Last summer when the US fled Afghanistan, I wrote a post on the history of US dollar dominance I argued then that the US dollar would remain the dominant world currency for the foreseeable future, but that it was in relative decline compared to other currencies, precisely because US imperialism has been in relative decline compared to other rival economies since the mid-1970s.

The Russian invasion of Ukraine has brought this discussion to the fore again among mainstream economists and strategists of global capital. The talk is that US dollar dominance will wane and that the world economy is set to divide into two blocs: west and east – with the west being the US, Europe and Japan; and the east being the ‘autocratic’ regimes of Russia and China, along with India. But is this the likely reconfiguration of currencies and capital flows?

In my previous post, I dealt in detail with the historic decline in the dominance of the US dollar in trade, capital flows and as a reserve currency. I won’t go over that again. Instead, in this post, I will try and look at the future and the consequences of new developments in the competitive struggles between the imperialist powers, the ‘emergent’ economies resisting ‘western’ dominance; and the wider world of peripheral and poor countries.

International competitors to US imperialism, such as Russia and China, have routinely called for a new international financial order and have worked to displace the dollar at the apex of the current global currency regime. The addition of the renminbi in 2016 to the basket of currencies that composes the IMF’s special drawing rights represented an important global acknowledgment of the increasing international use of the Chinese currency. And the aftermath of the Ukraine conflict will clearly accelerate that drive by Russia and China as they face severe and long-standing sanctions in trade and money markets that will reduce their access to the dollar and the euro.

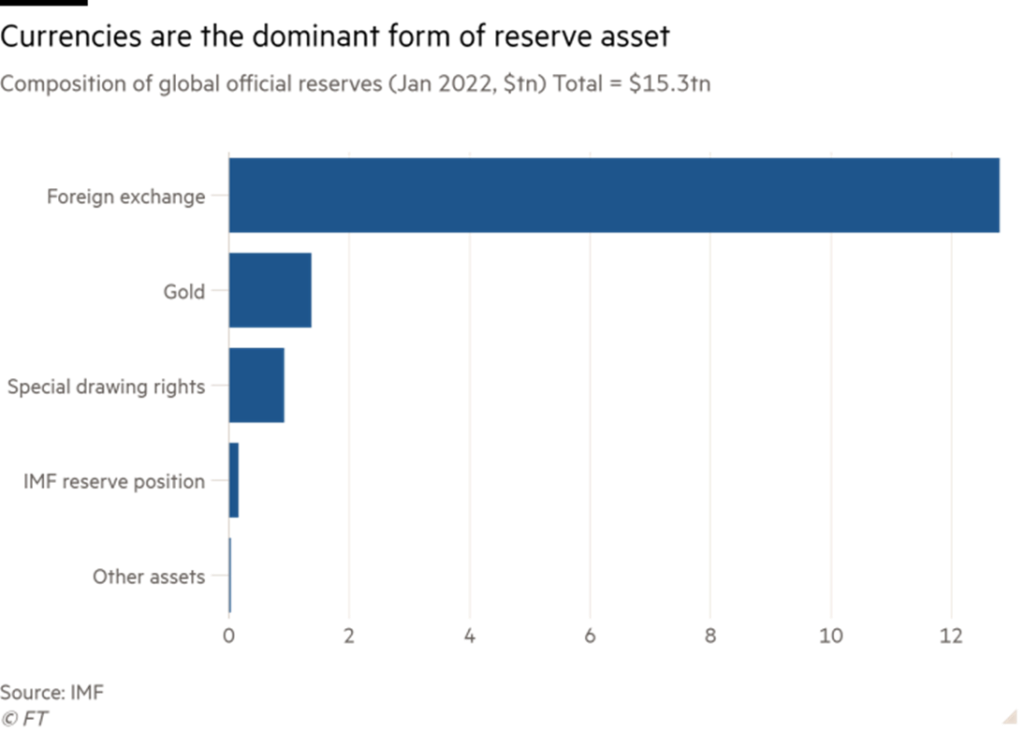

But there is still no real alternative in international markets to the US dollar. First, there can be no return to gold as the international money commodity; and the role of international money as created by the IMF in Special Drawing Rights (SDRs) is minimal; while it’s a volatile future with other potential monetary assets like cryptocurrencies.

