchange for giving up the communist revolution. The USSR was at the apex of its prestige in 1945, after almost single-handedly defeating “Third Reich“ Germany in May of that year.

#2 is the more interesting question.

We must differentiate the superstructural concept of State from the philosophical concept of State. Usually philosophers use the term “Leviathan” to designate the State as the thing-in-itself (philosophical sense), in homage to Thomas Hobbes’s magnum opus Leviathan — one of the greatest philosophical works in Western History, which I recommend everybody alive today to read.

If you think the State as a superstructure, then you may argue — with difficulty, but it could be made — that China and the USSR are/were bigger States than any liberal nation-state. The thing is it is difficult to calculate the true size of the State in the liberal (capitalist) nation-states, because the private sector is symbiotically related to the State (e.g. the industrial-military complex and the American State; the Indies companies and the Dutch and British Empires). The impression China and the USSR have bigger States probably come from the fact that, since they’re centrally planned economies, they’re more “in the open”, “in your face” but mainly, easier to calculate.

From the point of view of the Leviathan, I don’t think there’s any serious argument to be made. The key here is that, when the proletarian class directly decides from something at the public level, it is necessarily an antileviathanic process, because the proletariat is the producer of absolutely all the wealth in existence. In the case of the USSR and China, it is patent they have weak or merely for display trade unions for the simple fact the proletariat didn’t need them: they could directly order the State the appropriate measures — the only limits being pressure from the outside, capitalist world and the horizontal (technical) division of labor (e.g. the steel millers cannot have something that would directly hurt, e.g. the teachers, and so on, up to the level total social output cannot be hurt just because a portion of the proletariat would benefit from it).

In the capitalist nations, the working classes have to beg the State — through strikes, negotiations etc. — to take some actions that would benefit them (e.g. the foundation of the welfare state). But power remains with the State, not the working classes: the working classes are just one more player in the liberal agora. So, e.g. in the case of the foundation of the welfare state, the State as the Leviathan has literally gotten additional obligations and, therefore, powers, while the working class has gained none. Hence the opposition faction to social-democracy — the neoliberals — call the Leviathan who accumulates the function of the welfare state either the “Maximum State” or the “Nanny State”, that is, it is not the working classes who have earned their fear and respect, but just a magnanimous State who is generous to the working classes and thus got bigger.

“The key here is that, when the proletarian class directly decides from something at the public level…”

Of course, that’s exactly what’s up for debate; saying it’s so doesn’t make it so. The “not serious” argument is the one that claims the proletarian class directly decides at the public level.

Excellent piece – on target on many fronts. Here some related work if there’s interest:

“Raising Social Security’s retirement age would slam low-wage workers yet again” – Karl Polzer/CCSE https://www.washingtonexaminer.com/opinion/op-eds/raising-social-securitys-retirement-age-would-slam-low-wage-workers-yet-again Thanks to the Washington Examiner for publishing this op-ed, which provides a perspective typically ignored by Washington’s elite and both political parties. The article is based on this study:

“A Widening Gap in Life Expectancy Makes Raising Social Security’s Retirement Age a

Particularly Bad Deal for Low-Wage Earners” – Society of Actuaries

Also see: https://www.inequalityink.org/resources/ITPI0820_hi%20Res_polzer_modified.pdf

Also see: “For life expectancy, money matters” – Harvard Gazette

Sens. Manchin (WVA) & McConnell (KY) alert! You have a dog in this hunt. The pain resulting from raising the Social Security retirement age would fall most heavily on particular low-income states and regions (including yours). https://news.harvard.edu/gazette/story/2016/04/for-life-expectancy-money-matters/

Other CCSE article on Social Security and private retirement savings/pensions https://inequalityink.org/resources/CCSE%20work%20on%20Social%20Security%20and%20retirement%20savings%20updated%20Sept%202022.pdf

Thanks Karl Great references

The answer to your question, capitalist thievery.

I was kicked off local BBC Radio. The host a Tory, was gobbing off about demographics impacting pensions. To make the argument easier for listeners I pointed out that over the course of the 20th century when productivity was rising between 2.5 and 3.0% p.a. workers were at least thirteen times more productive at the end of the century than at the beginning. In the mean time standards of living were about four times higher. Thus everything else being equal, the average worker could support more than three times the number of pensioners at the close of the century. This eclipsed any issue of demographics. He would not have any of it, and despite the protests of his editor, I was out. Never did get the promised re-invite because of the way I was treated.

