The swift collapse of Afghanistan puppet government when US troops withdrew from the war with the Taliban and left the country after 20 years has been likened to the fall of Saigon at the end of the 30-year ‘American’ war against the Vietnamese people. The scenes of Afghans trying to get onto US planes at the airport to escape seem startlingly familiar to those of us who can remember the last days of Saigon.

But is this a superficial similarity? After all, America’s occupation of Vietnam was way more costly as a share of US national output and in terms of the lives of American soldiers than the attempt at ‘regime’ change in Afghanistan. The Vietnam disaster led to the US government running deficits for the first time since WW2. But even more important, it meant a diversion of investment into arms rather than productive sectors at a time when the profitability of capital had already begun to fall, the Golden Age of investment and profitability having peaked in the mid-1960s.

Source: Penn World Tables 10.0, author’s calculations

Indeed, by the end of the 1960s, it was clear that the US could never win in Vietnam, just as it was clear at least a decade ago (if not from the very beginning) that it could not win in Afghanistan. But the ruling elite continued under Nixon and Kissinger to prosecute the war for several more years, spreading it into neighbouring countries like Laos and Cambodia.

But by the official end of the war in Vietnam, the economic consequences of this 30-year ‘intervention’ exposed an important turning point – the end of Pax Americana and the outright hegemonic position of American imperialism in the world economy. From then on, we can talk about the relative decline (relative to other imperialist powers) of the US, with the rise of the European countries, Japan, East Asia and more recently China. Despite the collapse of the Soviet Union in the late 1980s and early 1990s, the end of the ‘cold war’ did not reverse or even curb that relative decline. The US no longer can rule the world on its own and, even with the help of a ‘coalition of the willing’, it cannot dictate a ‘world order’.

Economically, it all started before the fall of Saigon. As the profitability of US capital started to fall from the mid-1960s, US industry began to lose its competitive advantage in manufacturing and even in various services to rising Franco-German capital and Japan. This eventually meant that the economic world order after WW2, which had established the economic hegemony of the US economy and its currency, the dollar, started to crumble.

Indeed, it is 50 years to the month when officials of President Nixon’s administration met secretly at Camp David to decide on the fate of the international monetary system. For the previous 25 years, the US dollar had been fixed to the price of gold ($35/oz) by international agreement. Anybody holding a dollar could convert into a fixed amount of gold from US reserves. But in August 1971, President Nixon took to national television to announce he had asked Treasury Secretary John Connally to “suspend temporarily the convertibility of the dollar into gold or other reserve assets.”

It was the end of the so-called Bretton Woods agreement, so painfully negotiated by the Allied powers, namely the US and the UK, over the heads of all the other countries in the world. Conceived, along with the IMF, the World Bank and the UN, the agreement established a framework that committed all to fixed exchange rates for their currencies and fixed in terms of the US dollar. The US in turn would fix the value of the dollar in terms of gold. No country could change their rates without IMF agreement.

But with Nixon’s announcement, the fixed exchange rate regime was ended; it was the US that had abandoned it and, with it, the whole post-war Keynesian-style international currency regime. It was no accident that the ending of the Bretton Woods system also coincided with the ending of Keynesian macro management of the US and other economies through the manipulation of government spending and taxation. The post-war economic boom based on high profitability, relatively full employment and productive investment was over. Now there was a decline in the profitability of capital and investment growth, which eventually culminated in the first post-war international slump of 1974-5; and alongside this was the relative decline of American industry and exports compared to competitors. The US was no longer exporting more manufacturing goods to Europe, Latin America or Asia than it was importing commodities like oil from the Middle East and manufacturing from Germany and Japan. It was starting to run trade deficits. The dollar was thus seriously overvalued. If US capital, particularly manufacturing was to compete, the dollar fix to gold must be ended and the currency allowed to depreciate.

As early as 1959, Belgian-American economist Robert Triffin had predicted that the US could not go on running trade deficits with other countries and export capital to invest abroad and maintain a strong dollar: “if the United States continued to run deficits, its foreign liabilities would come to exceed by far its ability to convert dollars into gold on demand and would bring about a “gold and dollar crisis.”

