Apart from inflation and war, what grips current economic thought is the apparent failure of what mainstream economics likes to call ‘globalisation’. What mainstream economics means by globalisation is the expansion of trade and capital flows freely across borders. In 2000, the IMF identified four basic aspects of globalisation: trade and transactions, capital and investment movements, migration and movement of people, and the dissemination of knowledge. All these components apparently took off from the early 1980s as part of the ‘neoliberal’ reversal of previous national macro-management policies adopted by governments in the environment of the Bretton Woods world economic order (ie US hegemony). Then the call was to break down tariff barriers, quotas and other trade restrictions and allow the multi-nationals to trade ‘freely’ and to switch their investments abroad to cheap labour areas to boost profitability. This would lead to global expansion and harmonious development of the productive forces and resources of the world, it was claimed.

There was nothing new in this phenomenon. There have been periods of increased trade and capital export before since capitalism became the dominant mode of production in the major economies by the mid-19th century. In 1848, the authors of the Communist Manifesto noted the increasing level of national inter-dependence brought on by capitalism and predicted the universal character of the modern world society: “The bourgeoisie has through its exploitation of the world market given a cosmopolitan character to production and consumption in every country. To the great chagrin of Reactionists, it has drawn from under the feet of industry the national ground on which it stood. All old-established national industries have been destroyed or are daily being destroyed…. In place of the old local and national seclusion and self-sufficiency, we have intercourse in every direction, universal inter-dependence of nations.”

Indeed, we can distinguish previous periods of ‘globalisation’. There was the period of 1850-70 which saw trade and investment expand sharply in Europe and the US (after the civil war), under the auspices of the British hegemony. The depression of the 1870s to 1890s saw the end of that wave. But another wave of global expansion took place in 1890s through to WW1, as new capitalist powers usurped British hegemony. No one power established hegemony and that globalisation wave was stopped in its tracks by world war and continued to reverse through the Great Depression of the 1930s and up to WW2. Then there was a new wave of global expansion under Bretton Woods and US hegemony, before the profitability crisis of the 1970s led to slumps and retraction. From the mid-1980s and through 1990s, there was the largest expansion of trade and cross-border investment in the history of capitalism, with the US and European capitalism spreading its wings further and China entering global manufacturing and trading markets.

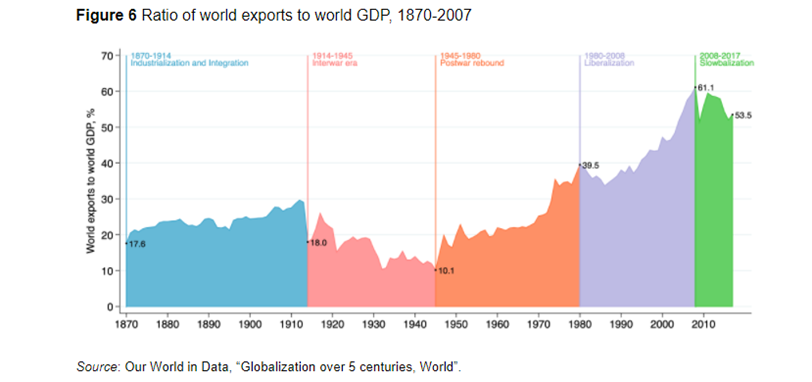

Indeed, according to the World Trade Organisation, a key indicator of ‘globalisation’, the ratio of world exports to world GDP, was broadly flat between 1870 and WW1, fell by nearly 40% in the interwar period; rose 50% from 1950-70; then stagnated until the 1990s, taking off until the Great Recession of 2009; after which, in the Long Depression of the 2010s, the ratio fell by about 12%, a decline not seen since the 1970s.

