In the second quarter of this year, the UK economy grew by a ‘staggering’ 0.2% in real GDP. The media and government were in raptures that the expected recession in the UK was being avoided. Indeed, real GDP is up 0.4% from the same period in 2022.

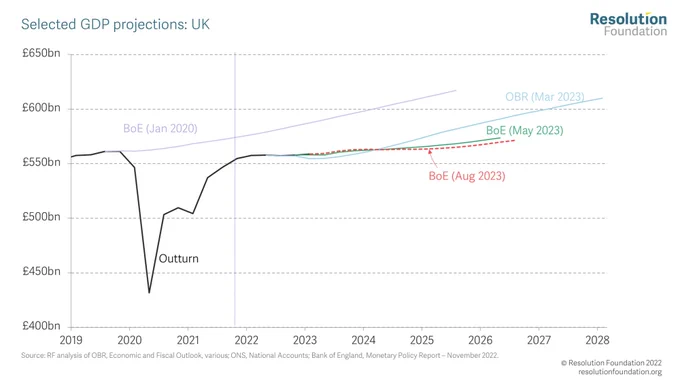

So all is well. But no. First, while a ‘technical’ recession (two consecutive quarters of contraction in real GDP) is no longer forecast for 2023, the Bank of England still expects stagnant output for next two years! And that may be the best outcome. The BoE Governor Andrew Bailey said, “We hope we can deliver the path we expect with no recession, but we will have to see”.

As the economic think-tank, the Resolution Foundation put it: “this might not be a technical recession but we are experiencing the weakest growth for 65 years outside of one (a recession).”

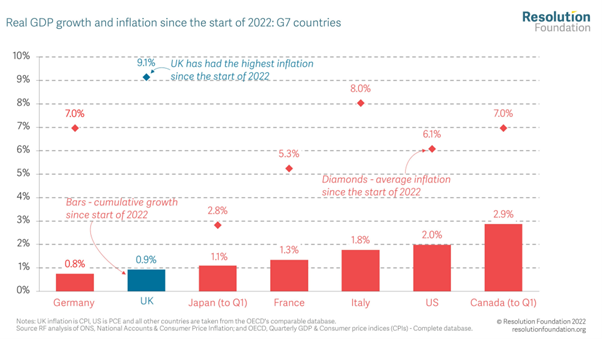

And the UK economy is just falling behind. Compared to the rest of the G7 economies, the UK has the highest inflation rate and the second lowest GDP growth (just in front of Germany which went into recession this year).

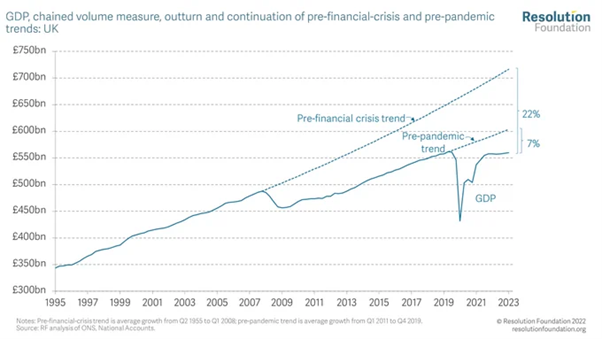

Real GDP growth is still more than 20% below its pre 2008 trend – although that fallback applies to all G7 economies, if at lesser rate.

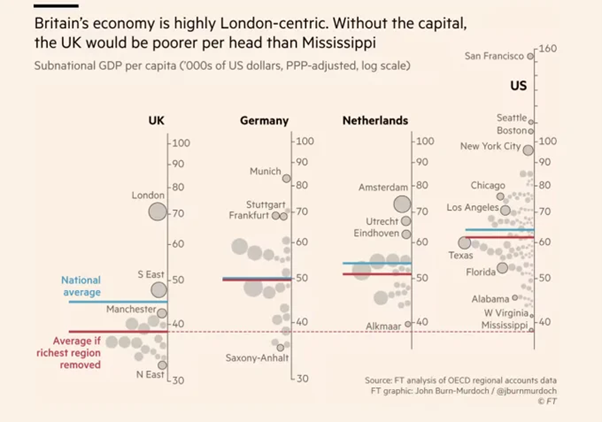

Indeed, people in north-east of England have an average standard of living less than half that of the average Londoner. There is no greater regional disparity anywhere else in Europe or the US. So much for ‘levelling up’.

isn’t it time we stop wanting more growth? reduction of working time, more equality, less unemployment , more public health, etc, of course; but more growth no, we must want de-growth

England’s de-industrialized, rent and interest seeking/militarized/destructive production, economy is co-eval with that of the US.

The island is still rich in the resources described by Daniel Defoe in his “Tour of the Whole Island”, in which he visits: small valleys southwest of London, whose fertile soils support millions sheep, thriving prenatal industrial towns, mines, etc. England doesn’t need degrowth. It’s already done that for use/surplus value production. It needs a revolution to regrow itself.

I agree with you. I really think the First World should start degrowing.

Yep, the UK is a low regulation offshore banking sector with a third world hinterland attached. All of the regional financial centres got centralized to London, while industrial production in the provinces collapsed. When the final reckoning with the on-financial-life-support post-GFC world happens, London may look more like 1970s New York. Stealing Russian oligarchs money didn’t help London’s reputation for keeping safe the ultra-rich’s ill gotten and tax-avoiding gains.

Do you have an idea why the Germans are doing so poorly?

“Old myths die hard. The one about how workers’ wages caused the inflation of the 1970s being among the hardest. In fact, Britain had imported the inflation caused by the USA deficit financing the Vietnam War and the Cold War. Further misery followed, when oil-producing former European colonies insisted that Britain pay a reasonable price for their oil.

It was an oil shock, too, which finally brought inflation under control. The Iranian Revolution and the ensuing Iran-Iraq war caused oil shortages which plunged the British economy into a severe recession. This was compounded by central bankers raising interest rates to historically high levels. And the false lesson that the central bankers, economists and politicians took from these events was that using interest rates to cause a recession was the best way of bringing inflation under control.

That error is being put into practice in 2023, as central bankers attempt to address a new round of inflation.

But while torpedoing the economy is easy, returning to growth is a much harder prospect – and one that central bankers and politicians seem to have failed to consider. The blithe assumption being that Britain will simply repeat the approach taken by the Thatcher government in the 1980s to smoothly return to prosperity.

In this video, I present seven reasons why the recovery of the late-1980s and 1990s cannot be repeated in the 2020s – and that, as a consequence, Britain is set to be the first developed state to experience an irreversible collapse. ( The ANGUISHING video here -> https://consciousnessofsheep.co.uk/2023/07/02/7-reasons-why-britain-will-never-recover/)”

You have just explained Brexit.

It’s not just Brexit