And that is what happened. Under the dollar-gold standard, imbalances in trade and capital flows had to be settled by transfers of gold bullion. Up until 1953, as war reconstruction took place, the US had actually gained gold of 12 million troy ounces, while Europe and Japan had lost 35 million troy oz (in order to finance their recovery). But after that, the US started to leak gold to Europe and Japan. By end-1965, the latter surpassed the former for the first time in the post-war period in terms of gold volumes held in reserve. As a result, Europe and Japan began to pile up huge dollar reserves that they could use to buy US assets. The global economy has begun to reverse against the US.

The dollar reserves in Europe and Japan were now so large that if those countries bought gold with their dollars under the gold standard, they could exhaust US gold stocks in an instant. Private financial outflows (outbound investment) from the US averaged roughly 1.2% of GDP throughout the 1960s—long term investment overseas through FDI or portfolio outflows. This served to finance net exports of US investment goods and a current account surplus, shown as negative here as an offsetting withdrawal of dollars. Netting these, about 0.4% of US GDP in surplus outward investment was made available every year during the 1960s from the US. This surplus was available for current account deficit countries in Europe and Japan to liquidate US gold, replenishing their diminished reserve positive, or accumulate other financial claims on the US—as shown on the right side.

But throughout the 1960s, the US current account surplus was gradually eroded until, in the early 1970s, the current account was registering a deficit. The US began to leak dollars globally not only through outward investment but also through an excess of spending and imports as domestic manufacturers lost ground.

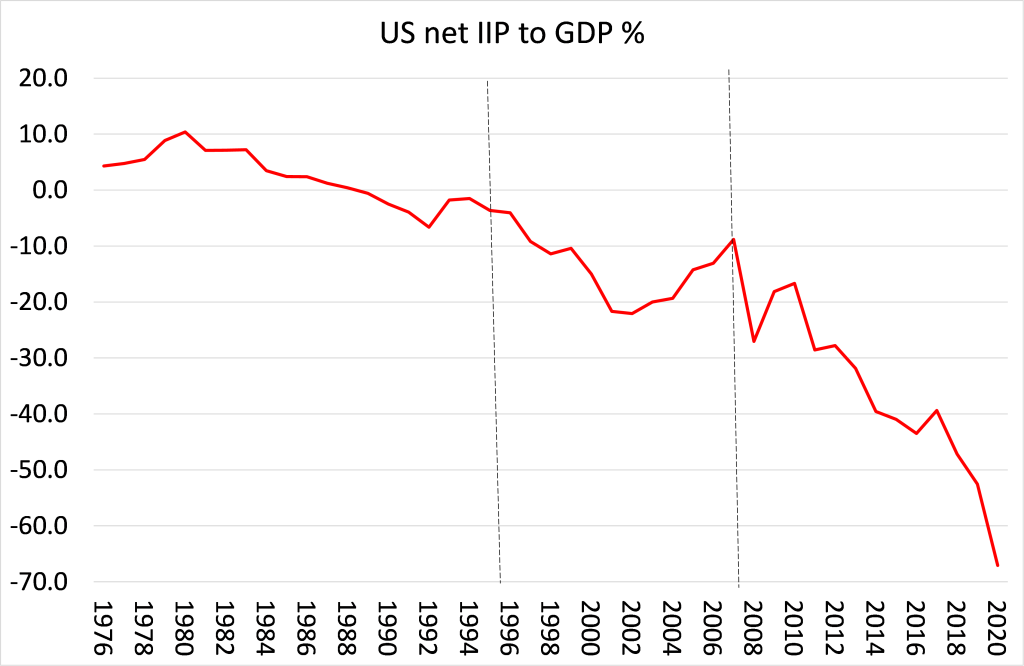

US current account balance to GDP (%), 1976-2020

The US became reliant for the first time since the 1890s on external finance for the purposes of spending at home and abroad. So US external accounts were driven less by real goods and services and more by global demand for US financial assets and the liquidity they provided. By the 1980s, the US was building up net external liabilities, rising to 70% of GDP by 2020.

US net international investment position as % of US GDP

If a country’s current account is permanently in deficit and it depends increasingly on foreign funds, its currency is vulnerable to sharp depreciation. This is the experience of just about every country in the world, from Argentina to Turkey to Zambia, and even the UK.

