Americans go to the polls today to vote in the so-called mid-term elections for the US Congress. All the seats in the lower House of Representatives are up for grabs, while a portion of the upper house, the Senate, is being voted on. Currently, the Democrats hold a majority of just eight in the lower house and have a majority in the Senate only through the vote of the Chair, who is the Democrat vice president.

Current opinion polls suggest that the Republicans will gain control of the lower house with a majority of 20-30 seats while the Senate is much closer. If that result is about right, it will mean the Democrat Biden administration will be pretty much blocked from carrying out any of its proposed measures over the next two years up to the next presidential election in November 2024.

Perhaps it makes no difference who is calling the shots over the next two years, as neither Democrats nor the Republicans have any useful policies to improve the lot of most Americans, particularly when it comes to the cost of living, better jobs, more investment in public services and infrastructure.

And let there be no doubt that it is the economy (stupid!) that matters for most of those likely to vote over any other issue. According to the polls, the economy and inflation is seen as the top issue by 51% of likely voters, much higher than the tortuous issue of abortion (15%) where the rights of women to choose have been emasculated by a right-wing Supreme Court and various Republican states. And the so-called conspiracy over vote rigging that the Trumpist right reckons is the key issue is only important to just 9% of voters; followed by gun policy 7% and immigration 7%. Climate change, the issue for the whole planet’s future, is most important to only 4% of voters.

And we can see why the economy and living standards are so dominant an issue. The economy is nearly always the leading issue, but with inflation rocketing up to over 8% a year and mortgage rates chasing after inflation, average real incomes (as in all the major economies) have been plummeting.

Living standards for the average American have now been flat for nearly three years.

The so-called ‘misery index’ is often used as a gauge of the well-being of households. It’s a simple addition of the official unemployment rate and the consumer price inflation rate. The misery index is at its highest since the Great Recession, and before that, since the cost of living crisis of the 1970s and early 1980s. Interestingly, quite often (but not always) the incumbent administration loses the mid-term elections when the misery index is high or rising fast (1958, 1974, 1982, 2010). Even though the official unemployment rate is near all-time lows, the rise in income earned from these jobs nowhere near covers rocketing inflation in food, fuel and rents.

The prospect ahead for the US economy over the next two years to the 2024 presidential election increasingly appears to be one of a new slump or contraction in national output in 2023 and a further fall in living standards for most Americans.

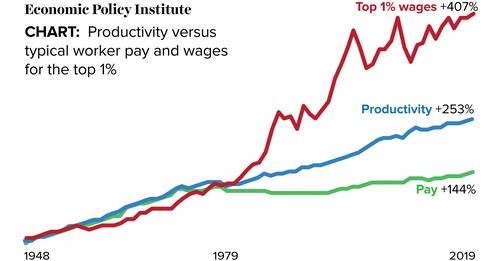

Of course, this decline in living standards only applies to most Americans. The top 1% of income earners are doing very nicely, thank you.

Indeed, inequality of income and wealth has never been so extreme in modern US history. The top 1% of American wealth holders now take 31.8% of all household wealth compared with 23.5% in 1989, while the bottom 50% of wealth holders have just 2.8% – down from 3.7% in 1989. According to the Federal Reserve, inequality of household wealth in the US has never been higher during and since the COVID slump.

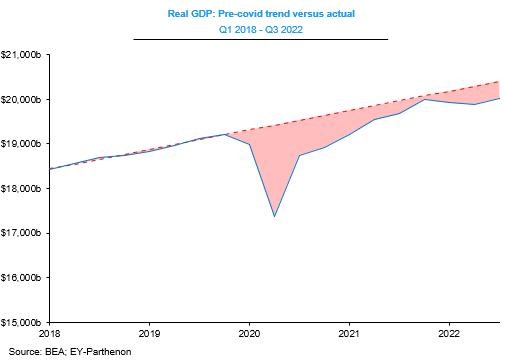

It’s true that US real GDP increased at an annual rate of 2.6% in Q3 2022, up from a decline of 0.5% in Q2 – so officially there is no ‘technical recession’ ie two consecutive quarters of contraction – yet. But year on year growth (compared to Q3 2021) was just 1.8%, the same as in Q2. And excluding inventories and government, sales to domestic consumers rose only 0.1% on the quarter and slowed to 1.3% yoy. Most significant, looking ahead, the PMI business activity indicator came in at 47.3, which indicates the second fastest pace of contraction since the Great Recession of 2009.

The US Conference Board’s index of the US Top 10 Leading Indicators has had a 100% success rate in anticipating every recession over the last 40+ years. And the indicators are now on the cusp of forecasting a new slump.

The US economic recovery since the pandemic slump year of 2020 still has not got back to pre-pandemic trend growth and that was weak enough compared to pre-Great Recession. And next year the US economy will grow even more slowly (at best) or more likely go into recession.

And the US economy is supposed to be the better performing of major economies; with Eurozone already in recession, Japan crawling along (as usual) and the UK heading for a deep two-year slump according to the Bank of England. In the drive to reduce inflation, the Federal Reserve continues to hike its interest policy rate, forcing up the cost of borrowing both for households and companies. And this is at a time when business debt by any measure is at highest historically.

