The ‘impossible triangle’ for the Syriza government was 1) reversing austerity 2) staying the Eurozone; and 3) Syriza staying in power (see my post, https://thenextrecession.wordpress.com/2015/01/21/syriza-the-economists-and-the-impossible-triangle/). The Troika prepared to break that triangle. What the Troika wanted was a Greek government carrying out a full programme of austerity (running a government budget surplus in the middle of a depression) and ‘structural reforms’ (ending labour rights, deregulating services and finance and privatising state assets). The previous Samaras government got bailout funds in return for such ‘conditionalities’. When Syriza wanted to change those conditions, not only did the Troika not concede, it actually tried to impose even harsher ones on Syriza.

This is partly because the Greek economy and government revenues have deteriorated during the five-month bailout extension. But it is also because the Troika wants to break Syriza and end a government pledged to oppose fiscal austerity and neo-liberal reforms. This is to ‘encourage’ the others.

The most forceful exponents of applying these even harsher measures include the IMF (which wants its money back); the German finance minister, Schauble, some small Eurozone states which are poorer than even Greece; and conservative governments in Portugal, Ireland and Spain which have imposed severe austerity on their electorates and now face anti-austerity movements at home. All these forces outweighed any forces for compromise that came from the French, the Italians and the European Commission.

And remember the cruel irony is that all these tortuous negotiations were designed not to provide help to the Greek people, but simply to release funds so that the IMF and the ECB would be repaid without any default. Over 90% of all the loans made by the Troika in the last five years have merely been siphoned back to Greek government creditors without touching the sides of the Greek economy – see my post, https://thenextrecession.wordpress.com/2015/02/21/greece-third-world-aid-and-debt/.

And these creditors were mainly French and German banks and hedge funds who got the value of their speculative purchases of Greek government bonds repaid with only a small ‘haircut’ in 2012. After that, the Eurozone, the IMF took on the debt while the Greek pension funds were stripped of their reserves.

The Syriza government went very far in dropping all its commitments which originally were: cancelling the debt, then halving the debt, reversing austerity, opposing privatisations etc. Eventually, to get a deal, the Syriza government even proposed a tax increase to annual incomes above $33,000 (thus suggesting that individuals in that income bracket rank among the wealthy). Basic food items and services were to carry a 23% VAT. The special VAT rate on Greek islands, which is so crucial for the tourist sector of the economy, was also to be removed. The early retirement age was to be increased as of the start of 2016 and a benefit for low-income pensioners was to be gradually substituted, beginning in 2018.

But on 25 June, the Christine Lagarde/Wolfgang Schäuble duo (IMF chief and German finance minister) wanted the benefit for low-income pensioners to be completely eliminated by 2017. If this proposal for overhauling the nation’s pension system were to be accepted by the Greek government, it would mean that a person who today receives a monthly pension for the amount of, say, 500 euros ($560) – close to 50% of Greek pensioners receive pensions below the official poverty line – would be deprived of nearly 200 euros ($223). This was one step too far for Tsipras and the Syriza leadership.

To understand why is to hear from Greeks themselves in various media reports. Here are the reactions gleaned from the media of Greeks living in Thessaloniki, Greece’s second largest city.

Michalis Nastos, 54, runs a clothing stall selling €10 jeans, €6 shirts and an array of cheap summer dresses, has seen his profits fall by more than 50% after years of crisis, unemployment and tax hikes. Nastos said his main fear was the proposed rise in VAT — an indirect sales tax that would push prices up and indiscriminately affect all shoppers, most of whom are already struggling with the effects of previous tax hikes. “Of course I’m against VAT rises, it’s already very high, it will have a knock-on effect. It’s the little details that will really affect people. The price of bread would go up — that’s important because people in Greece still eat a lot of bread, so you could see the price of a sesame-seed loaf rise from say 50 cents to 70 cents, that would really have an impact. Packaging costs will rise, energy, basics like pasta. Low-income people won’t be able to afford to buy and more and more people won’t be able to make it.”

Michalis Hadji-Athanasiadis, 84, a former police officer who had retired aged 50, said his pension had shrunk from €1,600 a month to €1,000 a month, and his extra benefits had been cut. But his pension was still far higher than the shrinking salary of his 52-year-old daughter who was a high-school teacher and who, like her brother and his wife, still lived with their parents to make ends meet. He said: “People are hungry. For five months it seems there has been no progress and business is down everywhere, a lot of shops have closed. Income is down, with VAT going up everything you need to buy becomes so much more expensive.”