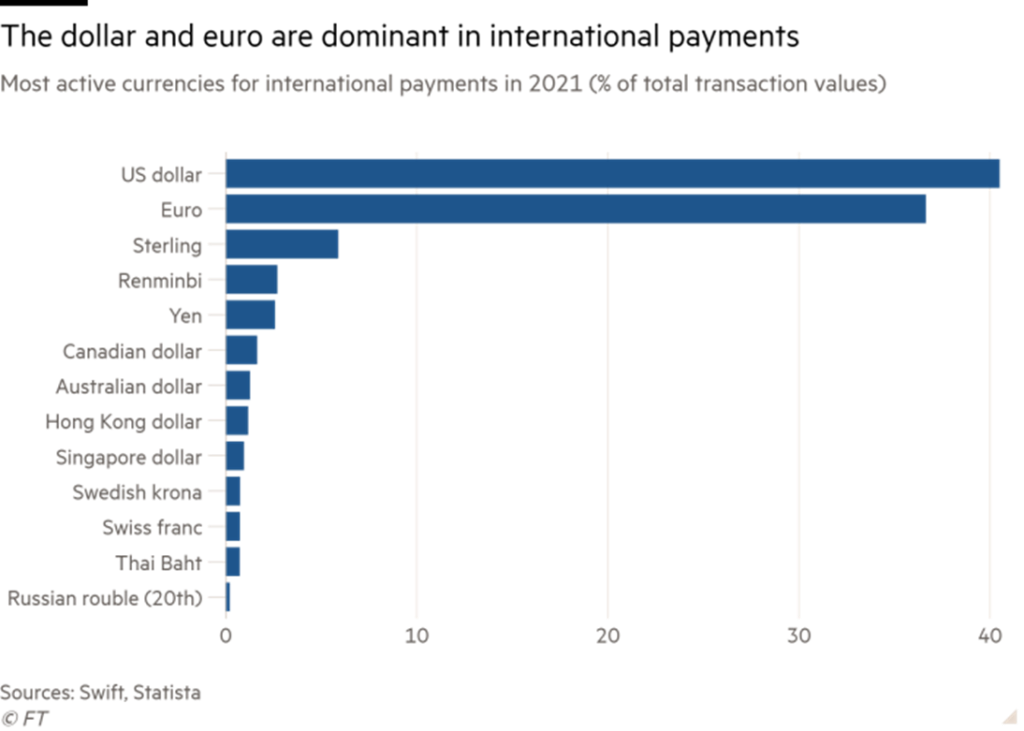

And the US dollar (and to a lesser extent the euro) remains dominant in international payments.

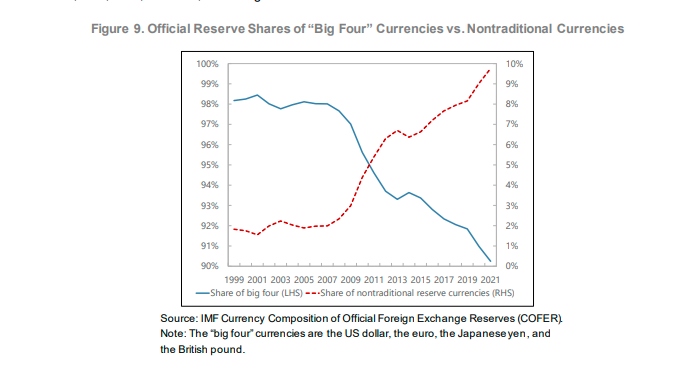

However, a recent IMF working paper does reveal an important trend. The US dollar is not being gradually replaced by the euro, or the yen, or even the Chinese renminbi, but by a batch of minor currencies. According to the IMF, the share of reserves held in U.S. dollars by central banks has dropped by 12 percentage points since the turn of the century, from 71 percent in 1999 to 59 percent in 2021. But this fall has been matched by a rise in the share of what the IMF calls ‘non-traditional reserve currencies’, defined as currencies other than the ‘big four’ of the US dollar, euro, Japanese yen and British pound sterling, namely such as the Australian dollar, Canadian dollar, Chinese renminbi, Korean won, Singapore dollar, and Swedish krona.

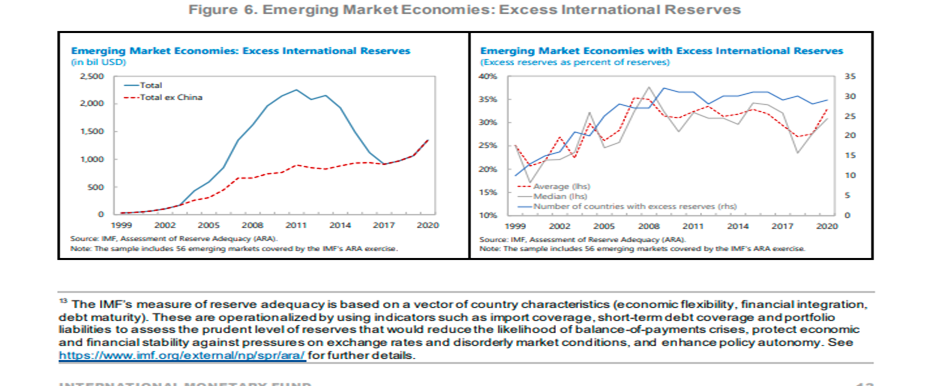

The IMF found that this shift to ‘non-traditional currencies was broad based: “we identify 46 active diversifiers that have shifted their portfolios in this direction, such that they now hold at least 5 percent of their reserves in non-traditional currencies.” Countries that build up what the IMF calls ‘excess’ FX reserves, ie over and above that necessary to deal with any trade or currency crisis, are increasingly diverting that excess away from the ‘big four’ currencies of dollars, euros, sterling and yen and into other smaller currencies. The IMF reckons that excess FX reserves now add up to $1.5trn (including China), or 25-30% of total reserves in the non-imperialist economies.

