Every August, the central bankers of the world meet at Jackson Hole, Wyoming, amid the Grand Teton mountains in mid-west America, to discuss the state of the world economy and the role of monetary policy and central banks. The central bank chiefs hear papers presented by leading mainstream economists in a restful weekend symposium hosted by the Kansas City Fed. Usually, it is an opportunity for the head of the US Federal Reserve, the hegemonic central bank, to make a speech outlining what’s happening in the US economy and future monetary policy (and its efficacy).

This August it was the turn of Janet Yellen, the current Fed chief. Global investors and financial market participants always await expectantly to see what the Fed is thinking. The immediate issue for markets is whether the Federal Reserve will resume its plan to raise its ‘policy’ interest rate towards a ‘normal’ level. The Fed policy rate is the floor for all other rates, like bank loan rates for households and companies and also for international rates, given the predominant position of Wall Street in global finance.

The Fed under Janet Yellen hiked its policy rate back in December 2015 for the first time in nine years, supposedly as the start of the move back to ‘normal’ – on the grounds that the US economy was fast recovering back to trend economic growth and full employment. Yellen explained that the US economy “is on a path of sustainable improvement.” and “we are confident in the US economy”. But since December, the Fed has sat on its hands.

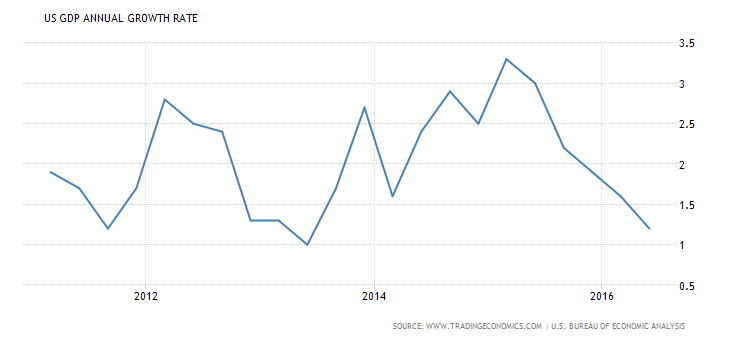

Why? Well, the return to trend growth has not materialised and inflation has not risen. In the first half of 2016, the US economy has expanded in real terms (after inflation) at less than 1%, more one-third the ‘normal’ rate. The economy has been slowing down, not accelerating.

At the same time, inflation fell back too.

So the Fed paused on its ‘normalisation’ policy. Indeed, there was talk of opting for cutting the policy rate and even introducing ‘negative’ interest rates. However, the Fed’s chiefs remained optimistic. Just before the Jackson Hole symposium, Fed vice-chair Stanley Fischer made a speech in which he reckoned that “the economy has returned to near-full employment in a relatively short time after the Great Recession, given the historical experience following a financial crisis.”

Now in Yellen’s Jackson Hole speech, she reiterated her confidence in the sustainability of the US economic ‘recovery’ and hinted that the Fed would soon resume its hiking of the policy rate. Yellen said: “In light of the continued solid performance of the labour market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months. Of course, our decisions always depend on the degree to which incoming data continues to confirm the Committee’s outlook.” Yellen added that the US economy was “now nearing the Federal Reserve’s statutory goals of maximum employment and price stability”.

Central bank ‘conventional’ measures before the global financial crash boiled down to manipulating the basic interest rate for borrowing or providing cash or credit for limited periods to tide banks over in a slump. But such was the depth and width of the impact of the global financial crash and Great Recession on the banks and the wider economy, central banks had gradually adopted more ‘unconventional’ measures, such as printing money to buy government and corporate bonds from banks at high prices to provide liquidity for the banks to lend on to ‘real economy’; and to offer ‘forward guidance’ to the markets and industry i.e. a commitment to keep interest rates as low as possible for as long as possible so that ‘confidence’ in investing was restored. The ECB’s version of this ‘forward guidance’’ was for ECB chief Mario Draghi to announce that the ECB would “do what it takes” to get the Eurozone economy moving.

However, as the world economy continued to crawl along, with GDP growth stuck, unemployment falling back very slowly and many economies slipping into outright deflation (bad news for those with big debts), it was clear that monetary policy, conventional or unconventional, had failed. In the last year, many have called for more radical measures and some central banks have adopted them; namely, ‘negative interest rates’ (Sweden, Switzerland, Japan) and even consideration of ‘helicopter money’ (straight cash handouts to households); or the abolition of paper money so that all money is kept in banks electronically to be spent (and not stuffed under mattresses). This last proposal is the ultimate in bank dictatorship over people’s rights to their cash savings.

