In this tortuous saga between the leaders of the Eurozone and the new Greek government over repaying its public sector debt and continuing with a Troika-imposed austerity programme, we must remember that the cause of all this mess is the failure of capitalism in Europe and Greece.

Yes, the Syriza government has retreated massively from its original position to cancel or renegotiate the ‘odious’ debt burden and it has given way on some (many?) of the immediate measures it wanted to take on reversing austerity and improving the hugely reduced living standards of Greek households. But that was inevitable if the government wants to sustain Greek capitalism inside or outside the Eurozone. Greek capital is the weakest in the spectrum of European capital, where Germany and France are strongest. They call the tune.

So the real villain of the piece is Capital in the persona of Franco-German capital and their supporters in the governments of the other ‘distressed’ EMU states of Spain, Portugal and Ireland, as well as ‘northern Europe’.

There are many commentators, including those on the Keynesian left, who complain that the Germans are being unreasonable and stupid. Giving the Greeks some leeway on public spending and reducing the burden of debt would help restore the Greek economy and keep the European project going in the face of increased scepticism from the electorate of Europe and a stagnating and deflating Euro economy. You see, austerity does not work, so goes the argument (http://mainlymacro.blogspot.co.uk/2015/02/greece-and-educating-economists.html).

But the Germans are not ‘irrational’ from the point of view of Capital. The Austerians reckon that European capitalism will not recover unless the capitalist sector is restored to high profitability and the burden of debt is reduced. That means neoliberal ‘structural’ reforms involving primarily decimating the power of labour through anti-trade union laws, increased sacking rights, reducing unemployment benefits and pensions and more privatisations. Alongside this, there must be cuts in public spending and debt to allow cuts in corporate taxation to raise profitability. Get labour costs down and boost profitability – that’s the way out of this depression (https://thenextrecession.wordpress.com/2012/04/14/the-austerity-debatehttps://thenextrecession.wordpress.com/2012/09/30/can-austerity-work/).

That is a rational strategy for Capital. The Keynesians, on the other hand, reckon that cutting wages and fiscal austerity just slashes ‘effective demand’, so that more austerity breeds even less growth. In the depth of depression, this argument has some validity, especially in Greece. But the essence of recovery on a capitalist basis must be a return to profitability and raising wages or spending more on welfare does the opposite (https://thenextrecession.wordpress.com/2015/02/08/the-causes-of-recovery-austerity-qe-and-the-spending-multiplier/).

So the German intransigence flows from an ideological belief that fiscal austerity and wage-cutting programmes are essential. As the Germans are not committed in any way to proper fiscal union in Europe (see my post, https://thenextrecession.wordpress.com/2015/02/12/red-lines-and-fiscal-union/), they do not want to make any (or the most minimal) concessions to Syriza. Moreover, they are backed in this by the venal, corrupt and harsh neoliberal governments still in office in Spain, Portugal and Ireland who have imposed Troika programmes on their people and who would be badly undermined if there are better terms for a leftist government in Greece. The feeble pro-capitalist social democratic governments of Italy and France, both trying to impose ‘structural reforms’ on labour, also go along with this.

Unfortunately, propaganda in Germany and the rise of Eurosceptic forces have led the German electorate to believe that the Greeks are lazy, are all on benefits, get huge pensions and are corrupt. Apparently, 66% of Germans asked do not want the Greeks to get any concessions. Of course, this characterisation of the Greek working class is nonsense.

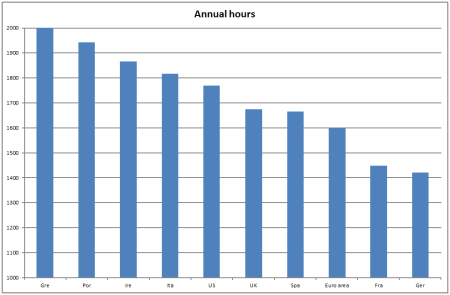

Greeks work more hours in a year than any other country in Europe – and more than even the Americans or Brits! And surprisingly, it is the Germans who are the ‘laziest’, if measured by hours worked.