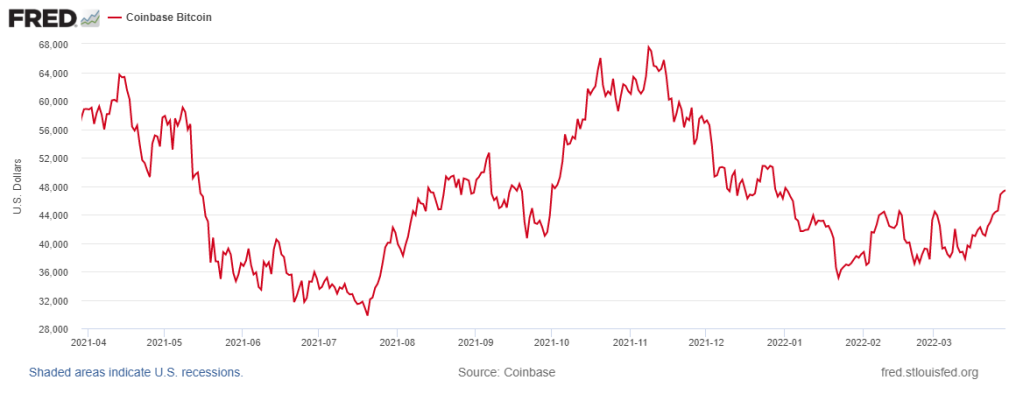

Then there are the countries that do not have ‘excess’ reserves but on the contrary, have scarce dollar FX reserves. Some of these have also resorted to alternative currency assets like cryptocurrencies (El Salvador and Nigeria). For example, a year ago, El Salvador adopted bitcoin as legal tender and has now announced the issuance of a government bond to be paid in bitcoin. These so-called ‘volcano’ bonds (El Salvador is volcanic), are designed to raise funds for the government and investors by eventually selling the bonds for dollars in five years. Of course, all depends on the dollar value of bitcoin rising by then. But look at the volatility in bitcoin’s dollar rate in the last year.

All this suggests is that the shift in international currency strength after the Ukraine war will not into some West-East bloc, as most argue, but instead towards a fragmentation of currency reserves; to quote the IMF: “if dollar dominance comes to an end (a scenario, not a prediction), then the greenback could be felled not by the dollar’s main rivals but by a broad group of alternative currencies”. That may have even worse consequences for world peace and for the smooth expansion of the world capitalist economy than a major split between west and east. Indeed, it implies almost an anarchic currency situation where the imperialist economies, particularly the US, could lose control over world currency markets.

It also implies that Keynesian hopes for a new coordinated world order in global money, trade and finance is ruled out. Kevin Gallagher and Richard Kozil-Wright, leftist economists in UNCTAD (United Nations Conference for Trade and Development), in a new book, The Case for a New Bretton Woods, argue that in the aftermath of COVID, governments have the opportunity to implement sweeping reforms to “(boldly) rewrite the rules to promote a prosperous, just, and sustainable post-Covid world economic order – a Bretton Woods moment for the 21st century,” or “we risk being engulfed by climate chaos and political dysfunction.”

The authors hark back to the Keynesian-inspired Bretton Woods agreement that set international rules for harmonious trade and capital flows that countries would follow. Bretton Woods was apparently a great success in the first two post-1945 decades of prosperity and growth. The authors reckon that big finance capital was not involved in the agreement, which instead was an international follow-up to the very successful New Deal programme for employment and growth instituted by US President Roosevelt to end the Great Depression of the 1930s – “Washington’s attempt to internationalise the New Deal”. Gallagher and Kozul-Wright note: “The New Deal programme not only abandoned the gold standard, but also broke with the wider liberal international agenda by taking on the financial elite both at home and abroad and opened the door to an alternative narrative in support of an activist public policy agenda.” The authors claim that this is the model that we must return to bring about harmonious and even expansion of the world economy from hereon. “It provides a blueprint for change that no one interested in the future of our planet can afford to miss.”

Unfortunately, this ‘blueprint’ is not going to happen in the 21st century – on the contrary. The Bretton Woods agreement was only possible because, in 1944, the US ruled the world and could dictate the terms for international trade, payments and currency controls. And the first two decades after 1944 were a period of high profitability of capital in the major economies that allowed all participants to gain (if unevenly) from the spoils of cheap labour globally (at the expense of the so-called Third World, which had no say in Bretton Woods) and from the introduction of new technologies developed during the war.

But as Marxist theory has proven, this ‘golden age’ could not last once the profitability of capital started to fall and when US dominance in trade and capital flows began to wane. The end of Bretton Woods was a product of changing conditions for global capital. it was not because of a change of economic ideology from Keynesian international macro management to ‘neoliberal’ free markets in currencies and trade. It was the change in economic conditions that forced a change in the ideology of economics and politicians to ‘free markets’, floating currencies and deregulation of trade and capital flows (globalisation).

A revival of a new ‘Bretton Woods’ is not possible in the 21st century. There is increasingly no dominant economic power that can dictate terms to others; and this is no ‘golden age’ of high profitability that all the major economies can share in. On the contrary, the profitability of capital in the major economies is near 50-year lows and the dominance of the big four currencies in world capitalist markets is fragmenting into a myriad of small currency regimes (as the IMF suggests).

