The Eastern Economics Association (EEA) held their annual conference last weekend. It’s not as large as the huge annual conference of American Economics Association (ASSA), but the EEA does incorporate much more heterodox and radical economic presentations than ASSA.

There were hundreds of papers presented. I shall concentrate on just a few papers from the sessions arranged by Union of Radical Political Economics (URPE), which were kindly sent to me by their authors.

But in this first of two posts on the conference, I shall look at the opening lecture by Joseph Stiglitz for 4th Annual Godley Tobin Lecture. Professor Stiglitz is a Nobel (Riksbank) prize winner in economics, former chief economist at the World Bank, former President of the EEA and now chief economist at the think-tank, Roosevelt Institute (its name shows its political orientation). Stiglitz has been a leading critique of mainstream neoclassical economics and advocate of getting capitalism to work for the many not the few.

Stiglitz’s lecture was built around a recent study published by him and Ira Regni at the Roosevelt entitled The Causes of and Responses to Today’s Inflation. After a short critique of neoclassical economics and its failure to explain why ‘the market’ does not avoid shocks and irregularities, Stiglitz concentrated on analysing the cause of the recent spike in inflation since COVID.

As he put it, the rise in inflation has sparked a debate about its causes, with some claiming it is demand-induced, largely the result of high spending in response to the pandemic. Others focus on pandemic-induced supply shortages and demand shifts, possibly exacerbated by market power and market manipulation. While there may be elements of all of these, the policy response needs to address the dominant cause. If it’s a result of excessive aggregate demand, then monetary policy—reducing aggregate demand through monetary tightening—is appropriate. If it’s largely supply-driven, a more tailored response is required, including fiscal policy that alleviates the supply constraints.

He concluded that current inflation is largely driven by supply shocks and sectoral demand shifts, not by excess aggregate demand – here Stiglitz disagreed with fellow Keynesian Larry Summers or for that matter former White House economist, Jason Furman, who both blame government spending for creating ‘excessive demand’.

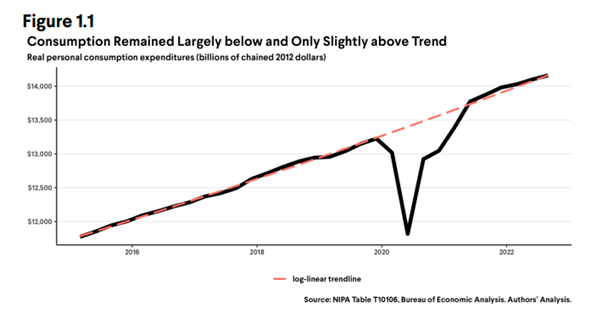

What flows from this is that “monetary policy, then, is too blunt an instrument because it will greatly reduce inflation only at the cost of unnecessarily high unemployment, with severe adverse distributive consequences.” It can’t be excess demand because US real personal consumption has largely been below trend, particularly in the periods when inflation heated up, and total real aggregate demand has been consistently below trend, “which reinforces the conclusion that the “problem” arises from the supply side.”

And a sectoral breakdown of inflation, as well as a closer look at the patterns in the timing of inflation, further support the conclusion that excessive spending during the pandemic is not the principal cause of today’s inflation. Breaking down inflation by sector reveals that it is tied to the obvious shocks and supply chain interruptions the economy has experienced, from high food and energy prices to the shortage of microchips for automobiles.

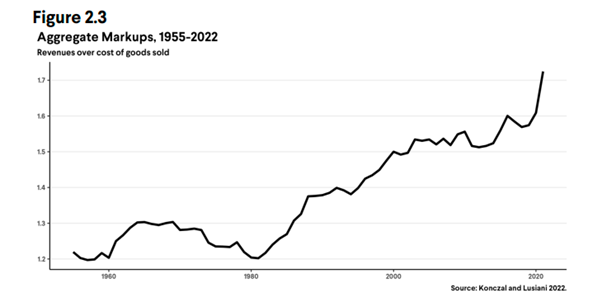

Shortages have allowed companies to hike their margins if they have sufficient market power.

As a result, corporate profits have jumped sharply while wages struggle to match price rises.

Stiglitz denied that there was any sign of a ‘wage-price’ spiral; and the other mainstream explanation of inflation, rising ‘expectations’ of price rises, also appeared to be weak. Indeed, as supply-chain blockages post-COVID and other supply shortages have subsided, inflation rates have started to fall back.