No wonder the incumbent Democrats face defeat in the mid-terms, despite the lunacy of the Trumpist Republicans. But the Republicans also have no answer to the long-term relative demise of the US capitalist economy.

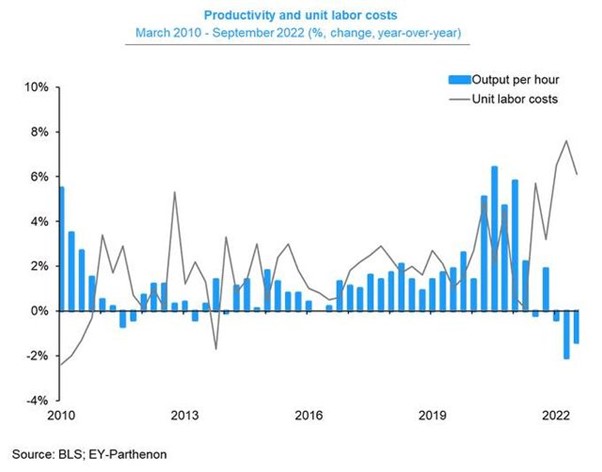

Economic growth depends on two factors: more employment and more output per worker. And right now it is the latter that matters. But the productivity of labour is falling in the US. In Q3 2022 there was a -1.4% yoy fall, making three consecutive quarters of yoy decline, the first such instance since the deep slump of 1982. So even though wages are rising at only just over 3% compared to US inflation of 8% plus, falling productivity is squeezing company profits as labour costs per unit of output rose by over 6% yoy.

The fall in productivity is a major factor in inflation because production is not responding sufficiently to consumer and business demand. The productivity slump could only be reversed by a sharp increase in productive investment in new technology and in human skill training. But US business investment is in a long-term slowdown.

Government investment, even after the limited Biden infrastructure program is nowhere near enough to compensate for slowing capitalist sector investment.

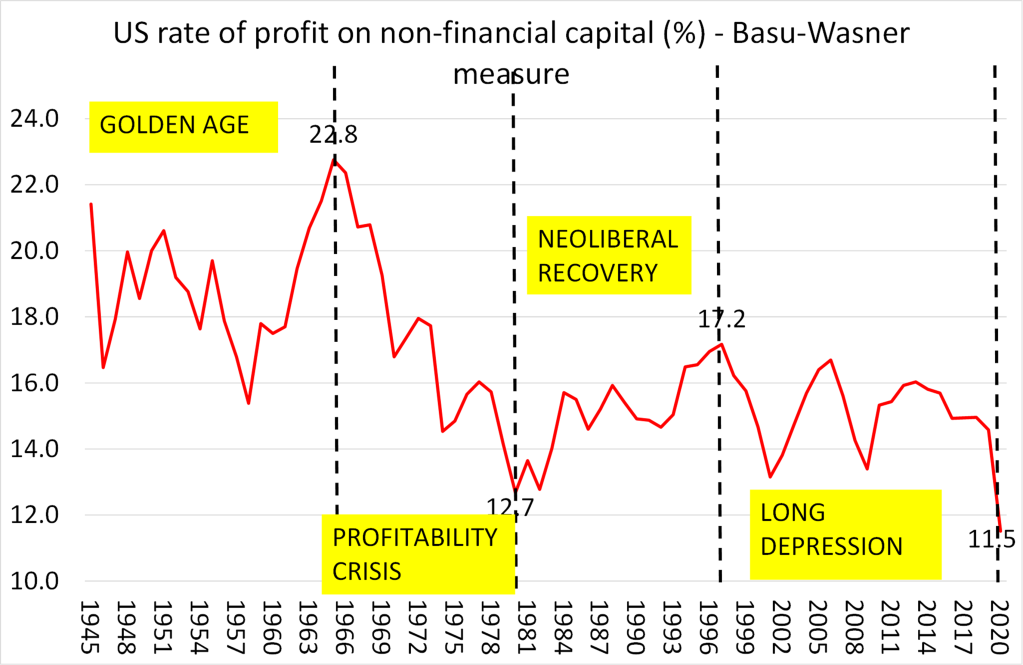

Businesses do not invest productively unless the profitability of such investment is high and/or rising. And that has not been the case in the 21st century. Even the big media companies that have led the profit bonanza since COVID are now seeing falls in profits. For most US companies the profitability on capital investment has been falling.

The only way to restore a sustained rise in profitability is through what Marx called the destruction of capital values, namely a major slump that clears out the weaker sections of the corporate sector and recreates a ‘reserve army of labour’, with unemployment rising by double digits. The Fed’s policy of increasing the cost of borrowing may well double the current unemployment rate over the next two years, but even that may not be enough to create new conditions for profitable investment. So the US economy is likely to totter towards the 2024 presidential election with the prospect of the return of the Donald.

