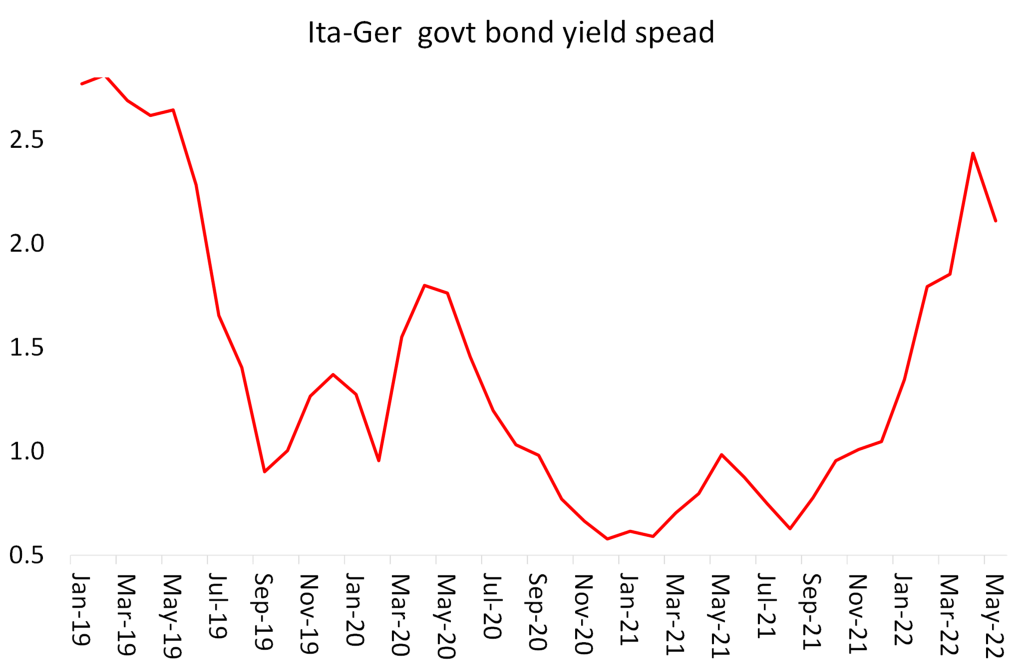

It’s been a big week for the major central banks. First, the European Central Bank (ECB) called an emergency meeting because government bond yields were rising sharply in the more indebted Eurozone economies like Italy and Spain. That threatens to deliver a new sovereign debt crisis as happened after the Great Recession from 2010-2014, leading to the Greek nightmare.

The ECB is now looking for ways to fund the weaker Eurozone governments by buying more of their debt and ‘printing’ money to do it. Ironically, having just announced that it had ended quantitative easing (QE) and looked to raise interest rates in July in order to control accelerating inflation, the ECB now had to revert back to QE for the likes of Italy.

Then the US Federal Reserve announced a hike in its policy rate (the Fed Funds rate) by an extra-large 75bp, with more to come, as it also tries to control accelerating inflation. And last Thursday, the Bank of England joined in by raising its policy rate to control an inflation rate heading towards double-digits.

Only the Bank of Japan (BoJ) resisted increasing its policy rate, preferring to try and protect an already weak recessionary economy which continues to have relatively low inflation. But the BoJ noted that, by having much lower interest rates than other economies, the price of the yen in dollars and euros had started to plummet. That might help Japanese exporters, but it would also add to imported inflation. Indeed, as foreign investors sold off their Japanese government bonds (with government debt at GDP now at 270%), the BoJ would have to buy yet more bonds to fund government spending.

Central bank ‘policy rates’ set the floor for interest rates for banks, households and corporations, where rates will be correspondingly higher. And the Fed hike of 75bp is the most in one go for 28 years.

Ostensibly, the purpose of raising central bank policy rates is to force up interest rates for borrowing by banks, households and corporations. This will eventually reduce spending on homes, consumer products and investment in financial assets like stocks and bonds, and also productive investment in equipment, building and software. That supposedly will eventually cool overall demand and so inflation rates will subside.

