There is confusion among mainstream economists and policy-makers on whether the major economies are heading for a recession, or are already in a recession; or will avoid one altogether. The majority view, at least in the US, is the latter. This optimistic view argues that, while inflation rates are high, they will start to fall over the next year, enabling the Federal Reserve to avoid hiking its policy interest rates too much to the point where it could restrict investment and spending. At the same time, the US unemployment rate is very low and the ‘labour market’ remains strong. Such a scenario hardly suggests a recession. Who ever heard of a slump where there is full employment?, the argument goes.

On the other hand, the pessimistic view is that the major economies are already in a slump that will be eventually recognized. If we look at the models that measure various aspects of economic activity, the major G7 economies seem to have contracted in Q2 of this year. The Atlanta Fed Now model puts US GDP contracting by an annual rate of 1.2%.

And the Euro-Area weekly tracker also suggesting contraction of about annual rate of 1% there.

Is it possible to have a recession and a tight labour market at the same time? US real GDP fell at a -1.5% annual rate in Q1 and looks like repeating that in Q2. That’s a ‘technical recession’, as it is called. But the unemployment rate is 3.6% near record lows and 380,000 jobs are being created each month, on average, over the past four months.

The extremely well-paid economists of the investment bank, Goldman Sachs, try to reconcile these divergent indicators. It’s true, they argue, that some GDP tracking estimates now project negative Q2 GDP growth, which would trip the rule of thumb that two quarters of negative growth constitute a recession. But they point out that the indicators on employment, real personal income less transfers, and gross domestic income have all continued to increase. And they find it “historically unusual for the labor market to be as strong as it is at present even at the very outset of a recession. In particular, nonfarm payroll employment has grown at roughly double the typical pace at the start of past recessions.” Nonfarm payrolls have grown at an annualized pace of 3.0% over the last three months and 3.7% over the last six, roughly double the typical pace at the start of past recessions.

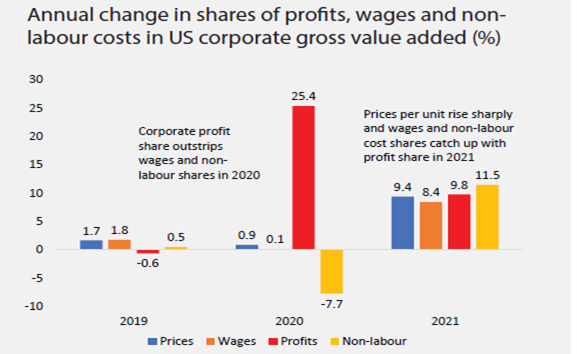

But Jan Hatzius, chief US economist at Goldman Sachs, said there is “no doubt that a labour market slowdown is under way”, adding that “job openings and quits are declining, jobless claims are rising, the ISM employment indices in manufacturing and services have fallen to contractionary levels, and many publicly traded companies have announced hiring freezes or slowdowns”. That suggests that unemployment is a lagging indicator in judging when a slump comes. Indeed, that would be in line with a Marxist analysis of slumps. First, profitability declines, particularly in the productive sector, then profits in total. This leads to a fall in investment by companies and then the laying off of labour and a reduction in wages.

The GS economists admit that the battery of economic indicators that they look at are now suggesting the negative in the latest months.

GS concludes that there is a 30% probability of entering a recession over the next year, but a 48% probability of entering a recession by next year – in other words, it’s more or less likely by 2023, but not yet. For them, “we do not have a recession in our baseline forecast, but we continue to expect well below consensus growth and do see heightened recession risk.”