Thanks Michael. Of course, I agree. The only thing I’d maybe add is the significance of personal debt within the US economy (average about $50,000 per person), which increases the significance of interest rate hikes, but often seems to be under-estimated in economic commentary, both in the US and here in Britain. Which – again predictably – takes me to the massive socio-economic and political importance of housing, on both sides of the Atlantic. I was in the US for the second half of 2021 and saw the very ambitious, but potentially genuinely transformative, Build Back Better agenda crumble in Biden’s hands. If, as looks likely, the Democrats take a hammering today, I’ll remember that moment, when, for example, a $150 billion investment in “affordable” housing was sabotaged by the fossil fuel lobby, personified by Joe Manchin. Flat-lining and falling wages are the key variable for working class people, but combine that with a dysfunctional housing system and the Return of Trump becomes entirely predictable.

The only solution I see for the USA right now that doesn’t involve a major crisis or a revolution is the destruction of the middle class and its inefficient labor productivity and individual capitals, i.e. an intense and sudden process of centralization of capital. Inequality is high, but not high enough by capitalist standards: it can still go much higher (and will go much higher).

The Americans already have a name for this process (which, for many of them, is in progress since Reagan): Brazilianization (of America/USA).

As for the mid-terms, I’m not an expert on the American electoral system and, since it is not a one person, one vote system, it is complicated for the polls to get it right, but the day Biden was elected even the dyed-in-the-wool pro-Democrat political pundits gave the House as lost because they predicted a majority there by 20-50 seats, and they won by only 8. Biden’s only hope is to somehow retain the Senate, according to those same sources.

The realistic expectancy is that Biden/Democrats will lose both houses – the Congress and the Senate – and will become what the Americans call a “lame duck President”. Historically, lame duck presidents only have margin of maneuver on the only subject that is historically bipartizan in the USA: foreign policy (wars). Expect Biden to go all-in in Ukraine and Taiwan after he loses these mid-term elections.

Biden is not a lame duck in any meaningful political sense until his successor is chosen. Clinton wasn’t a lame buck after the 1994 elections and Obama wasn’t a lame duck after the 2014 elections. Neither of them were irrelevant after the Republicans took the legislature nor will Biden be. Biden’s real problems are that he is a mediocrity who couldn’t provide solutions to the irrationality of capitalism in the first place (admittedly an impossible task, but he applied for the job after all.) And in the second place, the Democratic Party is neither a programmatic party nor a genuine opponent of the Republicans, including Trump. Biden is of course following Trump’s anti-Iran and anti-China wars while adding the Russia war, while he is not undoing Trump’s only real achievement, lowering taxes on the wealthy.

To be fair, the nonsense about “lame ducks” is a commonplace cliche, popular largely because it sounds realistic while confusing all analysis. Nonsense is a form of propaganda in its own way, useful for drowning out sense. If having the legislature in the hands of your enemies made you a lame duck, Lula is a lame duck from day one. What then is “Brazilianization?”

The impression that the problem with people’s livelihoods is inflation is a close cousin to the proposition that their problem is taxes. Although it may seem obvious if you stop to think, most people are underpaid, not overtaxed. They are underserved by the government, so they are also undertaxed in that sense, to be sure. Similarly, most people’s problem is that they are not paid enough, not that their capital is losing its value through inflation. Similarly, they also suffer from inflation keeping their nominal wage increases from being as substantial in real terms—-with the significant exception of the previously unemployed/underemployed/lowest wage workers. (This group is the special target of the Federal Reserve because lowering labor costs is deemed by the Fed to be the key to restoring profitability, or so it seems.) It’s true inflation is increasing housing, but then, housing has been undergoing asset inflation for a long time.

Since Biden withdrew from Afghanistan all the bourgeois media has been universally against Biden. (Crybaby Trumpers have whined that all the media was assassinating Trump but they lie: Fox News et al. are mainstream mass media and were always pro-Trump.) Like the largely imaginary crime crisis and immigrant crisis, the inflation crisis has been hammered at as part of the movement to the right of the bourgeoisie, some of whom are the owners but the rest are customers of the mass media, buying audiences for indoctrination into a right view. Inflation is bad, but in politics it promotes class collaboration with the bourgeoisie, as “we” are all consumers together, right, with a common interest supposedly. It is unemployment that truly undermines class solidarity and is a true catastrophe for society.

The difference is that Bill Clinton presided the American Empire during its territorial pinnacle (in my opinion, the American Empire reached its greatest territorial limits in 1998 or 1999), right after Russia became a vassal, in 1996/1997 (Yeltsin called Clinton begging for the rigging of the Russian elections of 1996 in order to avoid the Communists coming back to power). During Clinton, it really looked like we were living the End of History and that the American Empire would last for a thousand years.

Those times I remember well, it felt like it didn’t matter who was POTUS and which party was in power in the USA: it looked like a well-oiled machine that kept going on autopilot. It was a true Capitalist Orchestra.

Brazil is a completely different case from the USA. I won’t delve on why Lula is not and will not be a lame duck president because this comment would be too long, but, long story short, there’s an abyss of difference between Brazil and the USA. The term “brazilianization” merely encapsulates the economic and societal decline of the USA, not the fact that the superstructures of the USA will become identical to Brazil’s; it is the process through which the USA will become a Third World country (at the social level; it will always be a First World country at the military level).