But will it work; or even more, will it work without engendering a slump in the major economies? The answer lies partly on whether you accept the mainstream arguments on what causes inflation to rise. I have discussed this at length in various posts. The first main theory is monetarist; namely central banks ‘print’ too much money relative to output of goods: ‘too much money chasing too few goods’; and so price inflation rises. If central banks raise rates and reduce the amount of money they print then inflation will subside.

Fed chair Jay Powell still seems to adopt the monetarist approach when explaining to the US Congress in the latest Fed Monetary Report on how central banks can control inflation: “The inflation rate over the longer run is primarily determined by monetary policy, and hence the Committee has the ability to specify a longer-run goal for inflation.”

Really? All the evidence of the last 60 years shows that monetary policy is not the driver of inflation or disinflation and is, at best, a secondary reacting factor. The real driver is the relationship between the productive output in an economy and the demand engendered by incomes from capitalist companies and workers households.

But that does not mean that it is ‘aggregate demand’ that decides the level of inflation and in particular, the demand generated by too much ‘wage pressure’. This is the Keynesian argument for inflation: ‘excessive demand’ and ‘wage-push’ on costs. The latest exponent of the Keynesian ‘excess demand’ theory is former US Treasury secretary and Keynesian guru of ‘secular stagnation’, Larry Summers. He forecast rising inflation rates back in 2021 because of too much government spending used to get out of the COVID slump. He called for government ‘austerity’ as the answer.

Now in a recent paper, he argues that inflation rates are being measured artificially low compared to the last inflationary spiral of the 1970s. That’s because how housing costs are calculated in the current inflation index have been altered compared to the 1970s. In 1983 a concept of “Owner’s Equivalent Rent” (OER) was introduced instead of actual home prices or mortgage payments. Summers argues that using the OER to measure housing prices lowers the inflation rate compared to the measure used before. This means that inflation now is really much higher than the official rate. So, to get inflation under control, the Fed will have to hike its policy rate much more than it thinks it needs to. Already, the Fed’s planned hikes would take the policy rate up to 3.5%, a massive increase in a short time. If it has to be closer to 5%, that really threatens to bring the whole house of cards down.

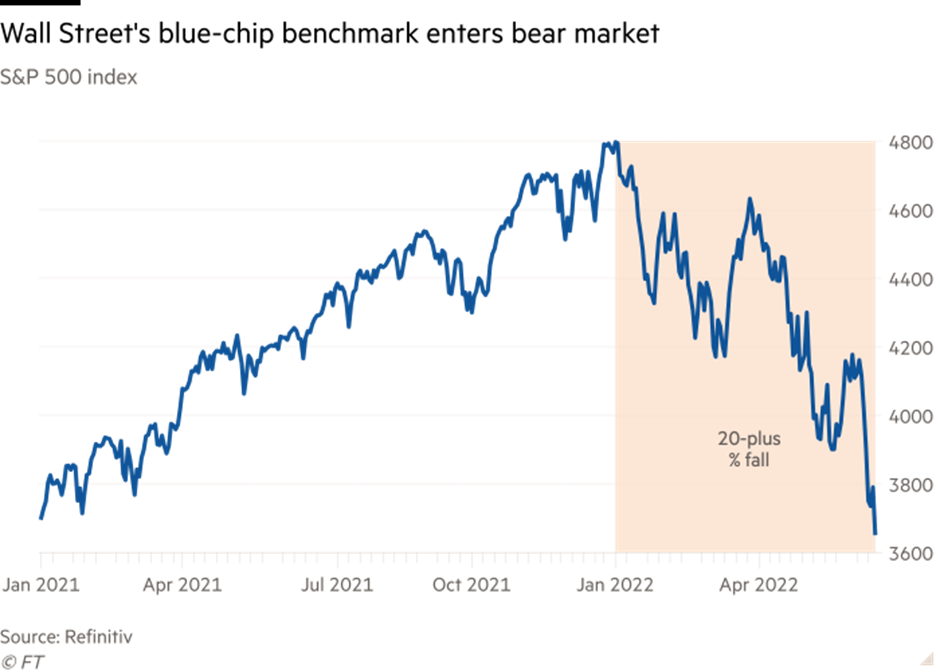

The first to go is usually where what Marx called ‘fictitious capital’ has accumulated ie financial assets and property. Higher rates make fixed income assets relatively more attractive, reducing demand for stocks, whose prices then fall. Already ‘Wall Street’ stock prices have dropped more than 20%, which is considered ‘bear market’ territory.

