From the very beginning of its coming into office in 2010, the Conservative-led coalition government in the UK has had as its main economic policy objective (some would say that it is its only economic policy) to reduce government spending and public sector debt, under the slogan of ‘austerity’. It wants to convince financial markets, debt ratings agencies and capitalist business that it would be the most effective government in the world in erasing annual budget deficits and reducing debt levels – a world leader in austerity.

Today, UK Chancellor George Osborne presented his statement on the country’s public sector finances and could not hide the fact this policy had totally failed, even on its own terms, let alone in helping the British people. According to the latest data, the UK government’s target for net government borrowing will be exceeded this fiscal year. The government has resorted to various measures of financial engineering to try and fiddle that target. It has incorporated the pension funds of the Royal Mail into reducing the deficit in the short term (as part of its plan for future privatisation of one of the few remaining state operations). And it has appropriated ‘seigniorage profits’ accumulated by the Bank of England (BoE) from its asset purchase scheme of UK gilts (in doing so, it is taking future gains from bond yields at the risk of losses, if and when the BoE should unwind its QE holdings down the road).

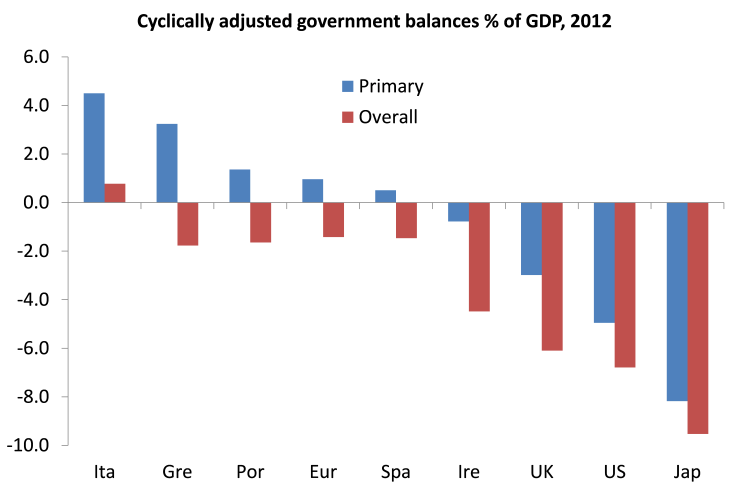

There were two specific targets that this right-wing government set itself. First, it aimed to erase the so-called ‘cyclically adjusted’ annual budget deficit by 2017. This is a bizarre measure that aims to reveal the underlying balance on spending and revenue after excluding the impact of booms and slumps. The UK’s cyclically adjusted deficit is much higher than the distressed debt crisis states of the Eurozone and is beaten only by the US and Japan.

The second objective was to get the government debt to GDP ratio to start falling by 2015 when the next election will be held. Now Osborne has had to admit that neither of these objectives will be achieved by the end of this parliament. Indeed, it may not be before 2018 before they can be met. The Institute for Fiscal Studies reckons that the government needs yet another £11bn in spending reductions, spread out into 2018 before the original targets set by Osborne will be met. It’s as though the UK has an American-style ‘fiscal cliff’ rising before it for another six years at least and nothing can be done about it. The government’s austerity policy has been referred to as ‘Plan A’, with Plan B being some alternative Keynesian-type approach of more government spending for growth. Well, as one senior Treasury official put it: “We do have a Plan B: it’s to keep doing Plan A for longer.”

The Keynesians consider that the government’s policy is mad. It is not economically sound because it based on crude ideology. As one leading left Keynesian Labour MP, Michael Meacher put it (The Guardian newspaper, 26 November 2012): “There is only one explanation: ideology. This is a government fixated on shrinking the state, privatising all services and squeezing the public sector out of existence. One of the fundamental precepts of its neoliberal capitalism is that there can be no proactive role in the economy for the state or the public sector. In other words, the government says it will do anything to bring about growth, but the one thing which will actually produce growth they won’t do, simply because it is ruled out by their ideology. William Jennings, the US presidential candidate declared famously in 1896 that America was being crucified on a cross of gold. Britain today is being crucified on a cross of ideology.”

