It’s just over ten years from its last major currency and debt crisis and Argentina is looking into the gun barrel of major slump again (see my recent post, https://thenextrecession.wordpress.com/2014/01/25/emerging-market-crisis/). In that post, I commented that “Argentina is suffering the most because it already defaulted on its debts back in 2001 and has had large deficits on its balance of payments with the rest of the world. The irony here is that many Keynesians like to use the example of Argentina as a way out of the austerity that the likes of Greece or Portugal are suffering in the Eurozone. Do what Argentina did in 2001: ‘default on your debts, leave the euro and devalue your currency, then you can get growth’, the argument went. Well, the proverbial chickens have come now to roost on that strategy.”

It seems that I am not the only one that has picked up on the contradictions of the Keynesian solutions for the slumps in Greece and Argentina. Neoliberal economists have swung into action to criticise Keynesians like Paul Krugman and Matt Iglesias for promoting the example of Argentina as the way out for Greece in its depression back in 2012 (see http://thefaintofheart.wordpress.com/2014/02/02/another-krugman-flip-flop-notice-that-he-never-misses-the-mark/ or http://econlog.econlib.org/archives/2014/02/where_the_stres.html).

Of course, these neoliberal critics argue that what was wrong with Argentina’s policies was not so much going for devaluation, or even defaulting on their foreign currency debts, but more that the government adopted “counterproductive statist policies” like nationalising the energy companies. My criticism was different. Back in February 2012, I posted (https://thenextrecession.wordpress.com/2012/02/20/exiting-the-euro/) that for Greece: “devaluation would not work, unless a national capitalist economy can improve competitiveness and raise exports to pay for foreign investment. Without that, devaluation can only make the foreign debt burden even worse. Indeed, competitively priced exports will be difficult to achieve if so much capital and raw materials must be imported to make those exports. And Greece’s import component of exports is high. Indeed, the experience of five recent devaluations of economies in crisis (including that of Argentina) shows that they lead to a 10-20% fall in real GDP and take five to ten years to recover to previous real GDP levels (http://www.cepr.org/meets/wkcn/1/1621/papers/Rebelo.pdf) – that’s no picnic.”

And back in May 2012, when looking at the Argentine ‘alternative’ for Greece in its euro debt crisis, I commented: “Argentina is usually cited as a successful example of a capitalist economy sticking its fingers up to the IMF and achieving fantastic growth after defaulting and devaluing. Clearly, writing off what Greek left leader Alexis Tsipras has called ‘odious’ debt must be part of the escape from recession. But leaving it at that and devaluing the currency by leaving the euro is no answer, even in the short term. A recent report by the Federal Reserve Bank of Dallas (Default and lost opportunities: a message from Argentina, May 2012) showed that Argentina was lucky in 2001 when they defaulted and devalued the peso. After a big drop in GDP, real GDP per capita rose by 7% a year for next seven years. But that coincided with the huge global commodity boom benefiting sales of agro products that Argentina produced. A similar default and devaluation of 1983 did not deliver a great recovery. Then, in the depths of a global recession (much like now), real GDP fell 15% and did not recover to pre-crisis levels until 10 years later.” https://thenextrecession.wordpress.com/2012/05/10/eurozone-debtmonetary-union-and-argentina/

Krugman has been stung into replying to his neoliberal critics. In a recent post, he retorted: “there’s no contradiction at all between saying that Argentina was right to follow heterodox policies in 2002, but it is wrong to be rejecting advice to curb deficits and control inflation now. I know some people find this hard to grasp, but the effects of economic policies, and the appropriate policies to follow, depend on circumstances….Running deficits and printing lots of money are inflationary and bad in economies that are constrained by limited supply; they are good things when the problem is persistently inadequate demand. Similarly, unemployment benefits probably lead to lower employment in a supply-constrained economy; they increase employment in a demand-constrained economy; and so on.” Presumably then, Argentina was in the latter state (inadequate demand) in 2002, although how it got into such a state Krugman does not say. Apparently, it is in the opposite state now (limited supply), although that is not what Krugman indicated back in 2012, when others were arguing that Argentina was in trouble.