Tax is not robbery, as the right-wingers claim. Tax is the privilege that emanates from imperium, i.e. the monopoly of violence, which may or may not be held by the State. In economic terminology, tax is the form of generation of wealth by the economic activity of producing violence, that is, the fruits of the labor of the warrior class (a process which probably brought the end of primitive communism and gave birth to ancient slavery) or, in the case of a historical State society, the police power of the State. That’s the correct, scientific definition of tax.

The problem with the USA nowadays is not the excess of immigrants, but the lack of them. Birth rates in Latin America have plummeted this last decade, and the American Empire lost dynamism after the collapse of 2008. The American Left argues, with reason, that mass immigration to the USA was key to the building of the American Empire, what makes it exceptional. Hence, they argue, mass immigration must come back in order for America to “feel young again”. They’re wrong in the sense that entropy can be reversed: there will never by another end-of-18th Century for America; the era of plenty immigrant labor is coming to a quick end.

vk: “the realistic expectancy is that Biden/Democrats will lose both houses – the Congress and the Senate – and will become what the Americans call a “lame duck President”.

Wrong two counts: “realistic expectancies” have nothing to do with the outcomes, and lame duck refers specifically to an official who has lost his/her bid for reelection and continues to occupy the office until the winner is inaugurated.

PS: Never heard the term “Brazilianization” used to refer to trends in the US domestic class relations. Heard “third world-ization” used to refer to the attack on workers’ living standards

vk wrote “Those times I remember well, it felt like it didn’t matter who was POTUS and which party was in power in the USA: it looked like a well-oiled machine that kept going on autopilot. It was a true Capitalist Orchestra.”

In my memory, the party that impeached Clinton certainly thought it mattered who POTUS was. The Contract on/with America certainly found policy differences. The hysteria about gays in the military within days of Clinton’s inauguration (complete with dark threats about irate soldiers as I remember,) claims that Hilary murdered Vince Foster, Clinton smuggled coke through Mena airport in Arkansas, the notion that this was well-oiled seems to me preposterous.

The production of violence seems to me to *not* be generation of wealth. Extraction of surplus, yes, but as stated, this seems to me nonsense. Feel free to assume the scientific definition of tax is beyond me.

The notion that profit in general is derived from superexploitation also seems to me to deny the reality of exploitation in the Marxist sense, the purchase and valorization of labor power at the market price, rather than below the prevailing wage. This seems to me to be close to the theory that excessive interest, usury, is the great failing of capitalism, fixable by reform. But, then, for that matter, I though US leftists believe US industrialization was fostered not by low waged of immigrants, but by the relatively high wages of the US workers. This drove capital accumulation in labor-saving devices, fostering economic growth.

@ Anti-Capital

The term Brazilianization certainly exists and is used by Americans. It is not that popular, but it exists and is used.

@ stevenjohnson

Of course that, as a Two Party system Republic, the USA is destined to have perpetual opposition kabuki, even when it is at its apex (i.e. during Bill Clinton).

Tax is not profit. In fact, profit can (and is) taxed. The difference between taxing and robbing/stealing is that the latter is a marginal social phenomenon, a collateral effect of the system, while the former is dominant, because without the State, there can be no free market.

Unless you’re talking about below subsistence wages, there’s no problem with the concept of exploitation and profit in Marxism. Profit is value by another name, and is socially expressed when amplified reproduction happens in capitalism. Amplified reproduction is reproduction beyond a certain point, that is, there’s no ontological difference between simple reproduction and amplified reproduction: amplified reproduction is simple reproduction beyond a certain point – this point is determined socially, that is, by the initial capital M invested by the individual capitalist (or the initial social capital M, if we’re talking about the capitalist world as a whole).

vk wrote “Unless you’re talking about below subsistence wages, there’s no problem with the concept of exploitation and profit in Marxism. ” Superexploitation I thought did refer to below subsistence wages, the average wage needed to reproduce the working class in a given social formation. Perhaps it is foolish of me, but I thought this included meeting the historical and moral standards of living sufficient to induce/encourage/allow parents to contemplate having children in the first place. There is both absolute and relative exploitation. I tend to believe that the growth of the productive forces under capitalism, just as in other modes of production permitted a general increase in population and that some parts of the working class has by comparison an objective rise in living standards. Mastering the powers of nature has some benefits. But I also tend to believe that on the world scale, capitalism does tend to push wages toward the level needed to reproduce labor power, which is the immiseration thesis. The historical justification of the capitalist mode, raising the productive forces, though, is increasingly failed because production for profit is increasingly incompatible with the ever more complex production process, which is ever more collective, more social yet not socialized. That’s capital becoming a fetter on capitalism, so to speak. The inevitable disparities in wages throughout the system, generated by the anarchy of production, are compounded by the invisibility of relative exploitation, though.

So, yes, I tend to think that viewing superexploitation is below subsistence wages, but no, it’s not the main driver of profits/surplus value. The infamous demographic transition in supposedly advanced economies is I suspect an indicator that relative exploitation there has impaired the reproduction of the working class in the advanced countries. The spread of declining birth rates to everywhere is I think an expression of the decay of the capitalist system worldwide. And the population crash in Russia on capitalist restoration or the depopulation of so many central and eastern european restorationist regimes is equally a symptom of capitalist failure. And so too the alarm at the aging of the Chinese labor force felt by the capitalist roaders in China.