And the prospect of fast rising interest rates has hit that other great bubble in financial assets: cryptocurrencies. Bitcoin prices are down 45% on the year, at $21,000 a coin. It now costs more ($25,000) to mine it. So not only are crypto speculators taking a huge hit but so are those who mine it. More proof that crypto currencies are not alternative money to fiat currencies (those created by the state) but simply another speculative financial asset.

As I said in a past post: “In the last 20 years, financial fictions have been increasingly digitalised. High frequency financial transactions have been superseded by digital coding. But these technological developments have mainly been used to increase speculation in the financial casino, leaving regulators behind in the wash. When the financial markets go belly up, which they eventually will, the digital damage will be exposed.”

And then there is housing. Last week, US home mortgage rates jumped by the most since 1987 to reach 5.78%, the highest level since November 2008. The rate was 3.2% at the start of the year, while a year ago, before the Federal Reserve embarked on an aggressive campaign to raise interest rates, the 30-year fixed rate mortgage averaged 2.93%.

The increase since January from 3% to 6% now means 18 million fewer households can qualify for a $400,000 mortgage.

That’s a 36% reduction in potential demand. Home buyer affordability has plunged.

As a result, the previously booming US housing markets has started to topple over.

Where Summers and the Keynesians are wrong is that it is not excessive demand that has driven up inflation rate in goods and services that people use, it is the weakening of supply. The supply bottlenecks generated during the COVID slump globally have now been compounded by the Russia-Ukraine conflict, particularly in energy and food. I have discussed before the global food crisis that has already started. And the sanctions against Russian energy supplies are also accelerating prices for fuel and heating.

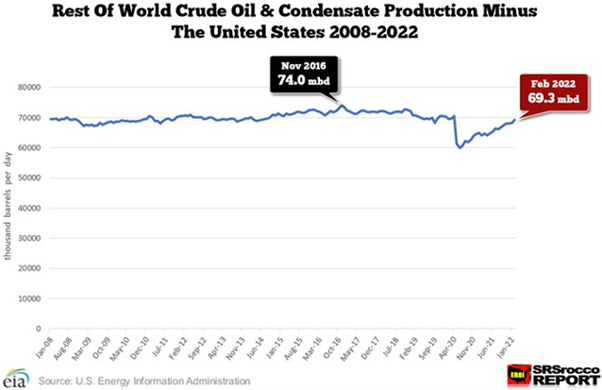

But here is the rub. Global production growth was already slowing before COVID. Take oil for example. Oil production outside the US had been static for years even before the COVID slump and was still below pre-pandemic levels before the Russia-Ukraine conflict exploded.

Productivity growth was very low and employment growth was slowing. Capitalist production and investment slowed because the profitability of capital in the major economies had reached near historic lows before the pandemic. The recovery in investment and production after COVID was just a ‘sugar rush’ as economies re-opened and pent-up spending was released. Now it’s becoming clear that output and investment growth in the major economies is just too weak to respond to the revived demand. So inflation has rocketed.

What this tells us is that it is not excessive demand or wage-cost push, or for that matter too much money, that is causing accelerating inflation but instead weak production growth and insufficient investment in productive assets. There is no ‘excessive demand’ from US households. Real retail sales growth (ie after taking into account inflation) is flat.

And we already know that wages are not keeping pace with inflation rates in all the major economies.

Now there are the first signs that even the so-called strong employment market is weakening in the US. Unemployment benefit claims are now on the rise.