However, it is not the same for the US because what is left from the Bretton Woods regime is that the US is still the main reserve currency internationally. Roughly 90% of global foreign exchange transactions involve a dollar leg; approximately 40% of global trade outside the US is invoiced and settled in dollars; and almost 60% of U.S. dollar banknotes circulate internationally as a global store of value and medium of exchange. Over 60% of global foreign exchange reserves held by foreign central banks and monetary authorities remain denominated in dollars. These ratios have not changed.

Export surplus countries like the European Union, Japan, China, Russia and Middle East oil states pile up surpluses in dollars (mainly) and they buy or hold assets abroad in dollars. And only the US treasury can ‘print’ dollars, gaining a profit from what is called ‘seignorage’ as a result. So, despite the relative economic decline of US imperialism, the US dollar remains supreme.

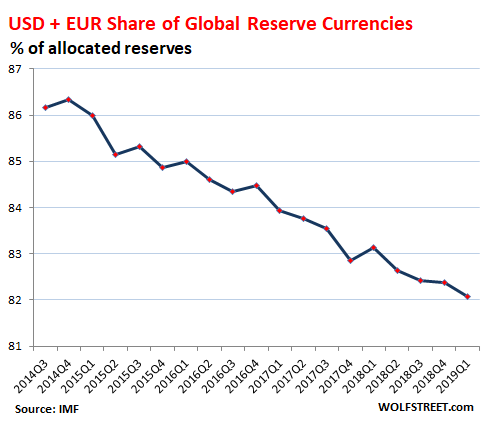

This reserve currency role encouraged US Treasury Secretary John Connally, when he announced the end of the dollar-gold standard in 1971 to tell EU finance ministers “the dollar is our currency, but it is your problem.” Indeed, one of the reasons for the European Union, led by Franco-German capital, to decide to establish a single currency union in the 1990s was to try and break the dollar hegemony of international trade and finance. That aim has had only limited success, with the euro’s share of international reserves stable at about 20% (and nearly all of this due to intra-EU transactions).

International competitors such as Russia and China routinely call for a new international financial order and work aggressively to displace the dollar as the apex of the current regime. The addition of the renminbi in 2016 to the basket of currencies that composes the IMF’s special drawing rights represented an important global acknowledgment of the increasing international use of the Chinese currency. And there is talk of rival countries launching digital currencies to compete with the dollar. But although the dollar-euro share of reserves has declined in favour of the yen and renminbi from 86% in 2014 to 82% now, alternative currencies still have a long way to go to displace the dollar.