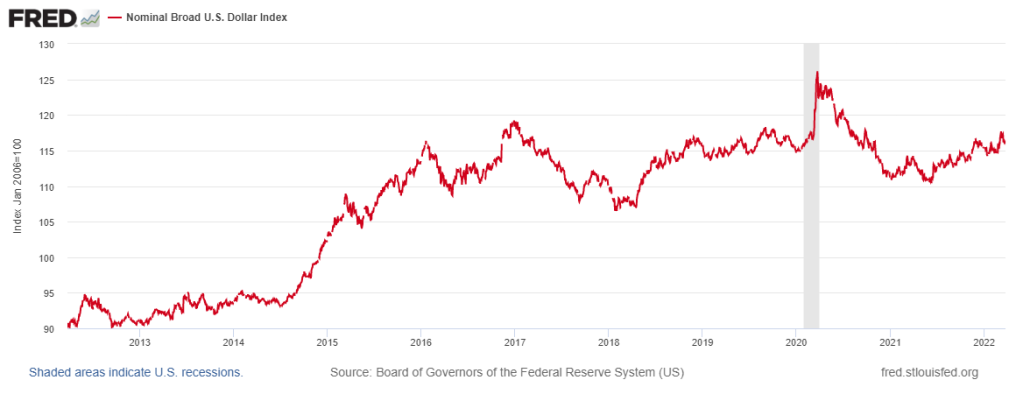

Don’t’ get me wrong, the dollar still sits in the driving seat in world markets. Indeed, in global slumps and in geopolitical crises, the dollar becomes the strongest among fiat currencies, alongside gold as the world’s commodity currency. And that’s especially the case when interest rates look set to rise more in the US than in other major economies.

The difference now is that rising interest rates and a strong dollar do not herald a more harmonious world capitalist economy, but instead disaster for the weaker and poorest countries globally. A recent study by the World Trade Organisation, based on measuring the dynamic impact of lost trade and technology diffusion, found that “a potential decoupling of the global trading system into two blocs – a US-centric and a China-centric bloc – would reduce global welfare in 2040 compared to a baseline by about 5%. Losses would be largest (more than 10%) in low-income regions that benefit most from positive technology spillovers from trade”. I suspect the damage to the poorest economies would be even greater in more fragmented currency world. This is something I shall take up in my next post.

I am sure you are aware Michael the one of the biggest moments in this decoupling saga is at hand as Germany and the EU has about another 24-48 hours to make it’s first monthly payment in their Rubels or Gold. Or not at all apparently I am glued to the news and looking for the world reaction, if the gas is shut off abruptly expect the war in Ukraine to ramp up as well. Ukraine is the physical battlefield, and the mediator is the economic world stage.

I was reading some of the top US policy think tank articles on the subject, check out this strategy plan: from a top geopolitics analyst: https://warontherocks.com/2022/03/the-urgent-case-for-energy-austerity/.

Seems like a new form of austerity lumped on top of another “great reset” style scheme. .

So, invest in Swedish Krona and Swiss Franc then?

Regards Rick

As you’ve probably seen today in the FT, Martin Wolf suggests (A new world of currency disorder, March 30) that China’s alternative to Swift, the Cross-border Interbank Payments System (Cips) and its digital currency, the e-CNY, may become the dominant system for China trade. Some of this is also conducted via currency swaps. This seems to suggest the development of a different type of finance for the real economy as an alternative to the fictitious financing of finance. I’d appreciate your comment on this.

These developments could help Chinese trade combat US attempts to stifle it. But I’m not sure that they will be enough to enable the renminbi to become an international reserve currency. That could only possible happen if China ended its capital controls – but that would be a huge mistake by opening up the economy to the vagaries of international capital chaos.

Thanks for Michael’s prompt response.

The problem is that he appears to still be thinking in terms of the Chinese RMB becoming an alternative rival currency to the dollar. However, as I pointed out, China is not proposing this. Instead they are suggesting replacing the dollar with a broad basket of currencies. I would very much appreciate his thoughts on the viability of such a proposal.

In addition, how will the new Chinese financial systems – its CIPS alternative to the West’s Swift banking transfer process, and the digital RMB – affect the world’s currency system?

Correction to email address

Another useful article from Michael Roberts. However, I would have very much liked it if Michael could have dealt with two significant aspects of the shifting global currency situation.

In this article much of the focus rests on foreign currency reserves, with little attention paid to the use of currencies in international trade. Is it not a key aspect of the dollar’s pre-eminence that until now the overwhelming majority of trade is still conducted in dollars? If this is an important factor in the continuing domination of the dollar in the global financial system we should be paying attention to the latest changes in currency usage in trade. An example of this is the change in the currency being used in the purchase of energy such as the recent announcement that India will begin to pay Russia for energy in rubles direct from the rupee. Or that Saudi Arabia will accept the Yuan for its future oil shipments to China. The importance of the petrodollar in the continuing acceptance of the dollar in the wake of Nixon’s decision in 1971 to end its (theoretical) convertibility to gold.

More importantly for the future of trading currencies must be the roll out by China of the central bank controlled digital Renminbi. This should allow international traders and even individual customers to begin to pay for their orders directly from their currencies into the RMB and vice versa, rather than having to use the dollar as a middleman currency.