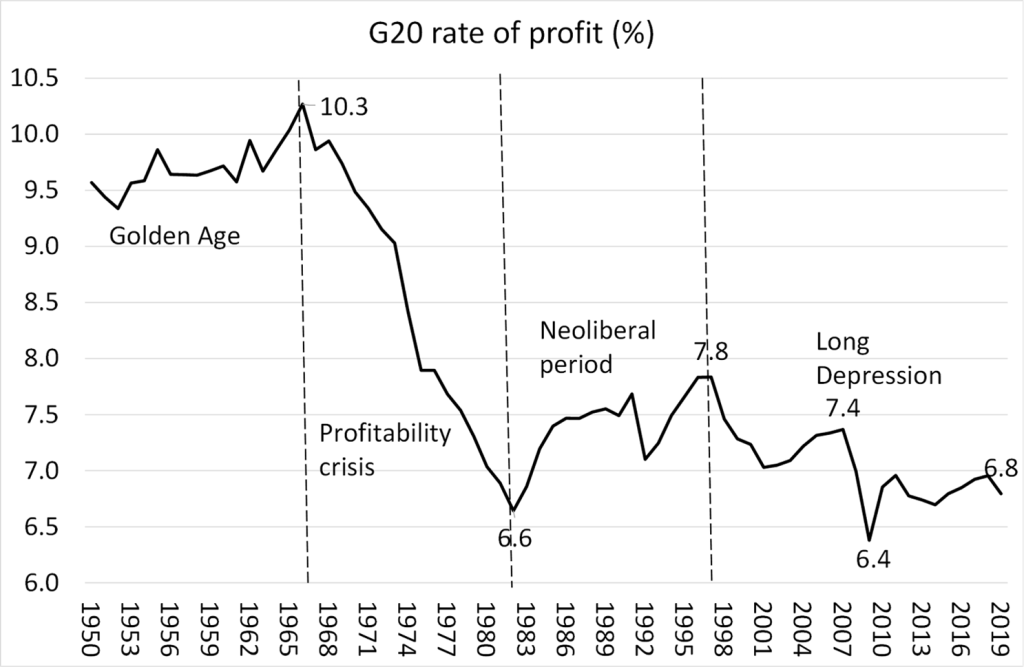

The latest globalisation wave started to wane as early as the beginning of the 2000s when global profitability slipped back.

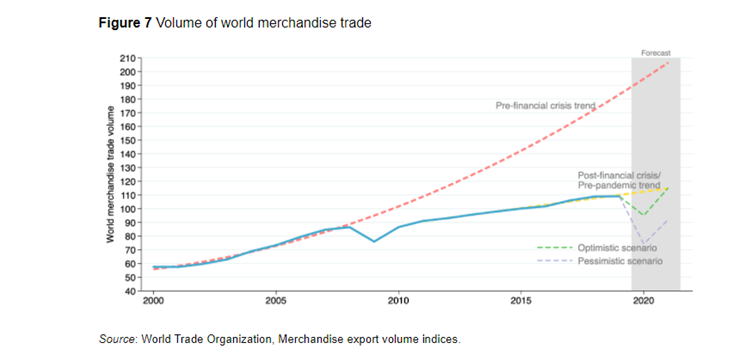

In the 1990s, world trade rose by 6.2% annually, cross-border investment (FDI) by 15.3% a year and GDP globally by 3.8%. But in the long depression of the 2010s, trade rose only 2.7% a year, slower than GDP at 3.1% while FDI rose only 0.8% a year.

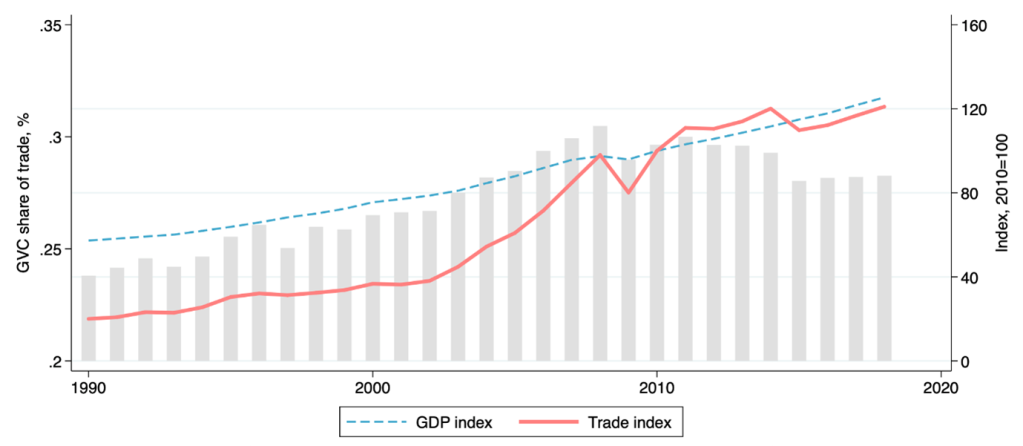

Flows of cross-border investment in physical productive assets also stopped growing in the 2010s, while the global ‘value chain’ trade (ie internal multi-national company transfers) also flattened.