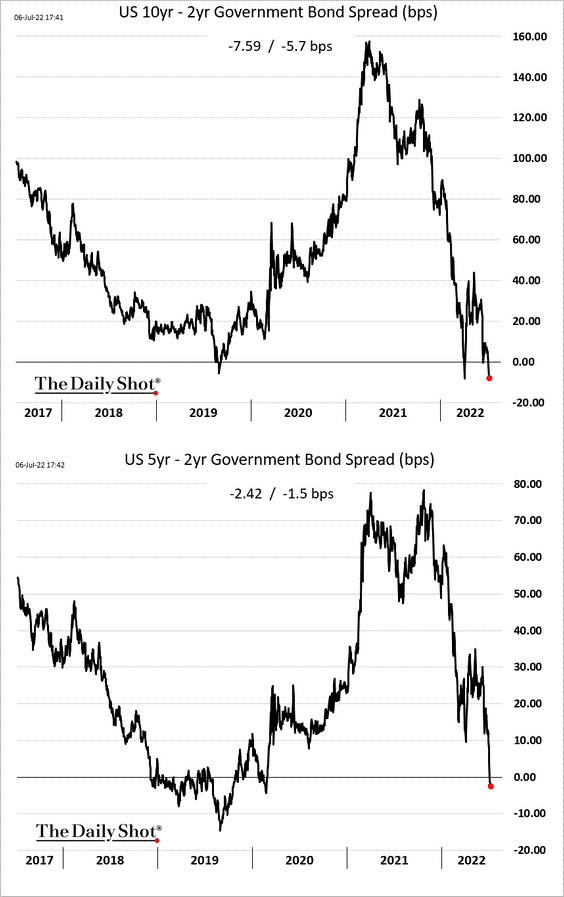

As I have referred to in several previous posts, if the government bond ‘yield curve’ inverts, it is a relatively reliable indicator of a future recession. The ‘yield curve’ measures the difference between the interest rate earned on a government bond that has, say, a ten year life or maturity and the interest rate on a bond of say just three months or a year. Normally, somebody who invests in a longer term bond expects a higher interest rate because their money won’t be paid back for a longer time. So the yield curve is usually positive ie the rate on the longer term bond is higher than on the short term bond. But sometimes it goes negative because bond investors are expecting a recession and so put their money into longer-term government bonds as the safest way to protect their money. So the yield curve ‘inverts’.

When that happens and the curve stays inverted, recession seems to follow within a year or so. The US government bond yield curve for 10yr-2yr is now inverted. The last time that happened was in 2019 when the major economies seemed to be heading for a slump anyway, just before the COVID pandemic.

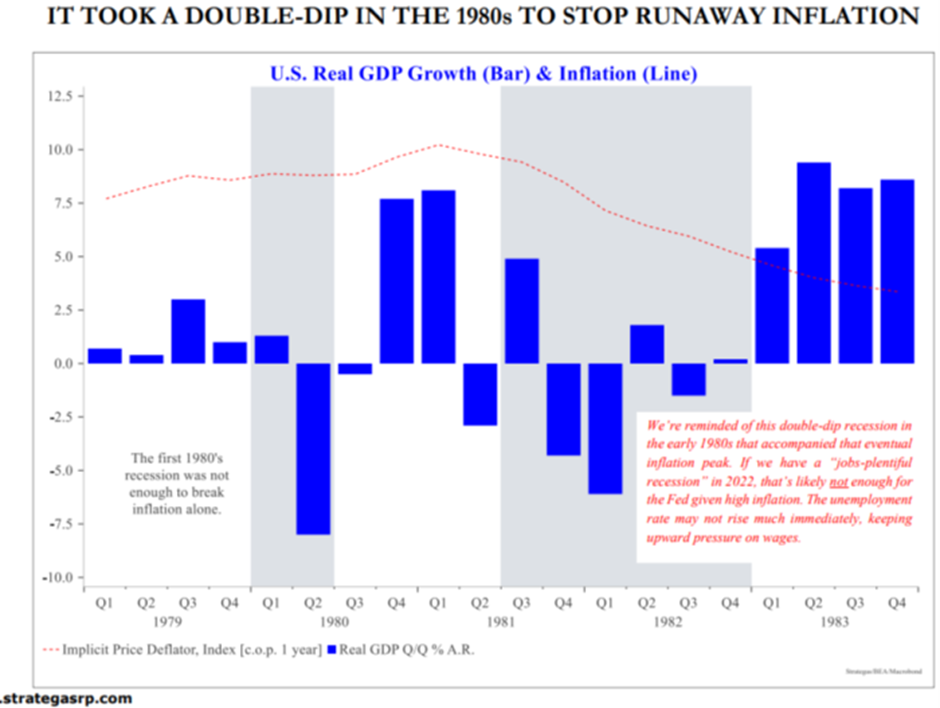

The frightening thought for the US economy is that if inflation rates stay high and unemployment stays low, then it may take two recessions to kill inflation and smash jobs, the ultimate aim of the Fed and the authorities. That’s what happened between 1980-82 – a double-dip recession.

