The Austrian school of economics is outside the mainstream. The Austrians start from micro-assumptions. This is not the neoclassical view of rational, fully informed human agents, maximizing their utility and profits. On the contrary, human actions are speculative and there is no guarantee of success in investment. According to Karl Menger, the founder of this school of thought, the further out in time the results of any investment are, the more difficult it is to be sure of success. Thus it is easier to estimate the returns on investment for goods that are for immediate consumption than for those needed for capital goods. Saving rather than consumption is a speculative decision to gain extra returns down the road.

Austrians reckon that the cost of saving can be measured by the ‘market interest rate’, which prices the time involved in delivering future output from savings now. ‘Business cycles,’ as the Austrians call booms and slumps under capitalist production, are primarily caused by periodic credit expansion and contraction of central banks. Business cycles would not be a feature of a truly “free market” economy. As long as capitalists were free to make their own forecasts and investment allocations based on market prices, rather than by bureaucrats, there would be no business cycles. Cycles are due to the manipulation of credit by state institutions. This differs from the neoclassical/monetarist school, which sees recessions as minor interruptions from growth caused by imperfections in market information or markets—not busts caused by artificial credit booms.

The boom phase in the Austrian business cycle takes place because the central bank supplies more money than the public wishes to hold at the current rate of interest and thus the latter starts to fall. Loanable funds exceed demand and then start to be used in non-productive areas, as in the case of the boom 2002–2007 in the housing market. These mistakes during the boom are only revealed by the market in the bust.

The Great Recession was a product of the excessive money creation and artificially low interest rates caused by central banks that on that occasion went into housing. The recession was necessary to correct the mistakes and the malinvestment caused by interference with market interest rates. The recession is the economy attempting to shed capital and labour from where it is no longer profitable. No amount of government spending and interference will avoid that correction.

Crucial to the Austrian Business Cycle Theory (ABCT) is the notion of a “natural rate of interest” ie how much it would cost to borrow if it wasn’t for government interference. In ‘free markets’, the supply and demand for funds to invest will set a rate of interest that brings investment and savings into line, as long as the markets for funds are fully competitive and everybody has clear knowledge on all transactions.

Already, you can see that these assumptions are not realistic. Even if the assumption of perfect competition was realistic, there is no reason to think that there is one interest rate for an economy. Rather there is one rate for houses, another for cars, another hotel construction etc. This point was even accepted by the Austrian school guru, Fredrick Hayek, who acknowledged that there is no one ‘natural rate’ of interest.

But without one natural rate of interest, you can’t claim the government is forcing rates too low and therefore the theory crumbles. Yes, the central bank controls a component of the interest rate that helps determine the spread at which banks can lend, but the central bank does not determine the rates at which banks lend to customers. It merely influences the spread. Aiming at the Fed’s supposed “control” over interest rates misunderstands how banks actually create money and influence economic output.

The primary flaw in the Austrian view of the central bank has been most obvious since Quantitative Easing started in 2008. Austrian economists came out at the time saying that the increase in reserves in the banking system was the equivalent of “money printing” and that this would “devalue the dollar”, crash T-bonds and cause hyperinflation. None of this came about.

Marx denied the concept of a natural rate of interest. For him, the return on capital, whether exhibited in the interest earned on lending money, or dividends from holding shares, or rents from owning property, came from the surplus-value appropriated from the labour of the working class and appropriated by the productive sectors of capital. Interest was only a part of that surplus value. The rate of interest would thus fluctuate between zero and the average rate of profit from capitalist production in an economy. In boom times, it would move towards the average rate of profit and in slumps it would fall towards zero. But the decisive driver of investment would be profitability, not the interest rate. If profitability was low, then holders of money would increasingly hoard money or speculate in financial assets rather than invest in productive ones.

What matters is not whether the market rate of interest is above or below some ‘natural’ rate but whether it is so high that it is squeezing any profit for investment in productive assets. Actually, the main exponent of the ‘natural rate of interest’, Knut Wicksell conceded this point. According to Wicksell, the natural rate is “never high or low in itself, but only in relation to the profit which people can make with the money in their hands, and this, of course, varies. In good times, when trade is brisk, the rate of profit is high, and, what is of great consequence, is generally expected to remain high; in periods of depression it is low, and expected to remain low.”

The leading proponents of the Austrian School usually shy away from considering empirical evidence for their theory. For them, the logic is enough. But a reader of my blog recently sent me a bag of empirical studies that purport to prove that the Austrian school business cycle theory is correct: namely that when the market rate of interest is driven below the ‘natural rate’ there will be excessive credit expansion that will eventually lead to a bust and crisis.