So central bask hikes will not bring inflation under control – unless a slump or recession ensues. The policy of aggressive interest rate hikes in the late 1970s by the then Fed chair Paul Volcker is often cited as proof that central banks can deliver lower inflation. The reality was that Volcker’s hikes only contributed to delivering one of the most severe slumps (1980-82) in the second half of the 2oth century that eventually decimated the manufacturing sectors of the major advanced economies. It was the recession, slumping production and rising unemployment that eventually led to the reduction in inflation.

That is the prospect now if the Fed adopts even half the policy hikes that Volcker applied. The profitability of capital was already low and now falling again in the major economies, as I have shown in previous posts. And as I argued in a previous post, alongside that fall is the issue of the cost of debt

Already investors have yanked billions of dollars out of corporate bonds because they fear that corporate busts are soon to emerge.

A recent analysis by the FT, found that companies with ‘volatile earnings and high interest costs’ face increasing risk of going bust. These ‘zombie companies’ as they often called, will reach 20% of all companies if interest rates double (which is the target of many central banks) and if profits fall by 25%, which now seems very likely.

And of course, that also applies to what is called ‘emerging market debt’ owed by many poor countries around the world. More than $38bn has flowed out of specialist mutual and exchange traded bond funds since the start of the year, according to EPFR data. The exodus will continue.

The world of credit is tightening and bringing with it a downturn in financial asset prices, but also exposing the fault-lines in ‘real economy’ production. As the FT put it in an editorial this week:“ the choice is stagflation, or deflationary depression.”

Looks like a checkmate to me. If you don’t raise interest rates, inflation will eat up the economy. If you do raise interest rates, a wave of bankruptcies will eat up the economy. There’s no Dollar Standard, there’s no equilibrium, there is no God, there’s no nothing – just collapse.

Now let’s see how the working classes of the First World countries will behave if a major crisis wipes out their middle classes. Will they go all-in on fascism, waging a total war against Eurasia (Russia + China) or will they finally do their vaunted, 100-year-plus-delayed communist revolution? My bet is on the first option.

Again, excuse the unwanted intrusion. The working classes have never gone in for fascism. Fascism is something segments of the ruling class goes all in on, because discipline is needed for restoring/creating the empire. This doesn’t change by adding “First World” in front of working classes.

First World Working Classes? Still exist?

And what will the working classes of the periphery (yourself) do while they wait for a new communist revolution in the first world? : they have already done it, voting for Bolsonaro’s fascism.

Not knowing when and where revolutions (revolutionary cycles) occur only makes you blame others for what you can’t do either. His permanent attack on the working classes of the 1st world is just a childish tantrum devoid of the slightest science.

Well, considering all of the communist revolutions that have happened so far in History were made by the working classes of the periphery — including the only one in the West so far, in Cuba — I have to say their chances are better, even if still very small. At least they’re greater than zero, as is the case of the 1st World.

If you read the mood of the working classes of the 1st world nowadays, you can clearly see that there’s no chance of a revolution there. The post-war miracle still shines bright in their minds, so they’re not ready to give up capitalism yet. In fact, the faith on capitalism is so strong in the First World that nihilist and apocalyptic pseudo-ideologies are more popular than communism.

Just a short answer to your answer, which does have a bit more evidence and science than your previous analysis (about the evil working classes of the 1st world). It is true, as he says, that the higher probability of a revolution will be in a peripheral country than in a central country. A revolution is much more likely in Brazil than in France or the USA. In the same way that a revolution in Brazil is much more likely to start in the working classes of small and medium-sized companies than in the employees of the multinationals (Petrobas, etc.,) or in the employees of their State. The cause of this probability is the same: the employees of the 1st world, multinationals and States have their current account much fuller than the rest.

Regarding the electoral vote for quasi-fascist parties (Bolsonaro, Lepen, Vox, etc…) I suggest that he read and understand the very correct and exact comment of Ucanbpolitic. The workers, all over the world, do not vote for parties for their fascism or not, they just swing from one side to the other of the electoral offer looking for a party that will stop their decreasing real wages. In the electoral market, the real growing party is the abstention party. No parliamentary party can stop the declining rate of profit, a declining rate that forces the affected employers to increase their rate of exploitation of the workers.