That’s the US economy, where the recovery from the COVID slump has been greatest among the major economies – although that is not saying too much. The situation is much worse in stagnant Japan (see my recent post) and in Europe where the Russia-Ukraine crisis portends a major energy crisis. Indeed, the war and the sanctions on Russia look like triggering a slump in the Eurozone of major proportions.

Already, Russian gas exports are down by one-third from a year ago and only 40% of the Nord Stream1 pipeline capacity is being used. As winter approaches, demand for gas in Europe will double, causing a serious shortfall for industrial production and heating homes. That alone could contract the Eurozone economy by 1.5-2.8% of GDP, according to some estimates. And rocketing natural gas and oil prices would drive up the inflation rate even more into double-digits by mid-winter.

The main pipeline for Russian gas to the EU through Ukraine is currently down for ten-day maintenance. But if Russia decides that it and the Nord Stream1 pipeline are not to be brought back online – fully or in part – things could get a lot worse.

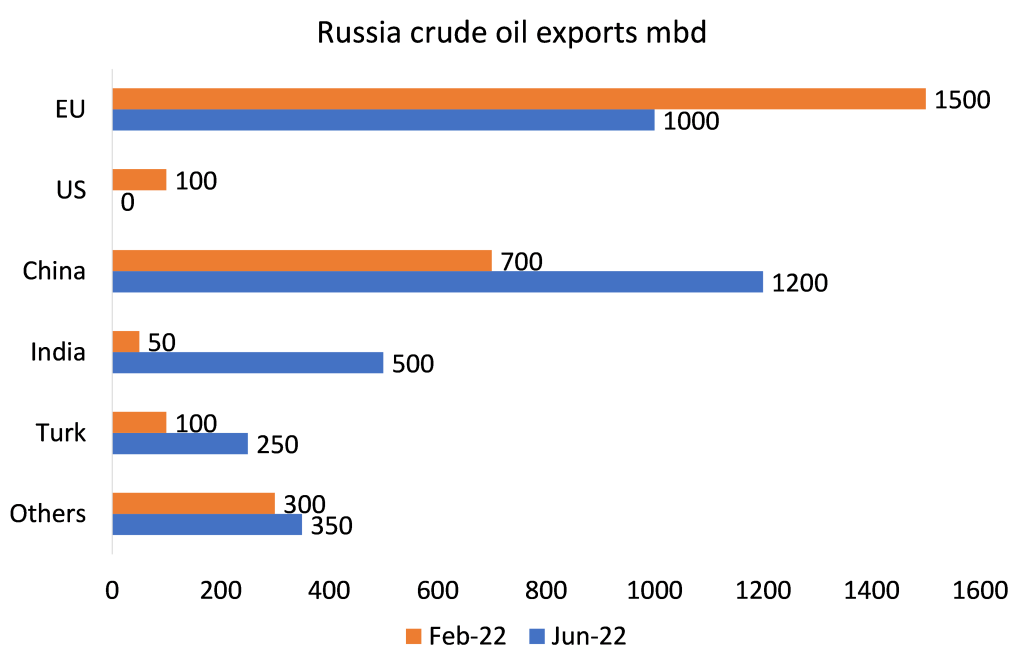

Russia now sells more oil than before it invaded Ukraine. So Russia’s current account surplus is likely to be over $160bn (more than 3.5 times the previous year), with more oil sold to China and India to compensate for the drop to Europe.

But what could trigger an even a deeper recession in Europe and globally would be if the G7/NATO countries go ahead with their plan to introduce price caps on Russian oil. The only way the G7 sees how to bring down oil prices and deprive Russia of oil revenues to finance its war is to price cap Russian oil. The cap would presumably be set between the cost of producing Urals (say $40/bbl) and its current discounted sale price of $80/bbl.