Near the market, one woman in her 50s, who said her main income came from selling black market Balkan cigarettes, described how customers used to buy five or six packets but were now only buying one or two. “It feels like life is over,” she said. “We can barely manage to feed ourselves.” Her adult children, who had lost their jobs as shop-assistants during the recession both lived with her. She adds: “It feels like they’re going after the little guy, all the high-income people got away with it and got their money out of the country.”

The next irony was that the IMF knows that Greece can never repay a €300bn debt equivalent to 180% of GDP and rising. Greece asked for ‘debt relief’ in return for agreeing to more austerity. And it asked for a long-term package. The Troika refused. It refused to consider debt relief and only offered ‘bailout’ funds for another five months in dribs and drabs, thus keeping Greece in the grip of depression and poverty.

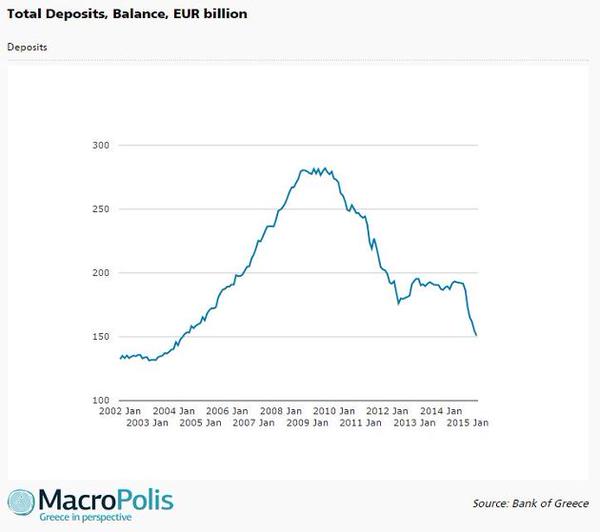

So we have a referendum. Greeks will be asked to vote on a complicated set of proposals put forward by the Troika. The question put is whether they will accept the Troika package or not. If they vote YES, then presumably the Syriza government will return to Brussels saying that they accept any terms offered. If the Greeks say NO, then the Greeks face the prospect of no more funding to pay their government debts and the cutting off of credit by the European Central Bank, which is currently financing the Greek banks to meet the increasing demands of depositors withdrawing their cash by the billions.

The government will have to impose capital controls to stop the flight of money (most of the rich and companies have already taken theirs already); it will possibly have to issue IOUs to pay its government workers and pensioners. These ‘euro IOUs’ will quickly devalue, as ‘real’ euros become scarce.

There are two more ironies here. The first is that if the Greeks vote yes to the Troika package, there will be no package to agree to. The current bailout programme ends on 30 June. After that, a completely new package will have to be negotiated and the Troika is talking about the impossibility of working with Syriza. They are looking to remove Syriza from power so they can negotiate with an amenable government.

The second is that if the Greeks vote no and the Greek economy is then cut off from euro credit by the ECB and Greece defaults on all its debts, there is no actual procedure for removing a member state from the Eurozone. Under the rules, a member state must ask to leave; it cannot be ejected. This is clearly uncharted waters for Merkel, Hollande and the Euro leaders.

The criticism of the pro-Troika parties in Greece was that Tsipras is using the referendum to avoid taking the decision himself. He is hiding behind the electorate. There is some truth in this but it is not the whole truth because Syriza will campaign for a no vote.

But what if it gets it? Surely, the government must move to end this tortuous mess. It must refuse to recognise the ‘odious’ Troika debt. It must impose capital controls; it must nationalise the Greek banks; and bring the commanding heights of the economy under the control of labour. The Greek people can start to turn round this depressed economy. But the Greeks cannot do this alone; it requires the combined efforts of European labour to break the grip of capitalist forces on economic policy and investment.

In another post, I shall try and analyse the state of the Greek economy and what could be done to turn it around within a plan for Europe.

Greece is the anvil upon which the ruling class in Europe wish to break any fight against austerity. It is for this reason that we should all be rallying around Greece right now. Impromptu demos in support of the Greeks are the order of the day.

We need to apply, inject, attach some sort of content to this notion of “rallying around Greece.”

What do you think that content should be?

Michael,

I’ve heard the proposal for these Euro IOU’s several times, but I see no reason for them, as they would devalue as you say, as would a new Drachma. Surely, the government pays its workers in the same way that the government and employers in this country pay their workers – by direct electronic transfer into their bank account.