It seems like there are some really bitter pills to swallow here. Capitalists will see the value of their assets plummet which is OK for me, that’s the game they are playing. However, does this mean that there are no other Marxist options on the table for workers in the destruction of capital values than the misery of unemployment?

It also seems you are promulgating increase in productivity, which in my book is a bitter pill for the environment, requiring replacing human labour with fossil fuels or renewable energy generation requiring heavy mining of scarce resources.

In the vast theoretical framework that you encompass, are there any solutions for economic instruments and policies that can create a feather-bed landing for workers AND a reining in of destructive fossil fuel burning and resource use?

The solution, for Marxism, is a revolution.

The problem with revolutions is that:

1) they’re very destructive, in all senses of the word. The American Revolution of 1776 resulted in two decades of recession and mass poverty;

2) they only arise in moments when all the possibilities of the dominant mode of production are depleted. In social terms, that means moments of the most absolute and widespread desperation of the dominated classes;

3) #2 not being enough, it is also necessary for the revolutionary class to have class consciousness, i.e. it has to be fully organized and mobilized in a moment of the most absolute desperation and poverty. It has to keep their head above the mayhem;

4) even when all the conditions are right, it still has an almost negligible chance of success, because the ultimate moment of every revolution is a military war. Military wars are won by the strongest, not the one who’s in the right side of History.

So, no wonder revolutions are rare even by the standards of History. But they do happen and Marx demonstrated they must happen if we’re speaking about the Historical period of Humanity.

The third bitter pill. Thanks for that. If you had to choose between unemployment and revolution where would you go? I am a middle class pussycat. I think I’d sit my life out in unemployment and wath with bitterness as the system destroyed itself.

After the Falklands war, a BBC crew came across a ranch house which stood out on the island. They met a couple from California. In reply to a question as to why they had relocated to this god forsaken place, they replied it was the furthest inhabited point distant from both Washington and Moscow. They wanted to avoid war, but war came to them. Asked what they were going to do now, they said return to California on the first available flight, informing the BBC crew that living on that island had been hell compared to California. The moral of the story Stephen, in the face of great historical events there is no place to hide.

The Bureau of Economic Analysis, BEA.gov, shows very high profits for nonfinancial companies — https://fred.stlouisfed.org/series/NFCPATAX — They increased from 2019 Q4 to 2022 Q2 from $1.127 tr. to $2.107 tr., increasing by 89% in 30 months. The graph shows a dip due to the pandemic, if one takes the pandemic dip to the now peak, profits jumped by 139%. Another source is BEA Table 6.16D, and nonfinancial corporate profits appears at line 13, they rose from $1.290 to $2.237 tr. over the 2019 Q4 to 2022 Q2 period, 30 months — that’s an increase of 73%. Bloomberg news also ran an article in August about high corporate profits, and Robert Reich linked to it at his site. I think the economy may tank, for Keynesian reasons, aggregate demand will drop terribly. A look at the BLS graph on the CPI shows that inflation has risen 0.16% in 3 months, which annualized is 0.64%, nearly flat. I wonder if the stock values will rebound now. Also, I recommend a site, RealTime Inequality, run by U.C. Berkeley economists. Not perfect, but very interesting, one can choose various types of income and population, for wealth and income. But mainly, how does M. Roberts answer these Fed Fred graphs about corporate profits?

Total profits and profitability of capital are not the same

Silly me I thought the Supreme Court ran the country.

There is no universal franchise in the USA thanks to Republican disenfranchisement at state level, gerrymandering and voter obstacles if not intimidation. Doesn’t stop the ‘democratic’ USA preaching to the rest of the world. In reality it is Republicans who steal elections, but hey, blame your opponents for your own crimes.

In the 1980s after the collapse of industry in the North the state intensified the war on drugs to contain the surplus African-American population and incarcerate them turning abprofit doing so. After 2008 and the growth of a surplus white population and its impoverishment, the state via the Republican Party fed these workers the toxic diet of white supremacy, misogyny and the comfort of militant Chritianity to contain them. Trump understood this and exploited it.

Finally guess what the average age of the president and the Dem Congress leaders is? 81 years old, says it all about this ossified party.

Elections for the floating crap called government decided by razor thin margins. looks like that 15% that think the Neolithic slave state should respect a woman’s right to choose were enough to keep the demi-shits and repo-shits in a viciously twisted 😳 embrace.

every 2, 4 years i feel like I’ve 🚶 into a particularly vicious no rules fight… on a friend’s TV. i wander in and out, catching glimpses of something that offends me.

others seem invested… i see it as vicarious sadism, masochism….???

Yesterday, a stranger exhorted a Mcd circle of strangers to VOTE. i told him I was a Utopian…Whom did he suggest i VOTE for?

Republican.

?they’re not Utopian.