This plan is not going to work, however. Countries like India, China, Indonesia and a raft of others are not going to join a cartel that punishes themselves whether they like Russia or not. Given that the supply and demand balance in global oil markets is very tight, knocking out whole or part of Russian output will raise global prices sharply. And Russia could well retaliate by halting all oil exports to either the EU or all participants in the cap scheme. Moreover, the scheme of using shipping insurance to enforce the cap on Russian cargoes will mean that both Russia and some consuming states will set up their own state-sponsored insurance schemes (as China did with Iran and as the Russian National Reinsurance Company is doing for Russian shipping now).

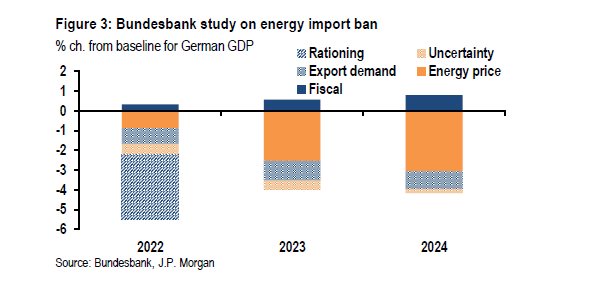

Far from forcing Russia to submit to NATO demands, any oil price cap is more likely to drive the oil price to near $200/bbl. That would trigger a global slump. The German central bank, the Bundesbank, reckons that real GDP in Germany could plunge as much 4-5% pts from its previous growth rate.

No wonder the euro has dropped to near parity with the US dollar in foreign currency markets, its lowest level since 2002.

Record high energy prices, fast-rising interest rates and collapsing profit margins among most companies (down 6% in the last year) spell a recession. See my post: https://thenextrecession.wordpress.com/2022/06/10/the-scissors-of-slump/

Central banks are currently planning to raise their ‘policy rates’ by about 2-4% pts over the next year. That’s not much compared to the hikes made to control inflation back in 1979-81. But inflation was much higher then. It will probably still be enough to stop borrowing for productive investment and for household spending. Mortgage rates will jump to squeeze the housing market.

Most important, rising global interest rates will likely provoke yet more debt crises in the Global South. Total debt in these poor countries is already at a record high of an average 207% of GDP. Government debt, at 64% of GDP, is at its highest level in three decades, and about one-half of it is denominated in foreign currency, and more than two-fifths are held by foreign investors who could pull out. About 60% of the poorest countries are already in, or at high risk of, debt distress. Already this has led to the collapse of the Sri Lankan economy and the removal of the corrupt government there.

And as I have outlined in many previous posts, corporate debt in the major advanced countries is also at a record high, with as much of 20% of companies getting profits below the cost of servicing that debt – the so-called ‘zombie’ companies. This remains a ticking time bomb for a corporate debt meltdown. And the countdown is ticking closer to zero.

In my next post which will be published this weekend after US retail sales are published on Friday, there will be a graph comparing employment based on the household survey and based on establishment payroll. Since March there has been no increase in employment based on the household survey. Thus the divergence between the two series has increased by over a million workers since then. The irony is that the ADP figures are closer to the household survey data which is why it is such a pity that ADP has retired hurt (their data is paused) after their figures varied to such a degree from what is inflated payroll data put out by the B..L..Sh.t. But you are right, the Department of Commerce could rule the economy not out because of the employment data. It all depends on how bad June data is. Given that the

the New York Tax authorities just announced that tax takings in the City had fallen back to 2017 levels it could be bad. Will this be reflected in retail sales, we shall see.

Given the “breaks” provided on real estate afforded to the wealthy, tax revenues in NYC are highly dependent upon declared capital gains. No mystery here given the importance of finance to the NYC economy. This decline is the product of stock market and bond market losses and is less important to retail sales than unemployment figures.

Understood. But how dependent is NYC on sales tax revenues. Other cities which are not banking centres also reported falls in tax takings.

No doubt. However in NYC, sales tax accounts for less than 9% of general revenues

Unemployment rates are irrelevant to economic analysis. What matters is the magnitude of total variable capital, its rate of surplus value and the OCC.