Just before Yellen’s speech, San Francisco Fed chief, John Williams had suggested setting higher inflation or ‘nominal’ GDP growth targets (so that central banks print even more money). And it is interesting that all the papers presented to the Jackson Hole symposium by various mainstream academic economists had one basic theme: existing monetary policy is not working and we need to consider more unconventional and extreme measures.

The economic strategists of capital are worried that monetary policy is not working to get the world economy (and the US economy) out of its ‘secular stagnation’. The failure of current monetary policy pushes the monetarists like former Fed chief Ben Bernanke into proposing yet more of the same (cutting rates) and more of the not same (helicopter money).

Yellen was vaguely sympathetic to Williams’ idea, but on balance, argued that nothing else was needed. And anyway, relying too heavily on these non-traditional tools could have “unintended consequences” as it might encourage “excessive risk-taking” and undermine financial stability. She argued that the Fed would not need to adopt any new measures of ‘unconventional’ monetary policy beyond those adopted since the onset of the Great Recession in 2008. Indeed, these measures could actually make the economic and financial situation worse. “Monetary policy is not well equipped to address long-term issues like the slowdown in productivity growth,” said Fed vice chair Stanley Fischer.

The alternative policy answer of the Keynesians like Paul Krugman, Larry Summers and Yellen herself is to call for government infrastructure spending and other efforts to counter weak growth, sagging productivity improvements, and lagging business investment. You see the problem is that the capitalist sector is not investing sufficiently to get productivity of labour growing faster and thus real GDP growth.

As a share of GDP, US annual business investment since 2008 has averaged nearly a full percentage point below the previous decade’s average, government data shows. This has generated an investment shortfall equivalent to $1trn with what it would have been if the previous trend continued. Little suggests a rebound any time soon. Fixed business investment has fallen in three successive quarters as a share of GDP and for the last three quarters up to Q2 2016.

And it is not as if the evidence is not there that the US (and UK) economies need to invest in new infrastructure and technology to lower costs and improve efficiency. The American Society of Civil Engineers has all we need to know.

But would government investment compensate? In most major capitalist economies, business investment to GDP is about 13-15% while government investment is about 1-3%, or about seven times smaller. If business investment slips by 1-2% of GDP, then government investment would have to nearly double in GDP terms to just stand still. And that assumes that governments controlled by big business and big finance would contemplate a doubling of government investment that involves large increases in taxation or rising interest rates for borrowing (in other words, enchroaching on profitability) (Kalecki).

As I have argued in this blog, what matters in a capitalist economy is the profitability of capital and the mass of profits generated by the workers employed. If the profitability is capital is too low and the capitalist sector remains dominant, investment and economic growth will not recover whatever central banks do or government spending does.

Indeed, there is yet more evidence from the Federal Reserve own economists that this is right. In a recent study, two Fed economists asked chief financial officers of major corporations and found the corporate internal rate of return needed to justify capital projects has “hovered near 15% for decades,” and barely budged even as global interest rates have fallen. So even if interest rates stay near zero or go negative or if helicopter money is handed out, it won’t make any difference if companies don’t think they can get their 15%.Fed on investment.

It is no accident that Marxist studies of the US corporate rate of profit in the productive sectors (i.e. non-financial) since the 1980s confirm an average rate of about 15%. US companies now expect 15% but can’t get it. So they buy back their own shares or increase dividends instead on investing in new technology, plant or equipment.

So yet again, it is profitability of capital that matters and from there to investment and growth. Yellen and Fischer cite higher employment and consumption as reasons for hiking interest rates now. But these are ‘lagging’ indicators; their movement ultimately depends on what is happening with business investment and behind that, profitability.

And the latest figures on US corporate profits that came out just this week for the first half of 2016 make dismal news. US corporate profits fell 4.9% in Q2 2016, compared to this time last year. And after tax was deducted, profits were down 6.3% compared to last year.

Corporate profits are the main driver of business. Where profits go, business investment is soon to follow, like the usual ‘night follows day’ proverb. And there is yet new evidence that this is right. Emre Ergungor is a senior economic advisor in the Research Department of the Federal Reserve Bank of Cleveland. He has been working on a model that can predict economic recessions. Most existing models try to predict recessions based on the movement of short-term and long-term interest rates. But they are not very good. Currently such models are reckoning the likelihood of a recession at no more than 20%. ec 201609 recession probablilities

But the Ergungor came across a startling fact (already known to the readers of this blog) that there is a very high correlation between the movement of business profits, investment and industrial production! He found that “A simple correlation analysis shows that the correlation between the change in corporate profits and the contemporaneous change in industrial production is 54 percent, but the correlation goes up to 66 percent if I use the one-quarter-ahead change in industrial production. Similarly, the correlation between the change in corporate profits and the contemporaneous change in gross domestic private investment is 57 percent, but the correlation goes up to 68 percent if I use the one-quarter-ahead change in investment. More formally, a Granger causality test indicates that the quarterly change in profits leads the quarterly change in production by one quarter, but the change in profits is independent of the change in production. A similar relationship applies to the quarterly change in profits and investment.6 Thus, firms seem to adjust their production and investment after seeing a drop in their profits.”