Global value chain trade

Of course, Marxist economics could have revealed this outcome of globalisation. David Ricardo’s ‘thought theory’ of comparative advantage has always been demonstrably untrue. Under capitalism, with open markets, more efficient economies will take trade share from the less efficient. So trade and capital imbalances do not tend towards equilibrium and balance over time. On the contrary, countries run huge trade deficits and surpluses for long periods, have recurring currency crises and workers lose jobs to competition from abroad without getting new ones from more competitive sectors (see Carchedi, Frontiers of Political Economy p282). It is not comparative advantage or costs that drive trade gains, but absolute costs (in other words relative profitability). If Chinese labour costs are much lower than American companies’ labour costs, then China will gain market share, even if America has some so-called “comparative advantage” in design or innovation. What really decides is the productivity level and growth in an economy and the cost of labour.

Contrary to the views of the mainstream, capitalism cannot expand in a harmonious and even development across the globe. On the contrary, capitalism is a system ridden with contradictions generated by the law of value and the profit motive. One of those contradictions is the law of uneven development under capitalism – some competing national economies do better than others. And when the going gets tough, the stronger start to eat the weaker. As Marx once said, “capitalists are like hostile brothers who divide among themselves the loot of other people’s labour.” (Theories of Surplus Value Vol 2. p29). Sometimes brothers are fraternal and globalisation expands as in the late 20th century; sometimes they are hostile and globalisation wanes – as in the 21st century.

For Marxist theory, globalisation is really the mainstream word for expanding imperialism. The 20th century started with world capitalism increasingly divided between an imperialist bloc and the rest, with the latter unable (with very few exceptions) to bridge the gap to the top table over the next 100 years. In the 21st century the grip of imperialism remains and if the imperialist economies start to struggle for profitability as they are now, then they start to fight and not cooperate, laying the basis for conflict and division.

Even the mainstream is now aware that free trade and free movement of capital that accelerated globally over the last 30 years has not led to gains for all – contrary to the mainstream economic theory of comparative advantage and competition. Far from globalisation and free trade leading to a rise in incomes for all, under the free movement of capital owned by the trans-nationals and free trade without tariff and restrictions, the big efficient capitals have triumphed at the expense of the weaker and inefficient – and workers in those sectors take the hit. Instead of harmonious and equal development, globalisation has increased inequality of wealth and income, both between nations and also within economies as trans-national corporations move their activities to cheaper labour areas and bring in new technology that requires less labour.

These outcomes are down partly to globalisation by multinational capital taking factories and jobs into what used to be called the Third World; and partly due to neo-liberal policies in the advanced economies (i.e. reducing trade union power and labour rights; casualization of labour and holding down wages; privatisation and a reduction in public services, pensions and social benefits). But it is also down to regular and recurrent collapses or slumps in capitalist production, which led to a loss of household incomes for the majority that can never be restored in any ‘recovery’, particularly since 2009. The capitalist world was never flat even in the late 20th century – and it is certainly mountainous now.

Take tariffs and protectionist measures – the anathema of globalisation theorists. There has been an upward trend in antidumping and countervailing duty investigations in the last ten years (see figure below).

The Great Recession, the weak recovery afterwards in the Long Depression, the COVID pandemic and now the Russia-Ukraine conflict, has blown away global supply chains, stymied global trade and stopped capital movements.