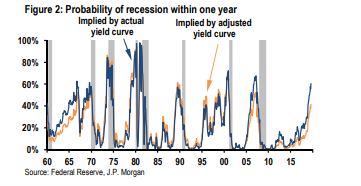

In one of these studies, Austrian economist James Keeler proxies the market and ‘natural’ interest rates by using short- and long-term interest rates in yield curves. The natural rate of interest is proxied by the long-term bond yield, and if the short term rate remains well below the long term rate, credit will expand to the point when there is a bust. That happens when the short-term rate shoots up and exceeds the long or vice versa ie there is an inverse yield curve. This is what his empirical study shows. Indeed, JP Morgan reckons on this basis the current probability of a slump in the US economy within a year is about 40-60%.

But while it may be that an inverted yield curve correlates with recessions, all it really shows is that investors are ‘fearful’ of recession and act accordingly. The question is why at a certain point, investors fear a recession and and start buying long-term bonds driving down the yield below the short-term rate. Moreover, when you look at corporate bonds in the capitalist sector, there is no inverted curve. Longer-term corporate bonds generally have a much higher yield than short-term bonds.

Another Austrian study by Ismans & Mougeot (2009) examined four countries, France, Germany, Great Britain, and USA between 1980 and 2006. This found that “the maxima of the ratio of consumption expenditures to investment expenditures are often reached during the quarters of recession or during the quarters just after recessions. This observation corroborates the Austrian hypothesis of overinvestment liquidation marking crisis.” But again the study relies on short and long-term interest rates and argues that “the term spread inversions mark the turning points of the aggregate economic activity. When the term spread decreases, the structure of production becomes less roundabout as entrepreneurs reallocate resources away from production goods to consumption goods.” In other words, when short-term interest rates rise or long-term rates fall, investors stop investing in capital goods and business investment falls while consumption rises or stays the same. Again, why does the yield curve to start to invert? Which is the causal direction? Is it falling investment in productive goods and services that drives long-term yields down or vice versa?

Carilli & Dempster attempt to answer this query in another study by carrying out a Granger causality test on two chosen indices of the ‘natural interest rate’ : 1) the real growth rate in GDP 2) the personal savings-consumption ratio. But they find that there is a marked lack of correlation between interest rates and economic activity.

Indeed, there is little evidence that the rate of interest is the driving force of capitalist investment and the price signal that capitalists look for to make investment decisions. A recent study by Dartmouth College, found that:

“First, profits and stock returns both have strong predictive power for investment growth, persisting many quarters into the future. Second, interest rates and the default spread—our proxies for discount rates—are at best weakly correlated with current and future investment. In short, changes in profitability and stock prices appear to be much more important for investment than changes in interest rates and volatility.”

Similarly, the US Fed concluded in their own study that: “A fundamental tenet of investment theory and the traditional theory of monetary policy transmission is that investment expenditures by businesses are negatively affected by interest rates. Yet, a large body of empirical research offer mixed evidence, at best, for a substantial interest-rate effect on investment…., we find that most firms claim to be quite insensitive to decreases in interest rates, and only mildly more responsive to interest rate increases.”

Some economists in the Austrian school have tried to gauge when the tipping point into recession might be by measuring the divergence between the growth in credit and GDP growth (see Borio and White, Asset prices, financial and monetary stability, BIS 2002). Apparently, there is a point when credit loses its traction on economic growth and asset prices and then growth collapses. But why? The Austrians cannot answer this because they ignore the fundamental flaw in the capitalist process identified by Marx in his law of profitability.

What drives capitalist economies and capital accumulation are changes in profits and profitability. Economic growth in a capitalist economy is driven not by consumption as the Austrians claim, but by business investment. That is the swing factor causing booms and slumps in capitalist economies. And business investment is driven mainly by one thing: profits or profitability – not interest rates, not ‘confidence’ and not consumer demand. It is when the rate of profit starts to fall; and then more immediately, when the mass of profits turns down. Then the huge expansion of credit designed to keep profitability up can no longer deliver.

What is heterodox economics? Since Austrian School heavily relies on methodological individualism and the free perfect market principle it qualifies in the same camp as neoclassical economics. I do not understand your assertion that Austrian School is outside the mainstream.

I think he means that Austrians don’t dictate economic policy or are the go-to guys for economic insight in media. I remember an anecdote in the wiki on von Mises according to which he stormed out of a meeting that included Milton Friedman calling the whole lot a bunch of communists.

Neoclassicals are very much in favour of state intervention to prop up failing banks and companies. The impression I have as an outsider is that Austrians are regarded as goofy oddballs who’re useful for animating academic discussions and evangelising in favour of the market, but who must be kept away from the levers of the economy. (As opposed to Marxists, who must be ignored, outcast and kept away not just from levers of the economy, but even from polite discussion as dangerous subversives.)

Thanks, most illuminating. I hope the reader who pointed you to those studies reads this, I’d like to know what he thinks of your views.