This is very similar to the correlations and Granger causality tests that I found and others have too. The time gap between profits and investment is about three quarters of a year. So Cleveland developed a new recession model to include corporate profits and found that “In early 2016, model 3 assigned an 81 percent probability to a recession in the next 12 months, and model 4 assigned a 73 percent probability to the same event. Thus, the consideration of the decline in corporate profits in this period worsened the recession probability by 8 percentage points. As credit spreads declined later in the period, the recession probabilities from both models declined to around 30 percent.” Cleveland cautions that their model does not always predict a recession. But the model is way better than one based on interest rates only.

I have spelt all this out in detail because it adds yet more evidence to the Marxist economic case that it is profits that matter and investment that decides, not the price or quantity of money (monetarism) or consumption and employment (Keynesianism). So expect business investment to fall further over the next few quarters. If the Fed decides to hike interest rates in the middle of that, it could well trigger a new economic recession if stock markets fall and the fictitious financial value of companies is exposed to the reality of their profits.

“I have spelt all this out in detail because it adds yet more evidence to the Marxist economic case that it is profits that matter and investment that decides, not the price or quantity of money (monetarism) or consumption and employment (Keynesianism). So expect business investment to fall further over the next few quarters. If the Fed decides to hike interest rates in the middle of that, it could well trigger a new economic recession.”

If its not “the price of money” (sic) – Marx derided the bankers like Overstone for describing the interest rate as a price of money, rather than what it actually is, the price of money-capital – which decides (and I agree it isn’t, because as Marx describes the rate of interest is a derivative of the demand and supply for money-capital, not a determinant of that demand and supply) then why would you argue that a rise in official interest rates would lead to a recession?

Secondly, although the rate of profit is a determinant of the supply of capital available for accumulation, as Marx sets out in Capital III, Chapter 15, its not the end of the matter. If you don’t have sufficient surplus value, you can’t expand more rapidly, but the mere existence of that surplus value does not imply higher accumulation.

As Marx sets out in Chapter 15, the conditions for realising surplus value are not the same as those for producing surplus value, and the two are often contradictory. There is no reason why capital should accumulate additional productive-capital, just because it has large reservoirs of available surplus value, unless it believes that the surplus value then produced can be realised, which as Marx describes is a function of demand. There are a whole series of reasons as Marx describes as to why the demand may not be present to make it possible to realise surplus value that has been produced. And, indeed one reason, he describes is that in periods of relative affluence, consumers require prices to fall by larger amounts in order to persuade them to buy proportionally more, i.e. as he says demand is a function of use value.

Moreover, as he also describes in Volume III, there are periods when it is attractive for the owners of these revenues to utilise them for speculation rather than to use them to fund real accumulation of productive-capital, e.g. as happened with the railway mania. A rise in interest rates that bursts the current asset price bubbles that have been blown up as a result of the continuation of The Greenspan Put, would signify to the money-lending capitalists that the Fed and other central banks no longer had their back, and that they could no longer count on guanranteed huge speculative capital gains.

It would make use of available resources for real accumulation a more attractive proposition.

Yay Boffy’s back, saying absolutely nothing new or insightful.

Insightful and well researched article. Simon, Boffy makes a good point about realisation and production of surplus value. The second quarter was decisive for the US economy, it was the point they had to turn it around and as Michael has pointed out corporate profits actually fell. GDP too is much weaker than the figures suggest. What is propping up the economy is P.C.E. but these are growing only because rents are rising as is healthcare costs. (Retail sales are much weaker) Now the bulk of rents are those imputed to owner occupiers. Ergo if market rents are rising so too are the imputed rents boosting GDP. Table 7.12 (BEA) gives the amount of imputed sales which are prevalent in PCE. In 2006 imputed sales amount to 11% of consumer expenditures now it amount to around 14.5% which has provided an automatic boost to GDP that is completely fictitious. Ergungor is to be applauded given he walks the barren world of the FED. He reinforces my view of the importance of the second quarter and the effect that will have on the markets in September and October. The FED is the toothless barking dog. It talks up interest rates hoping to restrain the markets because it can’t actually increase them.

If you were more familiar with Boffy you’d know he’s just repeating an old canard about how excess financialization is just a temporary blip and soon the money is all going in to productive capital.

Well the thing with Boffy is that he already believes money has gone into productive capital because he claims the last 25 years have seen the most product innovation in history!

But for some reason Boffy at the same time thinks the financialization of the last 25 or so years has been a bad thing.

The 2 things don’t match up and Boffy’s argument makes little sense.