No doubt this is an important element of the Plan A policy, but as Richard Seymour responded in the Guardian, it is an inadequate explanation. As Seymour says, even if the austerity measures succeeded in meeting the fiscal targets, they would not come to an end. ” For those advocating a radical Keynesian solution to the crisis, the Tories’ insistence on deeper cuts, even as they seem to impede growth, can only be seen as “ideological”. And if the Tories’ main goal was to reduce the deficit, this would make sense. In fact, things are not as they seem. Austerity will not end in 2015, or in 2018. The Tories have been explicit about this. The cuts will be implemented over a long period, but once implemented they are intended to stay.”

So as I put it in a post in September, “What is the point of austerity? Why do so many governments of the major capitalist economies persist in policies to reduce public sector spending, raise taxes and lower budget deficits at a time when their economies are in recession? Are they mad? Krugman thinks so (“Europe’s austerity madness”). And so does Larry Elliot, the Keynesian business editor of the UK’s Guardian newspaper, “Austerity mania is sweeping Europe” (http://www.guardian.co.uk/business/economics-blog/2012/sep/28/blame-austerity-mania-breaks-euro).

“It’s true that there is an ideological aspect to austerity. There is a built-in antagonism to any sector of the economy that is not capitalist and could threaten the dominance of capitalist production, by taxes on profits, ‘excessive’ welfare benefits, more regulation and ‘interference’ with free markets. But that is not the main reason for governments pursuing policies of austerity. The main purpose of austerity is to restore the profitability of the capitalist sector of national economies after the Great Recession and resulting decline in profits.”

So the policy of austerity is not mad or just ideological. It is necessary to restore capitalist production by lowering the burden of debt or fictitious capital in the system and getting labour and capital costs down to boost profitability. Public debt is only so high because the public sector took on the burden of the banking collapse and the ensuing Great Recession. Now it must be slashed. Otherwise, financial markets will lose ‘faith ‘ in Britain and be unwilling to lend more money to government at historically low rates. Up to now, UK government debt has been seen as a ‘safe-haven’. But if fiscal targets are missed, the rating agencies will downgrade UK government debt from its triple-A rating, driving up gilt yields. Credit agencies are particularly sensitive to government gross debt ratios rising to or above 90% of GDP and the UK will reach that in 2013, higher than France which has already lost its triple-A ratings.

The problem for the government is that the UK economy is not growing. Productivity growth is non-existent, investment is very low, competitiveness is worsening and export performance is poor. Real GDP growth forecasts for 2013 have been downgraded. The EU Commission now expects only 0.9% growth next year; the IMF at 1.1%, below the average for advanced economies. And now the government has now shrunk its own forecasts for real GDP growth in 2012 to 0.1% and 1.2% next year, although it hopes for a measly 2% in 2014. The Office for Budget Responsibility has also revised its independent forecast for 2012 from the 0.8% it expected last March to almost zero, and for 2013 from 2% to nearer 1%. And the OBR accepts for the first time that the UK economy cannot return to boom-style rates of growth for the foreseeable future.

The UK capitalist economy is in a terrible mess. The recession of 2008-09 was the deepest since the 1930s. The period since then, a phase of the cycle when output normally expands rapidly, has instead seen little, if any, growth. As a result, the economy is still 3% smaller than it was in mid-2007. If you exclude the period immediately after the Second World War, this is the worst five-year growth rate since the first half of the 1920s. Output is 15% smaller than it would have been had it grown at its previous (post-war) trend rate.

Indeed, the UK economy has performed worse than the US in the recovery since mid-2009 and even compared the Eurozone until last year. This will be the fourth year out of the last five that the economy has underperformed consensus expectations. This remains the worst recovery of the modern era. Output in the third quarter remains 3.1% smaller than the pre-recession peak reached during the first three months of 2008, now 18 quarters ago. By contrast, GDP was 4-5% above peak at this stage in the 1970s and 1980s cycles, and 7-8% above at this stage in the 1990s.

British manufacturers have reported stagnant output over the past quarter, the weakest reading since late 2009 when the country was recovering from its deepest recession in more than 50 years. The Engineering Employers Federation forecasts that manufacturing output will contract by 1.2% this year and grow by only 0.7% in 2013. But the real nightmare for capitalism is that investment (private and public, including housebuilding) is down an even sharper 19% from its peak.