Similarly, I’m sure that a lot of Greeks, as with people here and across the globe pay a lot of their bills by direct debits, they use credit and debit cards, with the balances again being transferred across accounts electronically.

Outside ECB control, why can’t the government simply instruct the Greek Central Bank to accept newly issued sovereign bonds, and to likewise make an electronic deposit of funds into the government bank account, so that it can continue to pay its bills?

After all, the government is currently running a budget surplus on current account, so it is not actually a matter of the government itself having sufficient funds.

The real issue of why the government has required lending from the troika,as you say, is not to cover its current spending, but to cover its obligations on capital account. Once you default on a debt that everyone knows isn’t going to be repaid, then that restriction and requirement itself disappears.

The other problem the country faces is paying for its imports but that is really a problem for private sector importers not for the government.

The Greek Central Bank is independent of the government and in any event, without European support SYRIZA has limited space to operate. A travel warning from the EU powers regarding Greece would destroy tourism and it would all collapse. This is a threat they can hang over Greece as they destabilize the political system. And Greece has import gasoline and most of its food so imports are no small matter.

Too bad the left isn’t proposing common ownership of the collective product of labour, along with democratic control of same and the abolition of the wage system. At least then, the immense majority of Greek citizens would have an anti-capitalist alternative to rally around.

“Syriza will campaign for a no vote. … The government must … refuse to recognise the ‘odious’ Troika debt. It must impose capital controls; it must nationalise the Greek banks; and bring the commanding heights of the economy under the control of labour.”

So Syriza-ANEL must campaign from now to July 5 (!) with this platform. Otherwise, how many Greek voters will conclude that a Yes vote is better than things getting worse and worse as the Eurocrats and Syriza play game theory with each other? But don’t hold your breath waiting for Syriza-ANEL to do more than denounce the Euro thugs.

Reblogged this on Econo Marx 21.

I read Varoufakis’ response to the EU with interest. He said:

“Some worry that a Yes vote would be a vote of no confidence in our government (as we shall be recommending a No vote), in which case we cannot promise to the Eurogroup that we shall be in a position to sign and implement the agreement with the institutions. This is not so. We are committed democrats. If the people gives us a clear instruction to sign up on the institutions’ proposals, we shall do whatever it takes to do so – even if it means a reconfigured government.”

I take this to mean that in the case of a “Yes” vote, Syriza would split, and those who have conceded so much to the EU already would then “reconfigure” themselves with the conservatives to form a majority to push through more austerity. If such additional austerity were to be resisted by further demonstrations and strikes, can we suppose the right of Syriza would work with the conservatives to use the full force of the police and army against them?

“Too bad the left isn’t proposing common ownership of the collective product of labour, along with democratic control of same and the abolition of the wage system. At least then, the immense majority of Greek citizens would have an anti-capitalist alternative to rally around.”. Yes, absolutely and – at last! – some common sense from a Marxian perspective

The idea that a basically reformist, non-revolutionary and therefore pro-capitalist Syriza government….

“must impose capital controls; it must nationalise the Greek banks; and bring the commanding heights of the economy under the control of labour. The Greek people can start to turn round this depressed economy. But the Greeks cannot do this alone; it requires the combined efforts of European labour to break the grip of capitalist forces on economic policy and investment.”

…..is just wishful thinking in the extreme. It is no solution at all

Trying to operate a system of capital accumulation in the interest of wage labour is utter nonsense and is a certain recipe for more disillusionment, more despair and yes even more austerity – no less so under a state administered, nationalised capitalism than under a system of privatised capital.

When, oh, when are our “marxist” economists finally going to grab the bull by the horns instead of dabbling in this reformist deception of raising false hopes?

Wonderful, in the meantime, how will Greece manage this utopia once it is locked out of the EU market (where almost all its exports go) and has a travel warning issued against (killing tourism) ?

For instance, Greece imported 2 + billion dollars worth of pharmaceuticals from the EU last year. How do you propose they pay for these as thing stand ? By “nationalizing the banks” ?

Real life is difficult.

Indeed real life is difficult, when the pharmaceuticals imported are not nearly enough to meet the needs of the population; when the program for so-called economic recovery requires reduced revenues; reduced support for social welfare.

Real life requires that we acknowledge that no matter what, Greece’s economy was bankrupt; that the Troika couldn’t care less about “growth” “development” improving living standards.

Real life requires that we recognize that economics is nothing but one class dominating the other.