He 🚶 away muttering Utopian? i haven’t heard that word in ages.

i did leave half my self identification off …

with friends, characterize myself Utopian Anarchist.

….🦧

The results of the elections are not 100% out yet, but a clear picture can already be taken: the Republicans will probably take the Congress by 2 and the Senate will be retained by the Democrats by the vice-POTUS’ Vote of Minerva.

If these results are confirmed, they’re amazing news for the rest of the world except Western Europe and Japan, and specially for Latin America: they would confirm the USA is in stasis.

The more the USA stays in stasis, the more it will decline without a major risk of a global war and a nuclear fallout. Couple that with a Russo-Ukrainian war that is taking just the right amount of time, and the result is that the Western Civilization will continue to decline to the benefit of the so-called Global South but more importantly socialist China. The more the capitalist world destroys itself without hurting the socialist world, the better for humanity.

Contrary to common sense, Greco-Roman-inspired republics are inherently unstable and usually end in catastrophic and tragic civil wars. They tend, mathematically (limit), to political-ideological polarization, fed by the system itself, which infantilizes its adult population to think everything is a game (the ludic aspect of the voting system, which resembles a game of gamble) and, overtime, leads to the formation of two polar opposite groups (in Rome, it was the Optimates vs. the Populares; the Greek poleis were plagued by numerous civil wars from political polarization) whose sole purpose is to defeat the other side. These artificially created poles are unstable themselves, because they are the amalgamation of numerous ideologically different subgroups, so, even when they win, they will eventually lose, because it will fragment again. That’s what we’re observing in the present-day liberal republics, which, as an inheritance of the French Revolution, are all, without exception, inspired by the Roman model.

Don’t believe much of this, after the first paragraph of near-term projections, is factual.

In the second paragraph, the US is not in “stasis” in the original Greek sense. In fact, the US is fairly steadily on track to imperialist war and the renovation, so to speak, by the bourgeoisie of the old political order. The rich are turning away from the old forms of bourgeois democracy and their employees in the political parties, the commercial media and the policy institutes are dutifully following.

There is a huge overlap in the policies of the Democratic and Republican parties, especially on geopolitical and economic issues. Culture war, so-called, is something else, but that is about dividing the working class in favor of cross-class collaboration with select bourgeois and petty-bourgeois misleaders.

There is a better case to make for the existence of a national bourgeoisie than for either cultural revolution *or* cultural counterrevolution from thought leaders in the cure of souls.

In the third paragraph, the US drive toward imperialist war is not an accident which can be avoided by paralysis at the top. When it comes to imperialist war, there is no paralysis, no “stasis,” no polarization, but merely tactical disagreements. Dirty politics in the personal rivalries are not epochal divisions in the ruling class. The US has launched hybrid world war III against Russia. The risk of nuclear war is already here.

In the fourth paragraph, “Greco-Roman” is nearly as ideological a construct as “Judeo-Christian.” Sparta was notoriously stable even in Greece itself. Further, the evolution of confederations terminated by Roman conquest exemplified a new type of “stability.” The Roman version of Republicanism, lasted for centuries. If that is instability, an individual’s entire life is nothing but an unstable arc. The notion that US politics is characterized in most districts by polarization is simply wrong: Most are de facto one-party states. Historically, the US is usually dominated by a single party, the Federalists in the beginning, the Democratic-Republican, the Jacksonians, the Civil War Republicans, the New Deal Democrats, etc. The two-party system in the US is basically, Ins and Outs. The Outs are more a relief valve for disgruntled “elites,” (the rich and their employees and their hired managers,) than an oppositional party. The US political system is so characterized by one-party rule in most cases genuine polarization is indeed a crisis. The classic example is 1860. But that resulted in one of the last bourgeois revolutions, arguably the last great bourgeois revolution, not in a free ride for the “Global South.”

Observing the last graph, I find interesting the separation that Basu-Wasner makes between the “Corporate Business” and “Nonfinancial Corporate Business” sectors. Because this modifies the profitability peak of the “NEOLIBERAL RECOVERY”. In the usual presentations the neoliberal peak is 2006, and here the peak occurs in 1997. The recovery after the 2001 recession does not reach the 1997 peak, so the great recession 2008-9 is seen to be preceded by a change on the trend line generated in 1997. The recovery after the great recession is anemic and would end at the bottom of the second post-war period in 2020.

I say this because there is a discussion about whether the 2008-9 crisis is preceded by a more or less long drop in profitability or not. More specifically the idea of whether the law of profitability explains only the general historical trends (accumulation, product and productivity in the long run) but not the recurring crises of capital. I believe that these data would reinforce the idea that Marx’s law of profitability could explain both cycles and trends in the history of capitalism.

I agree with this conclusion and it is one that I have been pushing in my papere etc.

No firm conclusions about the rate of profit can be drawn without the inclusion of circulating capital. Fixed capital tells only a partial story. Given the acceleration in turnovers into 2008 due to globalisation and its effect on circulating capital, most emphatically the peak in 2006 equalled 1996, when the rate of profit is investigated as it should be and not confused with the crude rate of return.