On checkmates and collapses of Capitalism. It will happen but not as fast as you estimate. There is the chess game of Capitalism in its final phase with the Ukraine-Russia war, but do not expect to see the collapse and corresponding socialist revolution before you, me and all of us see: a) continued extreme misery, b) mass demonstrations and repeated of the workers in the streets with revolutionary parties at the head and c) very weak governments with short duration, in coalition and unstable. That is V. Lenin’s definition of a pre-revolutionary situation. My calculations, based on the thesis of the revolutionary cycle and various studies, indicate 2040/2050 as the most probable date.

Yea! Of course I trust the working classes of the first world. Particularly as the racist right and far-right gain the upper hand in Sunday’s French elections, the “Front Nacional” almost increased its participation in the French parliament tenfold, while the united left fell back in the number of votes.

I don’t have the slightest confidence in the almost extinct European proletariat, as they are content to earn government subsidies (taken from the third world, of course) and become a new type of lumpenproletariat, only now earning a minimum to survive.

Right Antônio, my permanent attack on the working classes of the 1st world is just a childish tantrum devoid of the slightest science. But you want me to take the big popular demonstrations in Europe seriously, like the boring ones in Puerta del Sol square.

When the money Mom and Dad had given them to stay in the square ran out, they went home to have some soup that Grandma had made.

At the very least, in the third world, you leave the square when the police (or the army) start beating or killing.

Rogeriomaestri,

Just one last answer because it is very unsocialist to saturate and monopolize the magnificent blog of M. Roberts.

To my rational response to V. K, (for his attack on the working classes of the central countries) you respond almost the same, you seem not to have understood anything and you continue asking the European workers for a revolution that you are not doing! Reading is not the same as understanding, as you already know. I repeat it briefly: there are objective, material and ECONOMIC conditions that prevent a working class from executing a revolution no matter how much they want it. These conditions prevent any working class, at all times and places. They prevent European workers and… Brazilians. I know those conditions and that is why I do not demand that you make a revolution in Brazil but you do not know them and you complain that I do not do it. First study the requirements of a revolution thoroughly and then we will debate, no doubt. For this study of yours, some more data: in the Europe that you believe has reactionary workers, there have already been socialist revolutions (Germany, Italy, Spain, etc.). In Germany, Rosa Luxemburg, Karl Liebknecht and the Epartachist League. In Spain, Revolution of Asturias, Civil War (a simple fascist counterrevolution of Franco against a semi-socialist Republic, etc.). They were failed revolutions but with many deaths. More deaths than in the nonexistent Brazilian socialist revolutions. Brazilian deaths that you unduly presume Failed revolutions in Europe but which extended (this is technically called a spatial propagation of the revolutionary impulse) its benefits to the working classes of the whole world, including the Brazilian ones.

I finish and I tell you in a somewhat more emotional way, hoping that you understand it that way: do you want a socialist revolution of the Europeans? Start doing it yourself! Why haven’t you done it yet?

All the best,

Antonio. I don’t expect European workers to make the revolution for Latin America, but after the 1960s, the nihilism and individualism of the so-called European lefts abandoned concepts of international solidarity that any party we could call left had until then.

They replaced the revolutionary impetus with the desire for consumption, the dishwasher and the TV replaced proletarian solidarity.

What is the difference in language that the Spanish PS speaks with the leaders of the third world with that the King of Spain?

What has become of the other so-called progressive parties, such as the English Labor Party?

What is the difference between these parties and the conservatives when they go to discuss neoliberal agendas in third world countries?

What I want is not help, it’s that they at least don’t get in the way with speeches and pseudo socializing proposals.

I’m going to cross my fingers and hope that the incoming global depression will be so severe that it destroys the entire capitalist system once and for all, bringing an end to the capitalist mode of production and the bourgeoisie. Then, at least there will be no chance of fascism happening if the entire capitalist system no longer exists. As to what happens after the collapse, I don’t know but at least capitalism would no longer exist.