The final insult is this. Given the degree of exploitation which is set at 60% currently, it means the average worker over the course of 45 years of work, will work 27 years unpaid, gratis for the capitalists. Then for the final 15 years of their life they are expected to survive on birdshit plus VAT or should I say the state pension.

And no Michael there are no reformist solutions to this crisis. If the capitalists concede a bit on pensions it is only because they seek to prevent the the overthrow of the wages system itself which condemns workers to working 27 years unpaid for their bosses.

Correct. And, unfortunately, it is practically impossible (with few exceptions such as the increase in the minimum wage in Spain) for parliamentary parties to offer real reforms (with real income gains) to workers. Why aren’t real reforms offered? Because we are in a period of counter-reforms, regressive and reactionary of the revolutionary cycle that began in 1917. And the cycle is regressive since the 80s. One more sample, there are millions of them around the planet, of the regression since the 80s can be seen in this comment reflected by M. Roberts.

‘’As a French sociologist put it: “For 40 years, successive governments have called on the French people to accept ‘reforms’ that reduce social rights. These have degraded the public services of health, education, transport, etc., while eroding purchasing power and worsening working conditions… The French are fed up”.

The regression in France, and in all countries, already started with Francois Mitterrand as he is well known. Mitterrand, in 1981 at the beginning of his government, promised and planned the nationalization of the bank and 11 French industrial groups. Two years later his government, which was probably the most supported social democratic party government in Europe, completely abandoned such nationalizations and other progressive measures. The revolutionary cycle is powerful and determining and will continue in its regressive phase at least until 2,040 as far as I know. It will end only when a sufficient majority of workers in France and another country understand that the reduction in their current accounts is becoming unbearable and that the capitalist economic model must change.

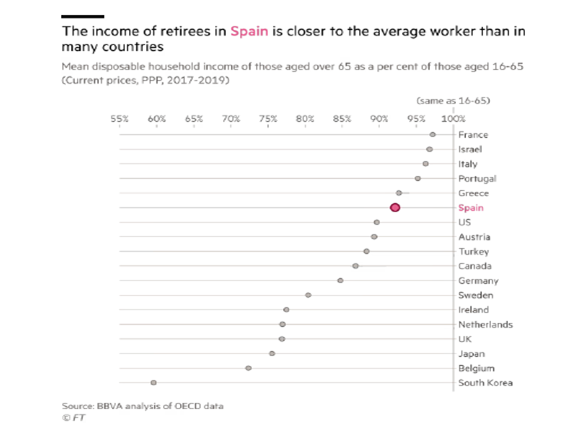

The Financial Times chart of retiree disposable income as a percent of workers’ disposable income probably wears rose-colored glasses. For the U.S. it shows about 88 percent.

But for the U.S. governmental program, Social Security, the retiree benefit is just under half their past average earnings, for the lowest-wage workers. The percentage is even less for retirees who were middle and upper income workers.

( http://www.cbpp.org/sites/default/files/atoms/files/8-8-16socsec.pdf )

It seems the Financial Times tallied all the retiree’s disposable income, which includes income from whatever he put into his individual retirement account. That depends on how much he put in and how well or badly the investment managers did with the money.

As a trade-union member nearing retirement, I’m always angered by talk of increasing the retirement age. This hasn’t occurred in my particular trade (yet) but has for my close friend who saw his union retirement age requirement rise (incrementally over 3 years) from 57 to 65.

By the time we hit our mid-50s, many of us have severe issues with our bodies, having labored for the last 35-40 years; we simply can’t continue for another 10 years into our 60s.

The Teamsters have had some of the worst pension issues with many retirees seeing their pensions halved.

The sad joke amongst “old timers” on the job-site is that most retirees only collect 13 pension-paychecks before dying; I’m not sure if this is true but it serves as an anecdote.

As for Social Security (State/public pension), funding-woes could be solved by eliminating the wage cap on payments (which increased from $128,400 in 2018 to $160,200 in 2023, which represents nearly a 25 percent increase over the past five years). What this means is that once a worker has earned more than $160,200 during a work-year, that worker stops paying into the Social Security fund via payroll taxes. This means that the wealthier/higher-paid workers contribute less per-capita per-annum than low-wage workers who rarely reach such a high-cap wage level.

Welcome to what Peter Thiel has been saying for 6+ years. He phrases it as productivity brought about by technological advancement, but the effect is the same.

Then he’s wrong: today’s problem is the polar opposite of technological advancement. It is the lack of technological advancement that is inducing the capitalist classes to expand exploitation of absolute surplus value.

Pretty sure Michael and the other Marxists have been saying it for far longer. Thiel is the neophyte here.