You know I expect bourgeois academics to hold on tight to their theories but Marxists not. It is no longer permissable to use the rate of return as a surrogate for the rate of profit when the formulaes for both turnover and circulating capital are now available. History is not kind to dogmatism.

Except the trend lines for ROP calculated on fixed capital, and fixed plus circulating, closely match, paralleling each other, including peaks and declines– and since the circulating capital is indeed recuperated in each transaction, but the rate of profit is calculated on the entire capital “sunk” into investment, this makes sense.

The trends are the similar only because they share the same numerator ie profit, but there relative motion differs in that the peaks and troughs vary because of the more volatile movement of circulating capital. As the saying goes, best to use a scalpel rather than an axe to dissect a body.

Brian,

I simply commented on a graph but did not make any definitive conclusions. I’ve used the potential “would reinforce” in the last line for precisely that reason. If we assume that the data is close to reality, then that conclusion could be reached. But there are so many presentations of the profit rate that at this point I am a bit dizzy myself, ;).

However, I find some of your objections somewhat strange:

1) Indeed: the rate of profit is directly proportional to the rate of surplus value and inversely proportional to the composition in value of capital and to the turnover time of circulating capital. But empirically it is not possible to deduce a greater reduction in the turnover time of circulating capital in 2006 than in 1997 due to the “effect of globalization”. The growth rate of exports of goods and services is in fact higher in 1997 than in 2006: 9.76 vs. 8.64% (I took data from World Bank). As of that year, it slows down sharply, ending in the collapse of 2009. After that, it will tend to grow more or less at the same rate as world product, so that international trade as a percentage of world product reverses the “era of neoliberal globalization” and tends downward.

2) The reduction of the turnover time of circulating capital, that is, the contraction of the total production time (production time plus circulation time) affects profitability through the growth of the annual mass of surplus value. The same capital will rotate more times in a given period of time, so it will produce and realize more surplus value, say, in the term of a year. If the data that Basu-Wasner put in the numerator reflects the annual mass of surplus value, even in an approximate way, I would not see your objection as valid. I repeat IF.

3) Adding constant circulating capital (and variable capital) into the measurement should produce lower profit rates not higher.

4) In the same way, if we put something in the numerator that is close to the Marxist concept of “business profit” (taking into account taxes, interest, etc.) the resulting rate of profit will be lower. But the important thing is the long-term trend that would not change.

5) Finally, I would like to point out an issue. It seems logical to me that an attempt should be made to calculate profitability by putting in the numerator the “total surplus value” (without distributing) and in the denominator some approximate measure of the constant fixed capital depreciated and adjusted for inflation. This gives an approximate idea of the Marxist division between productive and unproductive capital, it also helps us to determine if the rate of profit falls for the reasons that Marx put forward: an increase in the organic composition of capital. However, this does not reflect the participation of the unproductive sector in the distribution of surplus value, especially the financial sector and the state. The reality is that although capitalist economic growth is determined by the accumulation of the productive capitalist sector, individual capitalists do not distinguish between a productive and an unproductive investment, they simply look at the return on that investment. That is why some Marxists like Alan Freeman suggest that we should measure the “finished” rate of profit as Marx suggests in the fifth section of the third book. This is formed as an average of all the capitals including the unproductive ones. This gives us a better approximation to the profitability of the capitalist productive sector whose business profit decreases due to the participation of the unproductive sector. Among other things, Freeman finds that the “neoliberal recovery” (in the core capitalist countries) does not compensate for the growing weight of the unproductive sector, so the “finished” rate of profit continues to fall.

Your comments are very profound and well-reasoned, too full to deal with here. So, I will limit my comments. The formula for turnover is GO/GVA+(GO-GVA)/GVA where GO stands for gross output (total sales) and GVA for gross value added (final sales). Is it accurate, as accurate as the data on which it rests. Is it sensitive, yes it reveals anomalies with the data. Finally, does it pass this test – is an acceleration in the rate of turnover revealed by the formula associated with the upward phase of the business cycle and therefore a rise in profits – always. Does the movement in the rate of surplus value once it is adjusted for turnover predict the movement in the mass of profits, always. There are numerous graphs on my website proving this especially when I use sectors such as non-durable manufacturing with its relatively high rates of turnover.

I only use non-corporate pre-tax profits as the numerator. Pre-tax because that means the profit trend is not confounded by changes to the tax rates and because it is the closest metric to enterprise profits which inform investment decisions and therefore the state of the economy. Also, as a legal category, corporate covers both production and commerce. As for pre-tax profits this is the net profit that emerges from the profit and loss account wherein is found that element of unproductive labour which reduces the gross profit transferred from the production account into net profit departing for the balance sheet. As I have pointed out the capitalists themselves see unproductive labour as a cost which is why it appears on their profit and loss accounts.

In the 1970s when it first became popular to extract rates of return from the SNA various Marxists assumed that turnover could not be calculated. So, it was swept under the carpet, accordingly what is out of sight is out of mind. This is no longer necessary, but it seems old habits die hard. Hence my exasperation for which I apologize.

We now have the Rossetta Stone or formula allowing us to more accurately interpret the data by reducing annual wages into variable capital. By providing the v, we now can calculate s/v, c/v and s/(c+v) for the first time rather than use annual wages as a substitute for v which is highly inaccurate.