The last sentence of the text is without a full stop. Is it just a typo, or is there more you didn’t upload by mistake. The last paragraph does look like a conclusion, but I’m not completely sure.

I find this incorrect: “Economic growth in a capitalist economy is driven not by consumption as the Austrians claim, but by business investment. That is the swing factor causing booms and slumps in capitalist economies. And business investment is driven mainly by one thing: profits or profitability – not interest rates, not ‘confidence’ and not consumer demand.” Capitalists invest when they anticipate profit-making: they anticipate consumer demand. Without demand there is no profit. If you do not agree, please explain why advertising comprises 15-20% of GDP in the richest countries. The same has to be said about the rate of interest and even ‘confidence’, however irrational it might be. The rate of interest influences the availability of money and, hence, investment, demand, consumption and profit. You are of course right: “What drives capitalist economies and capital accumulation are changes in profits and profitability.”

Click to access mrpostk421.pdf

Thank you and ucanbpolitical. I will read this with a lot of interest.

This is a post from earlier this year you commented a lot on, though, Dordi

Hi Dordi, you have mistakenly added an extra zero to the advertising spend. At $288 billion in 2020 advertising amounted to under 1.5% of GDP.

Of course without demand there is no profit, but what causes demand in the first place. Demand is primarily driven by unspent revenues or legacy value. Legacy value best describes revenue or the monetization of past labour. It takes the form of wages, rents, profits, interest and taxes arising from previous cycles of production. What is the only thing that can expand legacy value and therefore demand? It is investment in production. What causes a decline in legacy value and hence demand, a fall in investment.

So investment is the trigger, it and it alone can either increase or decrease legacy value and with it demand. So a rise in the rate of profit which increases the tempo of investment increases demand while its fall reduces or stalls investment decreasing demand. It is always difficult getting to the core of the matter when one addresses the problem from the standpoint of the individual capitalist. Both Michael and I have shown conclusively that it is the movement of investment that triggers movements in consumption though mine is much much better because I include circulating capital as well. To balance this criticism, Michael, impressive article.

When the real voices are stilled, only the unreal voices can be heard, and there is nothing more tedious than the Austrian School. Well done for not falling asleep while writing this article.

Hello ucanbpolitical. Thank you for your explanation – I need to think about it. I am absolutely not an expert in this, but have a look here: “According to a new report, advertising contributed $3.4 trillion to the U.S. GDP in 2014, comprising 19 percent of the nation’s total economic output,” which is what I was thinking (without knowing it for sure). See: https://www.ana.net/content/show/id/37679

I see what you mean. It’s a case of the advertisers advertising themselves. There can be no evidence that advertising stimulates demand because you cannot eliminate advertising to prove the opposite. At best advertising encourages consumers to spend on particular products and sometimes to go into debt in order to do so.

Demand doesn’t determine profit. You can produce one extremely luxurious item (e.g. a work of art) and sell it for an exorbitant price and have an extremely high rate of profit.

Alternatively, you can produce food at a 30% waste rate at a given price and profit a lot, while if you sold the same food at 0% waste you could profit less, not profit at all or even at a loss.

What determines profit is the rate of exploitation of (living) labor. That’s the only explanation.

Austrians love some microeconomy. Well, if you ask a little girl selling lemonade in her suburb front yard why is she doing that, she’ll answer you that she seeks to receive a quantity of money higher than the quantity of money she invested on the lemonade and the stand (profit). She will not answer you that she seeks a natural rate of return (interest). The more she profits, the better, there’s no end in sight. This is common sense: every person investing some money already knows how much he/she will need to get back in order to profit – they don’t imagine a natural rate of return that must come back only because they invested.

The only way out for the Austrians I can see is if they consider the profit of the lemonade girl to actually be the interest charged over the people who buy the lemonade as the price paid for their laziness from not wanting to spend the time producing the lemonade themselves (the time saved = interest). But then you don’t have a single natural interest rate, because different products have different times of rotation. Interest would then simply be another name for price, which on its part defeats the whole purpose of the theory.

The problem isn’t that “interest rates are too low.” It’s that banks are enabled to charge interest at all on something they lent into existence out of thin air, when it should be naturally free.

The Austrian assumption that the hegemony of specie money arose “naturally” or “spontaneously,” and the function of providing liquidity must come from “past savings” and be banked by bank reserves, is fundamentally unjustified.