That’s real life. Not acknowledging that leads you to acting like a Sonderkommando in a death camp. That’s what the referendum should be about. Do we want a government of Sonderkommandos, keeping order, parceling out death, one memorandum at a time?

Heard James K. Galbraith on KPFA (a leftist radio station in the SF Bay Area) this morning. See http://utip.gov.utexas.edu/JG/default.html and especially http://utip.gov.utexas.edu/JG/Comments%20and%20Interviews.html

Galbraith made much of his connections to Yanis Varoufakis, even referring to himself as some sort of semi-official “advisor” to the SYRIZA government. Based on the above CV, Galbraith appears as a sort of “radical Left” Keynesian – really a measure of how “radically Right” the so-called “mainstream” has become on economics. Hence much of what he had to say about the present situation was predictable.

However there is the question of the contribution of Greece’s NATO military expenditures to its debt situation:

Here is a “mainstream” take: http://www.tradingeconomics.com/greece/military-expenditure-percent-of-gdp-wb-data.html

The “biased Leftist” view: http://www.analyzegreece.gr/interviews/item/145-frank-slijper-an-insane-level-of-military-spending-led-greece-to-massive-debts-for-weapons-does-not-need

Also: http://www.theguardian.com/world/2012/apr/19/greece-military-spending-debt-crisis According to this,

“No other area has contributed as heavily to the country’s debt mountain. If Athens had cut defence spending to levels similar to other EU states over the past decade, economists claim it would have saved around €150bn – more than its last bailout. Instead, Greece dedicates up to €7bn a year to military expenditure – down from a high of €10bn in 2009.” and “”One could argue that with 1,300 tanks (!!!), more than twice the number in the UK, Greece has many more than it needs”. Defense expenditures are also a prime source of corruption, unsurprisingly.

Of course the excuse for this is to defend against Turkey, a fellow NATO “ally”!

I was thus astonished to hear Galbraith blandly state, without further comment, that the “radical Left” SYRIZA “remains fully committed to NATO”! Now it is tactically understandable that the hard-pressed SYRIZA government would not want to open up yet another front here at this time, one that would furthermore incur the wrath of the the strongest imperial power of them all, the United States (and this is part of the calculus in the present U.S. qualms over the EU treatment of Greece) – also the #1 supplier of arms to Greece, according to the Guardian article. This doesn’t excuse handing over the defense portfolio to the right-wing ANEL, meaning that this issue can never be addressed until ANEL is gone.

However if the Left supporters of SYRIZA, however nuanced, conditional and “tactical” that support is (and I count myself as a purely “tactical” supporter, only so long as they move in the correct direction, even if “correctness” here was forced upon them by the Troika) are TRULY SERIOUS about SYRIZA as a longer term political project, and want to show that they are working for more than a flash-in-the-pan government, then they must have as a *minimum* political program a true longer-term “regime change” government – the electoral political conditions are already there.

If SYRIZA survives the present crisis, this means the “radical Left” must move on to address the profound irrationalities of Greece as a social formation (there’s an expression the Poulantzas-trained SYRIZA members should recall), for which the defense expenditure stupidities are merely the tip of the iceberg, and that are also connected to the contradictions of Greek public opinion concerning the Euro. Modern Greek bourgeois-national identity is heavily invested in this myth of the country as the source of “Western Civilization” and of course, “Democracy” (this latter with some ideological use in the present situation). This myth is of course an export product of early 19th century British imperialist neo-classical romanticism that saw itself as the latter-day “world Athens”. The myth is not of Greek origin at all, but imperialist. Real material Greek national history is that of a country of the Balkans-Asia Minor region, but that is the region that the Turk-hating, anti-communist Greek bourgeoisie has kept the Greek people relatively isolated from. It is the material roots of this mythology – found variously in the role of the Greek Orthodox Church and in NATO membership – that need to be pulled up over the longer run, for Greece to find a viable economic path to development in the longer term.

Otherwise, it really is just artesian’s clown wigs and noses, and why waste our credibility, much less time, on a farce?

BTW, Greece is also a *founding* member of the U.S. organized and policed OECD, the the American-Athenian brain-grandchild of the Marshall Plan and its Olympian successor, the OEEC. The layers of mythology grow ever deeper – what’s that we heard about “The tradition of past generations weighs like the (Alps) PARTHENON on the brains of the living.”?

The Eighteenth Brumaire of mini-me Hitler the Nephew may be what bears down upon the brain this time.