During the 1990s and 2000s, mainstream economics (with few exceptions) lined up with Ricardo and the unblemished merits of globalisation. Just read this piece for the list of the usual suspects (https://www.theguardian.com/world/2017/jul/14/globalisation-the-rise-and-fall-of-an-idea-that-swept-the-world). In the teeth of current trends, some mainstream experts still stick to the view that globalisation will return. “It was inflation that helped create a new policy environment in the mid-19thcentury and in the 1970s. As the economic and political costs of inflation became more obvious and more damaging, it appeared more attractive to look for ways to calm inflationary pressures. For sure, the disinflationary cure — more globalisation as well as more effective government — was temporarily uncomfortable. But it drove the world to seize technical and geographical opportunities once ignored or neglected. There is, in short, a post-conflict future to which we might look forward with some degree of hope.”

One expert claimed that “Finally, call this blind faith, but the last rites for globalisation have been read several times, and on each occasion, it’s bounced up from its sickbed looking quite sprightly. Companies have been resourceful, technology supportive, and even actively destructive governments haven’t crashed it.” Sure, world trade and cross-border investment is not going to disappear and will continue to grow (somewhat) despite pandemics, wars and collapsed supply chains. But that is hardly an argument for saying the previous globalisation wave is not over.

The argument is that the profitability and inflation crisis of the 1970s was followed by the globalisation wave of the 1980s and 1990s. and this could happen again. It’s not a very convincing scenario. The 2020s looks more like the period leading up to WW1, with rival economic powers struggling to gain a chunk of profits (‘hostile brothers’). Writing in the late 1880s, Engels forecast, not harmonious global expansion as German Social-Democrat leader and theorist Karl Kautsky thought, but increased rivalry among competing economic powers resulting in a new European war: “the depredations of the Thirty Years war (of the 17th century) would be compressed into three to four years and extended over the entire continent… with an irretrievable relocation of our artificial system of trade, industry and credit.” (see my book Engels 200 p129). No return to the global expansion of 1850-70.

The Keynesians seek to return to the days of Bretton Woods with its fixed exchange rates, government fiscal stimulus and gradually reduced tariffs. The Keynesians claim that this would lead to a revival of ‘multilateralism’ and global cooperation. This apparently can restore a world order of peace and harmony. But this is just a denial of history and the reality of the 2020s. The multilateral organisations of the post-war era like the IMF, World Bank and the UN were all under the kind ‘guidance’ of US capitalism. But now US hegemony is no longer secure; but more significant, the high profitability for the major economies post-1945 no longer exists. The brothers are no longer fraternal, but hostile. The current US attempt to maintain its hegemony is more like to trying herd cats into a bag.

It’s perfectly possible to argue that for capital, “Deglobalisation would decrease the efficiency of companies by raising prices and lowering competition and that “with any reversal predicted to slow growth, a deglobalized world would be “vastly inferior” to the past 30 years of open trade.” A recent study by the World Trade Organisation, based on measuring the dynamic impact of lost trade and technology diffusion, found that “a potential decoupling of the global trading system into two blocs – a US-centric and a China-centric bloc – would reduce global welfare in 2040 compared to a baseline by about 5%. Losses would be largest (more than 10%) in low-income regions that benefit most from positive technology spillovers from trade”. Indeed, the collapse of globalisation could turn, not just into a battle between two blocs, but instead into a melange of competing economic units.

But globalisation will only return if and when capitalism gains a new lease of life based on enhanced and sustained profitability. That seems unlikely to happen this side of another slump and maybe more war.

I think globalization is a term that is not exclusive to capitalism. “Globalisation is the expansion of trade and capital flows freely across borders”, I think the word “free” should be understood as not obstructing the interests of core countries in the capitalist system (imperial countries). A term that I think is more accurate is “globalizationism”. Globalizationism is the ideological foundation of imperialism, or in other words it is the peaceful humanity version of the imperialism, and war is the violent one. So when the globalizationism ends, then the imperialism also ends, but globalization does not because globalization is still a feature of the productive forces of the 21st century.

Soviet foreign minister Vyacheslav Molotov described Stalin’s thoughts on the US plan to bomb 200 Soviet cities at once: “Stalin looked at it this way: World War I has wrested one country from capitalist slavery; World War II has created a socialist system; and the third will finish off imperialism forever.” (Феликс Чуев, «140 бесед с Молотовым».)

I think the term used by the communists to designate what you think is globalization is “internationalization” (internationalist, internationalism).

