February’s data for gauging the strength of the world economy is now available. Readers of this blog will know that I use certain monthly indicators to get a ‘high frequency’ picture of the world economy. I use the so-called Purchasing Managers Indexes (PMIs), which are basically surveys drawn from company managers about their corporate purchases in each month – things like new orders, employment, wages, prices and production.

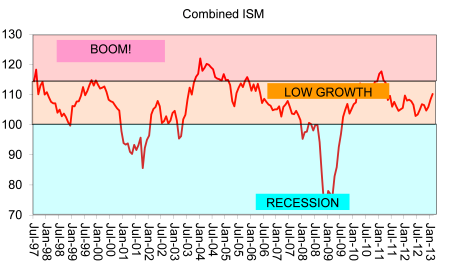

Starting with the US, I have compiled a composite index of the PMI for manufacturing companies with the PMI for services companies. This is how it looks.

As you can see, the US economy remains in a low-growth path with some signs of a pick-up. The US is certainly nowhere near a new recession. However, the impact of the increased taxes being imposed after Congress agreed a hike last January and the reductions in government spending coming from the so-called ‘sequester’ are likely to hit growth over the year by as much 1% pt of real GDP. We’ll see what that does to the data.

An even more frequent indicator of US economic activity is the weekly ECRI that looks at a number of high-frequency measures including stock market prices and interest rates. This also shows the US economy comfortably moving along a low growth path, but still not near boom levels.

And just yesterday, we got the monthly jobs figures for the US. The headline data looked stronger. There was an increase in overall US employment of 236,000 and the unemployment rate fell from 7.9% to 7.7%. The accompanying survey of US households about their employment found that jobs had risen 170,000. But here is the rub. This increase was actually in part-time, low-paid jobs which were up 446,000, while full-time jobs fell 276,000. Just under 300,000 left the labour force (i.e. they were no longer looking for a job) and this explains the fall in the unemployment rate. Long-term unemployment (27 weeks or more) rose by 89,000, the first increase since October. And when you compare the rate of recovery in employment since the end of the Great Recession, this is the weakest post-war turnaround of all employment recoveries. After over five years, employment is still 2% below its pre-slump peak, and at current rates of net new jobs, it could take another 18 months to get back to that peak.

Both the employment-to-population ratio and the labour force participation rate are much lower than they ought to be. As one commentator put it, “it’s important to ensure that the unemployed get jobs. But in many ways it’s even more important to try to create jobs for people who simply aren’t working, rather than just for the people who are actively looking for work.” There are 89.3 million Americans who are not in the labour force, of whom 6.8 million currently want a job. The economy ought to be able to find good, rewarding jobs not only for the 6.8 million, but for a large chunk of the other 82.5 million as well. And that is not happening.

What about the rest of the world? Well, the PMI for the world as a whole is still above 50, the point at which an economy rises. It is rising relatively strongly in the US and China, as we know. Even the UK is expanding on the PMI measure. So a ‘triple-dip’ recession for the UK is not on the cards based on the February PMI. But the Eurozone and Japan economies remain well in recession mode.

The overall Eurozone figure came as Ireland, Spain, Italy and even Germany saw their individual country PMIs worsen between the first and second months of the new year. Italy saw its all-sector PMI slide from 45.2 to 44.2, deep below 50, Spain’s PMI dipped from 46.5 to 45.3 and France’s only managed to inch up, from 42.7 to 43.1. By contrast, German business activity was on the rise, even though the PMI index fell from January’s 54.4 to 53.3 in February.

The world economy crawls along, with the US and China leading the way and Japan and Europe struggling along behind.

Michael,

!st time I’ve ever really totally disagreed with your “by the numbers” conclusions (re your take on the US now). You correctly point to “real unemployment” as opposed to the labor market indicator (U1):

This increase was actually in part-time, low-paid jobs which were up 446,000, while full-time jobs fell 276,000. Just under 300,000 left the labour force (i.e. they were no longer looking for a job) and this explains the fall in the unemployment rate. Long-term unemployment (27 weeks or more) rose by 89,000, the first increase since October.”

This part-timing of the labor force has been ongoing here since the bust started. Speaking this week on National Public Radio (NPR) the US correspondent for The Economist cited part-timing, speed up, frozen wages and falling benefits as the main reason for the large uptick in corporate earnings being seen. He also considers this “unhealthy” especially in view of the sudden boom in stock prices. He was far more pessimistic than you. He also thinks the stock market boom is a sucker’s trap played by the big “institutionals” that are using the Fed’s “quantitative easing” to dump crap assets into a hot market. It’s really to bad we can’t get a speaking tour scheduled for you here– get you out of the study a bit. I’m sure that relative to most of the Euro zone, excepting Germany, that the US economy doesn’t look too bad. But that should be a merely relative point. Austerity in the USA has taken the form of a direct assault on the value of variable capital– wages, benefits, full time jobs, work intensity etc than of debt reduction (although as you write once the “sequester” kicks in that will change the picture). So I think you’re quite too rosy eyed here. I could go on– but I’d need a blog.