On the question of what will replace the dollar, I understood that China rather than looking to swap its currency for the dollar is seeking to create a broad basket of currencies to act as the reserve, which is similar to the option proposed by Keynes at Bretton Woods and rejected by the Americans. Perhaps Michael can give us his take on the feasibility of such a change.

Last but not least, Michael’s fear of the negative impact of a future chaotic and fractured currency on the developing countries is missing a key aspect. Surely a rising China and a growing expansion of public investment in the developing world (via an increasing BRI) could be a key factor in offsetting the currency changes that Michael talks of here.

Good points Pat. Yes, FX reserves are not the only drivers: trade and capital flows are even more important. I did deal with these in my summer post, but as you say, recent events are bringing new changes (towards fragmentation, I think). I have mentioned China’s digital currency before. But there is no way China’s renminbi can replace the dollar while it maintain capital controls. And if it were to remove those controls, which the pro-capitalist finance wing of the Chinese elite wants to do, China’s economy would become subject fully to the vagaries of international capital flows and booms and slumps. China already uses a broad basket of currencies to set its renminbi movement limits but not yet to replace dollars in its reserves to any great extent. I think China’s public investment BRI will be a counterweight to volatility in growth and capital flows for many Global South economies – but the US is out to stop that development.

The important lesson here is not if the USD Standard will stand or fall, but that no monetary system can save capitalism (even though it can give a singe nation-state – the USA – a very good shelf life).

Michael, what about the missing credibility of dollar as a reserve active (a store of value) as, at it has been showed, no one can be sure that it cannot be expropriated if USA/UK governments think that this would be necessary for them to follow their political objectives? Do not this adds as a final nudge to the decades-long suspicion with the “exorbitant privilege” US enjoys in international trade?

Yes, that surely will accelerate looking for alternatives to the dollar as a reserve currency.

We’ve been hearing about the coming end to “dollar hegemony) for what? 50 years now? I think the first “contender” was in the 1970s with the German mark, then the IMF’s SDRs, then the yen, then the euro, then yuan/renminbi…… and then “something happens” and all the would be replacements go scrambling for currency swap lines offered by the US Fed.

To be sure, it– replacing the dollar might happen– but it won’t happen easily or peacefully, and it doesn’t simply mean the decline of the US, but the fracturing of the global system of exchanges.

The dollar reserves are in large part “banked” as US Treasury securities, the market for which is the most liquid and secure for commercial reserves. Again, no country least of all China wants to take on the responsibility for essentially guaranteeing the entire mass of the wealth the bourgeoisie have accumulated.

That was proven, not for the first time, in 2008-2009, and then again in 2015-2016.

This argument for “dollar replacement” is akin to the “anti-imperialist” argument for a different imperialism to replace US led imperialism. Might happen, but not easily or peacefully. “Replacement” does not entail progress. Overthrow and abolition do. Absent that overthrow and abolition, a substitute imperial currency is not a “lesser evil.” Collapse of the entire system is.

I think fiat currencies are losing their function as a medium of exchange, they are just acting as a store of value. Nowadays, to transfer money from location A to location B, it is only necessary to record the transaction in a database or information system. The unit of numbers that can be USD, EUR, CNY, JPY are not important as it simply represents the value representing “socially necessary labor time” (SNLT). So when an iPhone was recorded as $2000 and a Mercedes was recorded as $40000, essentially an expression “20 inphones = 1 Mercedes” was recorded.

This is not to say that the era of “barter system” will return. As long as labour power is not completely free (or zero), it is necessary to measure the SNLT. There will be a commodity that is considered the atomic mass of SNLT. We used to use seashells, gold, oil for that. Their common feature is to participate in the widest range of human activities, from economic, social, political, to war. In the 20th century, it was oil, but now oil is no more, because for example we can produce power without oil. The 21st one will be the semiconductor. We cannot live without chips, even war cannot without chips. So we’re going to move from the oil standard to the semiconductor standard.

There can be no return to gold… It sound a bit to categorical to me. If this crisis in Ukraine get worse, a world divided in blocks that do not trust each other I think hard currency will be the means of payment among these rival blocks of countries.

Another insightful article on contemporary discussions in mainstream economics which this website excels at.

One omission. The growth of regional financial centers such as Dubai, Singapore and Shanghai, leading to an end to the duopoly of London and New York, will further accelerate the emergence of alternative currencies regionally traded. Having been a janitor in the City of London (joke), you will know from firsthand experience how financial centers become hubs of liquidity, which as they deepen, attract local funds which would have previously absconded to New York and London. The growth of these financial centers and the derivatives they will generate will challenge London and its monopoly, e.g. Brent crude, the LME, and so on, reducing the necessity for trades to occur in Dollars.

However the implication by the authors you cite, that currency competition is the prime reason the world economy will become poorer in the future is wrong. Currency fragmentation is not the cause but the consequence of the breakup of globalized production already in train since 2016, and caused, by you guess it, the fall in global profitability. As my latest article will show, Chinese profitability in February 2022 was down 46% from its 2011 peak. No that is not a typo. By the second half 2022 the same will apply to the USA now that Covid profit margins are being crushed.