In his reply to the neoliberals, he reverts to attacking them for always claiming that increased money supply will lead to inflation. As he correctly says, that depends on whether an economy is overheating because of ‘limited supply’ or is suffering from a ‘lack of demand’. In the former, as in Zimbabwe, pumping up credit will lead to hyperinflation, but in the US now, more credit and spending does not lead to inflation of goods prices, so it is not a problem. All we have to do is recognise in what situation we are in. So Krugman says, it was right to devalue and boost spending in Argentina in 2002 but not right now. This time the Argentine government is “making the symmetrical error to that of people who think that running deficits and printing money always turns you into Zimbabwe; it’s the belief that the orthodox rules never apply. And it’s an equally severe mistake. It’s not a common mistake these days; a few years ago one would have said that only Venezuela was making the old mistakes, and even now it’s just a handful of countries. But it is a mistake, and we need to say so.”

Krugman may be right that increased credit won’t drive up the prices of goods and services in a situation of slump. But what the experience of the period before the Great Recession and in the current ‘recovery’ period shows is that huge injections of credit will drive up stock and property prices, but not boost real GDP or investment. Unconventional quantitative easing has not succeeded because it does not recognise any problem exists in the productive sectors of the capitalist economy. So it actually creates yet new bubbles (see my post, https://thenextrecession.wordpress.com/2013/11/30/secular-stagnation-or-permanent-bubbles/).

You can see where we are going here with Keynesian economic policy. It is a question of macro-managing an economy: if it heats up too much, then cool it down with higher interest rates and tighter fiscal policy. If it is in a cold slump, then cut interest rates towards zero, boost credit and government spending. So it’s a continual battle for a ‘Keynesian-style’ government to keep the capitalist economy on the ‘straight and narrow’. It would seem that Keynesians accept that a capitalist economy cannot stay on an ‘equilibrium path of endogenous growth’ (as the UK’s current Labour finance spokesman, Ed Balls, used to argue that it could when he was in the last UK Labour government under Gordon Brown just before the Great Recession).

For Keynesians like Krugman, an economy is a bit like driving a car with faulty steering. They see the car veering off the road, so they attempt to correct it by turning the wheels, but they never find out why the steering is faulty in the first place – that’s less important when you are veering off. As a result, they cannot predict when the next swerve will happen and so the car usually ends up in the ditch.

In contrast, Marxist economics makes a serious attempt to see why capitalist economies suffer from recurring crises around a cycle of booms and slumps. Argentina had not achieved an ‘endogenous growth path’ by devaluing and government spending after 2002. G Carchedi and I tried to explain why in our recent paper,The long roots of the present crisis, when we analysed Argentina as a case study. We did not do so by looking at money stock growth or inflation, but at Argentina’s rate of profit on capital accumulation.