The term “globalization” is an exclusively capitalist (neoliberal).

In my view, when talking about the workers’ movement, use the terms internationalization, internationalist, internationalism. In the field of political economy, use globalization. More precisely “globalizationism” is not the ideological foundation of imperialism, but a doctrine of the capitalist class, of which imperialism use it as one of the theoretical foundation of political economy.

In soclialism, the productive forces are still globalized, and the relations of prodction are internationalized or, more precisely regionalized, automatized (Union of city-states).

The people at the World Economic Forum are wanting globalizationism to not only stop at the layer of relations of production, but also apply it to the superstructure with an ambitious plan called The Great Reset.

I would say there are three factors molding the pattern of globalization.

The populism evident in most western societies is a reaction to the globalization which saw the transfer of work to low labour cost countries. To some extent this political imperative is working against globalization.

The underlying factor driving post WWII globalization has been access to cheap labour firstly in Japan, then South East Asia and then China. As the internal cost structure of these countries rose pursuant to their internal economic development, attention diverted to the next cab on the rank. China will suffer the same fate as Japan eventually. Perhaps India will assume the mantle of the go to low labour cost country except, perhaps, for the third factor.

The third factor is geostrategic competition and re-organization. The West is increasingly freezing China out of its markets. This is partly due to the first factor and partly due to the emerging global strategic framework. And given India is attempting to straddle both emerging blocks, it may end up as a pariah state in the West. (Its internal arrangements also seem to deter western capitalists from becoming overly interested.)

At Bretton Woods, the US dollar was decided to be the global reserve currency. But Keynes had proposed otherwise: that the reserve currency should be produced by an “international currency union” (i.e. a global central bank), which would not be under the individual control of any one nation. That would in theory allow the same fixed exchange rate system that powered Bretton Woods, but without the instability introduced by placing the Americans in charge.

What are your thoughts on his proposal?

Keynes was an English economist, not a USAnian one.

But the British empire was actually one of the losers of WW2.

Fantastic article Michael, and sobering.

At least now maybe those particularly angry and dismissive of the likes of Dugin might think twice about how predictive his analysis was, in terms of national liberation struggles manifesting themselves in countries much larger and closer to the West than many would still like to believe. No one seems to have seen this coming this clearly outside of a thin group of geopoliticians.

As the multipolar world fragments the original concept of Chinese globalism comes back into the spotlight: is BRI and the alliance with the Eurasian sphere going to yield a concrete alternative to the dollar and when will it happen? Do we see a lightning blitz of BRI rapidly taking over Asia or is this still the 20-30 year project that everyone was projecting? Does Russia’s success in Ukraine in terms of winning land, resources, and decoupling from western economies signal a coming stampede as Liberal powers resort to the usual “soft power” narratives to make them feel better?

How long does it take European powers to look at Russia and gradually leave the American sphere for greener pastures? Given the big Macron win, along with Sweden and Finland going NATO, are we going to see a military boom that solidifies Europe with the West followed by increasing economic stagnation?

An extremely interesting time to be alive to be sure, but will be see anything but hardship and war for the rest of our lives?

Many Western Marxists think Putinist Russia is a fascist State because of Dugin (the founder of Russian Traditionalism), but the reality is Dugin’s influence in the Kremlin is vastly overestimated: his book used in the RuAF is his general introduction to Geopolitics, not his more ideological works; and Dugin himself fell into disgrace in 2014 after the failure to face the Maidan color revolution, losing his job as professor and, with it, whatever access he had with the Kremlin.

The reason why Dugin’s book was enshrined by the RuAF lies in the fact that, during the USSR, Geopolitics was (correctly) considered an anti-Marxist pseudo-science, i.e. a “bourgeois science”. When the USSR dissolved, capitalist Russia had to adopt Geopolitics as a substitute to Marxism in its governmental, diplomatic and military doctrines. Since there were no geopolitical theoreticians available, they had to make do with the new ones, and Dugin published the right book, in the right place, the right time.