Brian,

Now that I read your response to Anti-Capital, I see that you are actually referring to raw materials prices. So I don’t understand why you raised the question of the speed of turnover of circulating capital in your first answer. As I said before, the increase in the speed of rotation acts positively on the rate of profit by increasing the annual mass of surplus value. As regards the price of raw materials which tends to fluctuate more violently (beyond the very long-term trend of deteriorating terms of trade), you are absolutely right. Indeed: I think we can ignore constant circulating capital when studying long-term trends, but we necessarily have to incorporate constant circulating capital into profit rate measurements to study the cycle. Otherwise we cannot establish with any precision the “peaks” and the “valley bottoms”. Having said that: do you have data on the rate of profit for the period that includes constant circulating capital that you can provide me with? Thanks.

theplanningmotive.com contains innumerable articles plus spreadsheets. Circulating capital is about more than power and materials it includes outsourcing, software etc in its modern setting making it about 30% the size of fixed capital with regard to the non-financial corporate sector in the USA.

“No firm conclusions about the rate of profit can be drawn without the inclusion of circulating capital. ”

But firm conclusions have been drawn. So where for example do your calculations differ qualitatively from say the calculations Michael Roberts produces. Do you calculate a peak where he produces a trough? Is there a difference in longer term trends?

“The trends are the similar only because they share the same numerator ie profit,”

That’s a little hard to buy as we’re talking about ratios, so both the numerator and the denominators have to express similar proportions for the trend lines to run “parallel” to each other.

Any doctor offered the choice of two thermometers the first accurate to one degree the sond only to two degrees will choose the more accurate one, despite the fact that both will record rising or falling temperatures. Why should we Marxists forgo using the more accurate tool, particularly when it reveals that the two rates diverge and converge when either the peak of the cycle or the trough of the cycle is reached. This information is vital when determining turning points in the cycle. I will prepare a graph yet again on my website to demonstrate this.

My last on this: to reply to UCBP– the issue with the falling rate of profit is not the empirical value at any moment, but the TENDENCY, the trend over time. For the “turning point” calculations to have significance, the issue isn’t the numerical value, but the approximate time of the turn. I’ve looked at UCBP’s comparison graphs of the ROP as he calculates it and as others calculate it and there doesn’t seem to be any opposition between the two TRENDS, including turning points.

There is no ROP below which capital cannot recuperate itself; the critical issues are the steps that are taken by classes in response to the “turning points;” what steps the bourgeoisie takes in response to a downturn which amount to offsetting, or attempts at offsetting factors. In short the exposure of economics as class struggle.

The US Dept of Commerce publishes a survey of manufacturers https://data.census.gov/cedsci/table?q=AM1831BASIC&tid=ASMAREA2017.AM1831BASIC01 and a Quarterly Financial Report https://www.census.gov/econ/qfr/ that provide substantial data for determining the trend of profitability.

It appears from the US election results that economics had little to do immediately with the political dynamic in that country. Nevertheless commentary here has inappropriately devolved into economic analysis, and would result in “economism” without correction, ie a return to a political analysis.

“Stasis” is illusory, what we have seen three times in a row – 2018, 2020, 2022 – is the majority rejection of radical right regime change by “constitutional-insurrectionary” means, that is, by a combination of legal and “extra-legal” means, since it is unlikely that the insurrectionary coup leaders around the Trump clique will suffer few real and crippling legal consequences. What they do receive will be but Badges of Honor, swag to be strutted about in front of the fascist comrades that will lend them more “street-(fighting) cred”. The “Beer Hall Putsch” phase has concluded.

Instead the dynamic in the USA will be the continued decay of the bipartisan regime, already deep, through temporary accelerations and decelerations. The mechanics involve the continued degeneration of the Republican Party as a cadre incapable of of ruling in the interests of US capital as a whole – including foreign capital parked in the USA – the whole point of having a capitalist state. That fact measures its depth, and as go the Republicans, so goes the bipartisan illusion of “two parties”, the bipartisan system itself, and with it, the Democrats. They know this and this is why they are desperate to “save the Republican Party” per Nancy Pelosi’s immortal words. Hence the deliberately did not compete hard in Florida so as to boost DeSantis in a “landslide” (out of all proportion to Republican results elsewhere), to build him up against Trump. The same has always gone for Texas, because without these two big states, the Republicans are toast at the Federal level.

The “Red Wave” turning out to be a dud actually intensifies the bipartisan crisis, as now the House Republicans must keep the insurrectionary radicals onside, and they are larger in number than than McCarthy’s House edge. So the bipartisan system will get more, not less, “crazy” dysfunction that will further damage it. At the same time the USA is successfully offloading the negative effects of the oncoming recession onto the world system, and it is reasonable to expect the recession in the USA will be less severe in its effects, compared to the rest of the world.

So I will predict that the Democrats will get a similar result in 2024 despite them “owning” the recession. But beneath the veneer of “stasis”, will be a further splintered Republican Party that can’t can’t without the far rightist insurrectionary vote.