If this analysis is right, then hiking interest rates to reduce ‘excessive demand’ will not lower inflation but instead “induce a major contraction” in the economy that will hit the “most marginalized in society.” This contrasts with those like Jason Furman who reckon inflation is the result of excessive demand and now call for the Fed to hike its policy rate to 6% (I quote from a Furman tweet: “If I were the FOMC, I would be raising rates by 50bp at the next meeting and signaling a terminal rate of 6%”).

What was Stiglitz’s alternative economic policy for dealing with high inflation? In answering questions, he advocated changing the Fed’s inflation target from 2% and allowing the target to be flexible and to rise even as high as 5%, which the economy “could live with”, rather than driving the economy into recession.

Fiscal policy should replace monetary policy as the weapon against inflation. But what did that mean? Here Stiglitz was a little vague. He advocated more government investment, particularly in green energy, regulation of monopoly price fixing (although he was opposed to price controls – correctly in my view). He wanted an end to marginal pricing in energy markets which only caused wild swings in energy prices. He wanted a windfall tax on excessive profits. He advocated intervention by government to direct production and resources to reducing supply shortages, perhaps using the Defense Production Act, available in war time to force companies to produce what was needed socially rather than profitably – this would be similar to making big pharma produce vaccines to deal with COVID.

I agree with much of Stiglitz’s analysis of the current inflation spikes and the cost of living crisis – and his critique of monetary policy as the answer (see my many posts on this). And many of his proposed alternative measures would undoubtedly be better than the Fed’s ‘shock therapy’. But there was no mention of taking over the fossil fuel companies and companies that are making huge profits from the inflationary spiral. That would threaten the basis of capitalist production in the US. In my view, without that, a plan of investment and production that keeps employment up and inflation down would be infeasible. Public ownership of the major economies? Politically impossible and unrealistic as a solution, you might say. But no more unrealistic than expecting any current government in the US or in the major economies to resort to Stiglitz’s proposals.

The main issue missing from Stiglitz’s analysis of the causes of the current inflation is the bigger, long-term picture. Why did the major economies fail to cope with the energy and food ‘shocks’ caused by the post-COVID ‘scarring’ of supply chains and trade linkages? In my view, the answer lies in the general slowing of productivity growth and productive investment that has taken place over the previous two decades and particularly in the period leading up to the COVID slump. The major economies not only could not cope with the ‘shock’ of a pathogenic pandemic; they no longer have the dynamism of recovery after a slump, even in the US, to deal with the aftermath.

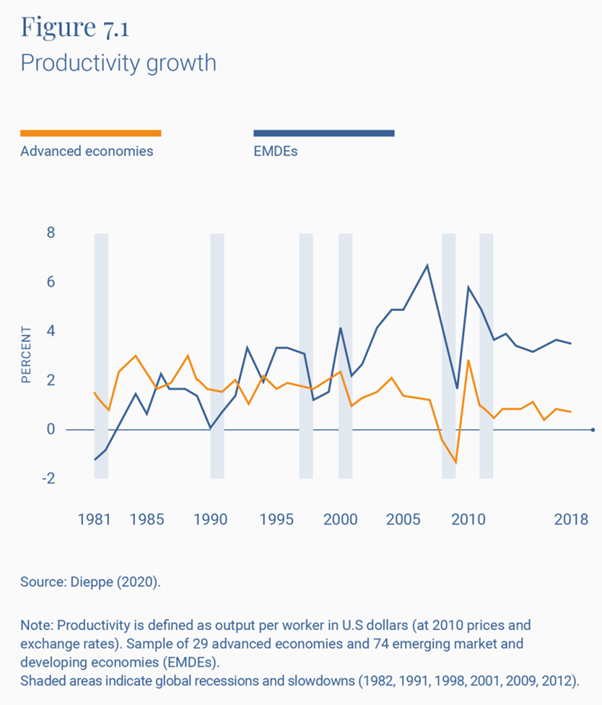

Let me quote from a recent Brookings Institution report on global productivity: “Growth of labor productivity—output per worker—is the single most important source of lasting per capita income growth. Unfortunately, even before the onset of the COVID-19 pandemic, productivity growth had been slowing around the world. In advanced economies, the slowdown continues a trend that has been underway since the late 1990s. In the aftermath of the 2007-2009 global financial crisis, emerging market and developing economies (EMDEs) have experienced the steepest, longest, and most synchronized fall-off in productivity growth in decades.“

The figure below shows that productivity growth in the advanced economies has steadily slowed since the late 1990s; the growth in the emerging economies is distorted by high productivity growth mainly in China, but even there that has subsided since the end of the Great Recession.