So can we blame the current stagnation of the UK economy on the fiscal austerity programme of the government? Osborne says it did not, the Keynesians say it did. The truth is in between. It’s true that the UK economy has been broadly flat over the last two years since the coalition government came into office and announced that its strategy would be to apply ‘austerity’. This compares with a significantly better recovery in the US and even in Europe until the last year, as I have shown above. And since 2009, under the austerity policies of the government, the cyclically adjusted primary deficit in the UK has narrowed by 4.5% of GDP compared to just 2% in the US. One study finds that this relatively tougher fiscal adjustment has contributed slightly less than half the 5% pt difference in real GDP growth between the two countries over the same period (see G Davies, J Antolin-Diaz, Why is the US economic recovery stronger?, Fulcrum Research, November 2012).

But there is another much more worrying reason for the failure of the UK economy to recover. It is the competitiveness of British capitalism in world markets. The UK is really a huge financial and rentier economy that depended on the financial sector to reap profits from its international role.

But the price to pay for relying on the unproductive financial sector for profit was a huge rise in fictitious capital in that sector. This weight of debt continues to hang over the productive sectors of the economy – such as they are.

Indeed, the productive sectors of the UK economy are just too weak or too overseas-oriented to compensate for the collapse and deleveraging of the unproductive sectors.

Apart from austerity being applied by the government from 2010, British capitalism tried to get out of the slump by allowing the currency to depreciate, a policy not available to the likes of Ireland, Greece, Portugal or Spain. Sterling dropped in value by 40%. At first, that appeared to help revive the economy. But the gain from cheaper exports has not lasted. Since the beginning of 2009, sterling’s effective exchange rate has been rising steadily. And more significantly, the real effective rate has been rising faster. That tells you that the gains in competitiveness in world trade from the initial devaluation have been eroded. There has been a 13% point shortfall in UK export growth relative to the US since 2007. And UK exports are now declining again. That’s a lesson for those who reckon the solution to the problems of Greece or Portugal is to leave the euro and devalue the currency. It won’t work for long.

UK exports are losing market share for two reasons. First, nearly half of UK exports go into the Eurozone, which is in a recession, or even depression in parts. While 60% of US exports go into the fastest growing area of the world, the Asia-Pacific region, only 25% of the UK’s do. So since 2009, UK exports have risen a cumulative 40% in value, but US exports have jumped 60% and even Germany’s have risen 50% despite Europe’s recession. And second, UK exports are becoming steadily uncompetitive, as unit labour costs rise faster than for trading rivals.

The UK’s current account deficit is widening, but remains relatively moderate because the huge deficit on visible trade is ameliorated by a surplus on net service exports and net factor income generated by the UK’s financial sector activities and investments. However, in the last 18 months, the deficit has widened as the visible trade gap bulges and surplus on services and factor income fell (investment income is now in negative territory).

And it is clear why. UK productivity growth has slumped from about a 2% rate in 2010 into negative territory. That has led to rise in unit labour costs. Indeed, since the beginning of the global recovery in early 2009, UK unit labour costs have risen faster than Europe and the OECD average and have only been surpassed by the US with its strengthening dollar.

Why has been productivity growth been so poor? Well, there’s the maths. If there is no GDP growth and employment rises, as has been the case for the UK, then productivity growth will disappear, QED. So that tells us nothing. We need to drill down below the maths. Productivity growth has been poor because UK firms have not invested. Business investment remains in the doldrums. I have reported before on the low and even falling profitability of the UK’s capitalist sector (unlike the US, so far). This is the explanation of the lack of new investment.

Indeed, it is reported that small and medium-sized UK companies are becoming zombie-like, only generating revenues sufficient to maintain the labour force and pay interest on their debt, but not enough to deleverage or invest. The productivity of small firms has plunged.

And that leads to the other reason for the UK’s falling productivity. Compared to the US, UK unemployment has not risen as much. Instead what has risen is underemployment (part-time and temporary work and self employment). Total UK employment has risen by 1.5% since early 2010, but part-time and temporary employment has risen by 5%. Indeed, nearly half of the net increase in employment has not been in full-time jobs.