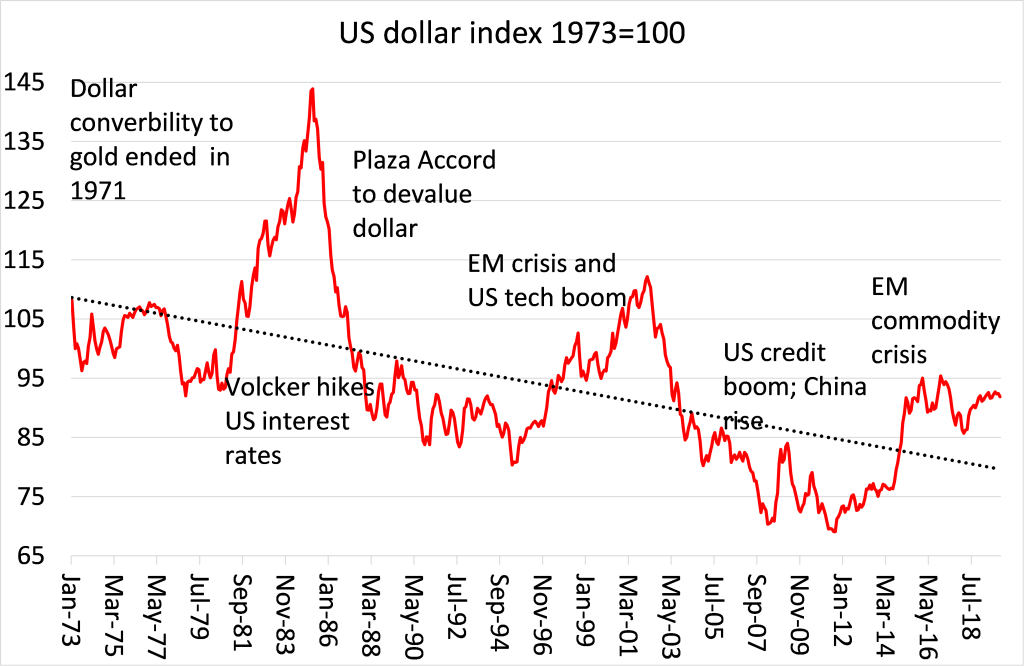

Having said that, the underlying relative decline in US manufacturing and even services competitiveness with first Europe, then Japan and East Asia and now China, has gradually worn away the strength of the US dollar against other currencies as the supply of dollars outstrips demand internationally. Since Nixon’s momentous announcement, the US dollar has declined in value by 20% – maybe a good barometer of the relative decline of the US economy (but an underestimate because of the reserve currency factor).

The dollar’s decline has not been in a straight line. In global slumps, the dollar strengthens. That’s because as the international reserve currency, in a slump, investors look to hold cash rather than invest productively or speculate in financial assets and the safe-haven then is the dollar.

That’s especially the case if US interest rates on dollar cash are high compared to other currencies. To break the inflationary spiral at the end of the 1970s, the then Federal Reserve Chair Paul Volcker deliberately hiked interest rates (adding to the depth of the economic slump of 1980-2). In the slump, investors rushed into high-yielding dollars. Bankers loved it, but not US manufacturers and exporters, as well as countries with large US dollar debts. The slump was bad enough, but Volcker’s action was squeezing the world economy to death.

Finally, in 1985, at a meeting at the Plaza Hotel, New York of central bankers and finance ministers in the then big 5 economies, it was agreed to sell the dollar and buy other currencies to depreciate the dollar. The Plaza accord was another milestone in the relative decline of US imperialism, as it could no longer impose its domestic monetary policy on other countries and eventually had to relent and allow the dollar to fall. Nevertheless, the dollar continues to dominate and remains the currency to hold in a slump, as we saw in dot.com bust and slump of 2001 and in the emerging market commodity slump and euro debt crisis of 2011-14.

The relative decline of the dollar will continue. The Afghanistan debacle is not a tipping point – the dollar actually strengthened on the news of Kabul’s collapse as investors rushed into ‘safe-haven’ dollars. But the monetary explosion and the fiscal stimulus being applied by the US authorities to revive the US economy after the pandemic slump is not going to do the trick. After the ‘sugar rush’ of Bidenomics, the profitability of US capital will resume its decline and investment and production will be weak. And if US inflation does not subside as well, then the dollar will come under more pressure. To distort a quote by Leon Trotsky, ‘the dollar may not be interested in the world economy, but the world is certainly interested in the dollar.’

To add a few elements complicating the picture: Fundamentally, US overseas investments have given them enormous profits to US firms, exactly at a time when domestic profitability fell off. So the current-account deficit is not necessarily a problem. There are also so many intricacies in these accounts that have been highly complicated by the structure of today’s ‘value chains’ and tax havens. Think of the tech giants. – The Fed international dominance has certainly also been strengthened. It now not only has swap lines with important central banks helping them when their domestic financial institutions are running short of dollars, but also a new regime, FIMA (Foreign and International Monetary Authorities) repo facility, which allows foreign central banks to use treasury bills for dollar liquidity. Contrary to the swap lines, this is also available to Chin. You can see these measures as a sign of desperation, but also as a sign of inventiveness to hold on to a dominating position.

Yes, as for Afghanistan, I just read that the US spent 2.2 trillion dollar on this ‘war’. Today, 54% of Afghans make less than 1.90 dollar a day. Imagine that just a fraction of all this money had gone to development, construction and aid. Would the taliban be winning today?

As for the end of American imperialism, ask Assange what he thinks about that.

I had heard that the transition away from gold standard in part had to do with the USSR and South Africa being major sources of gold, with the US being concerned about the fall of the Apartheid government in the late 60’s/70’s. I believe that was covered in Hennie Van Vuuren’s Apartheid, Guns, and Money. Have you heard anything about this geopolitical issue being implicated in this transition?