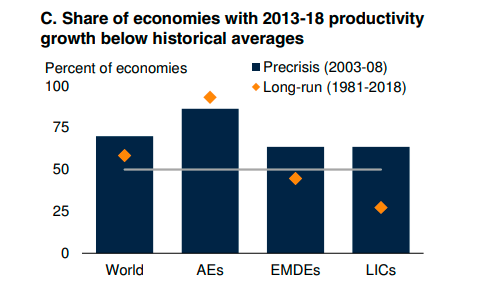

The World Bank has shown that nearly 75% of economies even prior to the COVID slump had average productivity below the long-term average; and in more than 80% of advanced economies.

A recent McKinsey report found that this productivity slowdown has mainly come from a decline in capital per worker and in innovation ie productive investment: “since the Great Recession, capital intensity, or capital per worker, in many developed countries has grown at the slowest rate in postwar history. An important way productivity grows is when workers have better tools such as machines for production, computers and mobile phones for analysis and communication, and new software to better design, produce, and ship products, but this has not been occurring at rates that match those recorded in the past. A decomposition of labor productivity shows that slowing growth of capital per hour worked contributes about half or more of the productivity decline in many countries.”

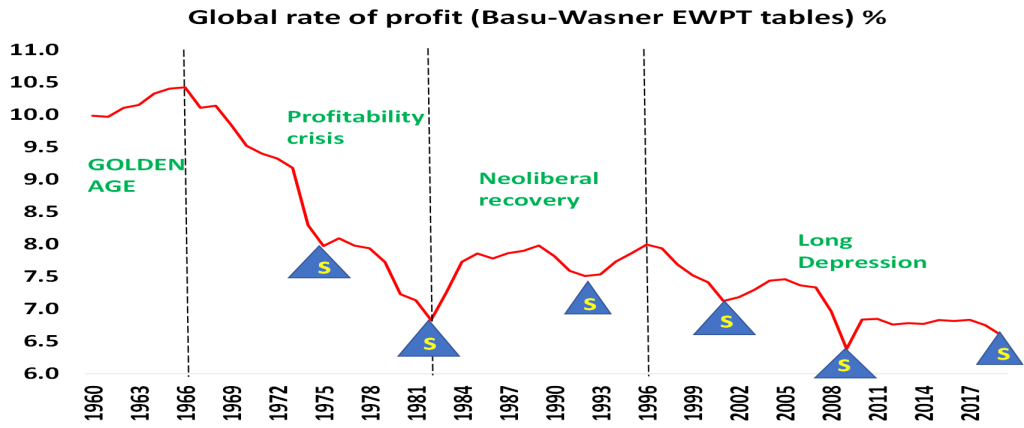

And readers of this blog will know only too well what I think is the cause of this slowing productive investment – it’s the long-term decline in the profitability of productive capital in the major economies (and accompanying recurrent crises – s in the graph below).

As inflation falls back, with the major economies slipping into recession, that will still leave everything as before: low productive investment and productivity growth and the energy companies, big pharma, the big banks all still in place. So the capitalist ‘market’ economy will face yet more ‘shocks’ to its fictitious ‘equilibrium’ in the future, as long as this fundamental economic structure remains in place.

Interessant læsning. Ikke så let at finde alternative politikker uden at gå helt radikalt til værks.

Mvh

bal

The Basu-Wasner global rate of profit unfortunately applies “nonsense” neo-classical estimates of the fixed capital stock based on discounted aggregates of future revenues, so they are wholly inaccurate as measures of some kind of Marxist rate of profit.

Thanks Bill – but this has been discussed before. But no doubt again.

Funnily enough you don’t correct a mistake by repeating it. As the United Nations explain in their manual for constructing the System of National Accounts (SNA) “assets represent a store of future benefits, all assets can be represented by a monetary value. This value represents the market’s view of the total of the benefits embodied by the asset” (UN SNA 2008 p.42). https://unstats.un.org/unsd/nationalaccount/docs/sna2008.pdf

Fixed capital advanced is a measure of past not future benefits and so is not measured in the neo-classical SNA, which measure (estimates/makes up a bogus number for) discounted aggregates of future benefits/profits.

And again, because Dr Jeffries is unique in overturning the whole concept of the rising composition of capital. In one foul swoop, not only is Volume 3 pulped, but capitalism is turned into an economy without end, though it be interrupted by periodic crises. Not so much the end of history as the end of theory.

Thanks as always for the report. If a mockumentary was made about the EEA held in New York it could be called “Clueless in New York”. Stiglitz is as good as it gets. The buy backs are bidding bye bye to the economy. Productivity is not only a question of fixed investment in the workplace but in infrastructure as well. The US has a current infrastructural deficit of $800 billion a year. That’s how much is needed to maintain and improve the infrastructure. In New York, the richest city in the world, the transit system is falling apart. So too is the largest power supplier in the US serving 65 million people where power generating plant is being scrapped faster than it is being replaced. That $800 billion approximates the spending on the military, shurely a question of projecting power over nations rather than building power stations.