For all intents and purposes, capitalism is always at full employment, where the members of the industrial reserve army of labor are de facto employed workers receiving a wage each equal to zero*.

If one takes employment as a true category of economic science, then one will reach absurd conclusions like those GS analysts did, that is, that the US economy is, at the same time, overheated and in a recession (i.e. shrinking) – which would make sense if you’re a hydrogen star, but not if you’re a mode of production that functions on amplified reproduction.

*assume a capitalist system with just three workers: one receiving 100 in wages, the other receiving 50 in wages and one unemployed. The average wage here is not 75 ([100+50]/2), but 50 ([100+50+0]/3); in this case, the worker in the industrial reserve army of labor represents a surplus value of 25 (75-50) to the capitalist, as he needs to be kept alive by the system in order to receive his wage, even though this wage =0.

Although The Road to Serfdom von Hayek is an officially respected Great Man in economics, people like Jerome Powell will keep on acting as though the industrial reserve army of unemployment Marx was the real deal. So far as I can tell, the problem of lower profit rates can only be attacked by lowering wages. The theoretical alternative, lowering the socially necessary abstract labor required by massive investments, is ruled out by the falling rate of profit. That obstacle could be removed of course by massive destruction of capital, either by liquidation or by war or by both.

The problem there is, mass unemployment historically can lead to unpredictable consequences. There is a tendency for the bourgeois media to sell the idea that inflation is the worst thing in the world. Well, it is, percentage wise for creditors. Workers suffer too but the fact is that unemployment is the workers’ worst fate. Inflation is the bourgeoisie’s worst fate. The more money they have, the worse relatively. I know this is not a popular view with economists.

As near as I can tell, the Federal Reserve, responsive to the big bourgeois as ever, is determined to induce a recession, both to “fight” inflation and to lower wages. And, though it seems to irritate our host, it seems to me that political considerations, namely undermining the Democratic Party and its chieftain Biden are a further motive. The bourgeoisie is no longer committed to the out-dated norms of bourgeois democracy, I think. This is an inevitable expression of the decline of the capitalist system in my view.

“This is an inevitable expression of the decay of the capitalist system in my opinion.”

Evidence of the decay of the capitalist system and its… implosion not far away in 10-20 years. In my point of view it is unstoppable and is very determined by the current economic structure (it is the economy that influences and directs politics and war) the sequence:

-Ukrainian War. War that will continue over time and with extensions because the Russian actor will not want to return to its previous situation of economic decline (decreasing GDP/per capita). A previous decrease in Russia and other countries derived from an inevitable unequal exchange with the dominant and imperialist powers. And decrease that would continue its course even with an end-of-war negotiation.

Energy prices and other rising prices. And prices that will not be reduced in a clear legal fraud against workers. Capitalist governments can fix the energy prices brought about by a few monopoly companies but… they don’t.

Decreasing real wages. Only decreasing because the pro-capitalist States do not decide to raise them.

Lasting recession. //Unemployment up to mass unemployment//Socialist revolution//

Capitalism can always be replaced by barbarism. Socialism is the only way forward for humanity as a whole but exterminism is always an option for those who think all men are enemies, not brothers.

“…the Russian actor will not want to return to its previous situation of economic decline (decreasing GDP/per capita). A previous decrease in Russia and other countries derived from an inevitable unequal exchange with the dominant and imperialist powers.”

Nominal Russian GDP per capita is highly correlated to the nominal oil price.

“Capitalist governments can fix the energy prices…”

OPEC and Russia set the oil price by adjusting production. If the US could control the oil price, Biden would not be in Saudi Arabia crawling on his hands and knees before MBS.

Exploration, development, production, and processing of petroleum has been “calling the tune”– with the unique disharmonies of inflation and recession– ever since 1973. Then and since, the bourgeoisie learned that price fluctuations could be handy tools to drive small and medium sized business into over expansion and then bankruptcy; used to attack living standards, labor conditions, unions, and reaffirm the critical status of the US in the overall structure and maintenance of capitalism.

Inflation, overproduction, price rises and collapses have all been instrumental in the overexpansion and bankruptcy of small and medium sized agricultural producers in rural US; the S&L collapse; Iraq wars; the blowout leading to the collapse of 2008-09; the “recovery” of 2014 and the mini-recession of 2015-6, etc etc.