The war in Ukraine is not a war over Ukraine, but a war to control the Black Sea. Should Russia prevail, as seems likely, it will shift the whole economic balance away from Europe to the East, but in a world where capital will be struggling to earn a Buck or a Renminbi, or Ruble or Riyal or a deranged crypto.

I think the dollar’s role as a trading and reserve currency is universally overstated.

When do we wage earners need a foreign currency? Not even in all cases when we travel abroad.

A single global currency is important for ALL capitalistic global players. Just imagine if they had to convert every single trade and financial transaction into a different currency every time. And the dollar’s benefit to US capitalists? The calculations that I know speak of an interest advantage of less than one percent.

There is a money fetish in capitalism and there is a dollar fetish among leftists.

Wal Buchenberg, Hannover

I thought the primacy of the US dollar was all about subsidising the US debt, which currently stands at $30 Trillion? At what point does the US dollar stop this subsidy? Only when those countries of the world no longer are forced to trade in the US dollar. Will this happen and over what time span?

The largest single holder of US debt is… the US government itself–not including the FED if I recall– approximately 20% is held by govt trust funds and the like on behalf of the US Railroad Retirement Board, Social Security Administration, Medicare, etc.

Debt held by all foreign countries combined amounts to about 8 trillion; the rest is held by US private investors– banks, individuals, corporate pension plans, corporation short term assets, money market funds individuals, etc.

In essence the US is paid by these foreign and domestic entities to provide a secure and liquid market for long-term and short-term deposits of funds. The US government in return pays interest on the deposits. This is no more a threat to the “dominance” of the dollar, than that incurred when a bank has more debt than the nominal value of its deposits.

There are conditions when sovereign debt doesn’t cut it any longer- the recent history of Greek, Spanish, Italian sovereign debt being an example– but that weakness had little to do with trade deficits or government budgets. It has a lot to do with the ability to meet the debt service requirements.

The ability of the US to retain its dominance depends on its role as the willing anchor of the entire global market system. IMO anyone who thinks China is ready or willing to assume that role, or any combination of BRICs is a viable substitute is making a big mistake.

Of course China is not willing or able to play that roll. It has no imperial aspirations.

shouldnt OPEC+ should be putting up a new currency as oil is the one commodity

old idea, first floated in 1975, IIRC. OPEC doesn’t work that way, being a coalition of sovereign nations who don’t want their economies tied to a single currency.

This from Russian military site:

Russian central bank announced that it will put the ruble on a gold standard. The bank pegged 1 gram of gold to 5,000 rubles. Now that means, one troy ounce of gold or 32 grams of Gold would now cost 160000 rubles in Russia. At the current exchange rate, 32 grams of gold would cost roughly $1,600 in Russia.

In the US, the same quantity of gold would cost you $1,928. That means Russia has effectively ratcheted up its currency’s value against the dollar by pegging it to gold. If, 1 gram of gold is bound to 5000 rubles, then according to Western standards, the ruble must be valued at 70-75 units against 1 dollar. – TFIG

https://t.me/c/1262772134/8171

Anyone who pays for Russian gas in rubles then pays a good 10 percent more than in dollars.

FYI: https://www.voltairenet.org/article216321.html

The Russian State Vnesheconombank (VEB) and the Indian Central Bank have set up an internet platform to replace the SWIFT system between their two banks.

It should become operational by 11 April 2022.

Yes, but is it still cheaper than the current spot prices being charged in the EU

Meet the New, Resource-Based Global Reserve Currency

https://www.strategic-culture.org/news/2022/03/31/meet-the-new-resource-based-global-reserve-currency/

Paul Krugman has lost his temper:

“Will Putin Kill the Global Economy?”

He’s pissed off because his theory was blown out of the water and now he’s placing the blame on alien factors in order to save his reputation.

Talk about living in a fools paradise but is this really so? On the surface, the USEUUK actions appear to be directed solely against Russia but is this really the case? It seems to me, given the crisis of capital, falling rates of profit, competition from capitalist economies outside the imperialist bloc (China, Russia) that the sanctions (like the responses, allegedly to Covid-19) are designed to reduce the living standards right round the planet! And of course, the ruling elites and their well-paid servants are not affected by this, in fact they’ve all got even fatter! And as the numbers roll in, we see that that the death rate due to lockdowns, destruction of small business, now outnumbers the deaths from the virus! There’s just too many people, for capitalism! Robotic production obviates the need for so many workers, what better way to dispose of them than through starvation! But we in the imperialist heartland are insulated from this reality. Okay, our poor are even poorer but so what? The capitalist class doesn’t give a damn and never has! It’s time the left woke up and smelt the erzatz coffee!

The answer to Krugman’s question is yes Putin could to fire the first shot to kill the dollar but he wouldn’t. It is not his intention any way, otherwise why he still accept to sell Rubles that it seemed will become hard currency for Dollar and Euro, that is just paper. He keeps propping up the finance of the countries that are real enemies of Russia, not “so called enemies”, that are behind Ukraine in this conflict. As a matter of fact there is very little usefull in what the Marxists have to say about Russia Ukraine t this moment.

Please enlighten us as to who the real enemies of Russia are

Let’s remember all these optimistic predictions of a new global order emerging with links provided by Barovsky– ruble pegged to gold; interbank transactions de-Swifted with the emergence of the Russia-Iran, Russia-India competitors, a year from now. Then we can measure how much all these progressive measures have contributed to a happier, less brutal world.