“Oil production …” -> At last! It’s terrifying seeing the wolf’s ears, isn’t it? “Global conventional crude oil production peaked in 2008 at 69.5 mb/d and has since fallen by around 2.5 mb/d.” Page 45 of the World Energy Outlook 2018 by the International Energy Agency.

Is tightening the English translation of garrotte. VK you are so wrong. Everywhere the left reformists are in the ascendancy. Depending on what happens in Colombia tonight and given the pending fall of Bolsanaro, it could be the case that every major economy in Latin America will be left. Then there is France today. That is not the problem. Without exception they will disappoint and betray their working classes. It is that betrayal and potential demoralisation that is the kindling for fascism. It is the reformist left which opens the door to the right always, that elevates the petty bourgeoisie

into a decisive political force but only because the reformist left have immobilised the working class. Thus the issue of fascism is not this chapter but the next unless the revolutionary left is able to make its mark.

Do I have this right?

The corporations/rich are causing inflation, and now it’s essentially path dependence toward a recession/depression because the fed and other central banks around the world are ideologically bound to ignore that fact – i.e., demand nothing from them (really because they are them) – and punish the working class for the sins of the owning class.

The capitalists discipline labor and eventually use the trillions in cash they have offshored these past many years to pick up “deals” and buy low. The zombie corporations may go bust, but the QE money the individuals garnered who make up those corporations doesn’t disappear, just the legal fiction that was an excuse to steal money in the first place…

Is that about the size of it?

It is interesting to read above the competing explanations for the impending (or not) path of capitalist dissolution.

I would say that the reason capitalism has survived this long is not so much because of capitalists but because of the so-called working class.

The working class has been incapable (for one reason or another) of fighting for its rightful share of output. Rather, it has played the capitalist game of funding their aspirations with debt, trapping many in a cycle of misery.

And the working class is aspirational – they want what the capitalists have. Additionally, they see what socialism in the 20th century did for the working classes, particularly those that did not comply with the diktats of their masters.

And capitalist globalization implanted the final nail in their coffin. It is the reason the working class in the West has turned towards right wing nationalist movements.

Rech, capitailism is not a mode of production. It is a social order. Socialism is also a social order, or rather a social movement, naturally brought to life within a sick, socially pathological capitalism, whose motive vivendi is to destroy socialism by destroying humnity and nature itself. Ethically, you reflect capitalist pathology perfectly.

without typos: Rech, capitalism is not a mode of production. It is a social order. Socialism is also a social order, or rather a social movement, naturally brought to life within a sick, socially pathological capitalism, whose motive vivendi is to destroy socialism by destroying humanity and nature itself. Ethically, you reflect capitalist pathology perfectly.

m&m,

“Ethically, you reflect capitalist pathology perfectly.”

To the extent that I find socialism anathema, an accurate diagnosis. However, the malady you ascribe to me is not entirely defined by your diagnosis, far from it.

Capitalism barely matches the depravity of some of socialism’s poster boys, Stalin, Dzerzhinsky, Yezhov, Beria and more recent proponents of Russian brutalism.

Henry. Even i choked on my porridge when you end by suggesting Putin is a socialist He has spent his career and machinations in preserving autocratic capitalism in Russia . Surely you agree with that interpretation of this corrupt autocrat

Michael,

Absolutely, Putin is not a socialist – he’s a fascist by any measure.

I was indulging myself.

I hope you can return to your porridge now with some equanimity. 🙂

Huh? Capitalism is exactly that, a mode of production:

The wealth of those societies in which the capitalist mode of production prevails, presents itself as “an immense accumulation of commodities,” its unit being a single commodity. Our investigation must therefore begin with the analysis of a commodity.

–Capital, Vol 1 Page 1

anti-capital, the capital of capitalism is first of all an historically evolved “social relation” between the owners of the means of production and critical mass of uprooted labor.

mandm,

take it up with Marx. Capitalism is precisely a mode of production.