Although Greek economy-wide productivity started from a low base when the country joined the Eurozone in 1999, growth in labour productivity since then has been faster than in the strong capitalist economies of Germany or France, Greece up 25% compared to just 10% in Germany.

The reason Germany has been so competitive has not been because the growth in its productivity of labour was so good, but because wages have risen the least, just 22% since 1999 compared to nearly double in Ireland and up two-thirds in Greece (see my post, https://thenextrecession.wordpress.com/2013/09/22/german-capitalism-a-success-story/).

So while Greeks saw their living standards improve under the euro until the crisis came, they did this by working the longest hours and by being exploited more than any other workforce in Europe. The biggest gainers from joining the euro were the Greek capitalists. The fruits of increased economic growth and trade went to them disproportionately. The wage share in Greek national income fell nearly 4% pts, a fall only surpassed by Spain and more even than American workers suffered relatively.

In my view, Syriza was correct to say that it wanted to stay in the euro and campaign for removing the debt burden and reversing austerity. To start from the view that Greece must leave the euro and then look at ‘reversing austerity’ puts the cart before the horse and also runs in the face of the aspirations of Greeks to be ‘part of Europe’.

But what is wrong with Syriza’s position (in my view) is to see the issue of debt and ‘fiscal space’ as the main (sole?) issues and have the illusion that the Eurogroup leaders will see it is in their interest to save European capitalism from a serious blow if Greece is thrown out of the euro. As we now know, Greek finance minister, Yanis Varoufakis, says he aims to save capitalism from the stupid policies of neoliberalism, get some time to recover and then look at socialist measures some way down the road when capitalism is on a better footing (see my heavily criticised post,

https://thenextrecession.wordpress.com/2015/02/10/yanis-varoufakis-more-erratic-than-marxist/).

What’s wrong with both the Syriza leadership position and that of the left within Syriza is that they have put the debt burden and the euro on the front burner rather than replacing failed Greek capitalism at home as the top priority. Whether Greece is in or out the euro will not restore growth and living standards if the capitalist sector continues to dominate in Greece. Greece’ s public sector debt can never be repaid and should be written off as odious. But the cost of servicing it has fallen to low levels already, so writing it off will not alone kick-start the economy.

The Greek government and its people must seize control of the commanding heights of the economy. That means public ownership and democratic control of the banks and the major strategic companies; the launch of a public investment programme for jobs and growth and an appeal to solidarity within Europe for the Greek alternative against the neo-liberal governments in the Eurogroup. That would probably lead to Greece being ousted from the EU, given the current balance of political forces. But at least the Greek people and the rest of Europe would see why the Euro leaders are doing it and also have a clear alternative plan B to implement (https://thenextrecession.wordpress.com/2011/09/11/an-alternative-programme-for-europe/).

The danger now is that Syriza will agree to a compromise with the EU leaders that ‘saves’ Greek and Euro capitalism at the expense of little or no improvement in the conditions for the bulk of Greek people. All that does is postpone the crunch between reversing austerity and the interests of Capital, without a Plan B in the interests of Labour.

Plan B was always going to be revolution. That is why the gamesman said there is no Plan B.

Why not simply, and immediately, repudiate the debt in its entirety; slap capital controls to freeze any capital “flight”?

Syriza didn’t put the “debt issue on the front burner,” the bourgeoisie did; capitalism did.

Syriza’s position, and it’s not a “mistake” but an accurate reflection of its orientation, program, purpose, mission, is that the debt issue can be decoupled from the issue of capitalism itself.

That’s why the Syriza government proclaims its allegiance to the euro, to “Europe”– as if such a thing as Europe exists outside a specific mode of production.

That is also why the Syriza government cannot “seize control” of the “commanding heights of the economy.” That takes a social movement, a class movement in opposition to the class of the bourgeoisie.