Neoclassical Economics is a reductionist approach and all about micro foundation. Most of the macro models (Solow, RBC, DSGE, etc) are formed around a representative agent, ie a single person (consumer-producer) to depict (macro) effects in the economy

It seems to me the “natural rate of interest” could always be expanded to incorporate specific rates in individual markets (except for the implicit interest of deferred wages?) And the “natural” part is where 1)the spending/investment choices of individuals, in a market free from the state distortions are the true expressions of their preference, as measured objectively by money, in accordance with human nature and 2)the free movement of capital optimizes the entire economy in accordance with the laws of nonhuman nature. (God is optional in this system?) The point is not so much to explain anything that is, but to explain what should be. Alvaro Zerda Sarmiento may be correct that this is perfectly mainstream.

But the presumption that the free market is an optimum equilibrium is in any event a gigantic counter-factual protected by limiting the terrain to prices and marginal utility. Further, the single rate of interest is more a technical problem in some presentations, useful in simple models of the dynamics, amenable to sophistication in more realistic models.

The thing that strikes me though, is that Austrian business cycle theory, so far as I know, doesn’t even pretend to offer an explanation of why business is cyclical, patterned, not random. It’s not even a theory in the sense of even trying to answer questions like, Why five to ten years? Why are some cycles more intense than others? Why aren’t fluctuations due to malinvestment (whatever that may be,) mere oscillations around a steady level, instead of parts of a long-term trend to growth?

Is it true that Austrian economics’ presence in the academy largely a deliberate cultivation by outside donors? As in Israel Kirchner’s endowed chair or the “work” of, say, the Ludwig Von Mises Institute? The public outreach of Henry Hazlitt and the Foundation for Economic Education and so forth? Should I include the Mont Pelerin Society?

My understanding is that the money commodity, of any particular nation State i.e. it’s currency, reflects the wealth being produced and that which lies in the natural resources. The amount currency necessary to circulate commodities in the market is also related to the velocity at which buying and selling take place. Am I totally off base?

Michael, if the interest rate fluctuates “between zero and the average rate of profit from capitalist production in an economy”, it means that it doesn’t correlate with profit rate? Or is there some relation between both?

The interest rate does not correlate with the rate of profit on productive capital, although it cannot exceed the latter for very long or there is no profit to be had. That is the risk of bankruptcy for so-called zombie companies

In the study of Valle Baeza, it is written that the interest rate affects the rate of profit, based on Granger’s causality tests.

Click to access What-is-the-Relationship-Between-the-Rates-of-Interest-and-Profit-An-Empirical-Note-for-the-US-Economy-1869-2009.pdf

Yes, this is an interesting paper by my colleague Alejandro Valle which I had not read before. The paper concludes: 1) the general rate of profit has fixed an upper limit to the real short-term and long-term Federal Funds interest rates; 2) the real long-term Federal Funds interest rate has undergone movements similar to those of the general rate of profit, whereas the short-run Federal Funds interest has experienced opposite movements regarding the latter; and 3) there is evidence supporting heterodox theories emphasizing that monetary policy affects the distribution of income through the modification of the rate of profit, which entails that monetary factors can be directly allowed in the determination of the rate of profit. Points 1 and 2 would be in line completely with Marxist analysis, in my opinion. Point 3 is more problematic but again the idea that the rate of interest could affect the rate of surplus value and thus the rate of profit at least during a business cycle gets some empirical support. But as Alejandro says at the end there are many variables involved.

I’m very glad that you’ve coincidentally refuted the very rude person who posted this paper in reply to your post on “Marx’s Law of Profitability after Capital” as proof of his contention that nowadays profitability is merely an actuarial value of no importance, set by the interest rate. I had been curious about it.

Interest rates when not manipulated by Central Banks responds to demand and supply and demand and supply responds to the phasing of the industrial (business) cycle. In the downphase eg the stagnation phase investment is subdued and the demand for loanable capital is diminished resulting in below average rates of interest. On the other hand in the up-phase such as rising animation interest rates pick up as the demand for loans increases

I agree

and what determines the business cycle?

The rate of profit based on the interaction between the rate of surplus value and the composition of capital

Speaking of the Valle paper above, I checked the Granger Causality Test in Wikipedia because I was curious and it says there that it only establishes precedence, not true causality. It’s popular in economics, but other areas must use it with a lot of caution, because it could even be used in reverse: the predicted future trend could be used to “forecast” the past trend if the timeline is inverted.

So could we say that both profitability and monetary policy react to another trend? Any thoughts on this?

Yes, Granger causation must be used with care. But I do use it. It tells you whether the ‘null hypothesis’ of no ‘Granger causation’ can be rejected – and so providing support for causation. The reverse if you like of showing causation directly. On this issue, interest rates could ‘lead’ profitability as interest costs could eat into profitability. But profitability will decide investment, not interest rates as the Austrians argue, because interest is just one part of total surplus value.

Very weak criticism. The Austrians (Schiff) answered most of the questions about the inversion of yield curves. Criticism of the position on the natural rate repeats Sraffa’s criticism, although Lachmann gave an answer to it half a century ago.