Here’s irony for you: Tsipras votes “YES”

http://www.ft.com/intl/cms/s/0/e82e0256-1fcb-11e5-ab0f-6bb9974f25d0.html#axzz3edtkr1Xu

1) As of late 2009 there was no explicit procedure for each of these: voluntarily leaving the euro; expelling a state from the euro; expelling a state from the EU.

Source: an ECB working paper https://www.ecb.europa.eu/pub/pdf/scplps/ecblwp10.pdf

In each of these cases the impicit yet somewhat absurd procedure is to refound each institution, with the signing of a new treaty by the mutually agreeable.

The working paper also considers a state using the euro but not being a constituent of the European System of Central Banks (the legal term found in the relevant statute).

2) Given the two-page letter from the Greek government last Tuesday afternoon (30 June) accepting the Troika’s final offer with a quibble here & there, the government effectively called for a ‘yes’ vote.

Importantly, especially in the light of yesterday’s statement by the IMF Greece team, this letter made no mention of debt restructuring.

3) The ECB decision, announced Monday, not to increase its loan to the Greek central bank seems to violate its duties. These are the relevant clauses of its statute:

“[. . .] the basic tasks to be carried out through the ESCB shall be: [the 4th and final one:] to promote the smooth operation of payment systems” (Article 3.1); &

“the ESCB shall contribute to the smooth conduct of policies pursued by the competent authorities

relating to the prudential supervision of credit institutions and *the stability of the financial system*” (Art. 3.3, my emphasis)

(Article 3 ‘Tasks’)

Click to access en_statute_from_c_11520080509en02010328.pdf

Why have almost all journalists, & others, chosen to ignore these facts?

I would have indented this to my Friday comment, but as of Sunday lunchtime it is still awaiting approval.

This addendum refers to part of my point #2, namely the lack of reference to debt restructuring in the Greek government’s effective agreement to the Troika’s offer, teatime Tuesday, 30 June. Today the Guardian linked to a NYT story dated 2 July that identifies the main sticking point of the final week’s Brussels negotiations: debt restructuring. So last Tuesday’s acceptance, with no mention of the core disagreement, not even as an aspiration, was a declaration to the creditors that the Greek government was capitulating – but it still wasn’t enough for them.

If the Greeks didn’t already know, the Troika wasn’t interested in making an agreement. As Tsipras is reported to have said to his team in Brussels on Friday morning, 26 June, in a meeting that ended with the referendum call, “[t]his is going nowhere, the 40-year-old Greek leader said in frustration, according to people who were in the room with him. The more we move toward them, the more they are moving away from us, Mr. Tsipras said.”

(Just seen my Sunday addendum wasn’t subject to approval, so this is the re-post of an improved version of Friday’s comment – perhaps it having links put it into spam, so I’ve twice added a space before the ‘.eu’.)

1) As of late 2009 there was no explicit procedure for each of these: voluntarily leaving the euro; expelling a state from the euro (forcing it to stop using the currency and/or removing its signature from the treaty); expelling a state from the EU.

Source: an ECB working paper https://www.ecb.europa .eu/pub/pdf/scplps/ecblwp10.pdf

I surmise that in each of these cases an implicit yet somewhat absurd procedure is to refound each institution, with the signing of a new treaty by the mutually agreeable.

The working paper also considers a state using the euro but not being a constituent of the European System of Central Banks (the legal term found in the relevant statute denoting the ECB plus the central banks of the signatory states).

2) Given the two-page letter from the Greek government last Tuesday afternoon (30 June) accepting the Troika’s final offer, albeit with a quibble here & there, the government effectively called for a ‘yes’ vote.

Importantly, especially in the light of yesterday’s statement by the IMF Greece team, this letter made no mention of debt restructuring, not even as an aspiration.

3) The ECB decision, announced Monday, not to increase its loan to the Greek central bank seems to violate its duties. These are the relevant clauses of its statute:

“[. . .] the basic tasks to be carried out through the ESCB shall be: [the 4th and final one:] to promote the smooth operation of payment systems” (Article 3.1); &

“the ESCB shall contribute to the smooth conduct of policies pursued by the competent authorities

relating to the prudential supervision of credit institutions and *the stability of the financial system*” (Art. 3.3, my emphasis)

(Article 3 ‘Tasks’)

http://www.ecb.europa .eu/ecb/legal/pdf/en_statute_from_c_11520080509en02010328.pdf

Why have almost all journalists, & others, chosen to ignore these facts?