Plan B requires something other than a change of mind or orientation by the Syriza government.

Would the whole issue of balanced economics in Europe, have been straightened out, if the cowardly countries that supported Greece and also have very similar economic predicaments, all Exit the Euro? Any opinions on this?

what countries would that be? Ireland didn’t support Greece; Portugal and Spain haven’t supported Greece. Italy?

Maybe by irresponsible you mean Finland, Germany, Austria, the Netherlands?

As long as they continue to put taxes on people for debts that have already been paid three times over the issue is whether Syriza can work for the Banksters without provoking a revolt. This is what is at stake. Just as Syriza believes you can end austerity within the EZ Schauble believes more cuts won’t lead to a revolt. In the end they are both fooling each other that a Divorce isn’t the best way to manage the situation.

Interesting post but I don’t agree that debt negotiations have been done at the expense of replacing failed Greek capitalism. There is enough in the Syriza manifesto and in their post-election actions to show that they fully intend to roll back on privatisation commitments and begin to nationalise key industries. Given the freedom to pursue this mandate it is possible they could usher in a radically different economy and social structure to that anywhere else in Europe. But the point here is that they do not have the freedom to pursue this mandate outside discussions with its creditors. Greece is facing a solvency problem which will undermine a nationalisation programme and unless it reaches a compromise with the Eurogroup, or secures funding elsewhere, its mandate could well be finished before it has begun.

The alternative would be to default immediately on the debt and leave the euro while Syriza enjoys the support of the electorate. Making the economy more competitive would be a step towards resetting its fiscal position but Greece would probably need to hold a referendum before bailing out the eurozone to try to ensure there is enough social backing to hold back the tide of protest that would accompany the consequences of debt default. Sadly though, without any major partners willing to support the Greek position or to offer it credit in the event of a euro exit, it is hard to predict what Greece will look like in the immediate post-euro years. And this is why it is almost impossible to decouple debt negotiation from replacement of the current system of Greek capitalism. To do otherwise risks severe socioeconomic turmoil which could unleash the far-right forces which Varoufakis has mentioned many times in recent weeks. It would be a huge risk but unless the Eurogroup changes its position it may soon be the only option left.

Severe socioeconomic turmoil has already been “risked” and implemented, with the working class suffering greatly. Far-right will be unleashed sooner or later. The question is how can the right be defeated?

I doubt there would be any popular “tide of protest that will accompany the consequences of debt default, ” and much more than a referendum will be required to actualize that default.

Push comes to shove, and when that happens there are two questions that must be answered: Who controls the military, and if “we” don’t, how can we neutralize i

I think you’re absolutely right that “The Greek government and its people must seize control of the commanding heights of the economy. That means public ownership and democratic control of the banks and the major strategic companies;” etc. Negotiations with the Troika are not going to get the Greek people what they need. Unfortunately, I think the Syriza leadership is going to choose capitulation over the confrontation that’s necessary.

Varoufalis thinks it’s the moral duty of leftists to save European capitalism from itself. He is opposed in principle to even attempting to build a socialist alternative. See my detailed analysis of why I don’ trust this guy as far as I can throw his :”muscular” motorcycle, and why I think Syriza will not be the force of change that the Greek people need, and Western leftists are hoping for., at The SYRIZA Moment: A Skeptical Argument

http://www.thepolemicist.net/2015/02/the-syriza-moment-skeptical-argument.html

Phew! European capitalism is saved. Pity about the Greeks though. When’s the next election?

Well, Syriza has given us its answer: Troika.

http://thewolfatthedoor.blogspot.com/2015/02/nsfws-2.html

Typo in the para between the annual hours and GDP per employee graphs? Last line should read to say that productivity growth was 10% in Greece and not Germany which was 25%?

Why should public sector debt reduce private sector profitability.

Reblogged this on Alejandro Valle Baeza.