Observation: if one has to label oneself “radical”, one is not radical.

The expropriation of capital is definitely the only solution. However, expropriating such capital, in such scale, would require a communist revolution at least in the USA. If the USA doesn’t fall, capitalism will always have the means to, ultimately, restore private property by the use of force thanks to its formidable navy, which rules the Seven Seas since 1945.

I have said before, that if capitalism doesn’t manage to ignite a brand new Kondratiev Cycle, it will have to resort to methods of extraction of absolute surplus value. The most obvious first steps for that will be to extinguish all the public pension systems and accelerate the destruction of the welfare state in the countries that still have one.

A cultural revolution — where lower life expectancy and higher death rates are normalized, where people working until they drop dead is normalized, where the promotion of religion (mysticism, “Opium des Volkes”) in detriment to science to the masses is normalized, where the elimination of Keynesianism from the universities, government office and think tanks and promotion of neoconservative economists to those same posts is quickly enforced, where the extinction of the last bastion of liberal religious zeal: the extinction of the concept of jobs that are only for men or only for women, will ensue — will do the rest during and after the revolts that will inevitably happen are crushed.

Cheaper and more effective entertainment will help smooth the pain of such defeat by the working classes; the consolidation of religion will serve as a moderator, in order to keep the worker away from too self-destructive habits that would inhibit him or her from coming back to work the next day. It is the good ol’ panem et circensis, just with the additional ingredient of discipline of human nature to the rhythm of the machines.

Needless to say, that would require, as part of the new cultural revolution of capitalism, that high birth rates are exalted and promoted. This will mean that, on top of that, women will also have to serve as birthing pods — once again.

As Gramsci has taught us, when a society fails to give the carrot (consensus), it becomes more and more dependent on the whip (force). As this transformation promotes the regress and not the progress of the development of the productive forces, the number and intensity of revolts would only rise. A new class of military enforcers would have to be created. We’re already seeing this in the phenomenon of the “militarization of the police” in the Third World and the USA. For such class, there would be a vast pool of far-rightists to draw upon. This new nobility class would be motivated by some sort of supremacist ideology, in order to keep them from trying to overthrow their own capitalist masters.

All of this gibberish I wrote in the four paragraphs above we call in Philosophy the negative phase (of capitalism). Every mode of production has a positive phase and a negative phase. We’re now entering the negative phase of capitalism, characterized by the fact that the mode of production starts to put itself above the historical necessity (of which it is only an instrument, a means) for the development of the productive forces. The means become the end.

–//–

Now, as we witness live the extinction of the last remnants of Keynesianism (and here I’m including all the social-democrats and all the Postkeynesian and Neokeynesian varieties of intellectuals), we can already picture their last argument: that profit rates are actually historically high and not low.

I imagine it would be a sigh of relief for them if all the data is completely wrong and, in reality, profit rates were never so good (i.e. so high). In that case, capitalism would be in top shape, and the matter of discussion would only be how to be a little bit more merciful, so that huge amounts of investments can instantly come, fully developing green energy, sustainable development, happiness etc. etc.

MIchael accepts that the neo-classical method of valuing the fixed capital stock is “nonsense” but nonetheless claims that the SNA actually apply some different method from the method that they say they use. They don’t.

“Similarly, [to inventory] consumption of fixed capital in the SNA is calculated on the basis of the estimated opportunity costs of using the assets at the time they are used, as distinct from the prices at which the assets were acquired. P10/11 UN SNA 2008

“the method most commonly used to derive estimates of consumption of fixed capital and the capital stock of fixed assets associates a stream of future earnings with the decline in value of a fixed asset in use in production” P78 UN SNA 2008

the depreciation methods favoured in business accounting and those prescribed by tax authorities almost invariably deviate from the concept of consumption of fixed capital employed in the SNA. 53

It is possible to draw a comparison between consumption of fixed capital and rental of assets under an operating lease…. Whether owned or rented, the full cost of using the fixed asset in production is measured by the actual or imputed rental on the asset and not by consumption of fixed capital alone.124

The value of a fixed asset to its owner at any point of time is determined by the present value of the future capital services (that is, the sum of the values of the stream of future rentals less operating costs discounted to the present period) that can be expected over its remaining service life. 124

Click to access sna2008.pdf

Let’s cut to the chase: in your opinion, the profit rate “a la Marx” is rising, falling or stagnant?