Some form of job has been preserved but at the expense of lower wages in real terms as inflation has outstripped wage rises and at the expense of profitability. It seems that UK firms (unlike US enterprises) hoarded labour during the slump and lowered wages instead. So the consumer has stayed weak, encouraging firms to hoard more cash and reduce capital investment.

What a mess! What can we do about it? Well, the coalition government basically says that we must renew efforts to cut public spending and apply austerity. There is no alternative – to use the old mantra of Tory leader of Margaret Thatcher of the 1980s when she imposed neo-liberal policies on the British public. And indeed, if the government has its way, most of the worst of austerity has yet to come. For example, total public sector employment is still far off the 710,000 job cuts planned. Some benefits cuts have been implemented, but most of the pain will hit next year.

The government is imposing a wide range of welfare benefits cuts on the disabled, the sick and poor. Indeed, welfare benefits are to be cut in real terms for at least the next three years. This is like the US administration slashing so-called ‘mandatory entitlement benefits’ across the board. A private company has been contracted to review whether the tens of thousands of unemployed on disabled benefits are really fit for work. This has already led to some very sick people having their benefits stopped and being forced to work. There are cases of severely disabled people dying just a few weeks after the loss of their benefit: the human cost of a callous philosophy of ‘the survival of the fittest’.

More of these measures are planned over the next six years as the government claims that are many ‘benefit scroungers’ out there and they must be undone. Yet the figures show that the maximum loss to the taxpayer of so-called benefit fraud is no more than £2bn a year. That compares to the government’s own estimate of £35bn a year in what is called the ‘tax gap’, where individuals and companies just don’t pay the taxes they are liable for or just hide their profits and evade tax or adopt elaborate tax avoidance schemes invented by accountants to get round tax laws. Some estimates put this gap at £120bn a year, or equivalent to more than whole budget deficit in 2012!

Recently, there has been much noise about the revelation that large foreign multinationals like Amazon, Google and Starbucks pay little or no UK corporation tax because they use transfer pricing mechanisms to shift all the profits made in the UK into tax havens like Bermuda or Luxembourg. Labour MPs have demanded that these companies be ‘more responsible’, claiming their actions are ‘immoral’. But since when did morality play a part of the capitalist mode of production? These multinationals are not breaking the law. The tax laws and ‘light regulation’ of such large companies were introduced by governments of left and right across the globe. Indeed, governments compete to provide the ‘best tax rates’ to attract multinationals. Indeed, Osborne boasted in his presentation of the Autumn statement that the UK will have the ‘most competitive’ corporation tax rate in the Western world by 2014! So there is no revelation here. And there is no way round this that would be effective without international tax agreements – or really the taking over of multinationals and their accountants! As usual, it is capitalism for the disabled and poor and socialism for the rich and powerful.

But is there an alternative to austerity under capitalism? The Keynesians argue that there is. They say that there is no need to try and get government debt down right now when the capitalist economy is so weak, consumers are not spending and companies are not investing. Instead, now is the time to spend more and reel it back later. Indeed, the best way to kick-start the capitalist economy is to boost consumption spending and that means raising wages, not lowering them. As Simon Wren Lewis, a leading Keynesian academic, put it recently on his blog: “My suggestion is that 2% CPI inflation (target set for the Bank of England) is replaced by a target for 4% growth in average earnings. In normal times 4% earnings growth and 2% CPI inflation would be quite compatible (because real wages grow with productivity), but currently average weekly earnings inflation is below 2%. So moving wage inflation from 2% to 4% is a real challenge for monetary policy. To help with this challenge, the Chancellor could at the same time sanction unlimited QE, and could suggest this goes beyond just buying gilts.”

(http://mainlymacro.blogspot.co.uk/2012/12/how-to-try-and-get-more-inflation.html).