Jara sorry not sure why it did not go through on Friday

No prob. But am I missing something about the ECB’s duty to keep funding the smooth operation of the euro in Greece, a funding that, according to Article 3, is absolute, conditional on nothing?

The “basic [task]” of the ECB “to promote the smooth operation of payment systems” turned up in a radio interview today with Martin Schulz, German ‘social democrat’ & President of the European Parliament.

The Guardian reports him as saying, “if they say ‘No’ they will have to introduce another currency after the referendum because the euro is not available as a means of payment.”

The interview was conducted Thursday & broadcast today by Germany Radio (Deutschlandfunk). Schulz knew his comments would be made public on the day of the vote, as evidenced by this from the quote in the Guardian: “[t]he moment someone introduces a new currency, they exit the eurozone. Those are the elements that give me some hope that people will not vote ‘No’ today.”

The “referendum” is meaningless; another bail-OUT is not on the table.

What is on the table, what will happen next is a bail-IN, where depositors get separated from their deposits a la Cyprus.

FWIW- http://thewolfatthedoor.blogspot.com

Jara. It seems that the ECB is acting politically and breaking it’s own mandates

Mark Blyth on Tuesday (7 July) made the same point:

“At the time of writing, the ECB is not only violating its own statutes by limiting emergency liquidity assistance to Greek banks, but is also raising the haircuts on Greek collateral offered for new cash. In other words, the ECB, far from being an independent central bank, is acting as the eurogroup’s enforcer, despite the risk that doing so poses to the European project as a whole.”

‘A Pain in the Athens: Why Greece Isn’t to Blame for the Crisis’; this article is punchy, not least because it is clearly written: https://www.foreignaffairs.com/articles/greece/2015-07-07/pain-athens

On the violation, Blyth links to an FT article of the previous day, Martin Sandbu’s daily Free Lunch column, ‘ECB, enemy of the euro?’: http://www.ft.com/intl/cms/s/3/bbf26c42-23bb-11e5-bd83-71cb60e8f08c.html#axzz3fWF305YC

Sandbu gives details:

“[. . .] while Frankfurt’s central bankers rarely mention them, the ECB has a number of other explicit responsibilities, so long as they don’t come into conflict with stable prices. Two are particularly relevant – one specific, one general.

“The specific task is to ‘promote the smooth operation of payment systems’. Ask the pensioners in line at Greek banks, or the importers finding their letters of credit turned down, how smoothly the payment system is working.

“The general task is to ‘support the general economic policies in the Union with a view to contributing to the achievement of the objectives of the Union’ as laid down in the treaty. One such economic policy is the ‘imperative to break the vicious circle between banks and sovereigns’ – that is to say, to make sure that the functioning of banks does not depend on the solvency of the state (and vice versa). And the stated objectives of the EU include ‘the sustainable development of Europe based on balanced economic growth and price stability … full employment … economic, social and territorial cohesion’.

“On the face of it, sectioning off the Greek banking system and blocking Greek residents’ access to banking services flies in the face of the ECB’s legal mandate.”

He also makes the point that because the ECB judges the Greek banks solvent with “equity of 18 per cent of assets” it means they judge themselves able to lend the Greek central bank 82% – it’s just that they choose not to, turning down last week’s request for extra liquidity *&* also devaluing the Greek state bills put up as collateral, effectively saying it would be too risky! Can’t have it both ways – unless you want to twist the knife.

FT Sandbu concludes: “[w]e must draw the rather dramatic conclusion that the ECB is violating its mandate”, saying “Paul De Grauwe goes further, arguing that the Greek state, too, is in good enough shape for the ECB to [start to (my interjection)] buy Greek sovereign bonds through the OMT programme.”

In an article, Friday, 3 July, De Grauwe argued that the effective debt burden of the Greek state is “less than half” of the nominal 180% of GDP. If Greece had a nominal growth rate of perhaps 2% then the Greek state would “most likely” be solvent – it’s just that it’s currently illiquid as a result of five years of contraction caused by Troika-imposed austerity.

http://www.voxeu.org/article/greece-solvent-illiquid-policy-implications (formerly in the Belgian parliament as member of Verhofstadt’s party (he of Wednesday’s outburst against Tsipras in the European Parliament), & now a LSE economics prof, drifting from Mises towards ordoliberalism)

In case you feel curious, I link the film of Syriza: https://vimeo.com/139440456

Regards