Geopolitics was never considered an anti-Marxist pseudo-science in the USSR. Western bourgeoisie “International Relations” was, as well as the nomenclature of more Schmittan definitions of “geopolitics”. The reality is that Clausewitz was a huge influence on Marx and especially Engels, as well as Lenin, Stalin, and Mao. Years ago West Point had a competition where is asked it’s ilk who was the “best Clausewitzan” and Mao came in 2nd in the voting.

The failure of the “Marxists” in the west to understand geopolitics and to push it off as a bourgeoisie science has been it’s undoing. The line denouncing aspects of it is a clearly an Ultra-leftist interpretation. Of course Materialism and Marxism subsumes it, but it’s not a rejection of it. Dugin predicted the forming “coalition of the disaffected” and it’s playing out as described. Michael is also alluding to a return to “great power politics” albeit from an economics perspective.

Your narrative about Dugin publishing something in the “right place and right time” is apt, but for completely different reasons. Dugin represented a return to geopolitical analysis of Clausewitz and the basis forgotten in Western Marxist analysis, and a return to Stalinism (Dugin himself calls his ideology Stalinist in nature). Back in the 90’s this was simply the “spiciest meatball” to most ML’s craving an assertive nature to an anti-Imperialist struggle.

Geopolitics (with capital G) didn’t exist in the USSR because it was refuted as a bourgeois science. I stand by my source. It is a “science” invented in Germany at the end of the 19th Century with the open objective to offer an alternative to Marxism, and it states that History is the History of perpetual struggle between nations, and not between classes.

That didn’t mean the USSR could and didn’t think “geopolitically”, so to speak. It’s just that they did it in a Marxist way. There’s no evidence the Soviets ignored the reality of the dominance of the nation-States, those were the times of the Comintern at most.

The issue with “Stalinism” is much more nuanced than many think. After 1991, it became enshrined in the West that Stalinism was the cause of the USSR’s downfall because it was a Gran-Russian chauvinist project disguised as a socialist project. But the post-1991 Russians think it was the exact opposite: that the USSR fell because it was an anti-Gran-Russian project, that Russia was too generous to the other smaller republics, and that they represented a drain to the Soviet/Russian economy.

So we have two polar opposite diagnosis on Stalinism: one that states it is a neo-nazi ideology (Westerners) and one that states it is a socialist ideology.

Exactly what “greener pastures” does Russia, in or out of the BIC combination offer the bourgeoisie of the EU? Can either/or extend unlimited currency swaps to keep global trade moving in the midst of an implosion such that the decline in trade does not become catastrophic, as the Fed did in 2008-2009 and again in 2016? Can either/or provide a market of sufficient size and liquidity and most of all, security to park currency surpluses to rival the market for US Treasury instruments?

What did it take to dislodge Great Britain from the top of the capitalist pyramid? Two world wars and a great depression. Something like that will be necessary for a new capitalist power to become the linch-pin of global exchange.

There’s only one thing that can save capitalism right now: a new revolutionary technology, on par with the invention of electricity, which can rebuild the entire world with unprecedented productivity and therefore profit rates. In more technical terms, capitalism would have to initiate a new Kondratiev Cycle.

When the USSR dissolved (by inner contradictions, not because it was militarily defeated), the USA found a new lease of life by ransacking the socialist space, with Bill Clinton leaving the country with a huge trade surplus. Everybody thought it was the End of History. It lasted only 17 years (1991-2008). Nothing suggests doing the same with China would deliver the true End of History to the Western people (capitalist empire, the First World): it would have what, 30 years of breathing room at best?

Besides, we should think about what a new WW would imply. In WW2, there were no missiles and no nukes; it was the height and the end of the Hegelian Era, where absolute violence between nation-States could be philosophically envisaged as the manifestation of the most absolute form of Freedom. Nowadays, the stakes are unimaginably higher: the fate of the entire human species is on the table.

What we’re witnessing here is the end of the Hegelian Era, therefore the end of the Bourgeois Era. Capitalism only works forever in a world with infinite space and resources, but we live in a very finite world. Nowadays, the only people trying to defend capitalism (somewhat, even so in a very veiled way, in the form of the juridical fiction of “liberal democracy”) are a bunch of Postmodern, Postcolonial thinkers who posit the field of “imagination” and “uncertainty” as a new escape valve to the contradictions of capitalism and are only influential in the arts world.

people working in PSU’s love capitalism

‘’There’s only one thing that can save capitalism right now: a new revolutionary technology, on par with the invention of electricity, which can rebuild the entire world with unprecedented productivity and therefore profit rates. In more technical terms, capitalism would have to initiate a new Kondratiev Cycle.’’