When I started off professionally in the mid 1970s there was a story circulating that the Russians would flood the market with gold and declare a convertible rouble and take control of the world’s financial markets. There’s always someone with an angle at the crazy end of the spectrum.

I guess these days this might be called fake news. (Haven’t heard that term for a few months now.)

Hi Michael.

My understanding of the Plaza Accord has been that US policy makers initiated or supported it for the purpose of bringing the dollar down to make US exports more competitive especially against Japan. And that it was an exercise in US hegemony over Japan that it could be pressured to accept a higher Yen that hurt its large export oriented manufacturing sector. Further that the higher Yen was one factor that precipitated increased Japanese investment in overseas production in Korea, Taiwan and elsewhere. But you mention the Plaza Accord in your article as an example of US imperialism’s relative decline. Which is accurate? Thanks

Yes, US manufacturers wanted a lower dollar versus the yen and the Plaza deal gave them that, but at the expense of Volcker’s aim to get inflation down, so it was swings and roundabouts for the US. But you are right, the US manufacturers got their way at the expense of the Japanese and Germans. But of course, they still could not compete and so resorted to taking their means of production overseas (globalisation) to reduce costs and export back to the US.

“But of course, they still could not compete and so resorted to taking their means of production overseas”

But of course, they could and did compete with Europe and Japan, as if financial beggar thy neighbor tactics are not the essential to competition, to argue otherwise is to buy into the mythology of “free markets,” that are intrinsically rational mechanisms, but subject to “abuse.”.

This is not a “relative decline of US capitalism,” meaning some other capitalism is ascending and will replace it. This is a systemic decline and cracking of capitalism as a whole, as a mode of production, that manifests itself in and through some regressions– “America first”– like trade wars, etc. The manifestation is uneven– more acute in certain sectors and areas, less acute in others– but the trend is the trend and not always your friend.

Remember Brazil in the 1950s? That was supposed to be the pre-China China. And the former USSR? Supposedly that was going to outstrip the US, even with 1/3 of its population dedicated to agricultural production, compared to less than 2% in the US? And the EU? That was going to replace the US….until OPEC dropped the hammer and recycled all those petro-dollars through US banks. And then Japan, and then and then and then….ad nauseum. Now it’s China with 40% of its population engaged in the rural economy. Good luck with that.

When the whip comes down, I don’t think China or India or Mercosur or BRICS or any combination is going to stand up. Remember, a rich man can always get through poor times better than a poor man.

The missing element here is restructuring. The key was the ability of us capitalism to restructure and cull capital compared to the keiretsu system in Japan which prevented structural obstacles preventing this and was one of the primary reasons for the longevity of the recession there in the 1990s. Also what is interesting is how when Japanese industry dominated global production how its profit generation propelled Japanese banks to to become the largest in the world.

Good article. Very many modern writers are ahistorical in ignoring this critical information post WW2.

It led to Thatcher and Reaganomics; and eventually Oboma’s banking fiasco.

The key is the US remains the Apex predator still. It straddles the summit of the value chain due to its technical dominance. This rather than the dollar is its main strength. Once it loses this dominance it loses its hegemonic power which is likely to happen with China’s ascendancy.

Economic size and economic power depend on two variable factors: the average labor productivity and the number of productive workers.

Until modern times, China had the largest economy in a world with no great differences in productivity because it had the largest workforce. With the development of capitalism in Europe, labor productivity per capita increased enormously there. Only in this way could relatively small peoples (England, Germany, etc.) have a large economic power.

However, the more labor productivity in the world balances out on a common level, the more the number of productive workers that a country has at its disposal becomes important again.

As a result of the equalization of labor productivity in the world, Europe and the West will fall behind not only in relative terms, but also in absolute terms. The (re)rise of China is only a matter of longer or shorter time.