It’s all about the redistribution of the disappearing or materializing profits.

And indeed, Steve Johnson is correct: ultimately the only offset the bourgeoise can use to offset the tendency of the rate of profit to decline is to drive down the wage– to drive the price of labor power below the cost of its reproduction.

It seems to me likely that businessmen have discovered this in every business crisis, even back when capitalism was a market phenomenon in a handful of large cities, rather than dominating whole nations, much less the world.

It also seems likely that the power to fix prices is not as universal as this seems to require.

But if it is correct, then wouldn’t good antitrust laws be sufficient to bring back the Golden Age?

”It also seems likely that pricing power is not as universal as it appears to be required’’

Yes, it is true that the power of capitalist governments to fix prices is not so universal and, for this reason, as H. Rech says, Biden must grovel before Saudi Arabia because he cannot fix the price of his Arab oil. Only a united and coordinated action of ALL oil consuming countries could set that price. But that would almost be the Socialism that we don’t have.

However, on the side of wages, there seems to have been an agreement to fix their price among all the capitalist governments. A tacit agreement and without the need for any negotiation. And agreement by which they have decided not to raise wages so that the worker could thus compensate for inflation.

So what happens to governments? Because it is difficult for them to unite to fix the prices of the capitalists and their union to fix wages does not cost them anything at all? What follows is elementary but some easily forget it: it happens this way only because they are class governments in a class society. capitalist class governments. A class that they ceaselessly favor, allowing today the increase in their inflationary prices and that of their extraordinary profits even at the risk of breaking up their countries due to the collapse of real wages. The rupture of their countries (Sri Lanka and all the countries to come) and their associated revolution that is “guaranteed” and determined by their condition as a class government.

The Golden Age? It’s not bad, but it was only a social democratic substitute for socialism. We work for the original and complete model: democratic socialism.

Michael, apart from the bond yield curve as an early indicator of recession, what do you think about the copper/gold ratio? In more general terms, do you think that gold, that is, “commodity money” continues to play an important monetary role, beyond legal inconvertibility? On the contrary, do you adhere to the theory of the total dematerialization of money? Because in the end, the relationship between fiat money and commodity money is established in the market. I’m thinking of Mandel’s old thesis that the price of gold is the inverse of the value of the dollar. That is, it expresses the gold content of the dollar. And if we compare January 1972 with January 2021, the price of gold increased 6 times more than the general price index. Therefore, even if we measure the current price of gold in 1972 dollars, the gold content of each dollar today is approximately 6 times less.

Luis – I agree the copper/gold ratio is a very good indicator of the level of global economic activity, indeed even the coppr dollar price is also. I think gold still plays an important role as money (international money) and is often used as a ‘safe’ alternative asset to fiat currencies. So I dont agree with the ‘total dematerialisation of money’. Money as a commodity is still expressed as gold. Bu tthat does not mean that we cannot measure the value of commodities in fiat money prices. We can do so by getting a reasonably accurate MELT ratio (monetary expression of labour time). This requires measuring output in labour hours against a relatively stable fiat currency or gold. And as you show, we can also measure the gold/dollar ratio over time. Anwar Shaikh makes this point here. https://thenextrecession.files.wordpress.com/2016/04/profitability-long-waves-crises-2.pdf

Sam Williams, Critique of Crisis Theory? Personally I don’t think capitalism arose because of gold from the New World.

If Adam Smith demonstrated anything, it was not gold, but a functioning division of labor that increased production was the true wealth of nations. I don’t think he’s been refuted on that point.

I’m not sure that there is really a singular money commodity. It’s not just that other metals can and have served but that other commodities such as petroleum (and reserves, which function in a way analogous to gold mining stocks I think,) can serve. Rice under the bakufu in Japan served as money as I understand it. And as a store of value, land, land, land has always been superior, save for the trouble of keeping it. Gold as the singular money commodity that is still the tail wagging the dog seems to have one grave difficulty: Gold has a very limited use value aside from its role as money. The use value of land is precisely why it is so important as a store of value I think and ditto the functional use of other commodities as money….or the collateral for credit. The use of credit as money is one way perhaps today’s capitalism really is different in ways requiring expansion of Marx?