So Wren-Lewis proposes trying to boost wages by injecting more credit into the economy through the Bank of England. And yet, the current governor of the Bank has already poured cold water on the effectiveness of ‘quantitative easing’ (QE) in boosting the productive sectors of the economy. And the small government project to provide banks with extra funds for direct lending to industry has been a damp squib of a failure. Since the Bank of England’s Funding for Lending scheme was introduced last August to boost lending, the 35 participating banks have expanded their loan books by just £500m, less than a 0.1% of total lending. Only six of the banks tapped the BoE for cash, borrowing just £4.4bn of the £68.2bn cheap funds available.

I have discussed the fallacy of the Keynesian solutions to capitalist crises in many other posts (see https://thenextrecession.wordpress.com/2012/04/27/effective-demand-liquidity-traps-and-debt-deflation/). The Keynesian mistake is to reckon that profits come from income and income comes from spending. But actually profits come from the capitalist appropriation of the value of labour’s work. And profits lead to income, spending and employment, not the other way round. So W-L’s proposal to raise wages will only eat further into the profitability of the capitalist sector. That will weaken investment growth further. Indeed, W-L hints at this problem, when he says “In the longer term 4% wage inflation is pretty compatible with 2% price inflation, unless you believe that UK productivity growth can never grow again at levels that were thought normal before the recession.” Well, yes, it would appear that productivity will not return to boost surplus value sufficiently to compensate for increased real wages, unless investment rises. British capitalism cannot ‘afford’ higher wages.

But what about more government investment if the private sector won’t invest? Up to now, the government has cut state-induced investment. Indeed, that is always the easiest thing to do: stop building or mending roads, extending rail track or opening new airport runways. Just stop and the money is saved. Road construction investment will decline 40% this year and 5% next year unless the government comes up with projects that can start quickly. The government-funded construction pipeline is poised to fall from £11.6bn in 2011-12 to £8.7bn in 2014-15. The government announced £20bn of private finance to be raised from pension and sovereign wealth funds to be invested in 500 road, rail, water and energy projects. But pension funds have raised only £700m and none of this has yet been received.

As we have covered in this blog before (see https://thenextrecession.wordpress.com/2012/10/14/the-smugness-multiplier/), there has been a big debate among mainstream economists on the impact of austerity measures on driving down GDP growth and also the opposite: the impact of more government spending or tax cuts on boosting growth. This is the so-called multiplier effect: namely how much will real GDP rise for every pound or dollar of extra government spending or tax cut? Is the multiplier less than one to one or more than one to one?: the argument rages. But what is clear is that government investment spending does have the biggest bang for your buck compared to tax cuts or increasing welfare benefits (see new research by S Leduc and D Wilson at the Federal Reserve Bank of San Francisco).

The coalition government has announced yet another pathetic plan to spend £5bn on infrastructure projects over the next two years, but plans to fund this by making more cuts in other areas of government! So far, such funding has done nothing. Although the coalition has launched two national infrastructure plans since coming to power in 2010, construction spending is falling 11% yoy and is expected to drop more in 2013. Of the £5bn pledged last year, just £750m has come through. One study argues that at least triple the £5bn a year would be needed to have any noticeable impact on economic growth (namely about 0.5% of GDP).

Moreover, as we have shown in this blog on many occasions (see https://thenextrecession.wordpress.com/2012/06/13/keynes-the-profits-equation-and-the-marxist-multiplier/), government-induced investment is not the same as direct state investment. Giving contracts and money to private contractors to build roads is much less effective than the state setting up a national building corporation to employ people directly on projects. Coupled with state-owned banks providing credit for these employment-creating projects would have the biggest multiplier effect that could really begin to turn the economy round. But of course, such an approach directly impinges on the capitalist sector, crowds it out and threatens its profitability even more. Such a radical state-owned and planned investment operation is anathema to capitalism and so is not advocated by anybody in the mainstream parties or economics.