I am certain that a “multi-polar” capitalism led by the statesmen from theological (Raisi), religious-fascist (Modi), autocratic (Putin), idiosyncratic-“socialist” (Xi), social democratic (Lula) governments,(and well advertised by conspiracy theorists like Escobar and Messyan), will be two, or maybe three, giant steps for all humanity, just as those regimes have proven to be giant steps for their domestic populations.

I supplied those links not because I necessarily agree with their (collective?) conclusions but because they offer different interpretations. Neither did I offer either an optimistic or indeed, pessimistic view, neither Anti-Capital or myself can see into the future but clearly things are changing, radically. But Russia’s ‘police action’ has really thrown the cat amongst pidgeons and thrown down the gauntlet, regardless of whether Putin is or is not, an autocrat, as if it makes any difference.

Barovsky’s too too modest, but gives himself away when he refers to Russia’s “police action,” having “thrown down the gauntlet.” Not to mention his tearful bemoaning over the “destruction of small businesses.”

Things are changing? That’s deep. Barovsky should have been a detective.

Yes, exactly. A brief and forceful socialist refutation of those willing (including Escobar journalists, etc., journalists only selling smoke to keep their businesses and opt for their own yacht) of new world orders, multipolar capitalism, new currencies, etc..

1.- Capitalism that really exists today in the countries of these new multipolar leaders (Putin, India, China, etc.) is sufficient and historically eloquent: misery of its peoples with obscene and savage surplus value of its leaders. uninformed baby comes out that these leaders are not going to do the same with the rest of the people?

2.- The World (neither does the capitalist mode of production) does NOT tend to multipolarity. It does not do it internally in the countries nor externally to them. It tends to the opposite. It is a fundamental Marxist and socialist law and is called Concentration of Capital. Nothing (capital) and no one (subjects) escapes this trend, and a law supported by the benefits of economies of scale and the corresponding need for growth of all economic subjects.

3.- The most likely scenario (derived from the revolutionary class cycle thesis) for the next 10/20/30 years is that of a national and/or international socialist revolution that definitively unifies humanity. The last socialist revolutionary imposed

4.-And in terms of dominant currencies, the only one will be the one issued by this new socialist and world entity. Dollar, ruble, renminbi, mark, yen, etc. will be history.

Antonio, a unified socialit world is not going to appear, after 20 or 30 years all at once, but perhaps beginning (with the first of numberous cycles?) out of the break-up of the present unipolar and murderous capitalist world order, which is in fact breaking up, along an east/west axis. You seem blind (and too rigidly categorical) regarding China’s, and even Russia’s accomplishment regarding the misery of its peoples…

m and m

China.

I am not blind to their obvious, necessary and historic socialist achievements and I am not so cocky and arrogant as not to value millions of Chinese lifted out of poverty and other social benefits. But I only value the achievements made in its progressive phase until the 80/90/00 years. I am afraid that since those years China has been returning to Capitalism as innumerable economic data commented on in this same blog repeatedly endorse that regression. Data that I will not repeat. This setback does not “hurt” me especially because I know that it is an economic determinism that should happen according to the theory of the revolutionary cycle that I know and that should happen in view of the empirical evidence of that same setback in ALL revolutionary processes ( socialists and capitalists) known. I emphasize the word “everyone” to show that it is a phenomenon with a scientific category as it happens at all times and places. It sounds categorical and harsh, but knowing and accepting that determinism saves me from disappointment with the current Socialisms (China, Cuba mainly),

Multipolarity.

The current order is not being fragmented into a multipolar one. Capitalism tends (is forced to do so) towards Concentration. The multipolarity between countries was already lost centuries ago. If a Socialist Order does not arise soon, the current war and another major war will only give rise to a single capitalist ruling bloc. And it would be an undesirable bloc for the working classes.

The cycle thesis.

Period of dates of the next revolution.- They are quite scientific data long to explain. It is likely that the current war (and the one to come) will result in a citizen not initially seeing any light at the end of it. However, the social collapse caused by a war is precisely the greatest, known and certain historical trigger of a revolution.

Number of cycles required.- The cycles already began in 1917. There have been 2 revolutionary impulses of maximum intensity and their cycles in Russia and China. And several “replicas” of low-intensity revolutions in Arab countries and South America.

Degree of Intensity.- Will the next socialist revolution reach the whole of humanity? I admit that this data is pending further and better academic elaboration on my part. That will only happen in 5/6 years when I hope to retire and thus dedicate more time to the thesis. However, the following data predict (a little) that the next socialist revolution will reach a high percentage of humanity: a) With the two revolutions in Russia and China, a third of the planet’s population was reached in a production mode situation socialist. 2 – The Capitalist mode achieved in 3 major revolutions in the World Center (English, French and European Liberals) achieve world dominance by completely liquidating Feudalism. It would be 4 revolutions if the American Revolution is taken into account, but it is quite doubtful to take it into account because it was a revolution in a peripheral country at the time.