However, there will be no Technological Revolution (Kondratieff cycle) that will give Capitalism more time. I will only make a single comment because I do not want to saturate the excellent blog of M. Roberts with the subject of the revolutionary cycle. And that would be unsocialistic of me. But I must comment on VK’s comment because it contains, in that single paragraph, the currently known thesis on long economic cycles both by all capitalist authors and by a part of the Marxists. That thesis says that technological revolutions generate growth. Well, this is radically FALSE.

Just two simple and irrefutable ideas, theoretically and empirically.

1.- The new technologies do not and cannot generate mass growth for any group of companies and/or countries. This error comes from Joseph Schumpeter but has already been refuted even in the capitalist academy (‘’GROWTH ACCOUNTING IN ECONOMIC HISTORY: FINDINGS, LESSONS AND NEW DIRECTION’’,Nicholas Crafts,Pieter Woltje). Why do not they do it?. Because there is no instantaneous or rapid transmission of innovation to all the companies in the market. Why doesn’t it happen? Because the companies in the market have DIFFERENT sizes. Different sizes that give them different purchasing capacities. Only large companies can buy (robotics today, for example) the new technology (revolutionary or not) and only after several decades, up to 4 decades, that technology and its corresponding increase in productivity and production reaches the latest and greatest small business in the market. That fact is happening today with the transmission of robotics: only large corporations (Tesla, Automobile, Steel, etc.) access robots and no robot is seen in the small workshops of the world. Regarding the supposed generalized growth, a single empirical evidence (there are hundreds of them) should be enough: is today’s robotics -is there any more “revolutionary” historical technology known than this?- is not giving any growth. The capitalist global economic reality and the most reliable forecasts only give “secular stagnation” with a GDP below 2% per year.

Can technology produce general growth? It is only possible in Socialism, in which all companies are a single company. That already happened in China and in real Socialism. And it is theoretically and practically impossible that it can happen in Capitalism.

2. The Kondratieff cycle, by the previous argument, is not a cycle caused by new technologies. What causes it then? Revolutions! Surprised? Briefly. Starting from the evidence: in the initial dates of all the Kondratieff cycles (detected and studied 20 cycles up to the 9th century in Europe-G. Modelski and Thompson) revolutions have taken place. In all of them. Why do revolutions affect growth? Because in all of them, to a greater or lesser degree depending on their intensity, property relations are modified. The property relations of productive capital, exactly. How do they affect them? Expanding the right of access to the means of production, that is, expanding the number of owners of productive capital. That is, companies have more partners and become larger. The time sequence of this expansion of productive capital is: Feudalism (small and family-only companies), Capitalism (private companies – with a greater number of partners) and Socialism (all citizens are partners who contribute capital via the State). Productive capital changes scale. It increases your scale in capital, employment, productivity, etc. These are the proven benefits of economies of scale. Where does the widespread growth come from? If a single company increases its size, its production will increase. If an appreciable number of companies in a country grows in size (Capitalism) the country will grow more. That happened, precisely, in the 19th century of the industrial revolution, average annual GDP growth of 1.5% versus 0.5% growth of Feudalism, with the capitalist companies of the bourgeoisie as new owners legally protected by their revolutions. And, finally, if a whole country becomes a single company (Socialism) that country will grow much more. That happened, with an average growth of 6.5% GDP per year, in real Socialism in the 20th century, in China until now, and in the Golden Age (50% of the production of countries owned by Western States ).

Therefore, and in conclusion: there will be no such Kondratieff savior for Capitalism and if there will be a socialist revolution in 2040-2050 that ends (or almost) with it.

It is interesting this conception that technological ruptures can lead to greater productivity, Productivity per worker used in terms of costs can lead to absurdities that as a demonstration I suggest you look at two types of sawmills that are presented on a website for the dissemination of products for engineering

“Tantum Tech HD” (https://youtu.be/GfAWK9LjYV4).