In addition to the difficulty of eating gold, restricting exchange to cash is like abolishing fractional reserve banking: It’s not clear that it wouldn’t cause more problems than it solves. The incubus of gold seems to me to be the main target of Keynes.

More abstractly, the money commodity conceived as a part of social production in the capitalist mode, are manifestation of the surplus value. (I think.) That is, money commodities are fetishes of profit. This is a mystification but I don’t believe capitalism is rational. If you just reduced it all to a simplistic application of supply and demand, as capital becomes more abundant/the supply goes up, the profits/the demand goes down. The money commodity loses its proportionate value, being the exchange value so to speak (loosely,) the expression of the capitalist division of labor.

Or, no singular money commodity is in fact the wealth of nations, no more now than when Adam Smith was quarreling with the mercantilists (and any bullionists still around?) Mandel’s thesis seems to me to be insufficient, if not wrong.

Money, by definition, is a single commodity. That’s one of the first logical demonstrations Marx makes in Das Kapital (book I, which he published in life).

Fiat currency is technically a single commodity, as it is a financial asset (which, even though being fictitious capital, is socially treated in capitalist society as a commodity). The plethora of fiat currencies can be explained by the existence of one single universal fiat currency – the USD – from which all other fiat currencies are pegged. That means the USD is the only true money (i.e. the only fiat currency that is a financial asset, therefore a commodity), while the rest are just coupons that can be convertible to USD.

“That is, money commodities are fetishes of profit….a mystification… I don’t believe capitalsim is rational”.

Really? Neither did Marx. Marx’s purpose in Capital 1 was not to show how fully matured industrial capitaism works, but how and why it doesn’t. But that does not stop the capitalists from behaving as if the their activities are as rational as the invisible hand of Smith’s “free market”. By Marx’s time mainstream politcal economists had abandoned Smith’s “rational” labor theory of value (rational enough for his hybrid merchant/early industrial capitalist times) for their market fetish apologetics. Marx’s critique of political economy demonstrates both the fatuousness the apologists but also the contradictions in Smith’s labor theory of value when applied to mature industrial capitalism. Capital 1 doesn’t explain how capitalism works, but why it doesn’t, and concludes with the foundational history of its violent, expropriatory beginnings,

…In his last chapter, on Primitive Accumulation (and elsewhere, especially in Grundrissa) Marx demonstrates how and why commodity money is real, not merely an irrational fetish—but as real as the transformation of the zero-valued products of the raped land and indigenouis labor of the Americas–when thrown into established European markets, in which all take on value, and, for example, gold and silver are miraculously transformed into commodity money, exchangeable everywhere for more and more muskets, ships, and armor. In Capital 1 Marx,s critique is often misunderstood as mere reform (even by “marxists”) of political economy. His critique required giving the devil his due. But in his last chapter is a portrait of the devil himself: he’s a gentleman.

Michael, MELT cannot work because it is based on physical hours not economic hours or as Engels called it, compound hours. Economic hours differ from physical hours because it factors for differing skills. Higher skilled workers produce more value than lower skilled in the same physical time. So a higher composition industry with its higher density of skills cannot be compared physically to a lower composition industry with a higher density of basic skills. MELT-EH would be a more accurate measure but difficult to compile with our resources.

Yes a few comments are spot on. Holding down wages reduces the need to raise interest rates to contain inflation and that requires the intimidation of mass unemployment.

MELT is based on economic hours, as it was deduced from Marx’s equations in Das Kapital.

Das Kapital analyses capital in its purest form, i.e. in a world without the middle class (unproductive workers), therefore all variable capital is productive labor.

You can question the viability of calculating MELT with bourgeois data and statistics (which is the only available in the necessary scale, as no capitalist will put Marxist economists to gather their data), but not MELT itself.

In aggregate yes, but in aggregate everything is equal, value, price, surplus value, mass of profits and so on ad infinitum, but at a local level everything is unequal. So MELT may work where it is not needed, aggregated data, but it certainly does not work where it is needed, at the concrete local level where capital and labour differ.