Bob Montgomery

Bob

I assure you that I am not rosy eyed and anybody reading all the posts on the US on my blog I think would see that. I agree with the comments of the Economist guy. All I was saying in this post is that the US is not in a new recession (yet). Although its growth is pathetic, it is relatively better than the Eurozone or Japan. Overall the world economy is crawling along at about 3% real growth at best (including China in that). It’s really a Long Depression.

What about this roller coaster pattern? Doesn’t it suggest that the US economy is close to a collapse?

So, even if a combined ISM and ECRI are somewhat improving, it just shows that a lot of commodities are extremely likely to being overproduced, considering that the wages are too low and the employment/population ration is extremely low.

Maybe the stock market roller coaster trends reflects better the situation in this case. The reason is simple, low wages, reflect bigger surplus, but it is just momentary given that profits give the vulgar managers of companies the impression that they should improve the production and analysts projects a higher growth and thus market stock rises. But no one will buy the commodities and then, the crisis, a horrible one, will begin again.

This is the roller coaster pattern:

http://finance.yahoo.com/echarts?s=%5EGSPC+Interactive#symbol=%5Egspc;range=19980306,20130101;compare=%5Edji;indicator=split+ke_sd+volume;charttype=area;crosshair=on;ohlcvalues=1;logscale=off;source=undefined;

The planet is the warmest it has been in 11,000 years and we’re still concerned about ‘growing our businesses’. The world’s population is set to hit the 9 billion mark by 2050. Extinction rates are up, up, up.

We need a shrink. We need shorter work time. We need to end the rule of Capital. But we are too busy to notice the cancer spreading.

Mike is right.

You say that the US is not in a new recession yet, by you also say overall the world economy is “crawling along” (at about 3% real growth at best) so that it’s “really a Long Depression”. This kind of analysis I had accepted until not long ago, but now I think it is better to avoid it, because it is confusing. Either the unit of analysis is a national economy or it is the world economy. Even in 1932 you probably could find states in the United States or provinces in France where the economy was “doing well”; so what? Were those ones examples that the Great Depression was a local phenomenon not affecting these nations? It seems to me that the unit of analysis for any relevant macro analysis in recent decades shall be the world economy. If that is the case, there have been clearly five crises since the 1970s to the Great Recession, and may be we are entering in the sixth. I believe there is some empirical evidence that profitability has dropped immediately before each of these crises. However you say there has been a secular trend downwards in profitability “for any period in which we have data” (thenextrecession.wordpress.com/2011/07/29/measuring-the-rate-of-profit-and-profit-cycles/). I think that is wrong as e.g. it is obvious from a look to your own graph that profitability would have been growing between 1982 and 2006.

I wanted to email you about this but I could not find your address.

Btw, Mike and Ellis are right. But I don’t find any of your views on global warming in your extensive blog.

Jose Tapia

I am not sure that we disagree. Increasingly, the ‘unit of analysis’ should be the global economy now that capitalism has become the dominant mode of production in the world especially after the ‘globalisation’ of the last few decades, as you say. And I agree that another recession is not far away – my point about a Long Depression is that it is like the 1880s and 1890s when every recovery was overtaken by a new slump so that growth and employment remained weak for a decade or more. Again, I could not agree more that profitability leads investment and thus growth or the lack of it – and I have quoted your excellent paper on this many a time in this blog. But (at least in the US) there has been a secular downtrend through cycles of profitability since 1945. I have attempted to measure a ‘world rate of profit (also referenced in my blog) that also shows a downward trend from the mid-1990s even in the BRICs.

I agree about the huge dangers from global warming – perhaps I need to do a post on that too.

Great to hear from you and I did send you my email address in the past to communicate various papers. Will do so again.

Thanks, and congratulations for your blog, which I just recently discovered. Nunca es tarde si la dicha es buena. I look forward to hear from you.

Michael,

Why the world capitalist economy is the correct site for evaluating the prospect for socialism: The distinction between value created and value captured. If you wish to defend Marx’s theory of value and to gauge where the economy is heading, it is necessary to evaluate the world capitalist economy, no matter how difficult that is. Yours had been the only blog site that hadsconsistently attempted to do so. So, I am quite pleased that Jose Tapia is also trying to take the same approach, as the world capitalist economy is the only ‘unit of analysis.’ from which any sense can be made of where capitalism is and where it is going.

I think that the data show that developed countries- US, Germany, Japan, etc. are ‘capturing’ surplus value from the global South-in the manner that John Smith has explained in his fine thesis Imperialism and the Globalization of Production. It is impossible to understand what is happening to the world economy without a clear idea of how value can be created in one place but transferred to another. This transfer can keep afloat over-ripe economies such as the US, Europe, and Japan. The enormous expansion of world credit operations is a sympton that the world rate of profit is also suffering from decline. Nobody can predict the pace of capitalist decline-it will continue to have its ups and downs, but it is difficult to see how it will get out of its declining conditon without a major, very destructive war. What we can predict is that ‘austerity’ and further ‘local’ wars will continue until the world working class decides that enough is enough.

Rather than calling this a depression, I think we should consider rehabilitating the Bolshevik phrase-general crisis of capitalism. For, in spite of ups and downs, the period 1914-45 was a period of general decline and increasing imperialist conflict. This was not just a Stalinist phrase, though it was also used by them in the 1930s. On the other hand, a depression is thought by many to be a severe period of negative growth.

Again, thank you for your blog.