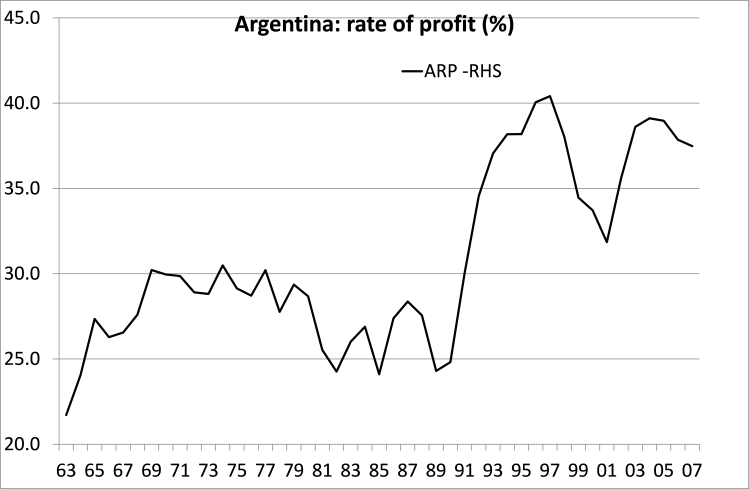

During the 1990s, Argentina’s rate of profit took off. But it peaked in the late 1990s and the rate of profit fell from 40.4% in 1997 to 31.8% in 2001. So the crisis of profitability ignited the financial crisis (rather than the other way around). The slump of 2001 onwards renovated the rate of profit for a while, but the level never returned to that of 1997 and started to fall again after 2004, well before the global financial crash hit the economy. So Argentina was ripe for another fall.

We concluded that “Argentina’s recovery (from 2002) was fuelled neither by devaluation nor by redistribution policies, but by the re-creation of previously destroyed private capital in the private sector with a low organic composition; a rising rate of exploitation; and improved efficiency. This is the cause—rather than Keynesian policies—of Argentina’s economic revival.” And a falling rate of profit after 2004 was the sign that the crisis would return.

This brings me to the causes of the Great Recession once again. Krugman has launched a series of lectures entitled: The Great Recession: Causes and Consequences. He has published the slides for his first lecture here. These are only power point graphs so far and Krugman’s explanation of the causes of the Great Recession are not developed in any notes yet. But nevertheless, we can see where he is going.

He quotes Keynes about the great slump of 1930: “This is a nightmare, which will pass away with the morning. For the resources of nature and men’s devices are just as fertile and productive as they were. The rate of our progress towards solving the material problems of life is not less rapid. We are as capable as before of affording for everyone a high standard of life —high, I mean, compared with, say, twenty years ago — and will soon learn to afford a standard higher still. We were not previously deceived. But today we have involved ourselves in a colossal muddle, having blundered in the control of a delicate machine, the working of which we do not understand. The result is that our possibilities of wealth may run to waste for a time —perhaps for a long time.”

So Krugman, like Keynes in the 1930s, sees the current Long Depression as an interlude (that could last a long time) but eventually, with the right policies, capitalism can be set back on a course of prosperity. What we have right now is only a technical malfunction in the economy that can be corrected if neoliberals and governments were not so stupid or greedy (see my post, https://thenextrecession.wordpress.com/2013/08/16/its-a-technical-malfunction/).

In his graphs, he suggests that the Great Recession was caused by a housing bubble that went bust and excessive credit, but he provides no explanation (yet) why that should have happened. There is nothing inherently wrong with the capitalist mode of production, except that occasionally it is liable to veer off the road and we just need to be vigilant and act quickly – and not just leave things to the market. Action is more important than analysis.

Krugman summed up his first lecture: “Macroeconomics: what is it good for? Two kinds of analysis, not the same: First, what is going on in a depressed economy? How is it that “our possibilities of wealth may run to waste for a time”? Second, what leads to the crises that precede a depressed economy? Strong temptation to obsess about (2) while taking (1) as obvious. It isn’t, and how you answer (1) is arguably the key issue for the world of today”. So, as in his book, End depression now! (see my post, https://thenextrecession.wordpress.com/2012/05/27/krugman-and-depression-economics/), it is more important to put in place the right policies to get out of this depression than to analyse why we got there in the first place. But unless you learn why something happens, you are doomed to repeat it, as Argentina shows.

Why is the secular tendence of profit to fall is backwards in Argentina?

Reblogueó esto en Econo Marx 21.

The more we expose the flaws of Krugman & the Keynesians the better. Only Marxists can come close to explaining the nature of crises under capitalism. Keep up the good work!

Then “Why is the secular tendence of profit to fall is backwards in Argentina?”?