Looking at an advertisement for Linck Holzverarbeitungstechnik GmbH, which is presented in the first few minutes of the video, and later a conventional Chinese sawmill is shown (it seems that it was shown as an example of German excellence in relation to the Chinese). for someone like me, who is an engineer, I didn’t see any superiority of the German in relation to the Chinese, I explain why:

1) The German sawmill only works with logs of practically the same diameter, the Chinese one cuts any type of log.

2) The wood waste due to the German felling process must be four or five times greater than that of the Chinese.

3) The amount of energy spent by the Germans in transporting the mats and various machines is at least ten times higher than the Chinese.

4) The cost of the German installation is at least 50 to 100 times higher than the Chinese one.

5) The German production of cut wood is at most 4 times that of China.

6) The number of direct workers in the production of the Chinese is ten times higher than that of the Germans, but the central problem in the world is employment.

In summary: With the cost of implantation and ENVIRONMENTAL of the German sawmill, the Chinese can implant about fifty conventional sawmills and if they use the small leftovers for a steam turbine they would have a zero footprint, while the Germans will have to import gas from Siberia.

Ah, I was forgetting that in Germany there is no unemployment!

The “only” thing that can save capitalism is the thing that always saves capitalism; defeat of the prospects for proletarian revolution.

Many (most?) progressive economists use the nonsensical term ‘neoliberalism’ to describe the new historical period of globalized capitalism (a stage of capitalist imperialism) which opened in the late 1970s and 1980s. Capitalism and capitalist imperialism became truly global in those years. Including by breaking into the vast reaches of the former Soviet Union and China for the purpose of capitalist exploitation of labour and resources. The term ‘globalized capitalism’ is the perfect descriptor for the world described here so well in Michael’s article. I hope we will increasingly see the term ‘globalized capitalism’ enter into the mainstream of economic discourse and displace the nonsensical term ‘neoliberalism’.

Paul Krugman has just echoed a term that I’ve been seeing in the American media, specially the NYT, these days. It’s what I call here the theory of the Arsenal of Democracy:

“America, Again the Arsenal of Democracy”, by Paul Krugman:

The “theory” states that the USA/Western Democracies should somewhat spend everything they can to make Ukraine win the war against Russia, which would halt the advance of “authoritarianism”, thus expanding the economic space of “democracy”, therefore making room for a full-fledged economic recovery of the USA.

So there you have it: modern mainstream economics has finally found its pro-war form.

Keynes stood solidly with the educated English bourgeois gentleman who still lives on and takes the Empire’s endless, but civilizing, wars (and loot) for granted. Violence might be exogenous to the capitalist mode of production as such, but mass production of military goods and services–and their use–is endogenous to the reproduction of capitalism as a social order.

The ignoble Noble Prize winner, “democratic” Democrat, Paul Krugman, has always been, heart and soul, a military keynesian. He just never had the occasion to say so. What’s different now is that the Empire’s use of its hegemonic means of violence has once again proved insufficiently extortionate–but in the nuclear age!–to balance the books, yet extortionate enough to have put Russia in a position (surrounded by NATO nuclear bases) to make a proxy threat of using nuclear weapons for the one which the Empire has maintained since the bombing of Hiroshima and Nagasaki. Russia wants nuclear war in the same way that Ukrainians want to fight and die for NATO fascist democracy. This sort of hallucionatory war/diplomancy has been standard in all NATO’s ventures, creating, as you point out, a general state of post-modern uncertainty. Some clarity and sanity seems to exist only in China….the next in line.

….So it’s Russians and their Ukrainian brothers and sisters who are paying the price for standing between barbarism and socialism. Again.

“There was nothing new in this phenomenon. There have been periods of increased trade and capital export before, since capitalism became the dominant mode of production in the major economies by the mid-19th century.” The new thing is the mass outsourcing of jobs, mostly moving to countries where imperialist capital can enjoy cheap wages and less environmental regulation.

Reblogged this on kk16085 and commented:

What we need is scientific socialism, globally, to end the present and people’s dependence on the blind laws of market (free or monopoly) in toto.