A note on Antonio’s 3 revolutions? The feudal mode of production in Europe was characterized by massive Church property. The religious “reformation” that dispossessed this form of feudal property were part of the rise of the bourgeoisie. That means such famous (at least they were once,) events as the Peasants’ War in Germany and the Wars of Religion in France were attempted revolutions in those property relations, whether they consciously looked forward solely to the implicit bourgeois future or an imagined past.

The American Revolution by the way also counts. The Atlantic Ocean is a highway, not a wall. There is currently a trend to apologize for today’s bourgeois democracy by denying the revolutionary essence. The secret argument is that if they had pure minds purged of racism, sexism etc. then they could have had real democracy….as “we” could have real democracy if the filthy masses thought correctly. At any rate, the new bourgeois state transferred vast amounts of property from pre-capitalist peoples to the citizens in addition to forcibly taking away vast possessions from the King of England (which is bourgeois-revolutionary by definition.) All great revolutions change property relations on a vast scale.

Also, the Dutch revolution, culminating in Dutch independence after decades of war with Spain, was every bit as essential to the development of the bourgeois world, including its social completion in the forms of bourgeois democracy.

The real point, that the transition from one mode to another, is a prolonged process is valid. The equality of money, the essence of bourgeois democracy, did not find its completed expression until every man and woman’s vote formally counted as the same. Bourgeois democracy couldn’t achieve woman suffrage until the twentieth century!

Sorry if this is picking too many nits, some days my “SOMETHING IS WRONG ON THE INTERNET!” button gets pushed.

Let me remind you all that this deterioration of the USD Standard, without any apparent successor (i.e. the collapse of the very idea of a single fiat currency standard) vindicates Marx even more.

Many neoclassical economists have been shitting on Marx because of his observation at book I of Capital, where he stated gold was necessary for world trade (i.e. money must always be a commodity). Those same economists used the existence of the USD Standard (and, by extrapolation, the existence of the fiat currency itself) to, somehow, claim Marx’s Theory of Value to be false.

Well, turns out the fiat currency system itself is just a superstructure of the capitalist system, not an essential part of the capitalist mode of production (material base), that is, just a phase of capitalist development (historicity), like the metallic standard was before it. Marx was always right – and will always be, because his theory is scientifically correct.

Reminds me of Gramsci’s opinion about what to do with a feudal estate: not breaking it up in many tiny parcels for single paesants but transform it in a coop where everybody shares in the benefits of a superior organization.

Gramsci was anti-Leninist on this point. The breaking up of estates into privately owned farms lowered agricultural productivity in Russia and Poland for years. (In Poland’s case, all the worker upheavals before Solidarity were prompted by efforts to subsidize the inefficient agriculture by raising meat prices etc.) The relative success of re-privatization by Dengists was because the new landholdings were rationalized from the start, a feat only achievable by in effect starting with a blank slate. Plus the massive increases in rural investments that were the disappeared part of the Cultural Revolution provided a superior infrastructure previously absent, portrayed as the personal efficiency of the new proprietors proving the superiority of the capitalist road.

Lenin led in adopting the whole program of the Socialist-Revolutionaries. This seems fair to me, they weren’t using it, because as a pro-capitalist party, counter-revolutionary party they couldn’t. (The SRs who meant it split into the Left SRs and allied temporarily with the Bolsheviks. Even then they were only half-hearted in their commitment to revolution, which is why elements attempted a half-assed coup against the Bolsheviks.)

There has been a good deal of hyperventilation concerning the demise of the US dollar.

When I began my professional career 50 years ago during the mid 1970s, in the middle of the oil price crisis, there was a conspiracy story doing the rounds that the Russians would declare a gold convertible rouble and destroy the West’s financial system.

Nothing changes.

Why is nearly everything here that people don’t agree with, labelled a (CIA-inspired) conspiracy theory? Very dialectical I’m sure and what a fucking copout! Instead engaging in rational debate, the argument is reduced to mud-slinging. God, what a come down. I’ve had with these self-proclaimed ‘Marxists’.

???

barovsky,

I presume this is directed towards me although I don’t fully understand the rancour.

Firstly, I’m not a Marxist.

Did I mention the CIA? I can’t remember the source of the story but it would have come out of the international finance industry, I suspect.

Where’s the mudslinging? I think you have way over reacted.

What is there to debate? I passed on a story. There’s been a few of them since the collapse of Bretton Woods. And they’ve never amounted to anything. Maybe this time it will be different. Personally, even if there is a rouble/yuan financial axis, I don’t believe the US$ will suffer as long as the US economy retains its power – and I can’t see why it won’t. It may not be the biggest economy but it is still a powerful economy and it will at the centre of Europe/Japan/US etc. commerce.

I would be more than happy to discuss these matters with you.

No, it’s addressed to you particularly, I apologise if that’s how it reads. No, it’s the word conspiracy, the catchall word used to dismiss inconvenient facts or opinions, now being used by those who call themselves left. An extremely depressing time, so I suppose I’m venting my frustrations on those who would rather dismiss than debate using a word actually promoted by the CIA in the 1960s, a word which now haunts us, but of course that was the intention in the first place.

No worries.

Conspiracy was my own word. I was too lazy to think of another word.

To paraphrase, there’s many a slip twixt tongue and brain.