Most economies experienced a rise in the rate of profit from the mid-1980s to the late 1990s. Argentina was no exception, although the rise in profitability in the 1990s was substantial, at first created by a severe crisis in the late 1980s and then driven by the commodity boom and huge demand from a fast growing China. In the 1990s, Argentina’s organic composition of capital fell with new technology and the rate of surplus value also rose with the use of cheaper labour (there was no rise in real wages during the 1990s). This was a sweet spot for capital accumulation, short as it was. Brazil’s profitability rose in a similar manner, if not quite so startlingly. But from the late 1990s, profitability resumed a downward course in Argentina and in most major economies.

A secular fall in profitability – if we mean a decline over a longer period from say 1945 or 1963 – applied in many economies, not just the US. Brazil’s rate of profit was a huge 59% in the late 1960s and is now about 40-45%. India’s was 50% plus in the early 1980s and is now about 40-45%. Argentina seems to be an exception on the data that I have. My data for Argentina are confirmed by the work of Michelena, G. (2009) “La evolucion de la tasa de Ganancia en la Argentina (1960–2007): caida e recuperación,” Realidad economica, no. 208: 83–106.

It´s hardly clear that the rate of profit in Argentina rose in such level during the nineties. Is has no relation with any other economic issues. Here is an estimation that recently published in Realidad Económica N°275. Michelena takes Financial Intermediation and Trade GDPS as profits considering that those sectors are surplus consumers but in that case the measure is highly indirect and not neccesarilly reflects the historical situations (with that profit level, so higher that ALL Argentina history GDP, employment, productivity has to increase in such way that finally never happen. That´s a more opaque measure.

On this estimation (total profits / fixed reproductive capital that takes 1910-2011 period) profitability recovers during the nineties, reaching a partial peak in 1997, but is far from pre 1973 levels, as happened in many other cases including other latinamerican countries like Brazil or Mexico.

In this link you can read the work http://www.iade.org.ar/modules/noticias/article.php?storyid=4573

Esteban

Thanks if this work is correct, then Argentina fits much better into the general trend of other economies. Ill check it out.

Speaking from a Greek perspective this article starts from a top down approach. The entrance of Greece into the EU bankrupted the economy and turned export surpluses as in agriculture, into deficits. The de-industrialisation of Greece, the mass importation of labour under the EU’s freedom of movement principles destroyed labour rates. The cancellation of foreign debt is a demand which is both natural and necessary only because Germany for instance never paid back its war debts, the war loans it imposed on Greece or the gold it took from its national bank. Merging six Greek banks into one, destroying the agricultural bank of Greece and breaking apart its infrastructure (shutting down its national airline Olympic Airways on behalf of Brussels whilst supporting say GM in Detroit against WTO rules) has as the aim of disrupting all business ventures in Greece.

Greece has 17million tourists annually. They could be doubled if allowed by Brussels (visa restrictions in place). Agriculture could serve to supply the tourist industry. Foreign multinationals if capital controls were introduced in Greece could be forced to buy Greek produce if they wanted to repatriate profits, Russian or Argentinian style.

The EU has no aim of getting out of any recession. They want a taxfree, union free, welfare benefit free zone in the former territory of Greece to become an example for the EU in order to compete directly with Bangladesh on a like for like basis, ie same wages same standard of living etc whilst at the same time looting its natural resources by bankrupting the state with interest rates which according to some Greek economists have seen Greek people pay over a $1trillion in a 30 year period.

A Left Exit from the EU, cancellation of the odious debt, nationalising banks whilst opening their books, reintroducing controls in capital, labour and goods, not an Argentinian style capitalist default (which was forced upon them by the rebellion) are the only options available in order to have a serious national economic policy in the era of transnationals. Anything short of that then we are buying time for the system to do us over and over again and again.

“For Keynesians like Krugman, an economy is a bit like driving a car with faulty steering. They see the car veering off the road, so they attempt to correct it by turning the wheels, but they never find out why the steering is faulty in the first place”

So, what is the fix that Marxism offer to the faulty steering? Dynamic systems in general, not only the economy, tend to follow the law of entropy. All equilibriums tend to be unstable to a degree and periodic external application of energy is ALWAYS needed to stay on course. This does not imply that the equilibrium mechanisms should be completely done away with in favor of a continuous external management.