Wal Buchenberg, Hannover

‘’ With the development of capitalism in Europe, per capita labor productivity increased enormously there. Only in this way could relatively small towns (England, Germany, etc.) have great economic power. ”

This paragraph and the full comment is an excellent synthesis of the history and economic development of the countries, in my opinion. I agree that Capitalism gave an economic boost to Europe in the 17th, 18th and 19th centuries. As later Socialism also gave it in the 20th century – the Golden Age growing at 6% per year are semi-socialist states promoted since the revolution in the USSR. And since my economic history of China is very short, the corresponding question is what happened in China? Didn’t Capitalism exist or did it exist only in too small a dose? The private capitalist companies – more business partners equals more power and economic productivity – that in Europe overthrew and replaced the individual and family feudal companies did not reach China?

“As a result of the equalization of labor productivity in the world, Europe and the West will fall behind not only in relative terms, but also in absolute terms. The (re)rise of China is only a matter of longer or shorter time.”

No, it is not “only a matter of longer or shorter time,” as if the bourgeoisie are going to stand or sit idly by, clipping coupons while China displaces their ability to use the scissors, much less issue the coupons.

What did it take to displace the UK as the “global hegemon” and the sterling as the dominant currency? Two world wars with the greatest of depressions sandwiched between.

Does anyone doubt the bourgeoisie will engage in another war before making room at the “grown-ups” table, much less accept a meal of Chinese rations?

Hadn’t Britain won both world wars? Not even these victories could stop the country’s decline.

Anti-capital, if I read your metaphors correctly, you are predicting that a thoroughly bourgeois empire (led by the US) is threatening war against China.

In historical support of your war scenario, you poin out that it took two world wars for the US to replace England as imperial hedgemon, which is true. But you fail to point out that England and all the other European capitalist “big boys” were given seats at the hegemonic table. Why then is the thoroughly bourgeoisfied China threatened with war rather than being invited also to a seat at the table?

Your metaphorical suggestion is that the reason for China’s exclusion is bad (proletarian?) table manners: e.g. vulgarly using scissors to displace the capitalists’ ability to gorge themselves on cupons properly.

–But Casus (excuse the pun) belly enough for the bourgeoisie, and, Anti-capital, aparently for you too.

Pun’s excused, but not the false equivalence.

England was given a seat at the grown ups table? Sure, if you consider sitting at the feet of the US being at the grown ups table. During WW2 and after, Britain ceded any power it held in the Caribbean to the US, agreed to the stationing of US bases on its soil, and got spanked by the US when it tried to stand up at the table, i.e Suez.

And no one can claim Germany after either war was given a seat at the table, nor was Japan after WW2. Later? Maybe but as junior partners. Somehow I can’t see the US bourgeoisie accepting the role of junior partners, particularly when they have all those aircraft carriers and missile carrying warships.

I don’t “think” the bourgeoisie are simply threatening war against China. I think capital is driven inexorably toward war by competition, overproduction, accumulation of means of production, declining profitability. China is seen as the source of all four. I would think the increased activity of the US Navy in policing Pacific shipping routes gives us a bit of a clue.

Sorry you find the metaphor of the scissors so “vulgar.” But that’s me in a nutshell, vulgar… and to the bone.

Agreed. Churchill stated that being forced to sign the Bretton Woods Agreement represented the biggest defeat suffered by the British Empire outside of war.

You should have read my comment as closely as I read yours. The “vulgar” attribution (and its proletarian implication) was attributed by you to the bourgeois view of Chinese behavior at the table: the “Chinese ability to displace their [coupon cliiiing] scissors”. It seemed to me that you were sympathiizing with the “big boys” and advocating war againt China. But I can see from your later comments that my suspicions were unfounded.

Maybe there are two morals to this story: be very careful with one’s metaphors, work against imperial war on China or anyone else this demoralized/demoraliziang empire choses to attack.

Comrade Buchenberg,

While I agree that the fracturing and weakening of capital alliances is inexorable, and that capital as whole is lurching its way into another depression, I don’t agree that “Britain won both wars,” particularly WW2. In military terms, the USSR won WW2, and could have successfully prosecuted the war to its conclusion against Germany even without the second front being opened in the west of Europe (but at an even more horrible cost).

Economically, US capitalism emerges from the war with England in a distinctly subordinate position, and bankrupt.