What do you mean “cut to the chase”? The neo-classical figures are not measures of capital advanced. Any curve they produce is nonsense, just like the statistics themselves.

I’m Canadian. Every time the US leaders raise interest rates, our government follows. This ensures that our dollar doesn’t become worthless on world markets. But it is causing recessionary fears, here. And inflation has already taken a toll. The long term solution is to end capitalism, in favour of socialism, before more workers are hurt by that failing economic system, imo.

In the short term, however, a Universal Basic Income (paid for with a well-crafted set of Wealth Taxes on the 1%) will be a way of “getting capitalism to work for the many not the few.” A demand-driven economy will ensue, reducing supply shocks and increasing GDP. If workers are happier, their production may increase, in spite of the “decline in capital per worker and in innovation ie productive investment”.

Having followed the link to the organizers of this academic event, no wonder the labour market is so tight in the USA.

Hi Bill, let us play a mind game based on real data. That is to say we will be comparing net value added to investment less depreciation.

NIPA Table 1.17.5 gives the relationship between net product and gross product or net value added vs gross value added. When calculating the rate of accumulation before depreciation and write downs, it is necessary to use the net value added as the denominator. On this basis the accumulation of fixed assets for non-residential purposes is roughly 17% this century. This 17% is unaffected whether we use nominal or chained data. According to the IRS the average periods of depreciation ranges from 5 years for vehicles to 10 years for most pieces of plant and equipment. So let us take 8 years. Thus the average depreciation is 12.5% p.a. again unaffected by whether the data is nominal or real. On this basis the NET addition to the stock of capital is roughly 4.5% in value terms (taking it year by year). Thus year 1 =100, year 2 equals 104.5 and year 3 equals 109 and so on everything else being equal and ignoring compounding. Further, let us assume that net value added grows by 2% (Table 1.14 real NVA growth for non-financial corporate business row 43). So year 1 it would be 100, year 2 it would be 102 and year 3 it would be 104. Now let us compare the figures by dividing NVA into fixed capital. The fixed capital to output ratios would be 1.00 in year 1 (100/100), 1.025 in year 2 and 1.05 in year 3. Thus a positive trend showing accumulation is taking place and undermining the rate of profit.

Now let us look at your data. At the turn of the century you had a ratio of roughly 1.00. However by 2013 it had fallen to only 0.43. It was even lower in 2006. Let us say for argument sake that if it was linear then a figure of 1.00 falling to 0.43 over 13 years would have implied the following. Depreciation would have had to exceed investment by 5% p.a. over this time. In other words de-accumulation if such a word exists.

Do you not see the absurdity of your position. I am really, really, getting bored trying to correct you.

Link for IRS data https://www.irs.gov/irm/part1/irm_01-035-006#idm140486825017888

“… LOW productive INVESTMENT and productivity growth …” “… the ENERGY COMPANIES …” -> Very good, we are getting close. One more step; Why OIL COMPANIES are LOWING their (UPSTREAM) INVESTMENT? What could be the reason? It must be very powerful to justify the risks: «Saudi Arabia said global oil production could drop 30% by the end of the decade due to FALLING INVESTMENT in fossil fuels. “We’re heading toward a phase that could be dangerous if there’s not enough spending on energy,” Oil Minister Abdulaziz bin Salman said in Riyadh (13 december 2021)». THIRTY PERCENT mean THREE SAUDI ARABIA MISSING from the oil world market in six year most. THIRTY PERCENT means CHAOS. So, WHY? Answer in page 45 of https://www.oecd-ilibrary.org/energy/world-energy-outlook-2018_weo-2018-en

Jose: For those of us who have no account with the OECD website would you please just quote the passage in page 45 which you refer to? I’m interested in what your point of reference is?

I can’t access this link could you summarise Page 45 ? thanks

Outstanding the close similarities between yours and Mr. Stiglitz’s explanations regarding the ‘root cause” of current inflation (supply shocks and supply-chain disruptions). I do hope that such an understanding evolves to a stage where governments will end up tackling structural economic problems, starting with the taming of the financial markets worldwide. It is a bit comforting that, in Brazil, we are moving towards a flexibilization (increase) of the current inflation core target (3,25%) combined with slashing the present (obscene) interest rate 13,75%.

I’m not trained as an economist so I have to ask: what causes the “supply shocks” and “supply-chain disruptions”? Without knowing that it seems that “explanation” is incomplete.

https://cepr.org/voxeu/columns/aggregate-effects-local-and-global-supply-chain-disruptions-2020-2022