I digress to these general laws of the universe – that apply to all branches of science (physics, chemistry and biology) – only to point that economics probably also would submit to these laws. Perhaps even more so, because it is a social science.

And please note that any alternative that requires human regulation will be as much susceptible to failing. To your example, even a perfect steering needs constant maneuvering and adjustment when guided by the human hand.

What evidence do we have that a Marxist system will drive economic well being any better than the current democratic capitalist system?

“For Keynesians like Krugman, an economy is a bit like driving a car with faulty steering. They see the car veering off the road, so they attempt to correct it by turning the wheels, but they never find out why the steering is faulty in the first place”

So, what is the fix that Marxism offer to the faulty steering? Dynamic systems in general, not only the economy, tend to follow the law of entropy. All equilibriums tend to be unstable to a degree and periodic external application of energy is ALWAYS needed to stay on course. This does not imply that the equilibrium mechanisms should be completely done away with in favor of a continuous external management.

I digress to these general laws of the universe – that apply to all branches of science (physics, chemistry and biology) – only to point that economics probably also would submit to these laws. Perhaps even more so, because it is a social science.

And please note that any alternative that requires human regulation will be as much susceptible to failing. To your example, even a perfect steering needs constant maneuvering and adjustment when guided by the human hand.

What evidence do we have that a Marxist system will drive economic well being any better than the current democratic capitalist system?

“So, what is the fix that Marxism offer to the faulty steering?”

Revolution and a complete worldwide termination of capitalism.

There is no theory of marxist socialist economy, in the sense you claim. Only of capitalist economy, except if you accept Lenin’s thesis that socialist is a monopole state capitalism, in transition to a stateless and classless society. But with a caveat, there should be only world wide planed economy, due a world wide revolution, that is, capitalism (non-socialist type) have to be completely terminated, under only one state, or at least, a very organized federation of states.

There are 2 simple reasons for that: non organized counter revolution and that, no matter how big is a country, the distribution of raw materials is extremely uneven.

After that is done, you have your evidence.

Not sure whether this comment was tongue in cheek. I am not implying that there is any Marxist economic theory, only questioning the rationale and any alternative that Michael Roberts has to offer to a Krugman’s “faulty steering”.

I personally believe that there is no such effective alternative and that Marxism is a failed ideology.

Regarding Daniel Rocha’s comment:

“So, what is the fix that Marxism offer to the faulty steering?”

Revolution and a complete worldwide termination of capitalism.

There is no theory of marxist socialist economy, in the sense you claim. Only of capitalist economy, except if you accept Lenin’s thesis that socialist is a monopole state capitalism, in transition to a stateless and classless society. But with a caveat, there should be only world wide planed economy, due a world wide revolution, that is, capitalism (non-socialist type) have to be completely terminated, under only one state, or at least, a very organized federation of states.

There are 2 simple reasons for that: non organized counter revolution and that, no matter how big is a country, the distribution of raw materials is extremely uneven.

After that is done, you have your evidence.”

Not sure whether this comment was tongue in cheek. I am not implying that there is any Marxist economic theory, only questioning the rationale and any alternative that Michael Roberts has to offer to a Krugman’s “faulty steering”. I personally believe that there is no such effective alternative and that Marxism is a failed ideology.

I was not ironic. I am serious about that. Whether the revolution is violent (with a large varying degree) or not and what should be done to achieve that, progressive or fast and violent, depends on which ideological strategy of a marxist.

But surely, revolution is the only answer. Michael Roberts agrees with me at least on that, maybe not with my strategy. My orientation is Leninist.

And, of course, I think Marxism is a failed ideology for those who believe in capitalism and protestant hard working ethics and can achieve with. My aim is of course, not to speak to them, not to the 99%, but for those in the bottom 50%, who work hard and earn nothing to have a decent life. Those in the 3rd world who cannot achieve anything worth of a decent life for endemic corruption.

The others, are enemies.