If you count the Iberian period (which the Anglo-Saxons do not), capitalism has existed for just some 530 years. That’s not much by History’s standards. If you go by the Anglo-Saxon historians, capitalism was only born with the birth of the Dutch and British Empires, in which case capitalism is even younger than that (and even then, feudalism existed alongside capitalism for centuries).

By far, the longest living mode of production of humanity was primitive communism (hunter-gatherism), which existed towards the entire human Prehistory, which is more or less 300,000 years. If you only take the History era of humanity, then ancient slavery is the longest living (more than 6,000 years – not counting the capitalist type slavery, which is a completely different mode of production).

Your comment is very funny because some readers of this blog spent a lot of time refuting my argument of the first comment (about the First World working class), only for you to comment right after me confirming everything I said.

vk,

There are many who rail against the notion that the working class has turned towards nationalist right wing movements. They cannot escape their doctrinaire prescriptions.

All the intellectual left can offer the working class is internationalism (more globalization – the socialist version) and brotherly love. 🙂

Capitalism development breaks up landed property with rents, prices and inheritance determined by custom rather than market, working to ensure that land is a commodity for sale. Thus, capitalism in the abstract, the state in the concrete, deprives the people of their customary privileges, etc. This process began well before Columbus. The labor shortages after the Black Death played a major role. [In central and eastern Europe, the feudal lords succeeded in reinforcing feudal bonds, the notorious “Second Serfdom.]

And, what seems to be forgotten most of the time, one species of landed property, one which tends to ignore national markets/national currency/the nation is the Church. In the West, a key part of capitalist rise was the expropriation of the Church lands. The Hussite revolt was premonitory long before Columbus too. This reached high gear with the Protestant Reformation. The Wars of Religion in France, the Peasant War and the Thirty Years’ War in Germany, the great Dutch revolt (eighty years of war!) were key in the rise of capitalism. They had little direct relationship with the New World. Contra Sam Williams, gold did not create capitalism via the Price Revolution of the Sixteenth Century. The rise of nations, as the term Westphalian system, is the codification of a new kind of state, a bourgeois state.

I can only explain the desire to find “capitalism” much later as due to the embarrassment of the bloody origins of capitalism and the signal failure to actually raise everybody’s living standards for a long period.

On a more narrow issue, finding common ground with Henry Rech on the vileness of the First World working class is a sign of bad judgment. Two straws leaning on each other are not stronger. They have to be bundled together, with strong arguments so to speak, before they reinforce each other.

The notion that voting is the act by which the First World working class expresses its will is purely ideological, a blind acceptance of bourgeois democracy, which is an ideology of class rule. It is not a transhistorical universal standard that pure sould must live up to. The bourgeoisie has a seemingly infinite number of ways to make sure that voting does not address the fundamentals, what you might call the constitutional order of property and power. It is technically called the dictatorship of the bourgeoisie, which exists in every bourgeois democracy, including those with free and fair (sic) elections. Fascists never rely on voting to take power.

I will concede it’s much, much easier to fight US imperialists at the end of very long line of supply, rather than in its own homeland.

Steven,

“They have to be bundled together, with strong arguments so to speak, before they reinforce each other.”

I can’t imagine any commentator in here wanting mutual support from me.

It is not a matter of “strong arguments”. It is a matter of confronting reality, which the intellectual left (armchair, slipper wearing revolutionaries) are incapable of doing.

Both you and vk deny reality by claiming “the working class” has turned right. You personally deny reality by wishing away the long and bloody history of capitalism and imperialism. My experience has been that all those obsessed with abusing dead Communists do so from hatred of living workers. You know nothing of reality because your malice makes you stupid. .

Steven,

I certainly recognize the appalling history of capitalism just as I do the appalling history of socialism.

Your line about dead communists sounds very clever but is completely contrived. Ask the millions of hapless victims of these dead communists what they think of your communism.

When commentators are reduced to personal abuse it is clear they have depleted their store of valid arguments.