ADDENDUM

There’s lots been said since on the Autumn statement, but can I recommend this piece on the failures of the OBR by Paul Hartley (http://www.counterfire.org/index.php/articles/analysis/16185-the-obr-fantasy-in-the-service-of-austerity)

“Productivity growth has been poor because UK firms have not invested. Business investment remains in the doldrums. I have reported before on the low and even falling profitability of the UK’s capitalist sector (unlike the US, so far). This is the explanation of the lack of new investment”.”Indeed, it is reported that small and medium-sized UK companies are becoming zombie-like, only generating revenues sufficient to maintain the labour force and pay interest on their debt, but not enough to deleverage or invest. The productivity of small firms has plunged.””That will weaken investment growth further.””Some form of job has been preserved but at the expense of lower wages in real terms as inflation has outstripped wage rises and at the expense of profitability. “So the consumer has stayed weak, encouraging firms to hoard more cash and reduce capital investment.”But actually profits comes from the capitalist appropriation of the value of labour’s work. And profits lead to income, spending and employment, not the other way round. “…..reply…..What is clear to me is that…if there is nothing to invest in because there is plenty of everything….then the profits absolutely must be invested into paying civilians/voters higher wages, (and this does not mean the people who are already making plenty of money nor government staff unless someone proves to me that they are making a low wage), and of course getting the unemployed working…..no age discrimination, no education discrimination, tell insurance companies to lower their rates for workers comp/medical benefits so that companies are freer to hire. Teach owners of existing companies…they are scared to change their ways because they rely on status quo..it may be true that once a business is established it runs on its own in many ways but to keep people who are paid low always low frankly is not fair…the high wage earner has found their way and established their lifestyle, has all new and maintaining….but the not the low wage earner…they will/are crumbling….

The other bit of “financial engineering” to massage the deficit is inclusion of planned sale of 4G waveband bringing in £3.5bn?

Yes that was a new bit that came out today

i wish the government would put the 35b rainy day fund back into the coffers too because this is a rainy day in my eyes.

another loophole which is being pushed onto claiments is to go self employed. as long as your self employment neither makes or loses money you are doing better than 90% of the businesses and you do not have to live off £10,00 £20.00 or £30.00 a week as long as you attempt to work 30 hrs a week as a couple.

Be interesting (and useful) to know what you estimate the deficit is if you strip out these ‘financial engineering’ items? Even notoriously tricksy Brown didn’t treat the 3G auction proceeds like this. More generally, they are one offs so misleading as to trend?

According to the OBR, if you strip out all these ‘one-offs’, the deficit would have been higher in the fiscal year ending March 2013 in billions of pounds. As a % of GDP, it would have fallen from 8.0% last fiscal year to 7.9%, assuming forecasts for this fiscal year hold.

Article confirms why growth is happening in countries deemed as practicing ‘state capitalism’ during a capitalist recession such as this. Countries such as China and Vietnam. As to others such as Taiwan or Singapore the element of some kind of state authoritarianism also has a hand in promoting growth. The query I’d like to make based on the above flimsy connection is what interesting strategies are being used by other capitalist models such as the Anglo-American or neoliberal ones to counter such competition if not an all out war?

From your point of view am I correct to understand that your main criticism of Osbourne is that he hasn’t allowed companies to go bust, therefore the rate of profit cannot be recovered?

(I understand that this isn’t from your actual point of view but from your analysis of the capitalist crisis).

It’s not so much the companies but the banks. The fictitious capital built up there has been switched into government debt, so the weight of this debt remains on the economy as a whole. The aim is cut that debt to stop further borrowing, increased taxation and rising interest rates. Osborne just cannot do it though. It will take another slump, bankruptcies and more unemployment.

IFS latest says Osborne figures leave £27bn to be found after next election. Good luck Labour!

http://www.dailymail.co.uk/news/article-2244119/Austerity-2018-means-spending-cuts-tax-rises-worth-27bn-IFS-warns.html

If we take as a given that the austerity cuts will be permanent, the NHS will never exist again and the increase in poverty and inequality is now a permanent social condition, what will be left to restructure the next time capitalism goes into crisis, as it will given the cyclic nature of capital accumulation/falling rate of profit etc?

More to the point, from the West’s own experience post war and, as stated in a previous comment, the success of the state capitals of China and Vietnam and more authoritarian capitals of Singapore, if capitalism can only be made to work for the majority through intensive government intervention why should the majority continue to support capitalism when that intervention is withdrawn? And if capitalism needs to have that intervention withdrawn to restructure itself in order to restore profit, thereby destroying society, how can it be considered compatible with the needs of the majority?