My point of emphasis is that the “decline” of the US empire is not going to occur simply because China, or Germany or country X emerges as a competitor. Decline includes devaluation, and the violent attempts to restore value through destruction

Great Old Britain does not serve well as a blueprint for today’s conflicts. Anyone looking for historical parallels could at best compare China with Russia, which could not be defeated by either Napoleon or Hitler.

“Does anyone doubt the bourgeoisie will engage in another war before making room at the “grown-ups” table, much less accept a meal of Chinese rations?” No doubt!

However speculative this may appear right now, for the first time since the postwar a Marxist perspective on US decline must regard the dysfunction of the domestic US political system as a decisive macro-economic factor.

Trumpism is not an accident, not a flash in the pan, but a comprehensive reactionary regime change program of a substantial, but minority, section of the U.S. bourgeoisie, especially the more parasitic sections of the domestically oriented bourgeoisie such as in real estate, etc., the whole collection of Elmer Gantry Music Men (munging two films), and including the professional reactionary ideologues of the political system and commercial media. Both sections are bloated by the oversized US domestic consumption of the world capitalist systems’ production, another feature of the post-Plaza accord deal that sought to keep this consumption as a “global engine”, Keynesian ideological style, though the revamped role wasn’t realized until Clintontime. It was a restoration of the US postwar role of “consumer of last resort”, and is no small part of the “USD hegemony”.

Trumpism has broken the bipartisan system for the time being. Look at the relatively muted Republican response to the Afghan debacle. Most of the flak is coming from the bipartisan warmonger Democrats, political representatives of the foreign policy bureaucracy called “The Blob”. The Biden Democrats are desperately trying to put Humpty Dumpty back together again, their success remains to be seen. But their failure could also mark the inflection point from relative to absolute decline. A political break is the key determinant for all such inflections points. Witness Habsburg Spain: Relative decline until late in the Thirty Years War, around 1640. That military-political reversal was instrumental condition for the Parliamentary reverse course from defense to offense that led to the English Civil War and Revolution. For example.

Hence I wager that everything is at stake for the USA right now, riding upon the Biden Democrat’s thin reed. USA back on the warpath is almost certain, as its current impotence of its military advantage since the Iraq fiasco, followed by Afghanistan, leaves only its financial advantage. The USA needs effective military power as a reminder of what awaits those who might undermine its financial hegemony, even unintentionally, as I believe is the case with China.

Collapse of the financial hegemony with in short order lead to social collapse, as the US social order is entirely strategically arranged around that hegemony since the end of WW2.

from Stansfield Smtih: You state, “As early as 1959, Belgian-American economist Robert Triffin had predicted that the US could not go on running trade deficits with other countries and export capital to invest abroad and maintain a strong dollar: “if the United States continued to run deficits, its foreign liabilities would come to exceed by far its ability to convert dollars into gold on demand and would bring about a “gold and dollar crisis.”

However, I have read other economic literature, such as https://www.pbs.org/fmc/book/14business10.htm :

“In every year from 1900 to 1970, the value of the raw materials and manufactured products exported from the United States exceeded the value of imported goods. In 1971, for the first time in the century, the merchandise trade balance was negative—imports exceeded exports by $9.5 billion, measured in 1999 dollars. The balance was positive again in 1973 and 1975, but every year thereafter the balance was negative.”

This would contradict what is in your article above.

(from Stansfield Smith) You write that the defeat of the US in Vietnam brought “the end of Pax Americana and the outright hegemonic position of American imperialism in the world economy.” This true if we ignore that about 1/3-1/4 of the world was part of the (divided) Communist bloc at the time, and the US had scant hegemony there. The US hegemonic position remained about the same, and actually increased with the collapse of the Soviet bloc and was at a high point in the 1990s, particularly when the pro-US Yeltsin was in power in Russia.

One caveat: while Bretton Woods could be called “Keynesian” in that some of his ideas were adopted into the nw framework, the final product was not something he liked. Particularly, the use of a gold standard for the US dollar was diametrically opposed to what he had advised. But the US was not going to opt for any post-war system that didn’t leave the US in the driver’s seat for the world economy. Our allies, who wer3e even more bankrupt after WW2 then they were after WW1, had lute choice but to take the deal offered. Keynes didn’t denounce the whole business as a dog’s breakfast, but he was not amused by the result and made that clear to all and sundry.