Translation of Xi Jinping’s speech to the CPCCC in January 2013 (right after he was first elected):

“Regarding the Construction of Socialism with Chinese Characteristics (2013)”

https://redsails.org/regarding-swcc-construction/

Literally in the first sentence of his speech:

Ten years later, Westerners still think China is capitalist…

Xinhua, November 12, 2013

The Communist Party of China (CPC) has acknowledged the market’s “decisive” role in allocating resources, according to a communique issued after its key session about reform.

China will deepen its economic reform to ensure that the market will play a “decisive” role in allocating resources, according to the communique after the four-day Third Plenary Session of the 18th CPC Central Committee, which closed on Tuesday.

The market had been defined as a “basic” role in allocating resources since the country decided to build a socialist market economy in 1992.

For quite a long time after 1949, the idea of market had been a taboo associated with capitalism.

Even after the reform and opening up in 1978, the country had struggled to define the market and some dogmatists still questioned whether socialism could accommodate the market economy.

It was not until the 14th CPC National Congress held in 1992 that a socialist market economy became a consensus. At the Third Plenary Session of the 14th CPC Central Committee, the Party agreed that the market, under state macroeconomic control, should be the basic means of allocating resources.

Prof. Xie Chuntao, with the Party School of the CPC Central Committee, told Xinhua that the definition of market in Tuesday’s document showed the Party’s in-depth understanding of what the market economy is and what role the government should play.”

“….the Party agreed that the market, under state macroeconomic control, should be the basic means of allocating resources.”

So if the market is the means of resource allocation, this implies the existence of prices based on costs and profitability. It also implies that capital has a scarcity cost.

How is this any different than oligopoly capitalism?

There has to be enterprise level objective functions. Are these enterprises allowed to set their objective functions (essentially based on maximizing profitability required for optimal resource allocation)?

Are there social objective functions set by the state?

How do these social objective functions mesh with enterprise level objective functions?

Moreover, ‘the market’ is a very wooly concept deliberately intended to obfuscate the pertaining economic relations. With the rise of modern capitalist oligopolies large capitalist companies PLAN. It makes no sense to argue with J K Galbraith that socialist planning aims to abolish the ‘market, while capitalist panning aims to meet it, for such a thesis posits ‘the market’ as antecedent to the social relations that constitute the economic nexus of which the market is the supposed expression. Further, ‘markets’ do nothing; it is human beings who conduct all economic activity. So we need clarity.

If J. K. Galbraith said that, he’s wrong.

I’ve taken you on on this topic a couple of times. So I’ve remained mum. But no one yet has answered your need for “clarity”. So here goes…..

What could be more clear than Xi’s speech itself?

China is surrounded with nuclear bases and threatened with war–is it because they are “imperial” competitors or because they are socialist? Maybe both or neither? It does not matter, The situation speaks for itself.

You are probably older like me, still living in the comforts of anti-communist “democratic” oligarchies, which have now matured into militarist neofacsism…

What Xi says about the legitimacy of actually existing socialist countries holds a bit more weight, I think, than the opinions of marxists, like us, who for better than 50 years tore ourselves to pieces while the Soviet Union was being destroyed (over the periood of two world wars and the cold war).

We can’t blame our own failures on actually existing socialisms, nor even on ourselves. History is the culprit.

Young peope are stirring in the belly of the beast. Experienced, informed old people have something to teach them. If we can only confuse, we should remain quiet.

correction: in the third paragraph “they are” refers to China and should be “it is”. (I know because I taught English too many years ago….)

VK & madm are you both aware of this site https://geopoliticaleconomy.org/ I sometimes attend there meetings but only to disagree.

Thanks for the link. I know of the group, but I missed this interesting session. I think they are the best of their kind. Radhika Desai is a particularly good theorist . Some of their listed international associates are people I seek out for information….etc.

But a haven’t signed their manifesto, which I haven’t read (yet). They are just a bunch of good to excellent academics, not a political party.

SOCIALIST ECONOMIC DEVELOPMENT IN THE 21ST CENTURY (UPDATE)

May 24, 2022. https://geopoliticaleconomy.org/ that Ucanpolitical references below.